Sunil Singhania

Sunil Singhania

Founder – Abakkus Asset Management

Sunil Singhania, CFA, is the Founder of Abakkus Asset Management, LLP, an India-focused Asset Management Company he established in 2018. Prior to this, in his role as Global Head – Equities at Reliance Capital Ltd., he oversaw equity assets and provided strategic inputs across Reliance Capital Group of companies including asset management, insurance, AIF and offshore assets. And as CIO – Equities, Singhania led Reliance Mutual Fund (now Nippon India Mutual Fund), equity schemes to be rated amongst the best. Reliance Growth Fund (now Nippon India Growth Fund) grew over 100 times in less than 22 years under Singhania’s leadership. Furthermore, he led Reliance Asset Management (now Nippon Life Asset Management) Ltd.’s international efforts and was instrumental in launching India funds in Japan, South Korea, and the UK, besides managing mandates from institutional investors based in the US, Singapore, and other countries. In this capacity, he provided strategic insights and managed equity assets across the Reliance Capital Group, encompassing asset management, insurance, AIF, and offshore assets.

Sunil Singhania, a highly acclaimed figure in the world of finance, has a distinguished career that spans over several decades. His remarkable achievements have solidified his position as a prominent fund manager and industry leader.

Recognized as one of the Best fund managers by Outlook Business in 2016 and 2017, Sunil’s excellence extends over a 10-year timeframe. He achieved a significant milestone by becoming the first Indian to be appointed to the Global Board of the CFA Institute, USA, a position he held from 2013 to 2019. Furthermore, Sunil Singhania currently stands as the sole Indian appointed to the IFRS Capital Market Advisory Committee (CMAC) from 2020 to 2023.

Beyond his impressive career, Sunil Singhania actively contributed to the finance community. He served as the Promoter of The Association of NSE Members of India, representing stock brokers. Sunil’s commitment to advancing the industry led to historic achievements, such as being the first individual from India to be elected as a member of the CFA Institute Board of Governors. His significant roles within the CFA Institute include Chair of the Investment Committee and a member of the Nominating Committee. Moreover, he served on CFA Institute’s Standards of Practice Council for a substantial six-year term. Sunil Singhania was instrumental in founding the Indian Association of Investment Professionals, now recognized as CFA Society India, and held the position of its President for eight years.

Sunil Singhania embarked on his educational journey by graduating in commerce from Bombay University. He solidified his expertise by completing his Chartered Accountancy from the ICAI, Delhi, earning an all India rank. Additionally, he holds the prestigious Chartered Financial Analyst designation conferred by CFA Institute. Sunil’s global perspective was enriched through extensive international travel and participation in numerous global investment conferences and seminars.

Notably, Sunil Singhania was a key member of the 15-member international committee responsible for rewriting the Code of Ethics handbook of the CFA Institute. His substantial contributions within the finance sector have left an indelible mark on the industry.

Sunil Singhania

Founder, Abakkus Asset Manager

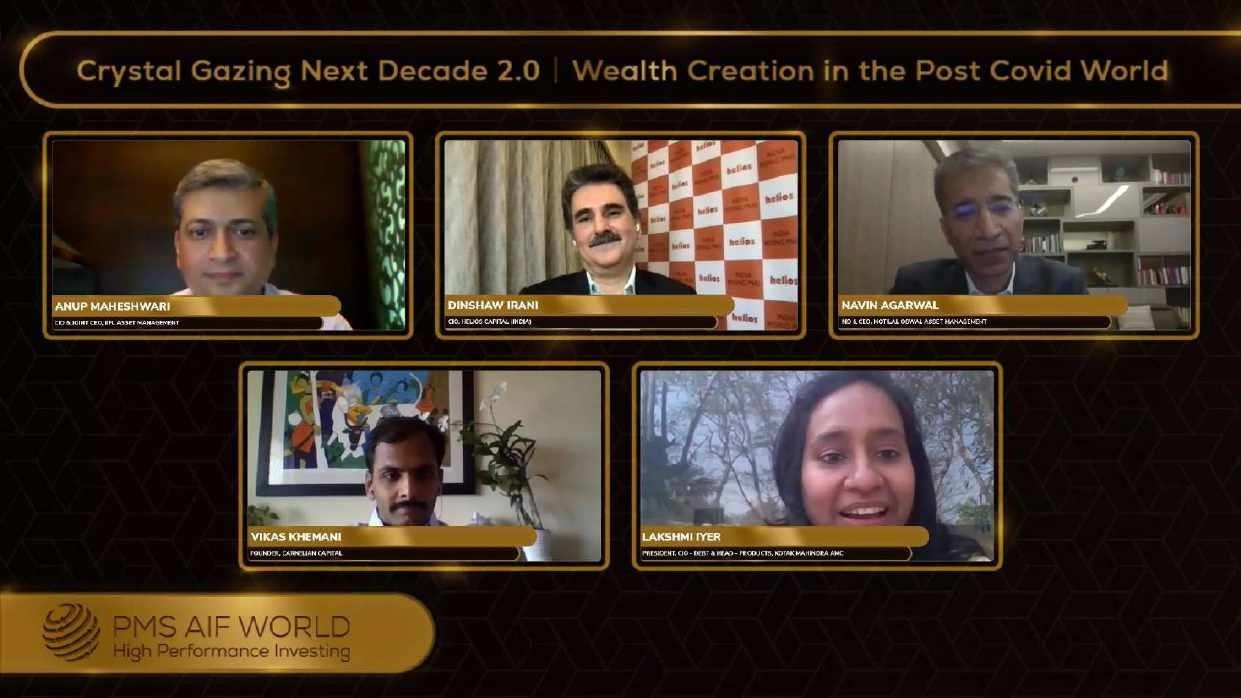

Samir Arora

Samir Arora

Founder – Helios Capital

Samir Arora is the main founder & fund manager at Helios Capital. From 1998 to 2003, he was the Head of Asian Emerging Markets at Alliance Capital Management in Singapore (both fund management and research, covering 9 markets). From 1993 to August 2003, Samir was the Chief Investment Officer of Alliance Capital’s Indian mutual fund business and, along with managing Alliance Capital’s Asian Emerging Markets mandates, managed all of Alliance Capital’s India-dedicated equity funds.

In 1993, Samir relocated to Mumbai from New York as Alliance Capital’s first employee in India to help start its Indian mutual fund business. He also managed ACM India Liberalization Fund an India-dedicated offshore fund from its inception in 1993 till August 2003. Prior to 1993, he worked with Alliance Capital in New York as a research analyst.

At Alliance Capital, India-dedicated mutual funds managed by Samir received over 15 awards during his tenure, including AAA rating from Standard and Poor’s Micropal for four years in a row (1999 to 2003) for the India Liberalization Fund. In 2002, he was voted as the most astute equity investor in Singapore (rank: 1st) in a poll conducted by The Asset magazine. More recently Helios Strategic Fund has been nominated for the Best India Fund by Eurekehedge in 2006, 2007, 2008, 2010, 2011, 2013, 2015, 2016, 2018 & 2020 and has won the award four times. Helios Strategic Fund has also received the AsiaHedge Award 2018 for its long-term (five years) performance.

Samir Arora received his undergraduate degree in engineering from the Indian Institute of Technology, New Delhi in 1983 and his MBA (gold medalist) from the Indian Institute of Management, Calcutta in 1985. He also received a master’s degree in finance from the Wharton School of the University of Pennsylvania in 1992 and was a recipient of the Dean’s scholarship for distinguished merit while at Wharton.

He likes to read books (not on kindle though), watch movies and attend live sporting events. Samir has total investing experience of 29 years. At PMS AIF WORLD, we have interacted a few times with Mr. Arora and his wise insights have always helped our audience navigate challenging market periods.

Samir Arora

Founder, Helios Capital

Nilesh Shah Portfolio

Nilesh Shah,

Managing Director (MD) at Kotak Mutual Fund.

Nilesh Shah has over 28 years of experience in capital markets, having managed funds across equity, fixed income and real estate for local and global investors. In his previous assignments, Nilesh has held leadership roles with Axis Capital, ICICI Prudential Asset Management, Franklin Templeton Mutual Fund and ICICI securities. Nilesh is a Gold Medallist Chartered Accountant and a merit ranking cost accountant. He was part of the team that received the best fund house of the year award at Kotak Mutual Fund, Franklin Templeton and ICICI Prudential Mutual Fund.

Nilesh Shah Portfolio

Managing Director, Kotak Mahindra AMC

Prashant Khemka Portfolio – White OAK Capital

Mr. Prashant Khemka, Founder – White Oak Capital Management

Prior to setting up White Oak Capital Management Consultants LLP in June 2017, an investment advisory firm in India, Mr. Prashant Khemka spent 17 years at Goldman Sachs Asset Management (GSAM) from March 2007 to March 2017, and also for the Global Emerging Markets (GEM) Equity from June 2013 to March 2017. He won several accolades as the CIO and Lead PM of GS India Equity. He and his fund won several awards including AAA rating from Citywire and Elite rating from Fund caliber among others. In addition to his long-standing India investing experience, Prashant brings a unique perspective derived across developed and emerging market equities and has successfully managed US and global emerging markets funds for leading institutions, during the last two decades.

Prashant graduated with honors from Mumbai University with a BE in Mechanical Engineering and earned an MBA in Finance from Vanderbilt University, where he received the Matt Wigginton Leadership Award for outstanding performance in Finance. He was awarded the CFA designation in 2001 and is a fellow of the Ananta Aspen Centre, India.

Prashant Khemka Portfolio – White OAK Capital

Founder - White Oak Capital Management

Jiten Doshi

Mr. Jiten Doshi,

Co-Founder & Chief Investment Officer

He co-founded Enam’s Asset Management (Enam AMC) business in 1997. He has over 30 years of experience in capital markets and has been with the Enam Group since 1992. He is a regular speaker at global forums on Indian economy like HORASIS and has advised several managements on shareholder value creation. Several companies have gone on record to appreciate his contribution in areas such as corporate governance, transparency, disclosure standards and effective shareholder communication. His guidance has helped several companies improve their interface with all stake holders.

Jiten Doshi

Co-Founder & CIO, ENAM AMC

Raamdeo Agrawal Portfolio – Motilal Oswal

Raamdeo Agrawal

Chairman, Motilal Oswal Financial Services Limited

An awardee of Rashtriya Samman Patra by the Central Board of Direct Taxes, Raamdeo Agrawal is chairman of Motilal Oswal Financial Services Limited (MOFSL) and the driving force behind the company’s approach to investing. Mr. Agrawal has created the “QGLP” (Quality Growth Longevity & favorable Price) Investment Process and its ‘Buy Right, Sit Tight’ investing philosophy. Mr Agrawal is also the driving force behind the MOFSL Groups highly awarded research. He has been authoring the annual Motilal Oswal Wealth Creation Study since its inception in 1996. An Associate of Institute of Chartered Accountant of India and a member of the National Committee on Capital Markets of the Confederation of Indian Industry, he has also been featured on ‘Wizards of Dalal Street on CNBC TV 18.

Raamdeo Agrawal Portfolio – Motilal Oswal

Chairman, Motilal Oswal Financial Services Limited

Anirudh Garg

Anirudh Garg,

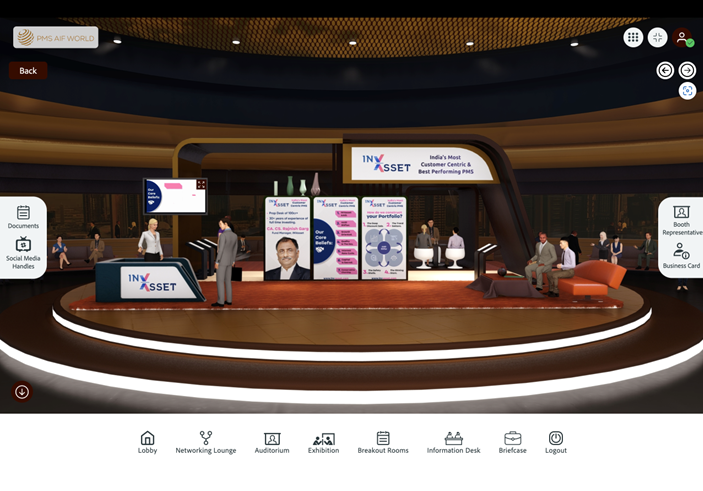

Partner & Fund Manager, INVASSEST LLP

Anirudh Garg stands at the forefront of financial innovation as the architect of InvAsset. His academic credentials include a Bachelor of Business Studies from Shaheed Sukhdev College and a Masters in Investment Management from the ICMA Centre. Anirudh’s foray into the financial world began at his family’s proprietary desk established in 1992, with his journey taking a significant turn in 2007.

Navigating through the challenging financial landscape of 2008, he gained invaluable insights into the intricacies of market dynamics. His extensive research between 2008 and 2010, which involved in-depth conversations with a diverse range of investors, culminated in the creation of InvAsset Aid. This pioneering algorithm, developed over three years and rigorously tested since 1987, is at the heart of his investment philosophy, emphasizing forward-looking market analysis, bias reduction, and the critical balance of alpha preservation and generation.

The successful application of this algorithm from 2013 onwards in managing proprietary funds led to the establishment of InvAsset in 2020. Today, InvAsset boasts the management of 300 crore in proprietary funds and 250 crore in client assets, showcasing Anirudh’s exceptional expertise and the effectiveness of his innovative investment strategies

Anirudh Garg

Partner & Fund Manager, INVASSEST LLP

Ashish Ahluwalia

Ashish Ahluwalia

Director – Private Equity, Axis AMC

Ashish Ahluwalia joined Axis AMC in July 2022 as Director – Private Equity to build and strengthen the firm’s private equity and venture capital investing capabilities.

He has over two decades of professional experience, of which 12 years have been in growth private equity and late stage venture investing. Prior to joining Axis AMC, he was the global Co-Head for Equity Investments in Healthcare, Food & Agri and Consumer at CDC (now British International Investment). Earlier, he was Director and Country Head for India at AIF Capital, an Asian growth private equity firm. Ashish began his professional journey with KPMG in India and later Goldman Sachs in UK. Across his widespread investing career, he has worked through the lifecycle of PE/VC investing of fund raising, deployment and exits and has worked extensively with portfolio companies as a Board Director/Observer on strategy, growth, expansion, fund raising, strategic sales and listing.

Qualification:- He is a Chartered Accountant and an MBA from the Indian School of Business, Hyderabad (Dean’s List)

Ashish Ahluwalia

Director - Private Equity, Axis AMC

Perumal Srinivasan

Perumal Srinivasan

Managing Partner, XPONENTIA CAPITAL PARTNERS

Previously Managing Director & Head of Citigroup – India Private Equity Team (CVCI)

Part of Leadership Team raised two global EM funds: USD 1.5 billion in 2005, USD 4.3 billion in 2007

One of 3 founders that set up HSBC India Private Equity & raised a USD 60 million fund in 1995

USD 700 million invested. Key investments include:

- At CVCI- Axis Bank, Yes Bank , Suzlon, Lupin, GMR and Sharekhan

- At HSBC India PE – Sharekhan, Kurlon, Dishnet, and Millennium Software

- At ICICI Ventures – Geometric Software, Microland