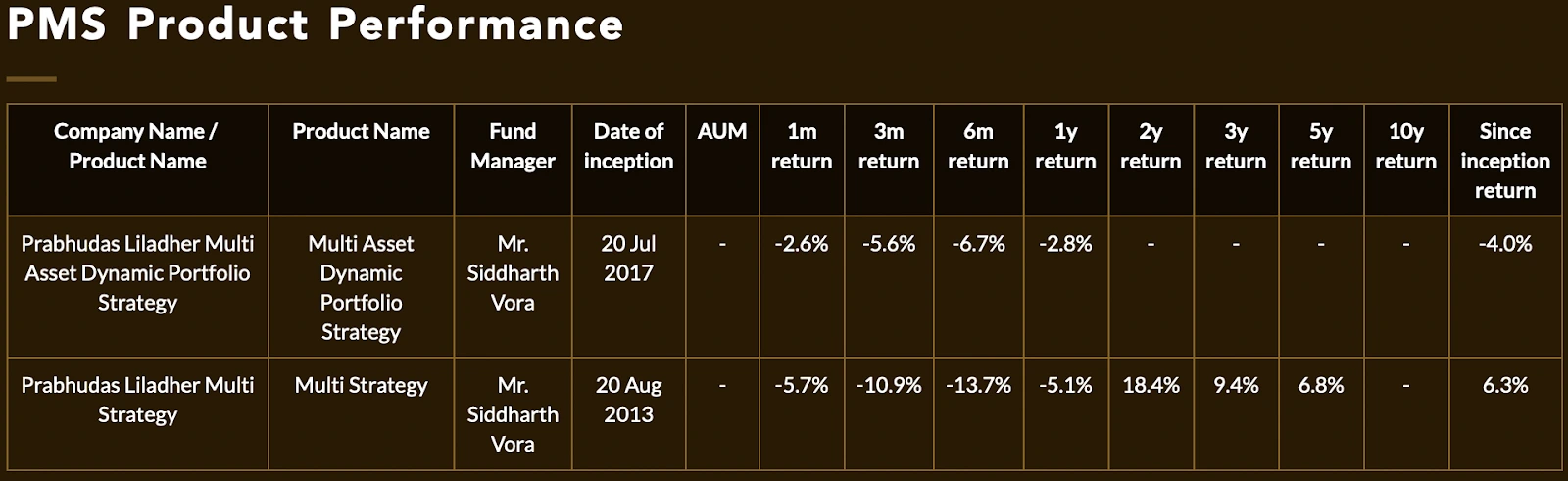

Date & Time: July 15, 2022 @ 04:30 PM – 06:00 PM IST

Speaker: Mr. Siddharth Vora, Head – Investment Strategy & Fund Manager – PMS, Prabhudas Lilladher

Moderator: Kamal Manocha, Founder & CEO, PMS AIF WORLD

Mr. Kamal Manocha, Founder and CEO of PMS AIF WORLD held an engaging webinar in conversation with Mr. Siddharth Vora, Head – Investment Strategy & Fund Manager – PMS, Prabhudas Lilladher to throw light upon the fact that Dynamic Asset Allocation is a great key to sustainable investment returns.

About PMS AIF WORLD

PMS AIF WORLD is a knowledge-driven, New Age Investment Services Company, providing analytics-backed quality investing service with an endeavor and promise of wealth creation and prosperity. We offer the finest PMS & AIF selection process after analyzing the products across 5 Ps – People, Philosophy, Performance, Portfolio, and Price, with an endeavor to ascertain the Quality, Risk, and Consistency (QRC) attributes that covers 9 ratios. We do such a detailed portfolio analysis before offering the same to investors.

We are a responsible and long-term investment service provider in the space of Alternates.

Invest through us in the best quality products and make informed investment decisions.

Speaker Profile

Mr. Siddharth Vora [CA, CFA], joined Prabhudas Lilladher in 2016, and since then he has been an integral part of the group’s new-age business initiatives. Before his move to the funds management business within the group, he also played a key role in driving PL’s investment advisory business.

