The endeavor is to create wealth for our investors over a medium to long term period by creating Benchmark Agnostic Concentrated Portfolios of quality stocks, based on fundamental research driven Bottom Up stock picking.

BOTTOM UP APPROACH

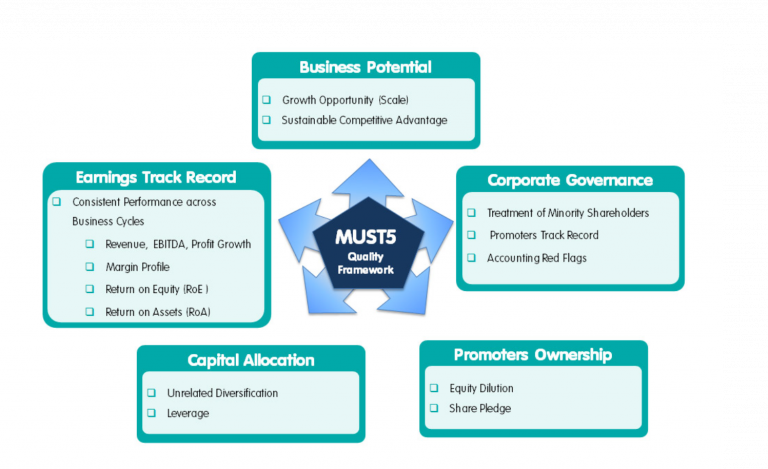

Nippon India believes that in all market conditions and across all capitalizations, there are stocks which may outperform. Hence, their Focus is on identifying such stocks, within the chosen sectors. Sectoral trends and macroeconomic research is used to identity macro trends / sectoral opportunities. The Conviction in their stock picks come from rigorous bottom up fundamental research. Fundamental Research involves study of historic track record, trends and future earning estimates through the lens of “Must 5” Quality framework.

The Assessment is based on Earnings Growth, Operating Leverage, Demand Environment, Margin Expansion, and Financial Leverage. Assessment also includes Senior Management Interaction, Key Customer, Suppliers feedback, Competition feedback, Key Stakeholders Interaction.

Post identification of stocks based on rigorous fundamental research, they identify reasonably priced stocks, based on Valuation gap analysis

- Historical Vs Current valuations

- Peer Group Valuation

- Potential Rerating Triggers

Investment is made in stocks with the Highest Conviction. Such companies tend to weather sector declines. Their endeavor is to benefit from the early identification of an investment idea; where there is higher potential for outsize returns