The jury is out…. Portfolio Management Services (PMS) have outperformed Equity Mutual Funds (MF) by a huge margin!

Charmi Shah

Content & Analysis,

PMS AIF WORLD

Which is better – Portfolio Management Services or Mutual Funds?

We have curated a detailed score card to analyse the performance of both. A comparison has been done between MFs and PMSs (data has been considered as of 31.03.2024 for both, and returns displayed here are net of all expenses and gross of taxes) and the infographics of the same are given below.

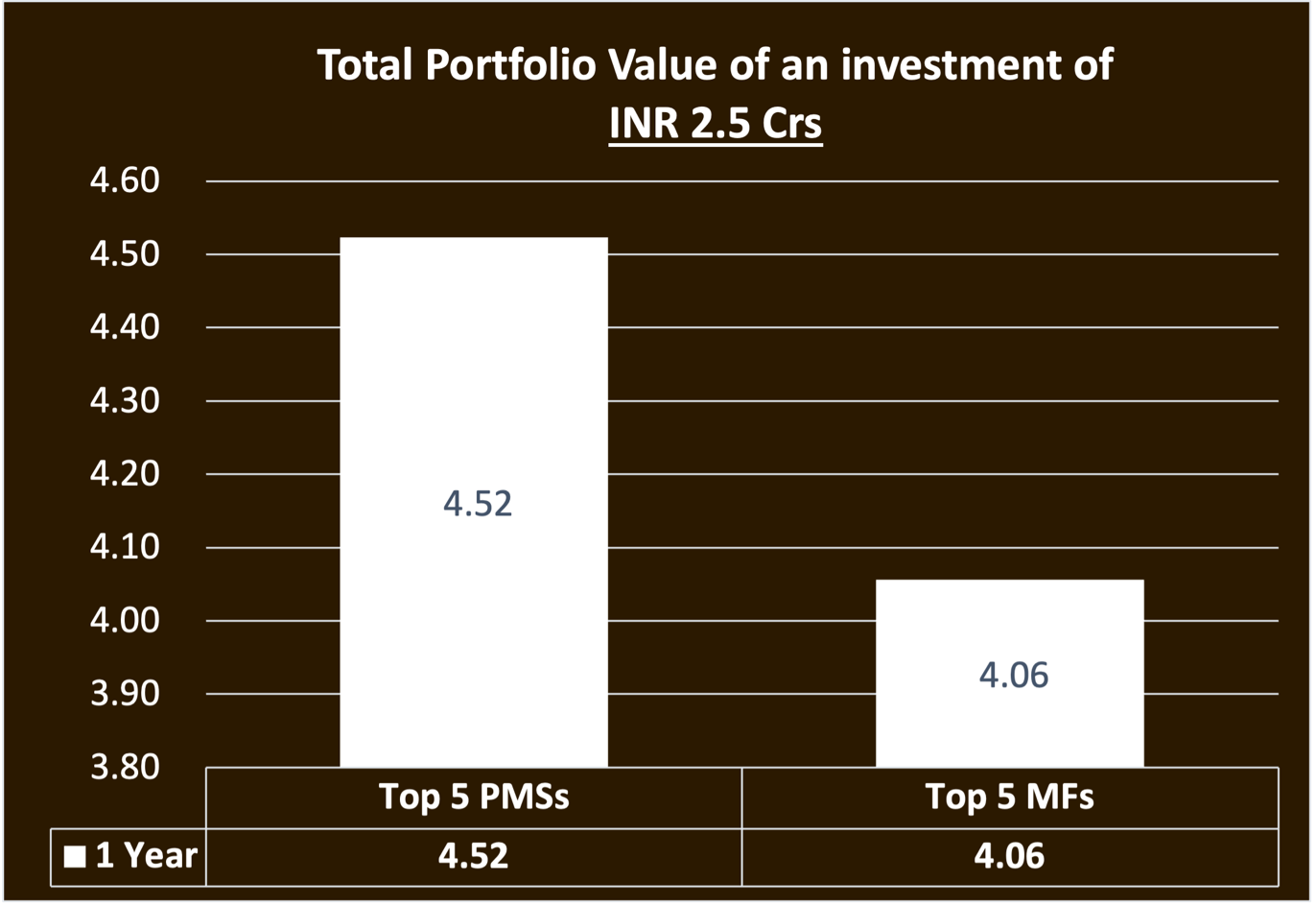

If you had invested INR 50 lakhs each in the basket of Top 5 Equity Mutual Funds v/s in Top 5 Portfolio Management Services over the last 1,2,3,5, and 10 Years, where would you end up?

Check out the numbers below!

For high performance investing, which is better – Portfolio Management Services or Mutual Funds?

Here we present a simple analysis to address some real questions asked by investors today – Where should you invest – Portfolio Management Services (PMS) or Mutual Funds (MF)?

While both are well regulated and credible structures meant to out-perform equity market indices, objective performance analysis conveys that it is the PMSs that have generated significantly higher alpha and so, are righty considered to be wealth-creating vehicles.

We followed 3 simple steps

Step 1: We filtered Top 5 PMSs and Top 5 Mutual Funds (Open Ended, Regular Plans) in different time periods of 1 Year, 2 Years, 3 Years, 5 Years, and 10 Years from all the options available during these time periods; for all— Annualized Returns have been taken for period ending 31.03.2024.

Also, since 10Y is a good long term horizon, we have not bifurcated the comparison into different market cap categories for 10Y. Thus, for a 10-year period, the comparison has been done across all categories; but for 5Y, 3Y, 2Y, and 1Y comparisons, we bifurcated into Multi Cap comparison as well as Mid & Small Comparisons.

Step 2: To make it simpler, we compared Multi Cap PMSs with Multi/Flexi Cap MFs and we compared Mid & Small Cap PMSs with Mid & Small Cap MFs.

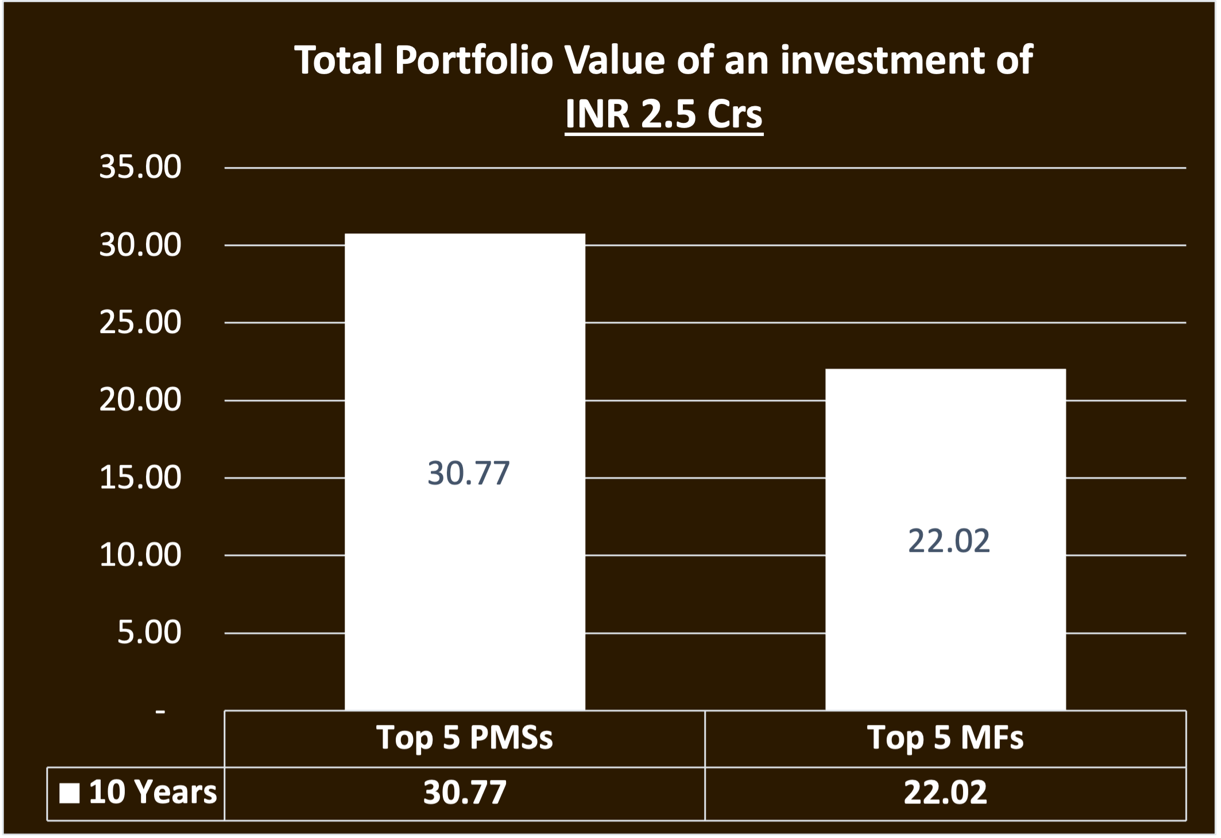

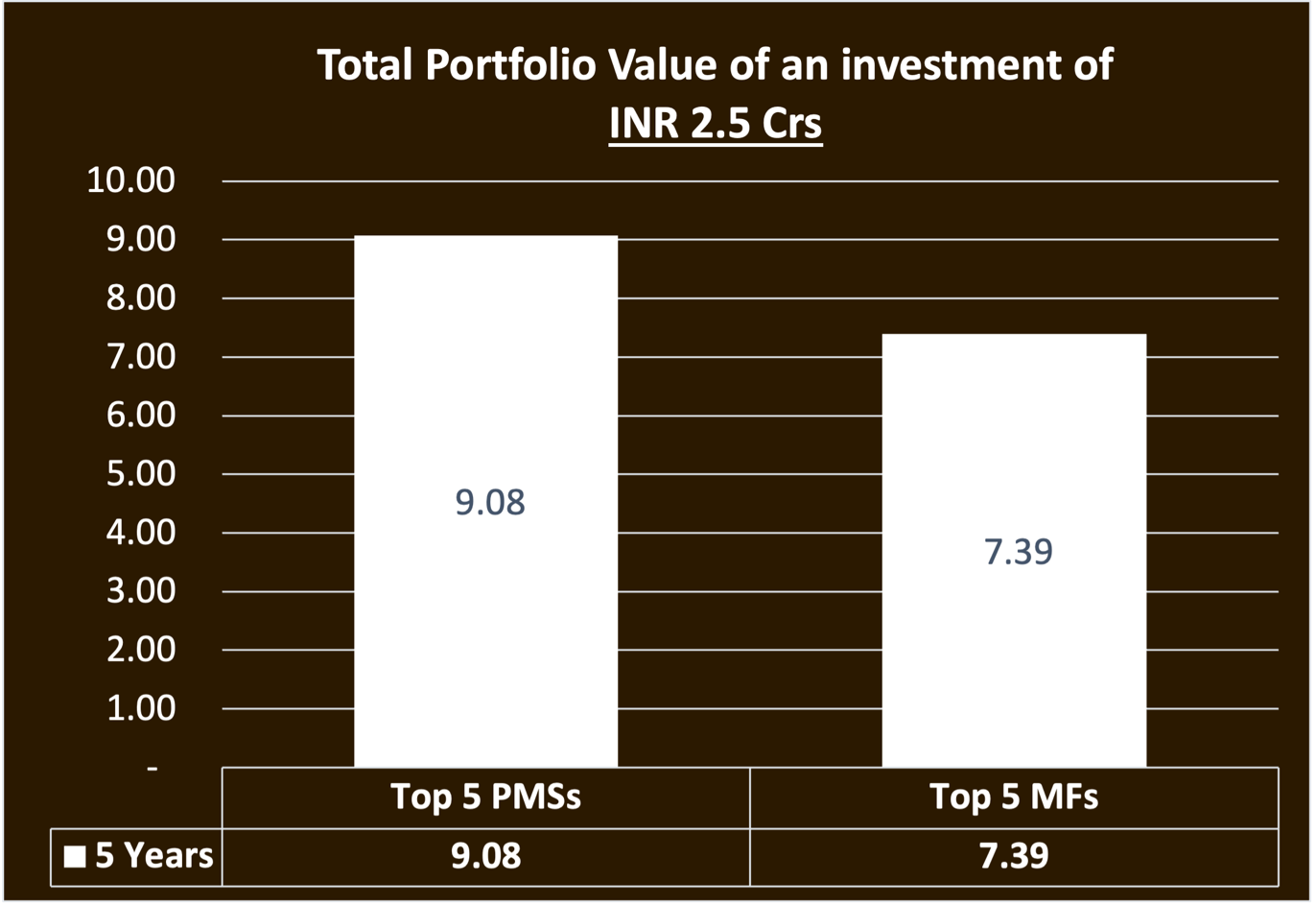

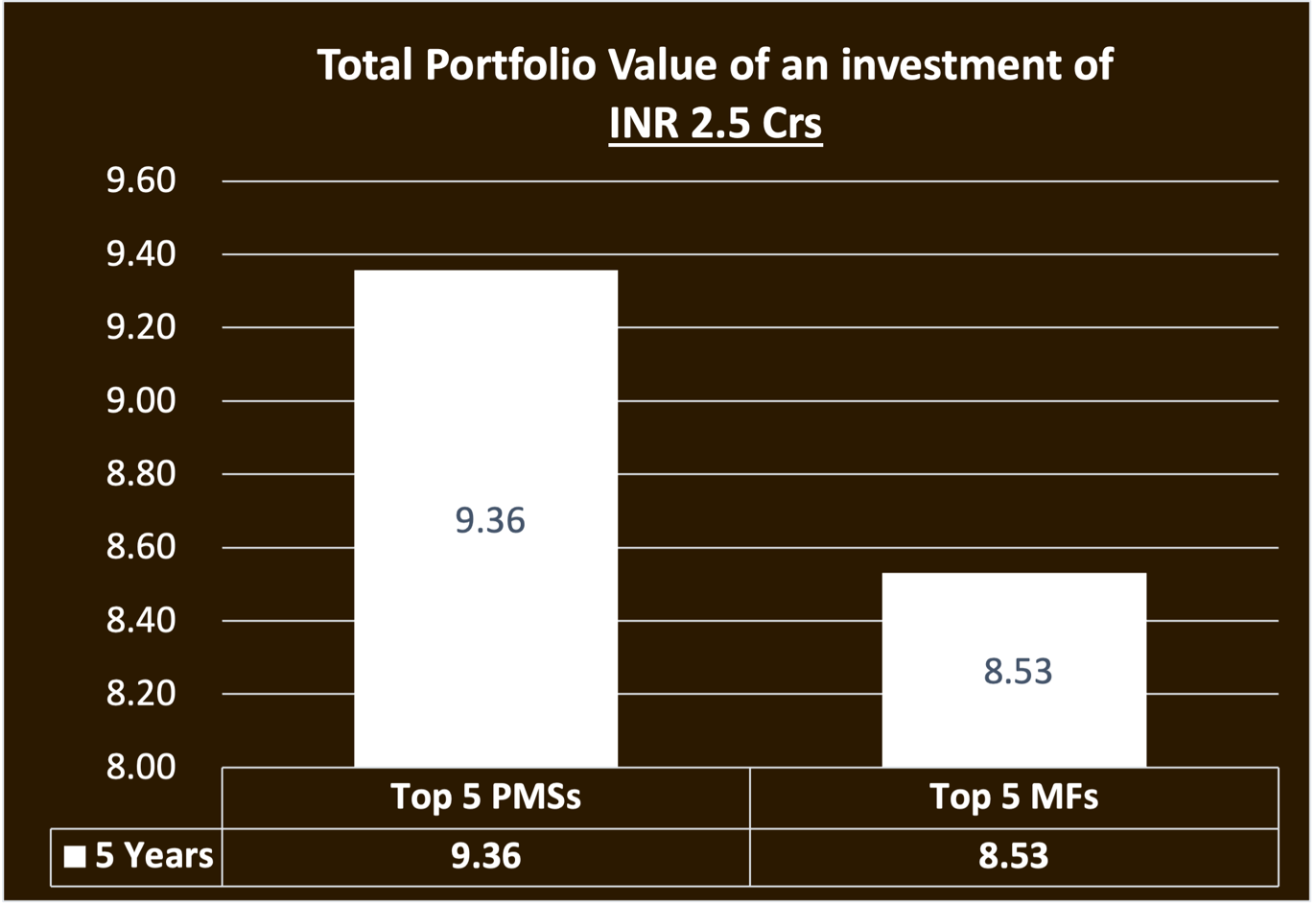

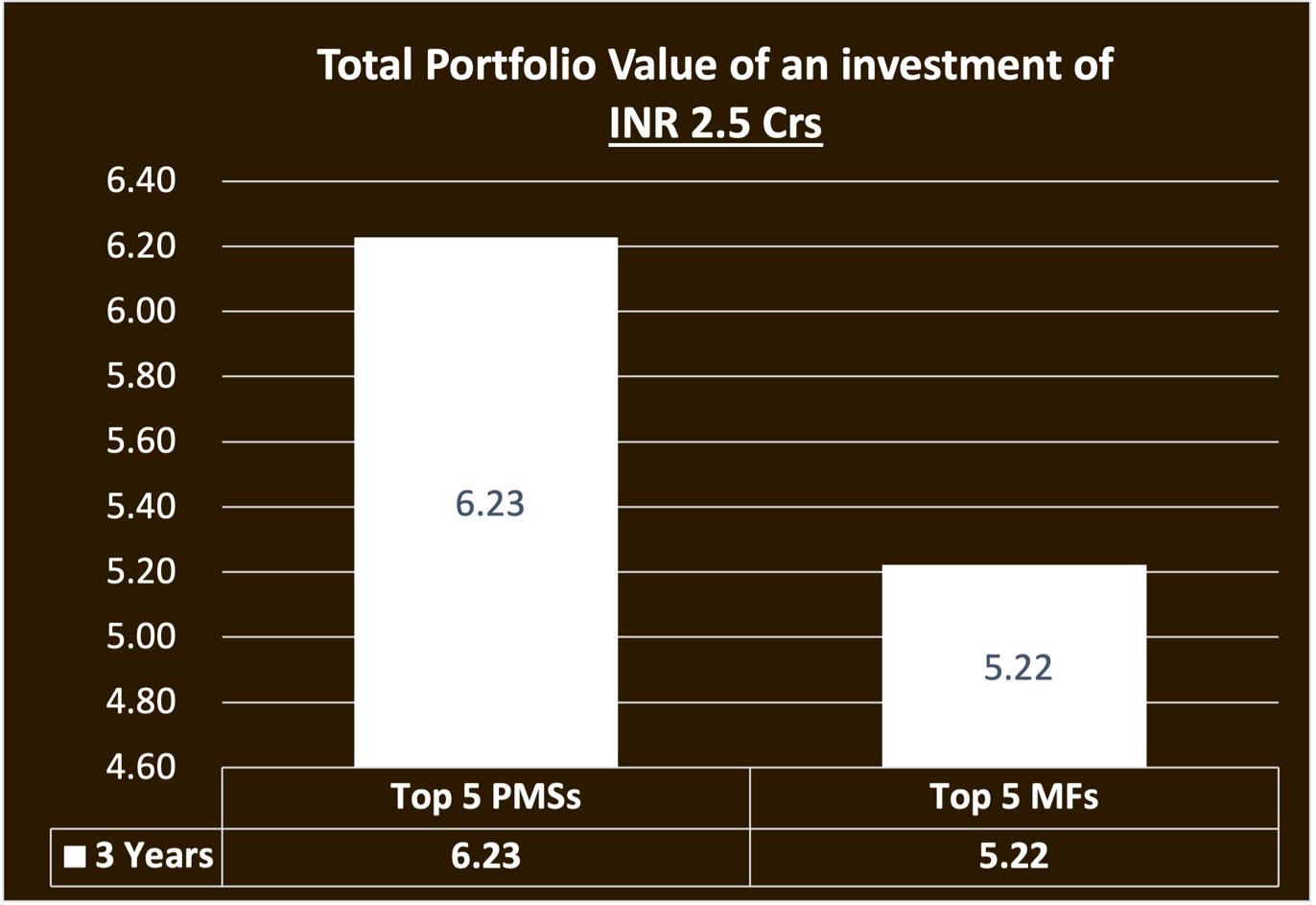

Step 3: We assumed investing INR 2.5 crores in equal weights (i.e. INR 50 lakhs each) in Top 5 PMSs & investing INR 2.5 crores in equal weights (i.e. INR 50 lakhs each) in Top 5 MFs during these time periods and arrived at the following results.

10Y Returns Comparison – Across All Categories

| TOP 5 PMSs- 10Y Returns (Across all categories) | ||

| Scheme Name | AuM (Cr) | Annualized Returns |

| Aequitas Investment India Opportunities PMS | 3149.16 | 34.92% |

| Master Trust India Growth PMS | 502.75 | 28.72% |

| Globe Capital Value PMS | 817.14 | 26.40% |

| Nine Rivers capital Aurum Small Cap Opportunities PMS | 730.00 | 25.97% |

| SageOne Investment Core Portfolio | 3490.00 | 24.00% |

| TOP 5 MFs- 10Y Returns (Across all categories) | ||

| Scheme Name | AuM (Cr) | Annualized Returns |

| Nippon India Small Cap Fund | 46044.13 | 26.44% |

| SBI Small Cap Fund | 25434.98 | 25.57% |

| Quant Flexi Cap Fund | 4154.65 | 23.39% |

| DSP Small Cap Fund | 13709.97 | 22.87% |

| Quant Active Fund | 8466.76 | 22.84% |

Conclusion: If one had invested Rs 2.5 Crs in these top 5 PMSs on 1st April 2014, rather than in the top 5 MFs, over a period of 10 years, one would have generated Rs 8.75 Crs more.

5Y Returns Comparison – Multi Cap

| TOP 5 PMSs- 5Y Returns (Multi Cap Fund) | ||

| Scheme Name | AuM (Cr) | Annualized Returns |

| ValueQuest Platinum Scheme PMS | 1529.00 | 30.16% |

| Sameeksha Capital Equity PMS | 1202.00 | 29.90% |

| Stallion Asset Core PMS | 1407.00 | 29.89% |

| Globe Capital Value PMS | 817.14 | 29.23% |

| Globe Capital Arbitrage PMS | 269.23 | 27.87% |

| TOP 5 MFs- 5Y Returns (Regular Plan, Multi/Flexi Cap Fund) | ||

| Scheme Name | AuM (Cr) | Annualized Returns |

| Quant Flexi Cap Fund | 4154.65 | 28.65% |

| Quant Active Fund | 8466.76 | 27.33% |

| Parag Parikh Flexi Cap Fund | 60559.43 | 22.71% |

| Axis Growth Opportunities Fund | 11310.89 | 21.04% |

| ICICI Prudential Large & Mid Cap Fund | 11333.37 | 20.48% |

Conclusion: If one had invested Rs 2.5 Crs in these top 5 PMSs on 1st April 2019, rather than in the top 5 MFs, over a period of 5 years, one would have generated Rs 1.68 Crs more.

5Y Returns Comparison – Mid & Small Cap

| TOP 5 PMSs- 5Y Returns (Mid & Small Cap Fund) | ||

| Scheme Name | AuM (Cr) | Annualized Returns |

| Green Lantern Capital LLP Growth PMS | 406.49 | 37.87% |

| UNIFI APJ 20 PMS | 620.50 | 29.03% |

| Aequitas Investment India Opportunities PMS | 3149.16 | 28.88% |

| Equirus Long Horizon PMS | 851.87 | 27.11% |

| UNIFI Blended Fund-Rangoli PMS | 12857.00 | 26.83% |

| TOP 5 MFs- 5Y Returns (Regular Plan, Mid & Small Cap Fund) | ||

| Scheme Name | AuM (Cr) | Annualized Returns |

| Quant Small Cap Fund | 17193.09 | 34.60% |

| Nippon India Small Cap Fund | 46044.13 | 28.27% |

| Canara Robeco Small Cap Fund | 9594.98 | 25.43% |

| Tata Small Cap Fund | 6289.22 | 24.93% |

| Invesco India Smallcap Fund | 3705.37 | 24.77% |

Conclusion: If one had invested Rs 2.5 Crs in these top 5 PMSs on 1st April 2019, rather than in the top 5 MFs, over a period of 5 years, one would have generated Rs 0.83 Crs more.

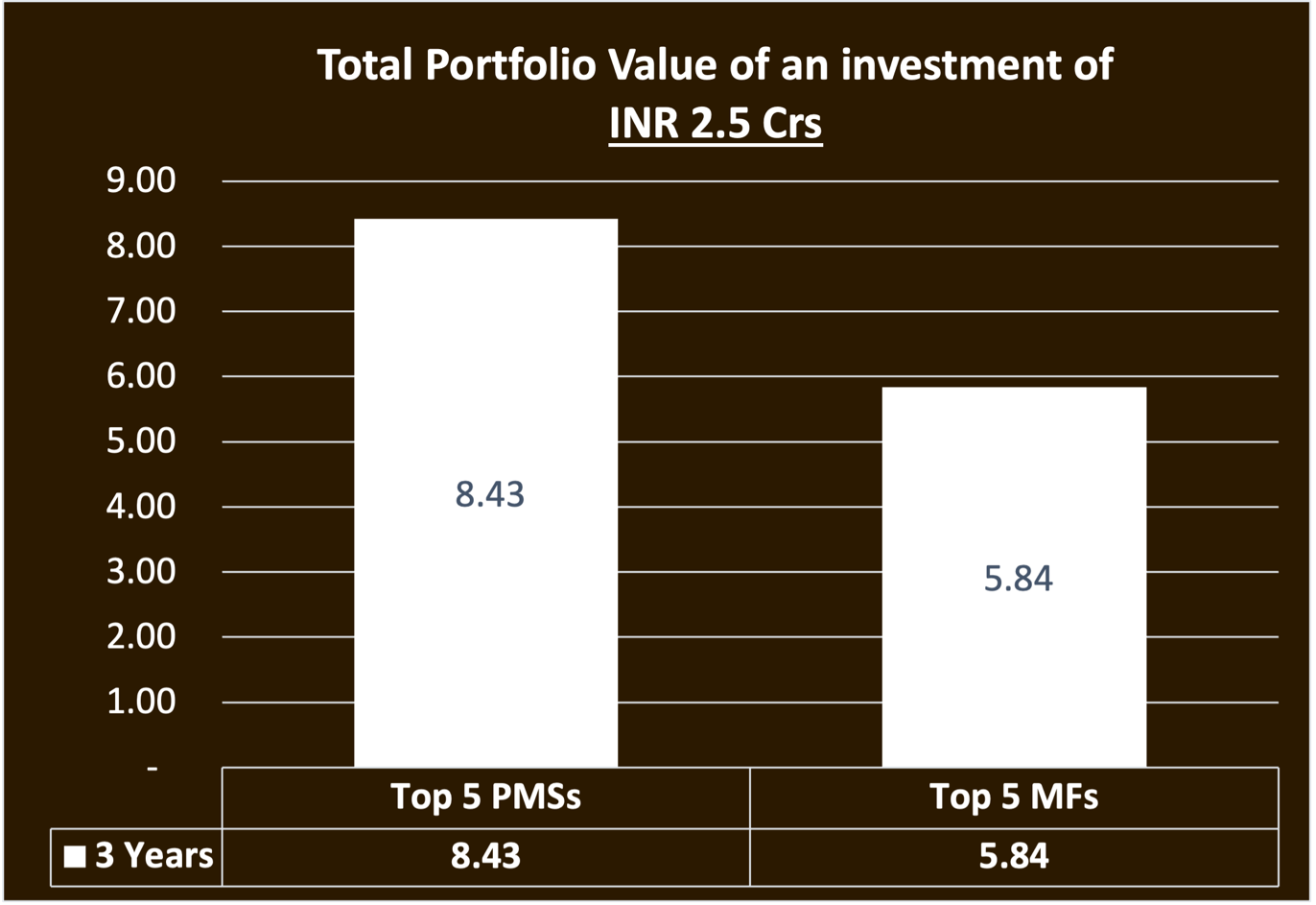

3Y Returns Comparison – Multi Cap

| TOP 5 PMSs- 3Y Returns (Multi Cap Fund) | ||

| Scheme Name | AuM (Cr) | Annualized Returns |

| Carnelian Capital Shift PMS | 1407.00 | 37.30% |

| Invasset LLP Growth PMS | 232.93 | 36.97% |

| Unique Asset Management Strategic PMS | 1247.65 | 35.39% |

| ICICI Prudential PMS Value PMS | 300.10 | 34.37% |

| Ambit Global Private Client Alpha Growth PMS | 402.000 | 33.70% |

| TOP 5 MFs- 3Y Returns (Regular Plan, Multi/Flexi Cap Fund) | ||

| Scheme Name | AuM (Cr) | Annualized Returns |

| Quant Flexi Cap Fund | 4154.65 | 32.23% |

| Nippon India Multicap Fund | 26808.69 | 28.86% |

| Quant Active Fund | 8466.76 | 26.31% |

| ICICI Prudential Large & Mid Cap Fund | 11333.37 | 25.89% |

| HDFC Flexi Cap Fund | 49656.92 | 25.62% |

Conclusion: If one had invested Rs 2.5 Crs in these top 5 PMSs on 1st April 2021, rather than in the top 5 MFs, over a period of 3 years, one would have generated Rs 1.01 Crs more.

3Y Returns Comparison – Mid & Small Cap

| TOP 5 PMSs- 3Y Returns (Mid & Small Cap Fund) | ||

| Scheme Name | AuM (Cr) | Annualized Returns |

| Counter Cyclical Investments – Diversified Long Term Value PMS | 577.04 | 58.95% |

| Green Lantern Capital LLP Growth PMS | 406.49 | 58.72% |

| Aequitas Investment India Opportunities PMS | 3149.16 | 55.31% |

| Electrum Laureate PMS | 283.00 | 37.10% |

| Equitree Emerging Opportunities PMS | 177.79 | 35.99% |

| TOP 5 MFs- 3Y Returns (Regular Plan, Mid & Small Cap Fund) | ||

| Scheme Name | AuM (Cr) | Annualized Returns |

| Quant Small Cap Fund | 17193.09 | 39.10% |

| Nippon India Small Cap Fund | 46044.13 | 32.93% |

| HSBC Small Cap Fund | 13746.58 | 31.55% |

| HDFC Small Cap Fund | 28598.92 | 29.85% |

| Franklin India Smaller Companies Fund | 11822.68 | 29.44% |

Conclusion: If one had invested Rs 2.5 Crs in these top 5 PMSs on 1st April 2021, rather than in the top 5 MFs, over a period of 3 years, one would have generated Rs 2.59 Crs more.