He spearheaded PL’s foray into the Quantitative Asset Management space. Currently, he heads the Quantitative Investment Strategy division and is also the Fund Manager of the group’s Portfolio Management Services business. Siddharth has conceptualized and developed PL’s flagship PMS offering – Multi – Asset Dynamic Portfolio (MADP). This is India’s first multi – asset PMS that deploys quantitative technology for asset allocation.

We all know that Equity, as an asset class, generates Wealth in the long term. But this is only possible if the Equity investment has been handled with professional discipline & skillset. One of the most important parameters is that of handling Macro risks. We all have witnessed heavily how much role macroeconomic factors play in deciphering the mood of the markets, and hence in the process of portfolio management, it is important for portfolio managers to approach macros, not as a skill, but as a science.

Contrary to the above statement, a poll conducted during the live webinar reported that 75% of attendees believed that portfolio management is less of a science, but more of skill. The webinar was all about breaking this belief.

Risks are short-term, but Growth is long-term

Setting the context for the webinar, Mr. Kamal Manocha, Founder & CEO of PMS AIF WORLD conversed with Mr. Siddharth Vora, Fund Manager at Prabhudas Lilladher. Mr. Vora has conceptualized the skill of managing PMSs at Prabhudas Lilladher through Science. This is one of the rare multi-asset PMS, where Science is applied, as an approach, to create Alpha.

Dynamic Asset Allocation can not only help create wealth, but also protect downside across cycles. While all investors understand that investing is a long-term journey, it is also important to note that this is a journey of multiple short terms. The aim of this PMS is to smoothen out these short-term journeys as well in markets full of volatility & bumps.

Strategic Asset Allocation, as the name suggests, is static in nature [tailor-made for all individuals]. It concurs that investment decisions are made in line with the investor’s risk profile & investment objectives. Tactical Asset Allocation, on the other hand, signifies making investment decisions based on risk management at an asset class level [and not at an individual’s level]. Hence, Tactical Asset allocation is more outcome driven as it involves active rebalancing.

The team at Prabhudas Lilladher, combines both these methods for their PMS, which makes it a Dynamic Aseet Allocation PMS. This is an opportunistic approach as the fund manager can hold equities in the PMS, anywhere between 30-80%.

“In a rising market, we participate with the market to a very great extent; and in a falling market, we are able to control drawdowns to a huge extent,” says Mr. Siddharth Vora.

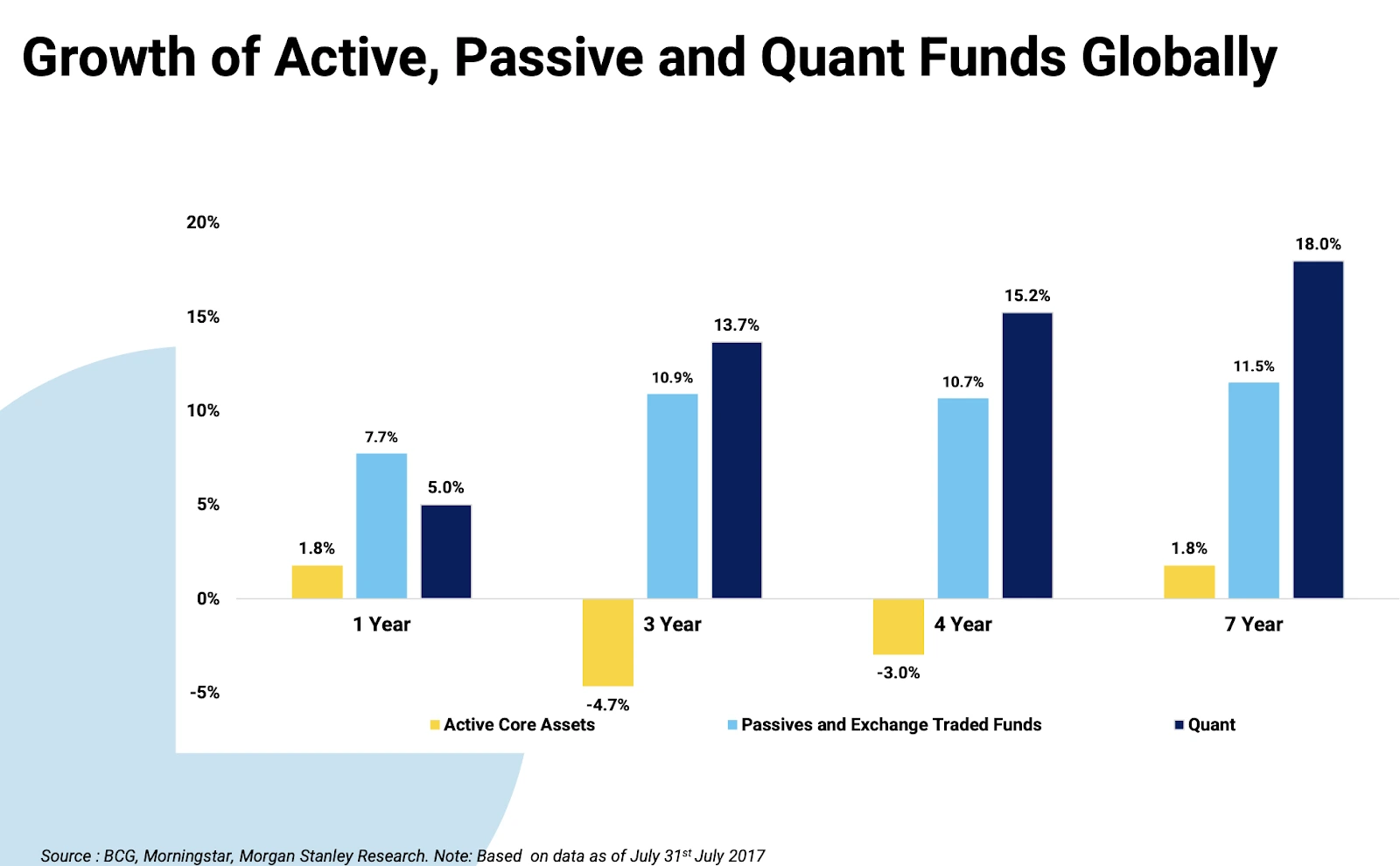

A global shift that has been observed is that, as of FY22, passively managed index funds & ETFs are now controlling 69% [as against 50% in April ‘19] of the total financial AUM in the markets. This can happen either because investors feel returns on actively managed funds are not enough as compared to the costs, or because ETFs are a very simple method of investing into the equity markets. Narrowing these stats for India, we get the following numbers:

30 years ago, we had neither Data, Science, nor Technology. Today, we have all 3- and it is only set to grow much more. This signifies the importance of Quant going forward… and this is validated by the numbers above that show constant growth of investments in Quant Funds.

30 years ago, we had neither Data, Science, nor Technology. Today, we have all 3- and it is only set to grow much more. This signifies the importance of Quant going forward… and this is validated by the numbers above that show constant growth of investments in Quant Funds.

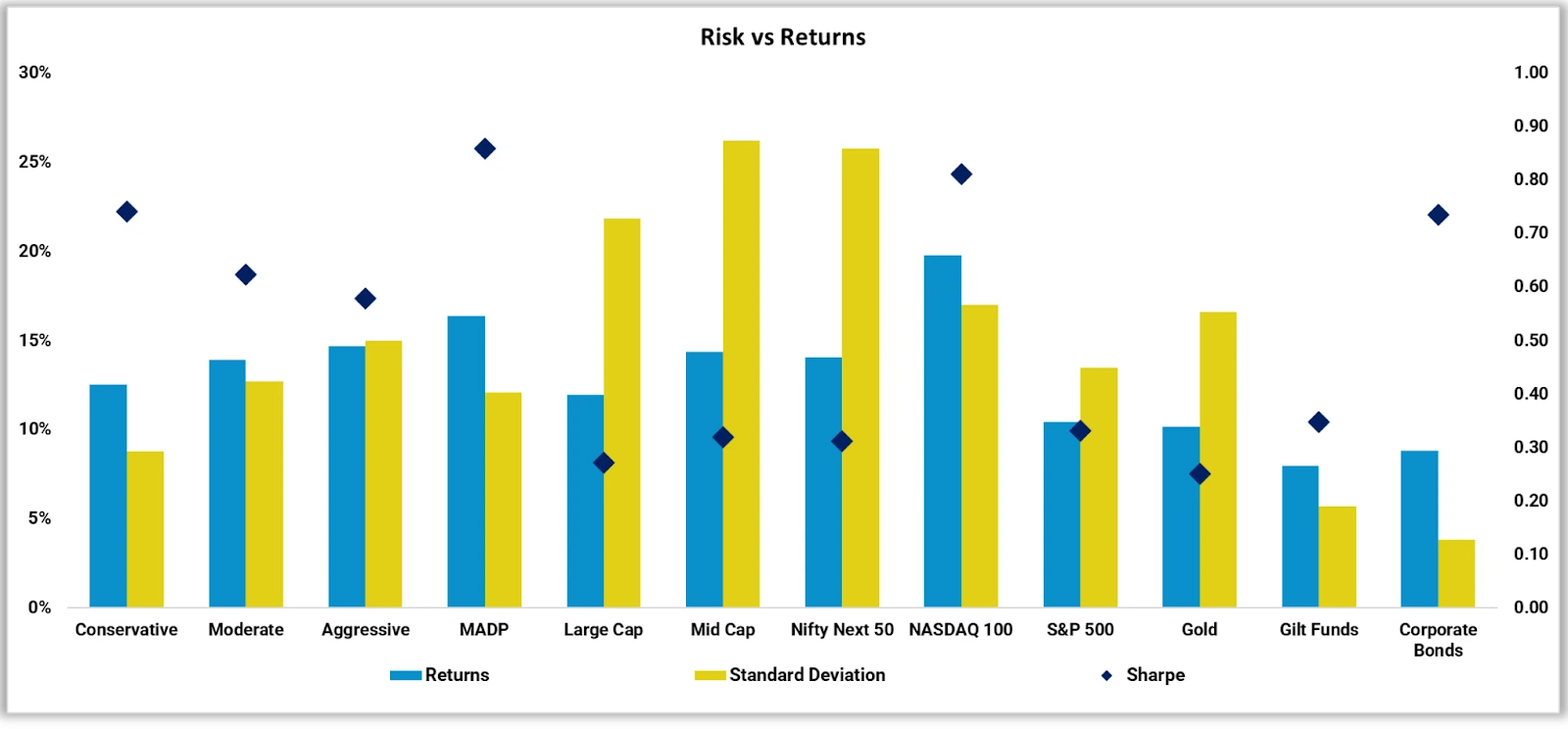

The first 3 blocks in the above graphic represent Strategic Asset Allocation. The 4th block represents the Dynamic Asset Allocation Strategy & onwards the 5th block, all single asset class returns are shown. As an investor, one’s ultimate goal is to have the highest sharpe ratio (black dot in the graph above), and the highest possible returns (blue bar) relative to the risks undertaken (yellow bar). It is clearly visible that the 4th block, the Dynamic Asset Allocation block, outperforms all Strategic Allocations (first 3) on a risk adjusted basis. The returns on the single asset classes (5th block onwards), are very inferior as compared to the Dynamic Asset allocation (4th block).

How does the team at Prabhudas Lilladher design the PMS to not only generate Wealth, but protect downside as well?

- Smart Asset Allocation: 91% of investment returns are driven by asset allocation, i.e. to say, only 9% returns are generated by stock selection, market timing, and so on. The focus is only on the 91%.

- Disciplined, Data-Driven, Process-Oriented Approach: To exclude human emotions & biases. Do not rely on Judgement & Experience, but on Data & Science.

- Stick to only Blue chip instruments: Not stocks, but instruments- investment in the ‘bluest of the blue chip asset classes.’ [Asset classes include: Equities, Debt, Commodities, Alternatives, and International Equities]

- All investment exposures are taken through AAA Securities such as Index funds & ETFs for Equities; no investment is made in direct equities or actively managed funds.

The above 3 decisions are made based on Prabhudas Lilladher’s proprietory Quant metrics.

Being a Quant-based portfolio, it works on a strategy called Quantifi, which is Prabhudas Lilladher’s specialized quantitative research and investment management arm. The strategy is only available as a discretionary PMS to avoid greed and fear of investors. It uses 100+ data points across various sectors to zero down on the most capable investments, that helps in generating asset allocation decisions that are unbiased and are controlled by data & not human emotions. Some of the important tools/data points used are: Macrometer [understanding the macro outlook], monetary meter [understanding financial liquidity, central rates, etc], Global RORO [Global Risk-on, Risk-Off tool; tracks 26 different indices across developed & emerging markets to understand global financial risks], and so on.

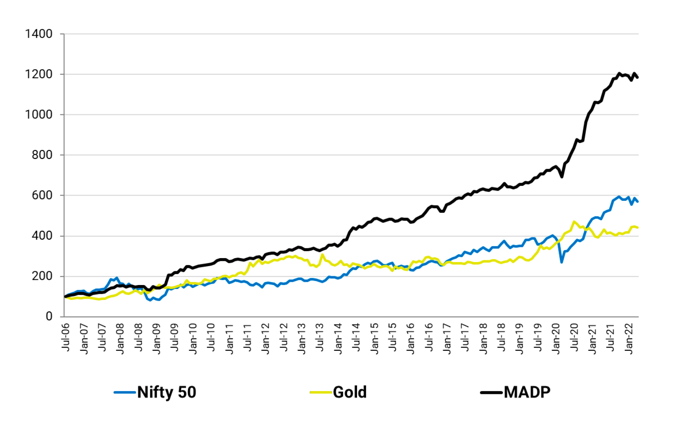

This graph (Data till 30th June 2022) denotes that if someone had invested Rs 100 each in Prabhudas Lilladher’s Multi Asset Dynamic PMS, in Gold, and in Nifty 50, he/she, as on 30.06.2022, would have made Rs 1200 in the PMS, Rs 600 in Nifty50, and Rs 400 in Gold.

Ideally, when thinking about Equities, the first parameter that should pop up in the minds of the investors is returns; but what pops up is, risks. This mindset, as rightly pointed out by Mr. Kamal Manocha, changes as an investor progresses in his investment journey.

Prabhudas Lilladher’s Multi Asset Dynamic PMS went live in July 2021, before which the team prop-tested it for 1.5 years, and has been back tested for 16 years prior to that. During the March ’20 Covid Crash scene, the fund was at 30% Equity Allocations. It is important to note that this allocation reduction was made on 7th Feb ’20, 1.5 months before the crash. This was done because of valuations, sentiments, and other proprietary triggers that were based not only on Macro factors but also on Momentum. The fund then went full throttle into Equities in around mid of April ’20 [when Nifty was at around 8,800 levels]; the Equity allocation increased from about 30% to 80%. This 80% level was intact till about Nifty reached 16,000 levels; after which the team gradually started trimming the weights. Currently, the allocation is: 45% Equities [domestic + intl.], 55% is across Corporate bonds, Liquid funds, Gold, and Cash. This 45% Equity allocation would be increased once macros start improving, valuations start coming off significantly, or a support from technical or momentum overlay is in picture.

“Now is the time to protect returns, and not chase returns,” says Mr. Siddharth Vora

When Mr. Kamal Manocha asked about different assessment metrics to track the performance of Prabhudas Lilladher’s Multi Asset Dynamic PMS, Mr. Vora stated their team of developers, quantitative analysts, and their in-house quantitative platform, helps in attributing returns to each decision taken for each investment order in this PMS. This helps in gauging various metrics like: from where does the biggest Alpha come, which metrics lead to protection of drawdowns, and so on.

To conclude the webinar, Mr. Manocha asked the guest about his personal favourite investment school of thought. Mr. Vora stated that he is a firm believer of investing into ‘Quality Stocks at Reasonable Prices’ that help in continued generation high ROEs, superior cash flows, and strong Balance Sheets.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION