Date & Time: 28th January 2022, 05:30 PM – 05:00 PM IST

Speaker: Abhisar Jain, CFA, Head & Fund Manager, Monarch AIF

Moderator: Sankalpo Pal, Biz. Development, PMS AIF WORLD

Investing narratives keep changing and the popular ones resonate in our minds for quite some time and create a bias. Let’s understand the argument from the perspective of popular narratives resonating today.

- Investing in 20-30 high quality stocks, irrespective of their valuation, is bound to make money for the investor in 3-4 years’ time as these are steady compounders.

- Just own Tech IPOs disregarding the valuations as these are disrupting businesses.

- Avoid cyclicals, infra & asset heavy sectors at all valuations.

It is not only teachers in the schools that love corrections, but financial markets too. And, the recent global re-rating seems to begin this process of correcting notions & above narratives as well.

This interesting article is from the web – conversation with Mr. Abhisar Jain, who is the Head and Fund Manager at Monarch Networth Capital AIF. He holds an MBA in Finance from S P Jain Global Business School and is a CFA Charter holder. He has over 14 years of experience in the equity markets.

Abhisar believes that every strategy involves risk and a sound investing strategy balances the risk-reward rationally as the reality of investing has shifted to a ‘rational’ style rather than a ‘growth’ or a ‘value’ strategy.

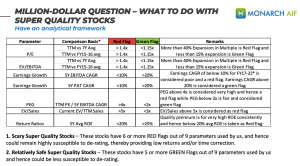

Let’s first see an interesting data from the recent Newsletter that highlights the scary side of super quality stocks at astronomical valuations.

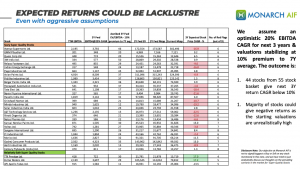

The above metrics from Monarch AIF were kept in mind to select 55 high quality stocks that have at least more than 10 years of presence in the market. The valuation on a trailing basis has seen a 100x increase vs its own 7-year average. The re-rating has been quite strong since FY2016 which is quite evident in the data provided. There were several disruptive events which lead to re-rating like Demonetization, Gst, Covid, SEBI’s defining categorization of MFs, credit crises, covid-19. All these lead to rise in risk aversion, and hence super quality stocks saw increase in flows and rise in valuations.

What Abhisar and team of Monarch AIF did is that instead of making this about a single parameter or valuation metric, they have made a comparative score card using 9 popular valuation metricises and compared them to their longer-term averages. Depending upon the stock premium, team gave them either red flag or a green flag.

What is interesting is that only 3 stocks out of the universe of 55 stocks have less than 6 red flags and these are shared as relatively safe super quality stocks. Pls refer the excel above for names like TTK Prestige, Eicher Motors, APL Apollo Tubes. What is worrying is that 44 stocks from this 55 stock universe are expected to give less than 10% CAGR returns over next 3 years. Additionally, as the starting valuations are unrealistically high, it’s likely that majority of these stocks could also give negative returns.

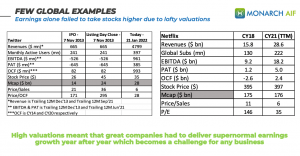

What has been observed in American richly valued cos is also very noteworthy :

The earnings for Twitter have gone 12x since its IPO while the stock price has not appreciated in the same manner. The same could be noted with streaming platform Netflix where PAT has risen 5x in the last 3 years, but the stock price just remained flat. A basket of US Nifty 50 Blue Chip stocks of the 1970s were proof that even with high valuations, the returns remained in the single digit category unless held for more than 20-30 years.

The larger % of top 250 non-financial stocks trade at high valuations in India vs US. The franchises in the US have solid earnings but still have lower valuation multiples than the ones present in India.

What Abhisar is trying to do at Monarch is build a Multi Cap approach where by it follows 60% allocation to businesses upto 20k cr market cap as from this universe, it’s possible to identify those companies that are rightly valued with good growth potential in earnings as well. And, rest 40% to those sectors that were not in favour for some reason, and now could lead the next bull run

The investment strategy in action in Monarch AIF follows three key steps –

- Cash Flow growth – High OCF/EBITDA conversion

- Superior Incremental ROCE – High base level ROE/ROCE (>15%) over 5Y/7Y & Incremental-ROCE > ROCE in the last 3Y/5Y

- Internal funded growth/Strong BS – Growth funded majorly by internal CF and a healthy BS position

The focus of Monarch AIF is on the strong growth-oriented businesses; the potential doublers and steady compounders with an approach of concentrated 15-20 stocks portfolio.

Ultimately, it all boils down to how a portfolio manager generates alpha through his/her strategies. A good batting average of 70%+ is considered good (% of positions going right and generating alpha). Moreover, a high sluggish ratio also needs to be kept in mind. It is the ratio of total profits made when right vs total losers incurred when wrong. Lastly, it depends on the position sizing and the duration for which they were held. A credible management, long growth runway and enough resources help to achieve High Slugging Ratio.

Stock picking is only 30% of the job done right, 70% is how you manage your held stocks

A pertinent question asked from the audience was about the alternative to buying quality at any price led to Mr. Abhisar Jain delving further into the nuances of picking high quality stocks. He explained that being sure of a high earnings growth is of utmost importance which may justify valuations in future. As is the worldwide notion that if the stock price defies gravity year-after-year, the earnings growth should also be on the same pedestal. Although the same cannot continue indefinitely for any company, simultaneous growth should be noticed over a certain period of time.

One really needs to work hard on the slugging ratio if the stocks held in the portfolio start to become pricier day-by-day. It is quite difficult to pin-point a particular exit point on a stock as it is a combination of smart investing and execution. It is easy to follow a narrative whereas it is crucial to follow a rationale to beat the index.

Moderator from PMS AIF WORLD team asked an important question on behalf of audience that how crucial is it to churn the portfolio or shift its weight as classical investing is all about investing for the long-term. Speaker replied that, it is an on-going exercise to check the valuations on a regular basis as yet again a defined threshold is quite difficult to ascertain.

An anti-climactic question asked yet again by Mr. Sankalpo Pal, is there a valuation bubble present in stocks like Twitter or Netflix (stock price that has barely budged in the last 10 years) or is it just a deviation from the usual? It was yet again reiterated that valuations must be supported with steady earnings growth. The regulatory or data related issues at the tech giants may be a cause of concern and a reason for them not being re-rated year-after-year but the same has been noticed across several other stocks.

Monarch AIF has a single scheme which is a closed-ended fund that has not taken inflows in the last 15 months. The theme at the fund house is multi-cap with a flexibility to invest across multi-cap markets and keeping the above filters discussed in mind. They largely invest in companies that have a market cap of 25k Cr or even lesser. The AUM for the first fund remains at 110 Cr but a second fund aims to have a larger AUM which is a CAT III long-only fund.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION