Q1

India entered this decade with a fairly comfortable degree of macro-economic and policy stability. But within the first 3 years of this decade, we have witnessed a lot of turmoil. Standing at a crucial juncture now, how fast will India recover from the macro shocks & what should investors hold on to?

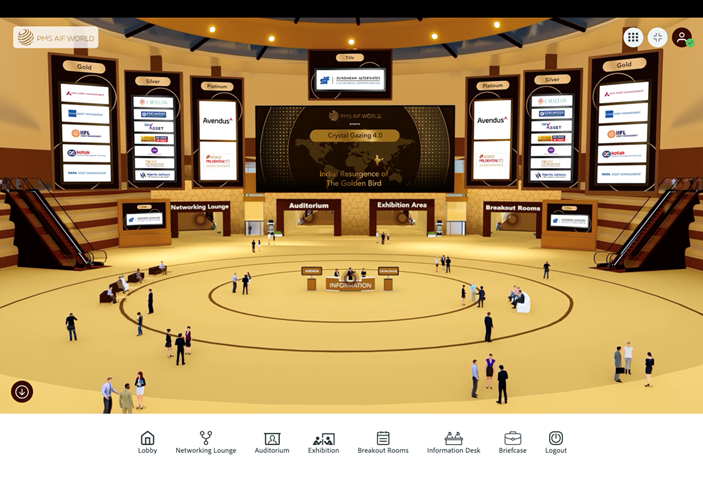

PMS AIF WORLD

brings to you

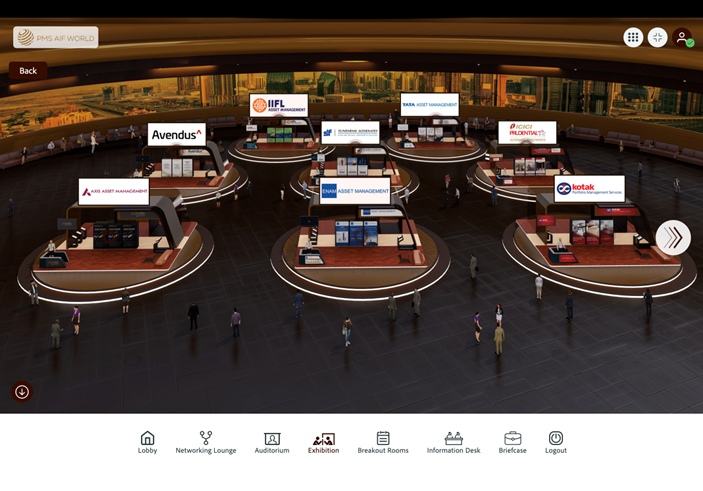

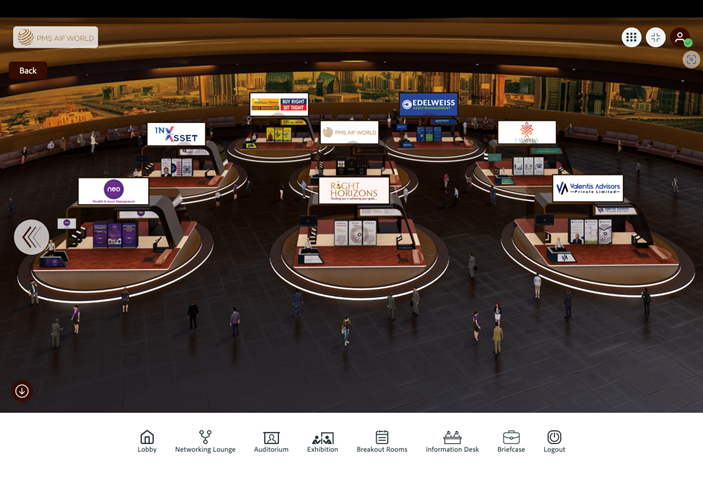

ALTERNATES SUMMIT & AWARDS 2024

CRYSTAL GAZING 5.0

6 Years to $6 trillion Indian Economy

FEB 2024

Esteemed Speakers

Esteemed Moderators

Event Schedule

CRYSTAL GAZING 5.0: 6 Years to $6 trillion Indian Economy

Day 1 | 23 Feb 2024

Welcome Note

Team PMS AIF WORLD

What does the trinity of Higher, Durable, and Qualitative growth of Indian economy convey for the future of stock markets?

