What are Alternative Investment Funds (AIFs)

Successful hedge funds will be entrepreneurial; it is the essence of the craft. –Paul Singer

An AIF or an Alternate Investment Fund means any fund established or incorporated in India which is a privately pooled investment vehicle which collects funds from sophisticated investors, whether Indian or foreign, for investing it in accordance with a defined investment policy for the benefit of its investors.

The minimum ticket size for investing in any Alternative Investment Fund or an AIF in India is ₹1 crore.

AIFs or Alternate Investment Funds comply with the SEBI (Alternative Investment Funds) Regulations of 2012. These funds may be established as a corporation, a Limited Liability Partnership (LLP), a trust, among other forms.

With the Indian market witnessing a surge in demand for innovative investment options, AIFs have emerged as a prominent choice for savvy investors. By investing into Alternative Investment Funds (AIFs), investors seek diversified investment opportunities beyond traditional avenues.

AIFs combines the operational ease of a mutual fund and the flexibility of a PMS making it a perfect blend geared for generating optimum performance for a stipulated investment objective.

To enhance risk-adjusted performance, these products can use complex strategies like unlisted equity investments, long-short hedging style of investments, and so on.

Why Choose PMS AIF WORLD?

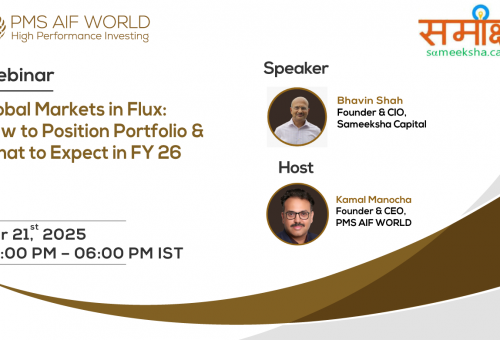

PMS AIF WORLD is a modern investment services company that offers a high-quality investing experience backed by analytics. Our goal is to create wealth and prosperity for our clients, and we have a track record of managing assets for over 6+ years and HNIs, UHNIs, and NRIs across the globe with a total of 1800+ crore in assets. We provide a range of services, products, and portfolios to help you make informed investment decisions.

To make an informed investment decision, it’s crucial to conduct thorough due diligence and seek guidance from experienced fund managers and financial advisors. We can help you navigate the complexities of AIFs, understand the associated risks, and identify funds that align with your investment objectives.

Types & Categories of Alternative Investment Funds (AIFs)

1. Category I AIF

Alternative Investment Funds (AIFs) which invest in the unlisted & private space of start-up or early-stage of ventures and popularly known as venture capital equity or debt funds. These are high-risk, high growth potential funds.

Besides the world of start-ups and disrupting ideas, this category also covers social ventures or SMEs or infrastructure projects or other sectors or areas which the government or regulators consider as socially or economically desirable.

2. Category II AIF

Alternative Investment Funds (AIFs) which invest in the unlisted or private space of mid stage or late stage of a business either in form of debt or equity.

These funds, when investing in the mid-stage of a business are also called private equity funds or PE funds. The same CAT II funds, when investing in late stage businesses are called Pre-IPO funds.

Both these categories of funds are very popular and many investment companies have AIFs running in this category, like Edelweiss, IIFL, Kotak, Axis, Avendus, and so on.

While the above described are equity funds, mid stage investing can also be in the form of debt financing as well and then these funds are called Real Estate funds, Credit Opportunities Funds, Distressed Asset Funds [as lending is in such funds is against real estate projects or business cash flows or business assets as a collateral for the lending], and so on.

Again, this category is also very popular with companies like Sundaram, HDFC, Birla, Axis, Kotak, Edelweiss, IIFL, and so on.

3. Category III AIF

This is one of the most popular and largest categories from the sellers and buyers’ perspectives as this category has maximum number of funds, as well as maximum number of investors.

Alternative Investment Funds (AIFs) which invest primarily in the listed space of equities across large, mid, small cap businesses and are allowed to employ diverse or complex trading strategies and may employ leverage through investment in listed or unlisted derivatives.

As of March 2023, Category III AIFs have reported managing an impressive corpus of funds, amounting to approximately Rs 75,000 crore. Moreover, there are about 90 distinct entities that are in charge of 206 diverse schemes within the AIF Cat III segment, with a significant 70% of these funds being operated through ‘long only’ schemes.

Category III AIFs are further divided into Long Only and Long Short Funds.

Cat III Long Only AIFs

Long Only Alternative Investment Funds (AIFs) are investment vehicles that primarily focus on long-term investments in various asset classes. These funds typically aim to generate returns by investing in stocks, bonds, commodities, or other securities, with the objective of profiting from the upward price movements of these assets over time.

Unlike traditional mutual funds or equity funds that have restrictions on short selling or taking bearish positions, Long Only AIFs solely participate in long positions, which means they only buy and hold assets with the expectation of their value appreciating in the future. These funds are suited for investors who have a positive outlook on the market and seek to benefit from overall market growth.

Many well-known companies with long only AIFs are ICICI Prudential AMC, Motilal Oswal, ASK, Alchemy, 360 ONE (previously IIFL Asset Management), Abakkus, Sage One, Unifi AIF, and so on.

Popular CAT III Long Only AIFs open for subscription are:

Explore PMS AIF WORLD's curated selection of best Alternative Investment Funds (AIFs) in India

Cat III Long Short AIFs

On the other hand, Long Short Alternative Investment Funds (AIFs) employ a flexible investment strategy that allows them to take both long and short positions in various asset classes. These funds aim to generate returns by simultaneously betting on assets that they expect to increase in value (long positions) and assets they anticipate will decline in value (short positions).

By taking short positions, which involve borrowing and selling assets they do not own in the hopes of repurchasing them at a lower price later, Long Short AIFs can profit from falling markets or specific asset price declines. This strategy provides opportunities for potential gains in both bullish and bearish market conditions, as the fund managers actively manage the portfolio to capture relative value disparities and exploit market inefficiencies.

Long Short AIFs are suitable for investors seeking a more dynamic investment approach that allows them to potentially generate positive returns even in volatile or declining markets. The ability to hedge against market downturns or capitalize on specific investment opportunities sets Long Short AIFs apart from traditional long-only investment funds.

In case of Long short funds, taxation happens at the fund’s end and the investors returns are net of fees, expenses, and taxes.

Some companies with Long short AIF products are Tata Captial, Kotak Asset Management, Avendus Capital, 360 ONE (previously IIFL Asset Management), Edelweiss, ITI, and so on.

Popular CAT III Long Short AIFs open for subscription are:

Explore PMS AIF WORLD's curated selection of best Alternative Investment Funds (AIFs) in India

What is GIFT City and what are some Investment options in GIFT City?

One of the key advantages of AIFs is their ability to cater to different risk appetites and investment horizons. Whether you’re a high-net-worth individual, institutional investor, or a qualified investor, AIFs offer tailored investment strategies that align with your financial goals.

Moreover, AIFs provide the opportunity to invest in sectors with immense growth potential, such as technology, healthcare, renewable energy, and infrastructure. By tapping into these promising sectors, investors can ride the wave of India’s evolving economic landscape and potentially reap significant rewards.

Features of investing in Alternative Investment Funds (AIFs)

Registration & Regulation

AIFs are regulated by the Securities and Exchange Board of India (SEBI) and are required to obtain registration to operate as an AIF. SEBI sets the regulatory framework and guidelines for AIFs, including eligibility criteria, investment restrictions, disclosure requirements, and reporting obligations.

Diversified Investment Strategies

AIFs offer a wide range of investment strategies beyond traditional asset classes. They can invest in equity, debt, real estate, infrastructure, private equity, hedge funds, venture capital, and other alternative investments. This flexibility allows AIFs to cater to various investor preferences and risk appetites.

Managerial Expertise

AIFs are managed by professional fund managers or investment teams with specialized knowledge and expertise in their respective investment strategies. The managers are responsible for making investment decisions, executing the fund’s strategy, and managing the portfolio to generate returns for the investors.

Sophisticated Investors

AIFs are open to a select category of investors, including high-net-worth individuals (HNIs), institutional investors, and certain qualified institutional buyers (QIBs). Some AIFs may also have minimum investment requirements, making them accessible to sophisticated investors.

Risk & Return Profile

AIFs typically target higher-risk investments with the aim of generating superior returns. The risk profile of an AIF depends on its investment strategy and asset allocation. Investors in AIFs should carefully evaluate the risk-return tradeoff and align it with their investment objectives and risk tolerance.

Lock-in Periods

AIFs may have a lock-in period, during which investors cannot redeem their investments. The lock-in period varies depending on the AIF category and is determined by the fund’s investment strategy, liquidity requirements, and exit provisions.

Disclosure & Reporting

AIFs are obligated to provide periodic reports, financial statements, portfolio details, and other relevant information to their investors and regulatory authorities. This transparency enhances investor confidence and facilitates informed investment decisions.

Limited Regulatory Restrictions

Compared to mutual funds, AIFs have relatively fewer regulatory restrictions on investment strategies, asset classes, leverage, and diversification limits. This flexibility allows AIF managers to adapt to market conditions and pursue innovative investment opportunities within the regulatory framework.

Advantages and Benefits of investing in Alternative Investment Funds (AIFs)

Skin in the Game

• Investment Manager (IM) / Sponsor must invest 10cr or 5% of the committed capital whichever is lower

• Alignment of Interest

• IM / Sponsor must be well-capitalized

Flexible Investment Mandate

• Can raise money in drawdown mode and so take advantage of market volatility

• There is No compulsion to reinvest. Can return the capital by booking profits from securities that attain targets, before the completion of the tenure of fund. Helps in profit booking if valuations are high

• Allowed to Participate in IPOs as Qualified Institutional Buyer (QIB)

• Allowed to invest in SME Stocks

Scope for Alpha Generation

• Maximum Investors allowed per scheme is 1000

• Limited corpus allows the investment manager to create differentiated & uncorrelated portfolio

• No compulsion to invest in higher weightage stocks in Benchmark —not benchmark hugging

Ease and Convenience

• No Need to open Demat account

• Taxation at scheme level.

• Pooled vehicle hence all clients investing at the same closure have similar returns experience

• No Requirement/ Restriction of opening a PIS (Portfolio Investment Scheme) account for NRI investors.

Access to Unique Opportunities

• Opportunities that may not be readily available to individual investors

• AIFs can invest in early-stage startups, private equity deals, distressed assets, real estate projects, and other alternative assets that are typically inaccessible to retail investors

Diversification

• Wide range of alternative investment opportunities beyond traditional asset classes like listed stocks and bonds

• Investors can spread their risk across different strategies, sectors, and geographies, potentially reducing the impact of market volatility on their portfolio

The safest and most potentially profitable thing is to buy something when no one likes it. – Howard Marks

The future is never clear; you pay a very heavy price in the stock market for a cheery consensus. Uncertainty is actually a friend of the buyer of long-term values. – Warren Buffett

Check out monthly AIF Newsletters with performance data as of every month.

FAQs

What is an AIF?

An AIF or an Alternate Investment Fund means any fund established or incorporated in India which is a privately pooled investment vehicle which collects funds from sophisticated investors, whether Indian or foreign, for investing it in accordance with a defined investment policy for the benefit of its investors.

In AIFs, one does not need to open a demat account this is a pooled vehicle; hence all clients investing at the same closure have similar returns experience. The tax implications are different for the different categories of AIF.

What is the minimum investment amount for an AIF?

Rs 1 Crore.

Who should invest in an AIF?

These are specifically made for high-net-worth (HNI) or UHNIs investors with customized investment needs.

How are AIFs unique?

AIFs combines the operational ease of a mutual fund and the flexibility of a PMS making it a perfect blend geared for generating optimum performance for a stipulated investment objective. To enhance risk-adjusted performance, these products can use complex strategies like unlisted equity investments, long-short hedging style of investments etc.

How many categories of AIFs are there?

There are three categories of AIF: Category I (CAT-I), Category II (CAT-II), and Category III (CAT-III),

What is CAT-I AIF?

AIFs which invest in the unlisted & private space of start-up or early-stage of ventures and popularly known as venture capital equity or debt funds. Besides the world of start-ups and disrupting ideas, this category also covers social ventures or SMEs or infrastructure projects or other sectors or areas which the government or regulators consider as socially or economically desirable and shall include venture capital debt funds, SME Funds, social venture funds, infrastructure debt or equity funds and such other Alternative Investment Funds as may be specified.

What is CAT-II AIF?

AIFs which invest in the unlisted or private space of mid stage or late stage of a business either in form of debt or equity. These funds, when investing in the mid-stage of a business are also called private equity funds or PE funds. The same CAT II funds, when investing in late stage businesses are called Pre-IPO funds. Both these categories of funds are very popular and many investment companies have AIFs running in this category, like Edelweiss, IIFL, Kotak, Axis, Avendus, and so on.

While the above described are equity funds, mid stage investing can also be in the form of debt financing as well and then these funds are called Real Estate funds, Credit Opportunities Funds, Distressed Asset Funds [as lending is in such funds is against real estate projects or business cash flows or business assets as a collateral for the lending], and so on. Again, this category is also very popular with companies like Sundaram, HDFC, Birla, Axis, Kotak, Edelweiss, IIFL, and so on.

What is CAT-III AIF?

AIFs which invest primarily in the listed space of equities across large, mid, small cap businesses and are allowed to employ diverse or complex trading strategies and may employ leverage through investment in listed or unlisted derivatives. This is one of the most popular and largest categories from the sellers and buyers’ perspectives as this category has maximum number of funds, as well as maximum number of investors.

Category III AIFs are further divided into Long Only and Long Short Funds. Many well-known companies with long only AIFs are Motilal Oswal, ASK, Alchemy, IIFL, Abakkus, Sage One, and so on. Some companies with Long short AIF products are Tata, Kotak, Avendus, IIFL, Edelweiss, ITI, and so on.

What are the fees / profit sharing structure in an AIF?

AIFs follow variety of share classes and so offer variety of fee structures. Generally, profit sharing is 12% to 15% above 8% to 10% huddle.

Does an investor need to open a demat account?

In AIFs, one does not need to open a demat account this is a pooled vehicle; hence all clients investing at the same closure have similar returns experience. The tax implications are different for the different categories of AIF.

Till what % is the fees negotiable?

In AIFs, there is a pooled structure, and hence no negotiation on management fees is possible. But, set up fees can be waived off completely.

What is an Angel Fund & how can AIFs invest in it?

Angel Fund is a sub-category of Venture Capital Fund under Category I- Alternative Investment Fund that raises funds from angel investors and invests in accordance with the provisions of Chapter III-A of AIF Regulations.

In case of an angel fund, it shall only raise funds by way of issue of units to angel investors.

Who is the “Sponsor” in an AIF?

Sponsor is any person(s) who set up the AIF and includes promoter in case of a company and designated partner in case of a limited liability partnership.

What is the maximum limit prescribed for Overseas Investment by Alternative Investment Funds?

Overseas investments by AIFs investments shall not exceed 25% of the investible funds of the scheme of the AIF subject to overall limit of USD 500 million (combined limit for AIFs and Venture Capital Funds registered under the SEBI (Venture Capital Funds) Regulations, 1996).

Click here to check the whole list of FAQs – AIF FAQs

What is GIFT City and what are some Investment options in GIFT City?

Latest Articles

May 09, 2025

Macro Investing in Volatile Markets FY’26 and Beyond? | Green Lantern Capital

Read moreJuly 10, 2024

Is it time to recall the 4 most dangerous words in investing – “This Time it’s Different?”

Read moreJuly 21, 2023

What is a Large Cap Portfolio Management Services (PMS) and why should one invest in it?

Read moreOctober 27, 2023

Understanding the Mid and Small Cap Equity Space with Abakkus Asset Managers Asset Managers

Read moreWish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION

Do not Simply Invest, Make Informed Decisions