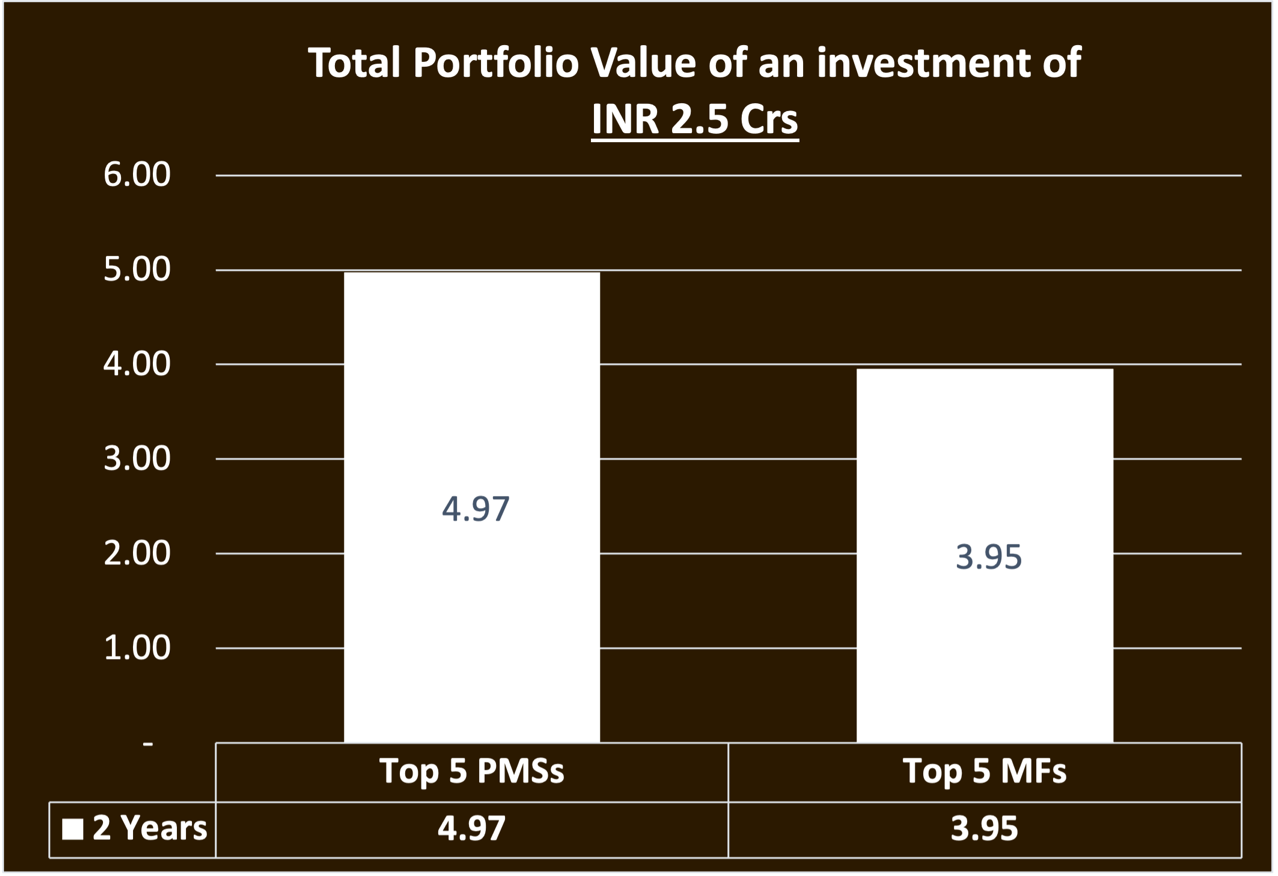

2Y Returns Comparison – Multi Cap

| TOP 5 PMSs- 2Y Returns (Multi Cap Fund) | ||

| Scheme Name | AuM (Cr) | Annualized Returns |

| Samvitti Capital Active Alpha Multicap PMS | 191.71 | 49.72% |

| Invasset LLP Growth PMS | 232.93 | 45.35% |

| Unique Asset Management Strategic PMS | 1247.65 | 38.27% |

| ICICI Prudential PMS Value PMS | 300.10 | 36.16% |

| Samvitti Capital Aggressive Growth PMS | 250.16 | 35.10% |

| TOP 5 MFs- 2Y Returns (Regular Plan, Multi/Flexi Cap Fund) | ||

| Scheme Name | AuM (Cr) | Annualized Returns |

| HDFC Multicap Fund | 12231.81 | 26.53% |

| Nippon India Multicap Fund | 26808.69 | 26.31% |

| Bandhan Core Equity Fund | 3883.52 | 25.56% |

| Quant Flexi Cap Fund | 4154.65 | 25.51% |

| HDFC Flexi Cap Fund | 49656.92 | 24.81% |

Conclusion: If one had invested Rs 2.5 Crs in these top 5 PMSs on 1st April 2022, rather than in the top 5 MFs, over a period of 2 years, one would have generated Rs 1.02 Crs more.

