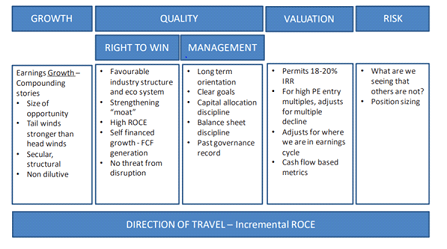

The objective is to invest in compounding stories (companies with tail winds of growth that are focused on disciplined growth around a core business definition, and where success is reflected in an expanding moat and increasing market share and ROE).

Performance Table #

| Trailing Returns (%) | 1m return | 3m return | 6m return | 1y return | 2y return | 3y return | 5y return | 10y return | Since inception return |

|---|---|---|---|---|---|---|---|---|---|

Do Not Simply Invest, Make Informed Decisions

WISH TO MAKE INFORMED INVESTMENTS FOR LONG TERM WEALTH CREATION

Disclaimer

#Returns as of 31 May 2025. Returns up to 1 Year are absolute, above 1 Year are CAGR.