Equity investments are known for their potential to create wealth in a non-linear manner. Investments made early on can snowball into large sums over time and this is where we help investors make informed investment decisions.

Having said that, some investors, having studied the markets only recently, come to us with an argument that Nifty 500 has made ~27% returns in 3Y, in the post-Covid time – and so one could invest in index funds as index itself has garnered good returns.

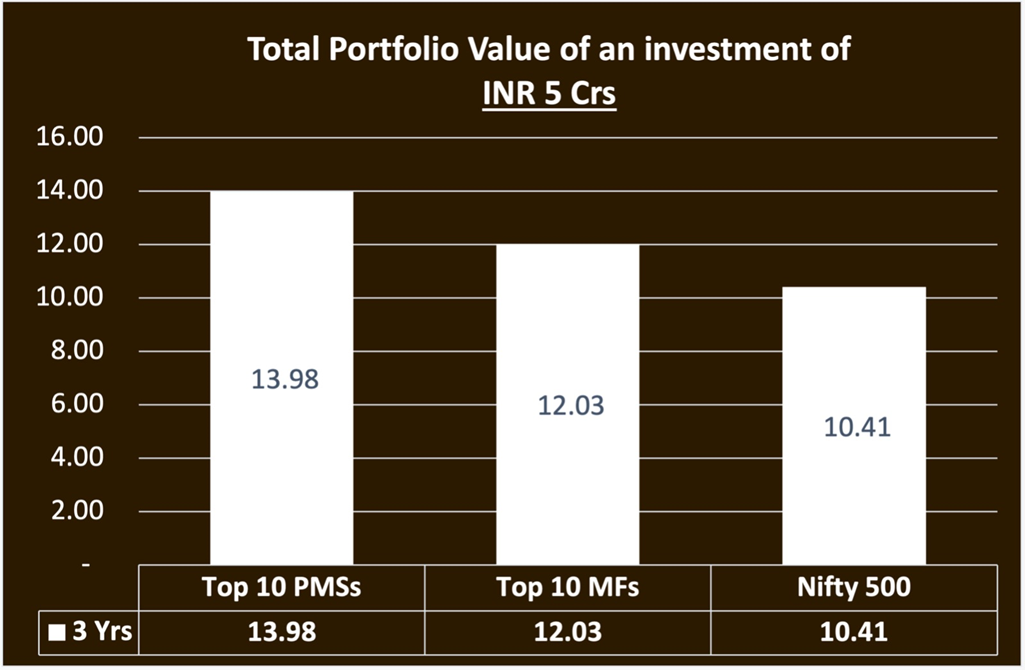

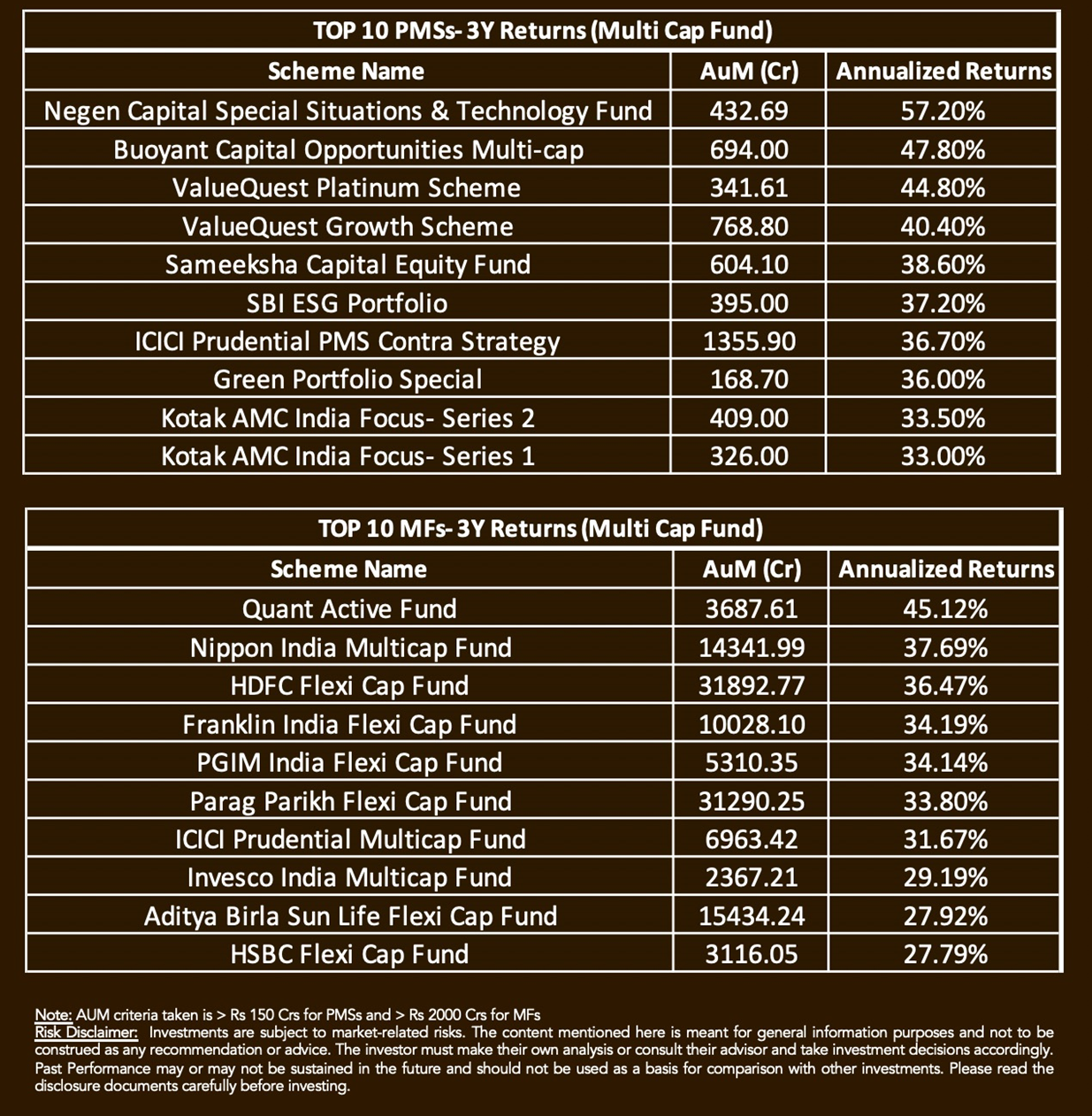

So, we carried out an exercise to evaluate the top 10 Multicap PMSs and top 10 Multicap Mutual Funds for the past 3 years. And here’s what we found out – if you had invested 50 lakhs each in the top 10 PMSs and 50 lakhs each in the top 10 MFs, and 5 Crs in Nifty 500, this would have been the results!

PMSs have successfully beaten the other 2 and have clearly generated more Wealth for investors.

We have carried this analysis [PMSs v/s MFs] across time frames, multiple time and results have always been in favour of PMSs and that is what makes us say confidently that is well informed and right investments are made, PMS is one of the best wealth creating structures. You can check it out by clicking here.

We have carried this analysis [PMSs v/s MFs] across time frames, multiple time and results have always been in favour of PMSs and that is what makes us say confidently that is well informed and right investments are made, PMS is one of the best wealth creating structures. You can check it out by clicking here.

At PMS AIF WORLD, we understand that making informed investment decisions is crucial, especially during these uncertain times. Our team of experts are always ready to help you make the right investment choices that align with your financial goals.

As the markets continue to exhibit resilience in the face of uncertain economic conditions, we remain steadfast in our belief that equities hold tremendous potential for growth and wealth creation.

After the promoters and the key employees of the company (holding ESOPs), the next set of people who make wealth are the investors in the company who hold their investments with the greatest conviction.

This is where the role of Portfolio Management Services (PMS) comes in. PMSs take high-conviction bets in some high-growth businesses, which is not possible in the case of mutual funds because they own stocks in the common pool and allocate units to the investor. MFs are a great way to learn investing in equities and are also great for income generation, but not for wealth creation.

Wealth creation can only happen by being a shareholder in great businesses.

With our expertise and the markets’ momentum, we are confident in our ability to generate positive results and unlock the full potential of your investments. So, if you are an HNI investor, click here to book a call with us today and let us help you make informed investment decisions.

Disclaimer: Securities investments are subject to market risks and there is no assurance or guarantee that the objective of the investments will be achieved. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements

Do Not Simply Invest, Make Informed Decisions

WISH TO MAKE INFORMED INVESTMENTS FOR LONG TERM WEALTH CREATION