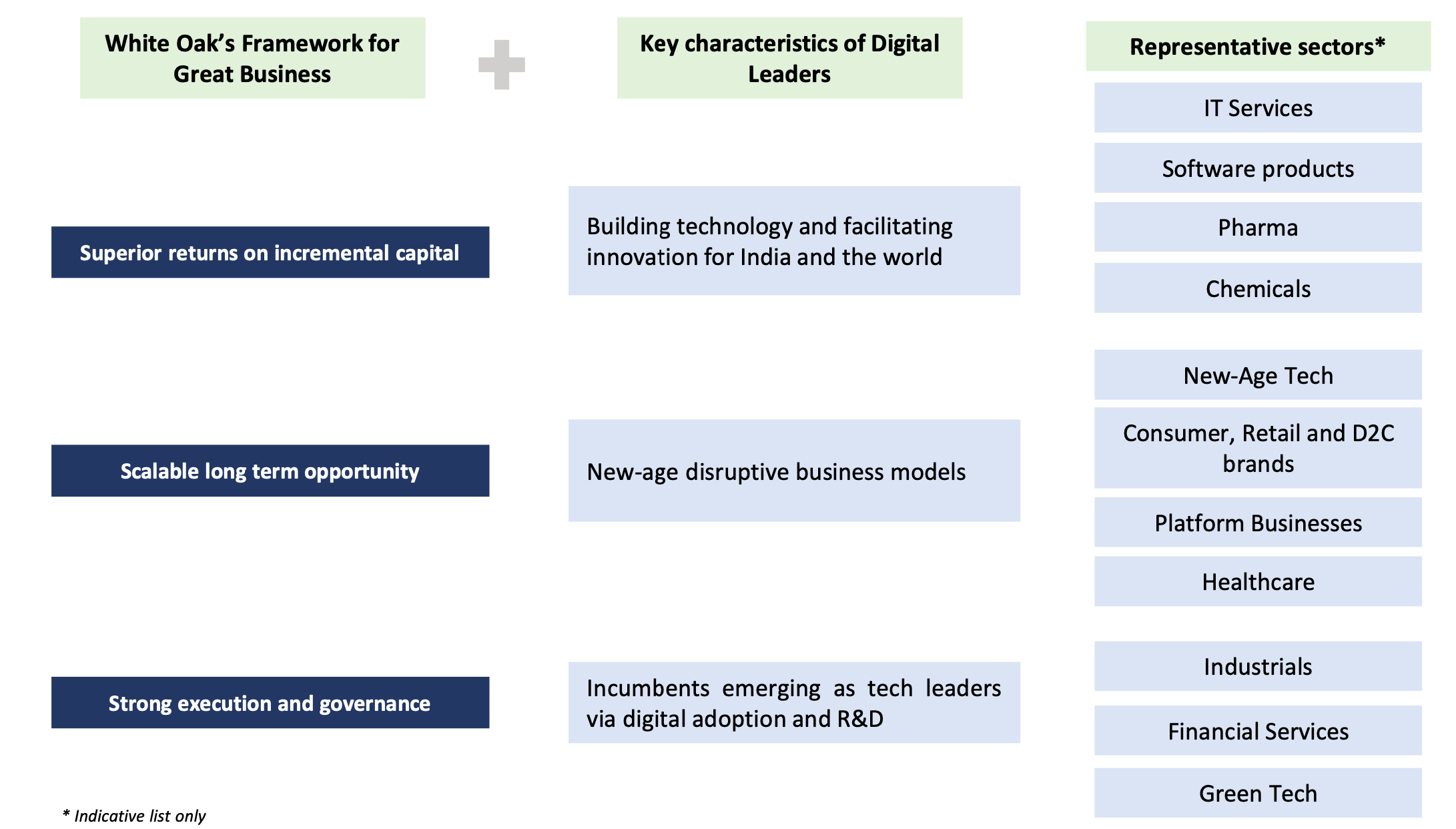

The investment philosophy of White Oak India Digital Leaders Strategy is that outsized returns should be earned over time by investing in great businesses. And, a great business is one that is well managed, growing, scalable, and generates superior returns on incremental capital.

A bottom-up stock selection based Philosophy is followed which intends to buy great businesses at attractive values.

The attributes they look for are: Superior returns on investment capital, scaleable long term opportunity, strong execution and governance.

The motto is to invest in businesses, not to bet on macros as the firm believes that macros are for entertainment, so, watch them, but focus on Micros i.e. the underlying portfolio companies in terms of business earnings, and valuations [Current price at a substantial discount to intrinsic value] – this is where White Oak’s Team keeps its focus.

Hence the investment philosophy of White Oak Capital is, “Growth at reasonable prices(GARP)”.