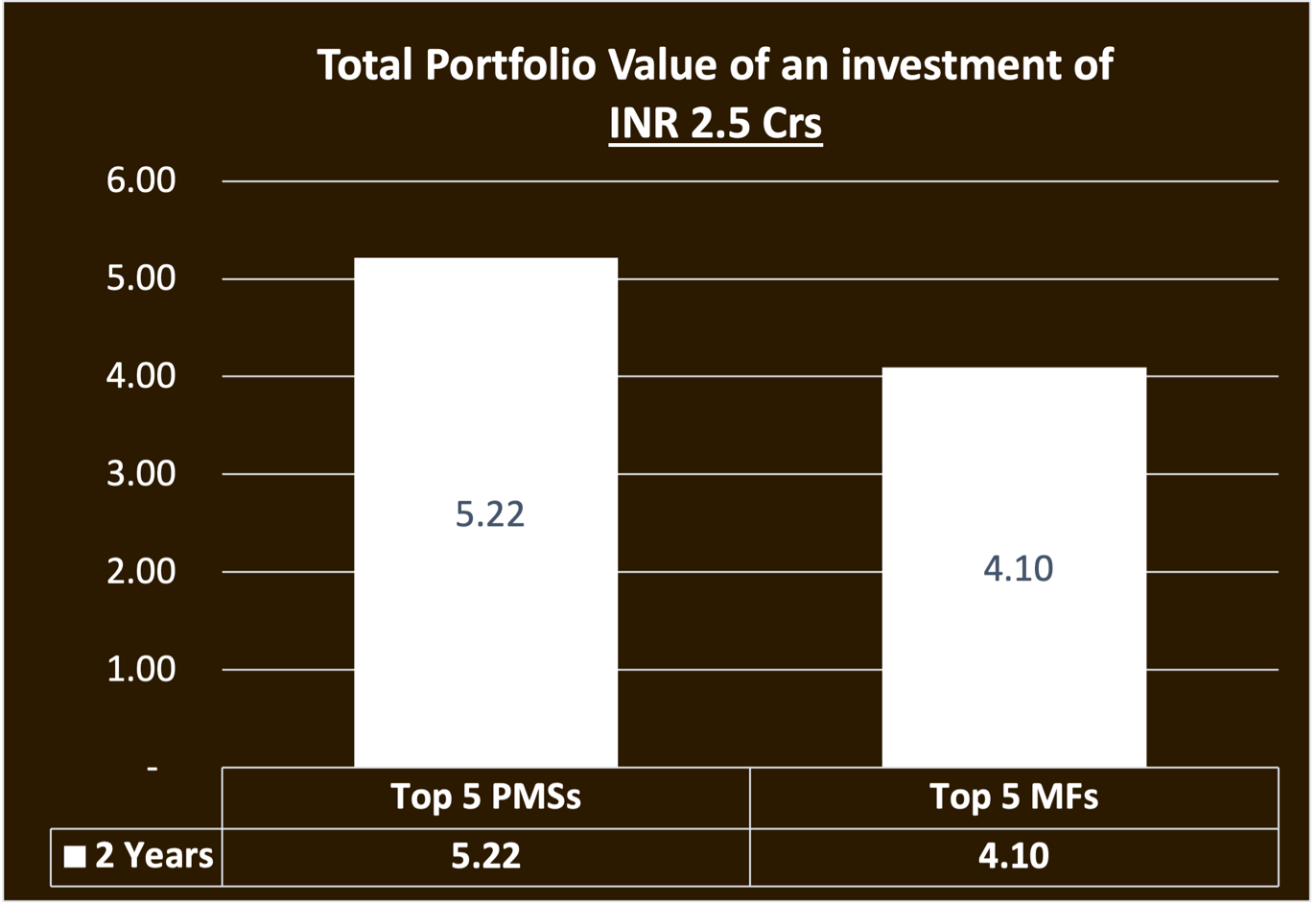

2Y Returns Comparison – Mid & Small Cap

| TOP 5 PMSs- 2Y Returns (Mid & Small Cap Fund) | ||

| Scheme Name | AuM (Cr) | Annualized Returns |

| Green Lantern Capital LLP Growth PMS | 406.49 | 60.41% |

| Aequitas Investment India Opportunities PMS | 3149.16 | 47.97% |

| Molecule Ventures Growth PMS | 459.72 | 45.64% |

| Counter Cyclical Investments – Diversified Long Term Value PMS | 577.04 | 34.87% |

| ICICI Prudential PMS PIPE PMS | 4792.60 | 31.54% |

| TOP 5 MFs- 2Y Returns (Regular Plan, Mid & Small Cap Fund) | ||

| Scheme Name | AuM (Cr) | Annualized Returns |

| Quant Small Cap Fund | 17193.09 | 30.48% |

| Franklin India Smaller Companies Fund | 11822.68 | 27.89% |

| Nippon India Small Cap Fund | 46044.13 | 27.88% |

| HDFC Small Cap Fund | 28598.92 | 27.69% |

| Bandhan Small Cap Fund | 4389.28 | 26.13% |

Conclusion: If one had invested Rs 2.5 Crs in these top 5 PMSs on 1st April 2022, rather than in the top 5 MFs, over a period of 2 years, one would have generated Rs 1.12 Crs more.

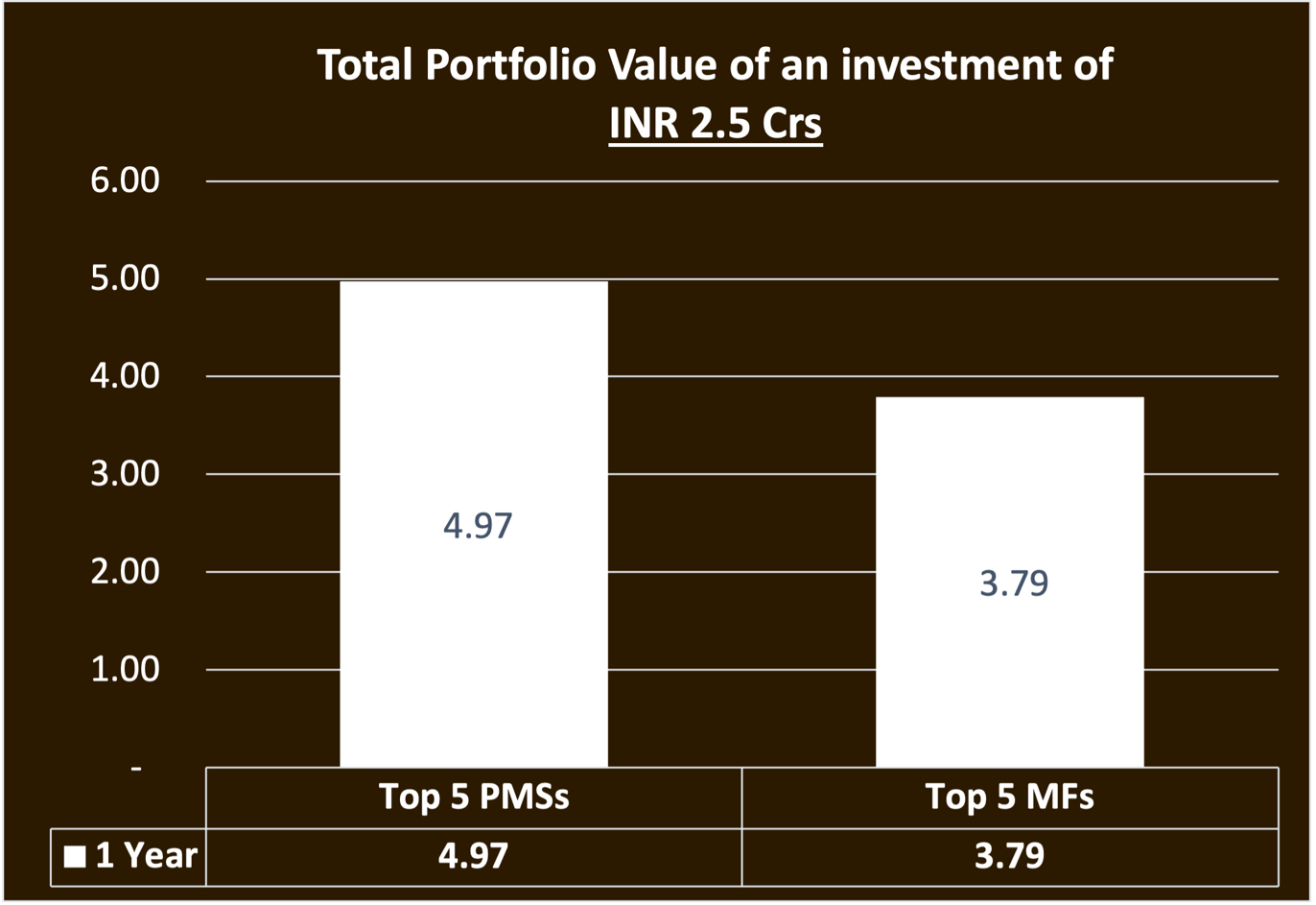

1Y Returns Comparison – Multi Cap

| TOP 5 PMSs- 1Y Returns (Multi Cap Fund) | ||

| Scheme Name | AuM (Cr) | Annualized Returns |

| Invasset LLP Growth PMS | 232.93 | 128.47% |

| Samvitti Capital Active Alpha Multicap PMS | 191.71 | 98.40% |

| Ambit Global Private Client Alpha Growth PMS | 402.00 | 94.80% |

| Shepherd’s Hill Value Mango PMS | 104.49 | 89.48% |

| Samvitti Capital Aggressive Growth PMS | 250.16 | 83.66% |

| TOP 5 MFs- 1Y Returns (Regular Plan, Multi/Flexi Cap Fund) | ||

| Scheme Name | AuM (Cr) | Annualized Returns |

| Quant Flexi Cap Fund | 4154.65 | 57.28% |

| Bandhan Core Equity Fund | 3883.52 | 52.72% |

| Nippon India Multicap Fund | 26808.69 | 49.99% |

| Quant Active Fund | 8466.76 | 49.47% |

| HDFC Multicap Fund | 12231.81 | 48.97% |

Conclusion: If one had invested Rs 2.5 Crs in these top 5 PMSs on 1st April 2023, rather than in the top 5 MFs, over a period of 1 year, one would have generated Rs 1.18 Crs more.

1Y Returns Comparison – Mid & Small Cap

| TOP 5 PMSs- 1Y Returns (Mid & Small Cap Fund) | ||

| Scheme Name | AuM (Cr) | Annualized Returns |

| Green Lantern Capital LLP Growth PMS | 406.49 | 110.79% |

| Aequitas Investment India Opportunities PMS | 3149.16 | 82.83% |

| Roha Asset Managers Emerging Champions PMS | 436.00 | 76.64% |

| Motilal Oswal AMC Mid to Mega PMS | 1425.00 | 68.03% |

| SageOne Investment Core PMS | 3490.00 | 66.30% |

| TOP 5 MFs- 1Y Returns (Regular Plan, Mid & Small Cap Fund) | ||

| Scheme Name | AuM (Cr) | Annualized Returns |

| Bandhan Small Cap Fund | 4389.28 | 69.29% |

| Quant Small Cap Fund | 17193.09 | 66.27% |

| Mahindra Manulife Small Cap Fund | 3526.63 | 65.59% |

| Nippon India Small Cap Fund | 46044.13 | 55.14% |

| HSBC Mid Cap Fund | 9724.77 | 54.91% |

Conclusion: If one had invested Rs 2.5 Crs in these top 5 PMSs on 1st April 2023, rather than in the top 5 MFs, over a period of 1 year, one would have generated Rs 0.47 Crs more.

From the above results, it is clear that investing in PMSs has created more wealth for investors than investing in MFs.

This was simple. The difficult task starts from here on. And, that is –

- How to select the potential Best 5 Portfolios for different periods of 3 to 5 years of future investments?

- How to have the conviction to hold the best ones for the longer term?

And, this is best endeavored by our Analytics & Content backed approach.

Our proprietary analysis & content helps tackle the above 2 tasks. We are very selective, and we analyze PMS products across the 5 Ps – People, Philosophy, Performance, Portfolio, and Price with an aim to ascertain the Quality, Risk, and Consistency (QRC) attributes before suggesting the same to investors.

Holding on to the good equity investments requires high conviction in the portfolio at all points of time, else, one tends to exit early owing to the traps of emotions or impatience. With our proprietary content via fund manager videos, newsletters, and articles, we keep our clients updated, and this ensures our clients always make informed decisions.

We offer responsible, long-term quality investing. Our Philosophy is simple, but not easy –

Quality + High Conviction = Compounding.

For any queries related to your investment needs, book an appointment with our experts.

This analytics is an endeavor to compare MFs and PMSs objectively.

Please Note:

- Min AUM taken for PMSs (3Y, 5Y, and 10Y Category) is Rs 200 Crs

- Min AUM taken for PMSs (2Y Category) is Rs 100 Crs

- Min AUM taken for PMSs (1Y Category) is Rs 75 Crs

- Min AUM taken for MFs (5Y, and 10Y Category) is Rs 4000 Crs

- Min AUM taken for MFs (3Y Category) is Rs 3000 Crs

- Min AUM taken for MFs (2Y, and 1Y Category) is Rs 2000 Crs

Source: Respective PMS Companies’ Audited Factsheets for PMS Data and Value Research & Moneycontrol P2P Data for MF Data. Returns more than 1 year is CAGR. These are Point-to-Point returns till 31st March 2024. So, for 10Y, the period taken is 01st April 2014 to 30th March 2024 and likewise for others as well.

Wealth Management Industry is not designed to be Fair. There are hundreds of products and strategies that waste time and money. A strict discipline is required, and one must practice caution while investing. It is easy to socialize and sell, which is what most sales-driven wealth management companies do. But it is equally difficult to maintain insight and integrity, which is what drives us.

PMS AIF WORLD provides analytics & content backed quality investment services. It is easy to socialize and sell, which is what most sales-driven wealth management companies do. But it is equally difficult to maintain insight and integrity, which is what drives us. Our focus is Performance, and we are driven by meaningful analytics.

We are a new age Wealth Management Company. With us, investors make informed investment decisions.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION