Rewarding long term performance of sizeable funds keeping portfolio risk in consideration

India's

Smart Money Manager Awards 2022

Methodology | Categories | Winners

Performance Data

As Of 31-Dec-2021

131 PMS Schemes

37 AIF Schemes

12 Categories

20 Winners

Objective Of Award Categorization

Recognizing funds who have been new-comers to the industry keeping in mind Covid-19 disruptions

Prioritizing categories with a substantial number of funds in the consideration set

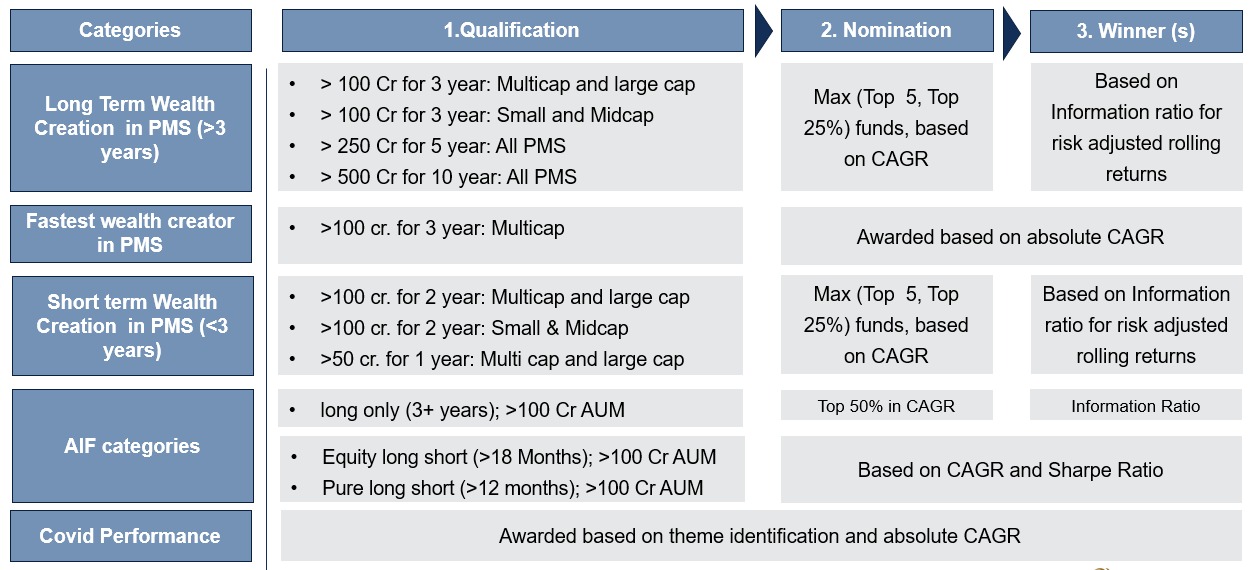

Overview of Methodology

We used a 3 stage process to arrive at the winner

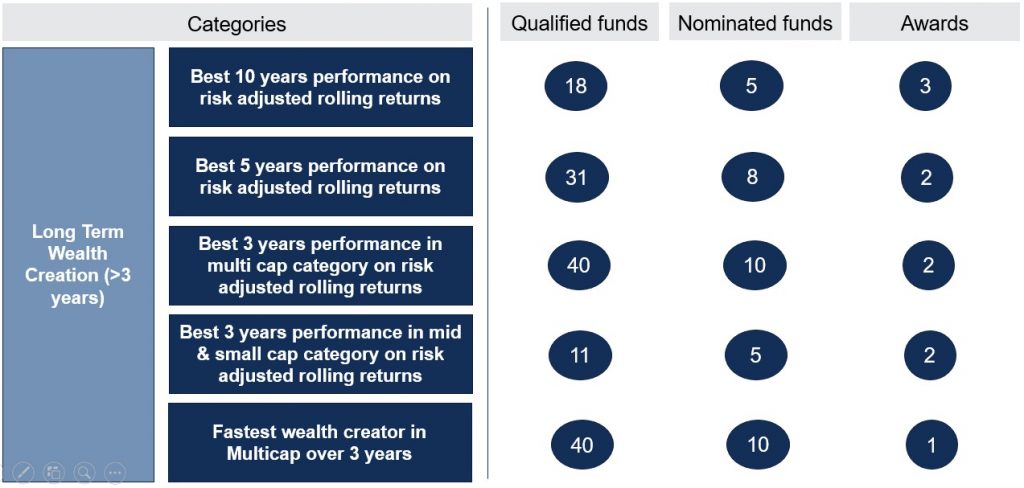

Award Categories

We Received data for a total of 131 PMS and 37 AIF strategies

Do Not Simply Invest, Make Informed Decisions

WISH TO MAKE INFORMED INVESTMENTS FOR LONG TERM WEALTH CREATION

Awards - PMS Winners

Best PMS in 10 Years across all categories

(Risk-Adjusted Rolling Returns)

Rank 1

Best PMS in 5 Years across all categories

(Risk-Adjusted Rolling Returns)

Best PMS in 3 Years: Multicap category

(Risk-Adjusted Rolling Returns)

Rank 1

Rank 2

Best PMS in 3 Years: Mid & Small cap category

(Risk-Adjusted Rolling Returns)

Best PMS on 2 Year Performance Multi Cap Category

(Risk-Adjusted Rolling Returns)

Best PMS on 2 Year Performance Mid & Small Cap Category

(Risk-Adjusted Returns)

Best PMS on 1 Year Performance Across All Categories

(Risk-Adjusted Returns)

Best PMS on Absolute Returns

And Best Theme Identification

(Post Pandemic Period)

Awards - AIF Winners

Best AIF CAT 3 Long Only

( 3 Years of Risk-Adjusted Returns)

Best AIF CAT 3 Equity Long Short

( 18 Months of Risk-Adjusted Returns)

Best AIF CAT 3 Pure Long Short

( 12 Months of Risk-Adjusted Returns)

Event Gallery

Please wait while flipbook is loading. For more related info, FAQs and issues please refer to DearFlip WordPress Flipbook Plugin Help documentation.