Date & Time: 23rd July 2021, 05:30 PM – 06:30 PM IST

Speaker:

Anil Rego- MD & CIO, Right Horizons

Moderator: Sankalpo Pal– Biz. Development, PMS AIF WORLD

Generating consistent returns: Right Horizons Philosophy & Process

Generating consistent returns has for long been the motto of numerous portfolio managers and considering the current situation it is paramount. PMS AIF WORLD is a performance-focused, analysis-driven, data-backed new-age investment services firm. We offer informed investing experience to our clients and provide the best quality investment products that are managed by experienced money managers. To keep the same motto in mind, we conducted a webinar with Mr. Anil Rego- MD & CIO, Right Horizons, and discussed how investors can generate consistent returns.

Mr. Anil Rego, a CFA, has over 18 years of experience in the market and manages four funds at Right Horizons. While featuring on popular business channels on the television and various forms of print media, he believes in the contrarian style of investing. He is also a teacher at leading management institutes along with being an author of the book, ‘Honey I lost All Our Money.’

He shares his experiences as an investor, wealth manager, advisor and fund manager through this book. Upon being asked the trigger point for writing this book, he explained that a close friend who happened to be the CEO of a company had to wind down the business. It led to his friend investing in the markets via F&O, where eventually he witnessed profits but soon ended up losing ₹3 crores. Initially, Mr. Anil Rego insisted that they reinvest the surplus but his friend had lost a huge sum due to which various positions had to be exited at losses. The idea was to take a cue from this story and educate investors about minimizing risks and generating consistent returns.

On the other hand, the birth of Right Horizons in 2003 also had a story to it where Mr. Anil Rego wanted to put an end to corporate life and start a business of his own. During the early days, the fund performed exceptionally well and allowed him to take loans against his securities as well. His experience under the Mergers & Acquisitions department in Wipro combined with the Business Planning role, he had a lot to offer as an individual. He believed in himself and set out to manage people’s wealth and aptly named the firm Right Horizons.

Markets have tempted investors to do the opposite of what you should be doing

To put it in a subtle way, you actually feel like investing when markets are at a peak. However, the best time in the market for our guest speaker has to be the tumultuous times of the market when they have performed poorly and vice versa. He did invest in areas that were beaten down, contrary to where investors would park their funds. However, the contrarian strategy was not applied at all times as studying the underlying businesses was equally important. Analyzing data and making informed decisions have been duly followed by the asset managing company. The factors to keep in mind for a successful contrarian strategy should involve inferring global financial news, inflows, outflows, currencies and commodities as well. Investing in Gold combined with equities has reduced the risk of the portfolio considerably. On the other hand a Debt/Equity allocation, too, would have performed poorly when compared to investing in Gold. When the equity allocation is down 16%, the debt side rises by merely 8% which is low if invested in Gold. Prior to 2019, when Gold prices touched $1,200 per ounce, investors were informed that it was a fantastic opportunity to invest as their returns were miserable over the last 3-4 years. Markets are the best teacher for managing risk as the falls are much larger and more evident. It took a huge rally by Sensex to reach the 21,000-odd mark before plunging to 8,000 within a span of 8 months during the financial crisis of 2008. Moreover, consistent returns were delivered by those management companies that had a sound in-house process of investing. Also, investors need to learn from their mistakes and try to gauge what is it that you can do to prevent it from happening. Continuous learning will also guide investors during turbulent times.

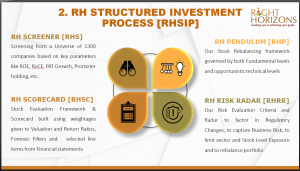

Since 2003, Right Horizons has managed ₹1500 crore of assets while managing ₹450 crore of assets on the PMS side. Mr. Anil Rego manages all the funds since 2019 after taking over the reins from all the portfolio managers. Stocks have fascinated him since his early days when he started investing and dreamt that he would retire as a portfolio manager. The four-stage investing process namely, RH Screener, RH Pendulum, RH Scorecard, and RH Risk Radar, is followed at Right Horizons that delivered returns for the past couple of years.

The first stage involves screening certain stocks on the basis of growth in sales, D/E ratio, market cap or ROCE to name a few. Furthermore, criteria’s are set out for turnaround/ growth triggers and potential disruptors as well. The objective is to look out for companies that are consistent. The second stage looks at the fundamentals through P&L parameters, Valuation matrix, B/S quality and return matrices in terms of financial modelling. The efficiency measures like Average ROCE and Average ROE over the last 5 years are also crucial. Forensic checks involve the % of institutional holding and credit rating of the firm. Qualitative filters allow managers to view the future potential of companies by keeping the numbers aside. Few parameters in the Risk Radar framework are checked on a monthly or quarterly basis. Analyzing the beta (risk in the portfolio), stock level cap, sectoral cap and the business moat help in minimizing risk. Moreover, important trigger levels are monitored by the RH Pendulum framework that include technical, fundamentals, macro factors and stock/benchmark decline. For example, Dixon Technologies outsources electronics manufacturing along with being a leader in the market. With a set parameter of 8% threshold for net sales, the company delivered net sales growth of over 21.44% in the last three years. During late 2019, the firm was uncomfortable with valuations as it had large chunks of liquid cash with itself. Returns were majorly in line with the index and investments in the Pharma sector played a significantly role in the post pandemic rally. Tier 2 names and smaller companies in various sectors were discarded, as focus shifted to market leaders only. During the 2020 March crash, the portfolio increased its risk appetite as valuations had fallen miserably. The Flexi cap fund performed 6% better when compared to the benchmark Nifty, post lockdown. In FY21, the fund grew at 79.9% when compared to Nifty’s 76% growth rate. It culminates to an alpha of 3% as the fund crossed the highs of the market much before the index.

Mr. Anil Rego clarifies that they don’t want to be the best performer when the market is at an all-time high as a sudden crash will leave them more vulnerable. They believe in consistent returns even if it entails not being the best among competitors.

Mr. Sankalpo Pal, who takes care of Business Development at PMS AIF WORLD, asked if any weightage is given to external forces not present in the process or is it a foolproof gamut of churning returns consistently? The question was answered in two parts wherein the future goals of the company/sector are analyzed and evaluating performance under various cycles is also taken into account. Returns will turn consistent but timing the market is equally difficult. Specialty chemicals had a lot to offer as the Chinese contribution in manufacturing was going down according to data. India would benefit from the pollution curb measures implemented in China and hence investments in this sector led to fabulous returns for investors. In 2017 funds were shifted from mid cap to large cap as the former did take a steep plunge. However, over the last 1 year, focus has shifted back to mid caps owing to data shown by the Relative Strength of mid cap against large cap stocks along with the inflection points. Strong global cues, especially from the US, have driven returns for quite some time now. Certain parameters were also tightened with respect to valuations to take advantage of market conditions. According to Mr. Anil Rego, positive momentum will continue for some time along with some volatility as well. The intermittent corrections are also necessary to portray the actual economic story.

The best time in the market is when investors have to be the most cautious about returns

Lastly, looking at risk adjusted returns is critical for investors, as valuations are going up across all verticals. India is poised to be the star of the decade as we have just left behind our worst one ending in 2020. The government measures and initiatives have played a role in shaping the future of the Indian economy. The Flexi Cap, IBL and Super Value funds from Right Horizons have performed brilliantly when compared to their respective benchmarks. Towards the end of the webinar, Mr. Madhusudhan, a member of the audience, asked a pertinent question that under asset allocation, planning and execution, what type/category/class of debt to choose from the 16 funds that exist? According to our speaker, debt is more difficult to hold in portfolio when compared to equity as it will perform poorly as safe and liquid returns are very low. The Templeton fiasco has made everyone aware of the quality of debt while investing. Safety of funds rather than returns has been the motto of Right Horizons when investing in debt. An investor looking for liquidity should be cautious while selecting an ultra-short term fund. Moreover, interest rates may rise slowly over a period of time which may reduce the returns of the portfolio. A higher risk appetite might entail investing in corporate bond funds while remaining very cautious if investing in credit risk funds.

Right Horizons is in search of the right mix between value and growth stocks; although a fund is named Super Value, it invests in mid cap stocks to be specific. However, few months down the line value stocks may outperform growth stocks. A conservative outlook from the speaker’s side has him concentrate half of his portfolio on specific stocks. The remaining half or may be even 60% of the portfolio is diversified among asset classes. Moreover, investors need to be cautious when investing in leverage companies as they will perform decently under the current scenario when interest rates have remained low or have been falling. A few calculated risks will help in consistent returns of the overall portfolio.

With e-commerce start-ups coming up with their IPOs, it becomes difficult to purchase the required amount of shares as they are mostly oversubscribed. Valuations are steeper and they are bound to go berserk but prudent investing will have a longer portfolio life. The webinar was wrapped up by Mr. Anil Rego specifying that the manufacturing sector will continue to do well. New age businesses and a few selected listed stocks will continue to have an uptick as a bottom-up approach is the key. The Pharma and Chemicals are also poised for a good run in the coming few months but one has to be picky among them. Metals have returned good short term returns as the portfolio has kept aside 15-20% to pick up the cyclical stocks.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

At PMS AIF WORLD, all PMS AIF Products are listed with all possible information and data for investors to understand & compare these products from the lens of risks as well as returns.

A unique proprietary framework has been founded by PMS AIF WORLD whereby 3 important attributes i.e. Quality (Q), Risk(R), and Consistency(C) are presented for more than 150 portfolio management services by covering 9 factors like Standard deviation, Beta, Sharpe, Alpha, Consistency Ratio, and so on. Many investors as well as the industry are using this proprietary framework to learn, compare, and select the best PMS products in India.

Here is the link to Register and access our QRC Database.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION