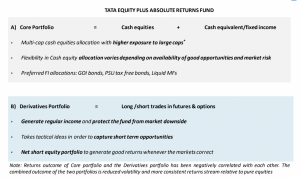

The investment strategy of TATA Equity Plus Absolute Return Fund- Category III AIF is aimed in such a way that:

TATA EQUITY PLUS ABSOLUTE RETURNS FUND = INVESTMENT PORTFOLIO + HEDGE PORTFOLIO

The investment portfolio is built for investing with an aim to generate alpha over Nifty 50. This is done by:

• Stock Selection

• Portfolio Construction

• Stock Exit Strategy

The hedge portfolio is built targeting to generate positive returns and cash irrespective of market conditions. This is done via:

• Long & Short Positions

• Supplement to investment portfolio

• Focusing on Risk:Return

• Profit booking orientation

• Dynamic Gross exposure adjustments