Date & Time: 04th December 2021, 11:00 AM – 12:30 PM IST

Speaker: Amit Jeswani– Founder, Stallion Asset

Moderated by: Kamal Manocha- Founder & CEO, PMS AIF WORLD

PMS AIF WORLD, which is India’s most trusted, alternates focused investment services firm lead by its Founder & CEO, Kamal Manocha, conducted an intuitive webinar with Mr. Amit Jeswani, Founder of Stallion Asset, a firm that provides two businesses- Research Analyst & PMS. He is the Portfolio Manager of Stallion Asset Core PMS.

Stallion Asset’s PMS, despite being heavily large-cap weighted, has not only been consistently low on Beta (Portfolio Beta Since Inception stands at 0.76 against Nifty 50), but high on CAGR as well, as compared to many multicap strategies in its peers. An alpha of about 17% Since Inception (fund age is 3 years), speaks a lot about the philosophy of the portfolio manager, in terms of right stock selection. PMS AIF World, that always aims to serve investors with knowledge, conducted this webinar to understand the philosophy behind the fund and to gain his insights on what lies ahead; and one of the ways to understand the future of the markets would be to understand the businesses whose earnings are likely to grow as we tread along.

As of today, India’s total profit pool stands at 6.6 lakh crores and he expects Nifty profit pools to grow at 10-12% for the next decade, i.e., to say 6.6 lakh crores to grow to 17.11 lakh crores by the end of this decade.

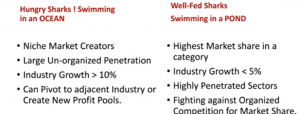

Let’s take up Auto Ancillary for instance. The industry’s profit pool stands at Rs 7147 crores as of today (led by MRF’s profit pool of Rs 1200 cr, followed by Balkrishna Industries’ profit pool of Rs 1100 cr, and Motherson Sumi at Rs 1000 cr). The idea is to understand the sector leaders, anticipate the growth in profit pool of the said industry, and identify businesses that are likely to lead the game of profit growth in the given sector. As far as Auto Ancillary is concerned, it is an important sector with respect to the PLI Schemes falling into place. Out of the total government’s PLI of Rs 2.5 lakh crores, this sector is set to recv. a PLI of Rs 26,000 cr. This narrows down the investor to keep his eyes on businesses that are likely to benefit from such PLI schemes.

He also shared his views on how PLI Incentives will impact the growth in sectors like Electronics and Real Estate. In electronics, a strong bias is being seen towards Dixon Tech. As for the real estate recovery, it is important to understand that demand recovery in the real estate sector implies a lot of other ancillary sectors like steel, cement, paints, construction, and so on, doing well as well. One can participate in 3 ways: housing finance, real estate builders, and/or Auto Ancillary.

Moving ahead, Mr. Amit Jeswani talked about 4 sectors that Stallion is looking at. The 2 defensive sectors are Consumers & Pharma. Other 2 sectors, the Aggressives, are Technology & Financials. While the Defensives help the portfolio maintain its stability during bad times, the Aggressives help the economy, and in turn one’s portfolio, grow multifold over a period of time. Having a mix of both Defensives & Aggressives in the portfolio, Stallion’s PMS drawdown has been much less than that of the benchmark across quarters.

Starting with the technology sector, he stated that out of the 6.6 lakh crore profit pool, Technology sector’s consolidated profit pool stands at 13% of it i.e. 91,000 cr (TCS: 34,000 cr, Infosys: 20,-000 cr, HCL: 11,000 cr, Wipro: 10,000 cr). Technology, being at the helm of economic growth, this sector’s profit pool is all set to reach at least 30-40% of the country’s total profits, by the end of this decade. While the large caps in this sector largely re-invest profits into buybacks, growth is likely to happen at 15% per annum. With the mid cap tech companies (Persistent Systems, Coforge, and so on), they inject money into acquisitions and thus can lead to a high growth of 20-25% per annum.

IT & IT Services is where the largest profit pool creation will happen, according to Mr. Amit Jeswani.

Tech companies, being asset-light, have very high ROCEs, which means low drawdowns. With the growth bound to happen, these tech services companies can act as the new Defensives.

Moving on to Financials, Private Banks’ profit pool stands at 75,000 cr (led by HDFC Bank: 32,000 cr, ICICI Bank: 20,000 cr, and so on). Finance has to grow for any industry to grow and private banks in India have been maintaining their credit risks. And a lot of this profit pool will come from tech-based financials. Bajaj Finance is the best example for the case in point.

Looking at the Consumers sector, the total profit pool of consumer companies in India is 42,000 crores (HUL: 10,000 cr, ITC: 15,000 cr, Nestle: 2,000 cr, Godrej Consumer: 1,700 cr, and so on). The question that investors and portfolio managers should ask here are questions like which business will accelerate the growth of the industry’s profit pool, which companies are creating high moats, how is scaling up happening and so on. The answers to these questions, after a religious study of such businesses, are the key to wealth creation in the coming decade.

Speaking about his portfolio weightage, he mentioned that they are heavily inclined upon large caps, then mid caps and a very less percentage of small caps. It is observed small cap rally happens every 4 years, the recent one being in current year 2021. Stallion PMS is cautious on small caps.

A growth rate greater than ROCE cannot sustain; unless the company can dilute again & again, it will have to revert.

Mr. Kamal Manocha, our Founder & CEO asked Mr. Jeswani to shed some light on the fact as to how does Stallion PMS aim to generate huge wealth as it mostly holds low-beta large cap stocks. To this question, our guest mentioned that Alpha will be created as long as the invested businesses grow faster than the economy. The aim is to focus on growth, longevity, and valuations. Valuations come in handy when one is looking at Emerging Monopolies, a field where Stallion PMS has generated great returns. India Mart, Info Edge, Dixon Tech & APL Apollo are some of Stallion’s portfolio holdings that can be considered good examples to validate the case in point with respect to valuations.

Low-beta does not equal low-growth.

A poll that ran during the webinar across an audience of 250 odd investors showed that based on a mix of old & new economy stocks, the audience believed that it is difficult for Nykaa, Zomato, Asian Paints, and Bajaj Finance to deliver two-digit growth for the coming 5 years.

Reflecting on the poll, Mr. Amit Jeswani mentioned that he believes that as far as tech stocks are concerned, in a monopoly or a duopoly, as long as hyper-scaling is done and consumers enjoy the product, typically these stocks don’t tank. Another point to keep in mind here is that these businesses require one primary business that generates the cash flow that is ultimately invested into other businesses of its own. For instance, Info Edge’s cash flow making machine was Naukri.com, from which sprang out other businesses like 99Acre, Jeevansathi, Zomato, Policybazaar, and so on.

Valuation is created on habits and Stallion Asset bets on those habits, reviewing such companies every quarter.

Nykaa has 71 lakh annual transacting customers that are bound to increase and each customer, on an average, buys makeup 4 times in a year. The profits generated from these customers is used to acquire new customers. This is where profitability is determined where one is anticipating the profit pools of tomorrow.

In the case of Zomato, which he believes will grow at 60% next year, is a proven business model. Looking at how fast its global peers like DoorDash and Uber Eats are scaling up, Zomato too will. The concern here is to identify how it plans to turn profitable. Assuming that Zomato makes a cumulative loss of Rs 1,000 crore this year, it is imperative to also focus on the fact that the company will build up a 22,000 crore franchise as well (which is much bigger than Nestle India!).

As far is stocks in the old economy are concerned, he believes that Bajaj Finance is pivoting itself towards a more technology-oriented business. Asian Paints should do well, as it will feel the ripple effect of the Real Estate recovery. Apart from that, crude oil prices have also come down and the company which doubled its distributors in just 2 years, recently made a 13-14% price hike (highest in a quarter); so assuming volumes remain same as last qtr, Asian Paints can easily generate a revenue of 8,500 cr for the coming quarter.

Betting on the retail sector, Mr. Amit Jeswani mentioned that the unorganized sector is so large that the retail segment businesses have huge scope to generate wealth for investors. QSR, being at the helm of this, is a space investors can watch out for!

2021-2025 will be one of the highest earnings growth years in the Indian Economy and a lot of bottom-up stocks will do well.

As the concluding question, Mr. Kamal Manocha pivoted the conversation towards sectors that were not mentioned so far in the webinar, namely, Infrastructure, Power, and Telecom.

Mr. Amit Jeswani, sharing his insights, mentioned that in Telecom we already have 100 crore users and one cannot say that each individual will have 2 SIM Cards. The industry is already disrupted (down from 16 players to 3 players) and the average ARPU for the players here (except Airtel) is Rs 150 and the markets are already discounting the hike in tariffs and he is unsure of what growth can now be generated unless a big disruption comes in the picture.

About the power sector, he highlighted that the problem lies in not generating high ROCEs as utilities are highly regulated in India. These are businesses that will reinvest capital at 12-15% ROIC and not 30-35% ROIC. And, as a portfolio manager, if one has the freedom to invest in businesses that reinvest at 25-30%, Stallion Asset obliges by that liberty and does not invest in the power sector.

Stay in the game, there is always going to be a bull market in India.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION