Best PMS & AIF Products

PMS AIF WORLD is a new age knowledge driven investment platform that provides one of the best investment services.

It make relentless efforts towards informed approach to investing by way of super articulate and meaningful content in form of webinars, articles, newsletters, reports.

Recently, it organized its 3rd Annual Investment Summit & Awards, Crystal Gazing 3.0: Richer, Happier, Wiser Investors, a 3D Virtual Event and demonstrated to the industry as to what is a well-articulated conference in terms of quality of discussions, content & overall experience.

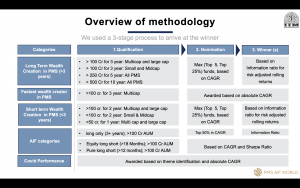

In the same event, PMS AIF WORLD announced 3rd annual awards in the Alternates Industry. These were conceptualised on a thoughtful & simple format of risk adjusted returns. For these Smart Money Manager Awards, PMS AIF WORLD collaborated with Team IIM-Ahmedabad to design a sophisticated methodology. This article and effort to explain the awards format in detail. The data used for calculations is as of 31.12.2021.

For investors, what matters is how much return is generated per unit of risk. This is because, while many products generate returns in long term, but investors seldom get benefit owing to the extreme volatile patterns of these returns where investors tend to lose confidence during bad times and do not remain invested. Hence, risk adjusted returns act as a safe parameter to conclude upon best performing funds.

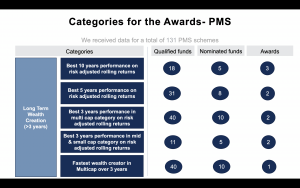

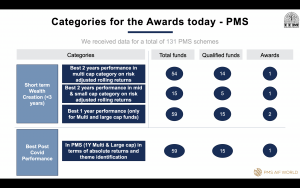

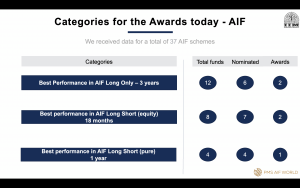

131 PMSs & 37 AIFs participated in these awards. The analytics is first of its kind effort in this industry and truly is a good academic initiative towards informed investing.

Entire study involved deep diving the data of all participating PMSs across returns and risk factors and calculating annualised rolling returns, standard deviation, beta, Sharpe ratio, and information ratio. Thus, provided us lots of insights and that form basis of our knowledge driven approach to investing.

Two objectives were covered, one, to recognise the long term, medium term, as well as short term performances. And, second, to acknowledge the best newcomers and also applaud the portfolios that performed best post the pandemic.

12 award categories had been thought through, and on the basis of that, 20 awards had been decided- 15 for PMS participants, and 5 for AIF participants.

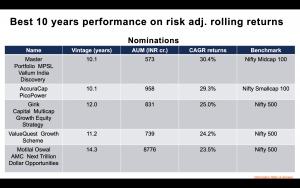

Here is the list of Top 5 Nominations all PMS categories ( Large, Mid, Small, Multi )in the last 10 years, as per risk adjusted rolling returns.

Winners across All PMSs ( in 10 years )

Basis of Ranking : Information Ratio

Rank 1: Accuracap Picopower

Rank 2: Master Portfolio Services Vallum India Discovery

Rank 3: Girik Capital Multicap Growth Equity Strategy

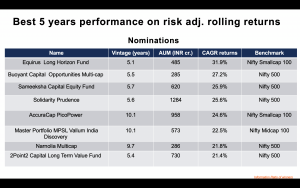

Here is the list of Top 5 Nominations all PMS categories ( Large, Mid, Small, Multi )in the last 5 years, as per risk adjusted rolling returns.

Winners across All PMSs ( in 5 years )

Basis of Ranking : Information Ratio

Rank 1: Equirus Securities Long Horizon Fund

Rank 2: Narnolia Financial Advisors Multicap Strategy

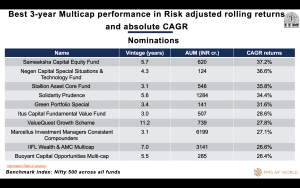

Here is the list of Top Nominations across all PMS products in the Multi Cap Category in the last 3 years, as per risk adjusted rolling returns.

Winners in the Multi Cap Category ( 3 years )

Basis of Ranking : Information Ratio

Rank 1: Solidarity Advisors Prudence

Rank 2: Stallion Asset Core Fund

Winner for Fastest Wealth Creating PMS Multicap Category 3 Years:

Winner : Sameeksha Capital Equity Fund

Basis the highest CAGR of 37.2%

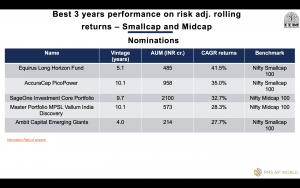

Here is the list of Top Nominations across all PMS products in the Mid & Small Cap Category in the last 3 years, as per risk adjusted rolling returns.

Winners in the Mid & Small Cap (in 3 years)

Basis of Ranking : Information Ratio

Rank 1: SageOne Investment Core Portfolio

Rank 2: Equirus Securities Long Horizon Fund

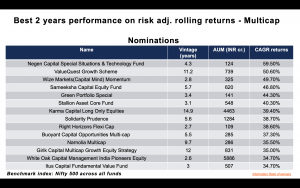

Here is the list of Top Nominations across all PMS products in the Multi Cap Category in the last 2 years, as per risk adjusted rolling returns.

Winners in the Multicap Category (in 2 years)

Basis of Ranking : Information Ratio

Winner : White Oak Capital India Pioneers Equity

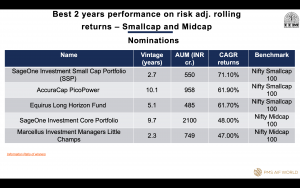

Here is the list of Top Nominations across all PMS products in the Mid & Small Cap Category in the last 2 years, as per risk adjusted rolling returns.

Winners in the Mid-Small Cap Category (in 2 years)

Basis of Ranking : Information Ratio

Winner : SageOne Investment Small & Micro Cap Portfolio

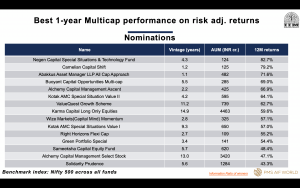

Here is the list of Top Nominations across all PMS products in the Multi Cap Category in the last 1 year, as per risk adjusted rolling returns.

Winners in the Multicap Category ( in 1 year )

Basis of Ranking : Information Ratio

Rank 1: Negen Capital Special Situations & Technology Fund

Rank 2: Kotak AMC Special Situations Value Series 2

Winner of Best PMS on Absolute Returns and, Best Theme Identification (Post Pandemic Period):

Carnelian Asset Advisors Shift Strategy

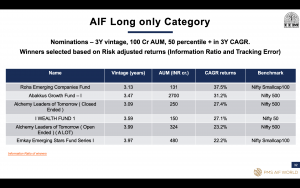

Here is the list of Nominations across all Long Only CAT 3 AIFs in the last 3 years.

Winners across all Long Only CAT 3 AIFs in the last 3 years, as per risk adjusted returns are:

Basis of Ranking : Information Ratio

Rank 1: Roha Asset Managers Emerging Companies Fund

Rank 2: Abakkus Asset Manager Growth Fund- 1

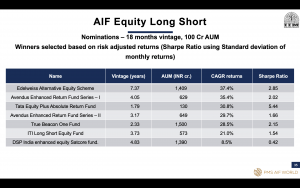

Here is the list of Nominations across all AIF Equity Long Short funds in the last 18 months, as per risk adjusted returns.

Winners across all AIF Equity Long Short funds in the last 18 months, as per risk adjusted returns are:

Basis of Ranking : Sharpe Ratio

Rank 1: Tata AMC Equity Plus Absolute Returns Fund

Rank 2: Edelweiss Asset Management Alternative Equity Scheme

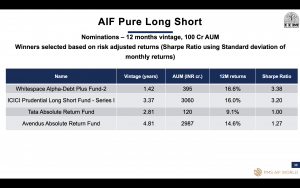

Here is the list of Nominations across all AIF Pure Long Short funds in the last 12 months, as per risk adjusted returns.

Winner across all AIF Pure Long Short funds in the last 12 months, as per risk adjusted returns is:

Basis of Ranking : Sharpe Ratio

Whitespace Alpha Debt Plus Fund

Entire study involved deep diving data of 137 PMS and 37 AIFs across returns and risk factors and calculating annualised rolling returns, standard deviation, beta, Sharpe ratio, and information ratio. Thus, provided us lots of insights and that form basis of our knowledge driven approach to investing.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION