The objective of White Oak India Equity Fund V Category III AIF is to generate sustained capital appreciation through superior returns over time.

White Oak Capital Management- India Equity Fund V – Category III AIF

Fund Category: Category III AIF

Structure: Close-ended Category III AIF

No. of stocks: 50-60

Founder's Name: Mr. Prashant Khemka

Fund Manager: White OAK Capital Management Consultants LLP

Founder's Qualification: Mr. Prashant Khemka has a BE in Mechanical Engineering from Mumbai University and an MBA in Finance from Vanderbilt University in the United States, where he received the Matt Wigginton Leadership Award for outstanding performance in Finance. He was awarded the CFA designation in 2001 and is a fellow of the Ananta Aspen Centre, India. Prashant is AA rated by Citywire based on the three year risk-adjusted performance across all funds he is managing to 31st January 2022

Founder's Experience: Total Experience-21 years, Founded White Oak Capital Management in 2017. He has an extensive investing record across India, Global Emerging Market (GEM) and the US

Investment Objective

The WhiteOak Difference

- WhiteOak Capital Group has its core competence in domestic and global emerging equity markets.

WhiteOak Capital’s differentiation lies in:

• Large Investment Team

• Balanced Portfolio Construction

• Sectoral Analyst: Team within team structure

• Experienced Analysts

• Strict forensic for negative list of stocks

• Tactical Allocation to Small Caps

Investment Culture

• People: Team of Sector Experts with Global Experience

• Bottom-up Stock Selection based Philosophy

• Time Tested Process

• Balanced Portfolio Construction

• Invest in business, don’t bet on macro

• Aim to ensure performance a function of stock selection

• Disciplined Fundamental Research

Investment Process

Idea Generation

• Company visits & field work Supply chain meetings

Analysis

• Business Assessment & Financial modelling

Decision & Sizing

• Combination of business & value Compare across opportunities

Ongoing Evaluation

• Monitor value gap

Avoid misgoverned companies

• Avoid companies which engage in unethical practices or have poor accounting visibility

Investment Philosophy

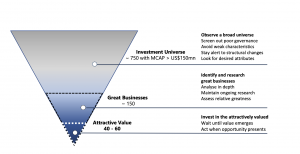

The investment philosophy of White Oak India Equity Fund V Category III AIF is that outsized returns should be earned over time by investing in great businesses. And, a great business is one that is well managed, growing, scalable, and generates superior returns on incremental capital.

A bottom-up stock selection based Philosophy is followed which intends to buy great businesses at attractive values.

The attributes they look for are: Superior returns on investment capital, scaleable long term opportunity, strong execution and governance.

The motto is to invest in businesses, not to bet on macros as the firm believes that macros are for entertainment, so, watch them, but focus on Micros i.e. the underlying portfolio companies in terms of business earnings, and valuations [Current price at a substantial discount to intrinsic value] – this is where White Oak’s Team keeps its focus.

Hence the investment philosophy of White Oak Capital is, “Growth at reasonable prices(GARP)”.

Investment Process

The investment process of White Oak India Equity Fund V Category III AIF is:

Awards & Achievements

• In 2022, White Oak Capital India Pioneers Equity PMS was awarded the Winner as the Best PMS in the Multi Cap Category, on a 2Y Risk-Adjusted Returns. These Awards were hosted by PMS AIF WORLD, in association with IIM-Ahmedabad.

• In 2021, White Oak Capital India Equity Fund, a Long Only Cat III AIF, was awarded the winner in the Best Long Only Cat III AIF, on 3Y Absolute Returns. These Awards were hosted by PMS AIF WORLD, in association with IIM-Ahmedabad.