Bharat Shah Moderator: Kamal Manocha

Are we heading towards a Bubble OR is this the beginning of a Mega Bull Run?

Chockalingam Narayanan | Divam Sharma | Hitesh Zaveri Moderator: Rakhi Prasad

Why and how to invest in Private Equity Alternatives

Ashish Ahluwalia

Does the private capital expenditure boom offer an opportunity for private credit funds to lend smartly for high double-digit returns?

Akash Desai | Shekhar Daga | Nikhil Garg Moderator: Lakshmi Iyer

Cyclicals vs Seculars: The bigger opportunity over next 3 years

Gaurav Mehta | Kunal Pawaskar | Ashish Jagnani Moderator: Romit Borat

How will the structure of India's top 500 companies likely transform as the country moves towards a $6 trillion economy?

Sunil Singhania | Nilesh Shah | Rajesh Kothari | Vikas Khemani Moderator: Kamal Manocha

Alternative strategies to tap opportunities that could create un-paralleled wealth in the future

Nishad Khanolkar | Jaimin Gupta | Neil Bahal | Yash Ravel Moderator: N Mahalakshmi

Role of alternative investment strategies for better risk-adjusted returns in the future

Praveen Kumar | Vineet Jain | Raman Nagpal Moderator: N Mahalakshmi

Vote of Thanks and Context for the next day

Team PMS AIF WORLD

Day 2 | 24 Feb 2024

Welcome Note

Team PMS AIF WORLD

If quant can be unbiased, Human can be a Genius

Amit Jeswani | Anirudh Garg | Sonam Srivastava Moderator: Kamal Manocha

How to identify fast growing and compounding businesses going ahead?

Manish Bhandari | Rajnish Garg | Arun Subrahmanyam Moderator: Kamal Manocha

How to steer portfolio towards sustained wealth creation in a landscape marked by high valuations?

Bhavin Shah | Jyotivardhan Jaipuria | EA Sundaram Moderator: Ritika Farma

Trend has changed

Anand Shah

As more investors embrace risk, how to make informed decisions and avoid the greed trap?

Anunaya Kumar | Nimesh Mehta Moderator: Rakesh Rathod

Why is the age-old flexicap among the most favored investment styles and how does it suit the present times?

Sandip Bansal | Govind Agrawal | Abhisar Jain Moderator: Archan Thakore

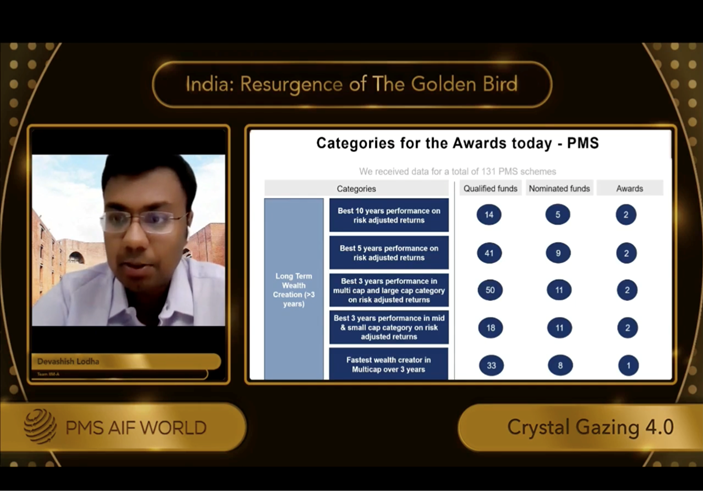

MONEY MANAGER AWARDS

Team IIM-A

Vote of Thanks

Team PMS AIF WORLD

Six Imp Questions that will be answered

Q2

As the Indian economy progresses from $3.5 tn to $6 tn over the next 6 years, what is the sector wise view? Which ones will emerge as best performing sectors in the stock market and how will sector wise weights change in NSE 500 over this period of time?

Q3

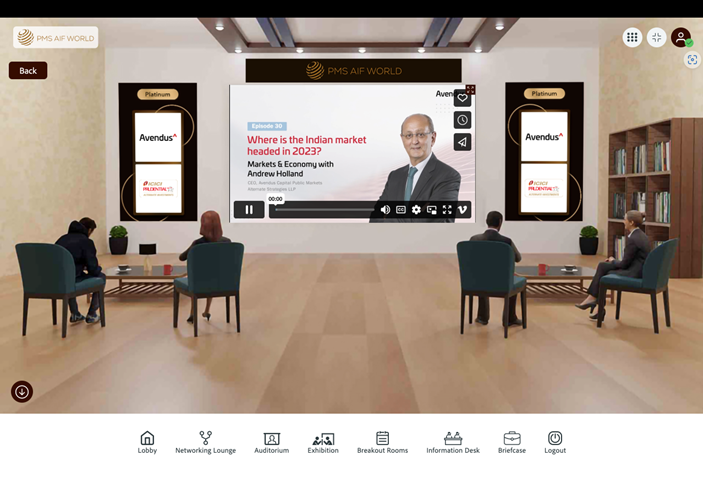

Most global banks and agencies have downgraded their growth outlook for India to below 7%. In such a scenario, how are markets expected to perform for the next few years?

Q4

With US bond yields crossing 5% in 2033 1st time after the 2008 subprime crisis, there seems to be a flight of capital from risky assets to risk free assets and this is leading to FIIs selling. With the Fed’s strict inflation target of 2%, the US seems to be firm on its hawkish stance towards federal rates. In the last 2-3 years, with FIIs moving away and DIIs adding in, the stock market has turned -ve for growth stocks and +ve for value stocks. What is the way forward?

Q5

Once branded a “third world country,” India is now among the biggest economies of the world. What lies ahead for India & what should investors look out for?

Q6

If the Indian economy is considered to be at an inflexion point, will we succumb to the ongoing global shocks or emerge victorious out of it? How will a global recession impact us & what should be the investment approach going forward?

WEALTH MANAGEMENT INDUSTRY IS NOT DESIGNED TO BE FAIR

This led to the creation of PMS AIF WORLD, where we focus on the best quality products, analysis-backed selection, and the finest educative approach for informed investment decisions.

Our right intent and relentless efforts have made us a trusted platform in the space of alternates.

GENUINE

VISIONARY

CREATIVE

FOCUSED

PERSISTENT

What Can One Expect

Strategic Vision

Explore the grand narrative of India’s economic ascent to a $6 trillion economy. This event will set the stage, offering a macroeconomic overview and strategic insights into the fiscal and regulatory roadmaps that could shape India’s financial future.

Sophisticated Analysis

We will delve into an in-depth analysis of market trends, investment opportunities, and policy shifts. Our line-up of speakers via engaging Panel Discussions will shed light on how these elements converge to influence investor decision-making.

Sectoral Spotlights

Our focused discussions will highlight key sectors that are instrumental in propelling India’s economic growth. Expect to gain valuable knowledge on which industries offer the most promising prospects for investment and innovation.

Sustainable Strategies

Sustainability is no longer an option but a necessity. This segment will explore how sustainable practices and ESG considerations are becoming integral to building resilient investment portfolios and contributing to the larger goal of robust economic growth.

Synergistic Dialogues

Engage with thought leaders and industry veterans in a series of interactive dialogues designed to foster collaboration and idea-sharing. These sessions will encapsulate the synergy between various market forces and investment philosophies.

CRYSTAL GAZING 5.0: 6 Years to $6 trillion Indian Economy

FEB 2024