Date & Time: 14th August 2021, 11:00 AM – 12 noon IST

Speakers:

Saurabh Mukherjea, Founder & CIO, Marcellus Investment Managers

Pramod Gubbi, Head of Sales, Marcellus Investment Managers

Tej Shah, Portfolio Manager, Marcellus Investment Managers

Moderator:

Kamal Manocha – CEO & Chief Strategist, PMS AIF WORLD

Investing in the Indian Kings of Capital

In her 75th year of Independence, India has scaled numerous heights in various fields but the one that has stood for all portfolio managers has to be the run up in the equity markets. They are at an all-time high with buoyance from an unlikely event last year. PMS AIF WORLD was glad to host Mr. Saurabh Mukherjea, Founder & CIO, Marcellus Investment Managers, Mr. Pramod Gubbi, Head of Sales, Marcellus Investment Managers and Mr. Tej Shah, Portfolio Manager, Marcellus Investment Managers for a webinar to talk about their fund, Kings of Capital, that invests in a portfolio of financial services companies. Mr. Kamal Manocha, Founder & CEO of PMS AIF WORLD, mentioned that the performance of the financial sector in comparison to their weightage in the major indices has not been up to the mark and that leaves an opportunity for investors to make amends with substantial returns.

Marcellus Investment Managers follows the same investment philosophy about the company having a clean promoter holding, having high barriers to entry and a sound capital allocation policy. A new fund does not change the core principle of the asset management company. Kings of Capital focuses on the 100 largest financial companies in India including banks, NBFCs, general insurance, life insurance and fintech companies as well.

The fund dwells on the financialization of savings, says Pramod Gubbi.

Indian households have ditched the traditional mode of investments like real estate and gold and have started to move towards financial assets. Thus, existing investors have a massive opportunity to benefit from the potential in the financial markets. Experts do believe that a sector specific strategy does provide the diversification benefits and it is akin to put all your eggs in one basket. However, healthy risk adjusted returns are proof that the strategy has pulled off for all investors.

Poor investing strategies or mode of investing is yet to be free from past behavioural trends even as the country touches the landmark of 75th Independence Day. Fixed deposits, real estate and low-quality products that do not beat inflation continue to remain in the market and deprive Indians of significant returns. Mr. Saurabh Mukherjea took viewers through the three major reasons for the inception of Kings of Capital just after the pandemic had struck us last year. The reasons mentioned by the seasoned investment manager are as follows:

- Public sector banks (PSUs) account for 60% of the Indian loan book. Government has continued to bail out PSUs from the hard-earned income tax earned from the public. It is not an efficient way to compete with high quality standard private sector banks. A structural shift will change the market share mechanics allowing investors to earn profits from bets placed on the private sector banks.

- Secondly, 80% of the 10,000 NBFCs in India have a rogue financial system where numbers are played with in tandem. The fragmented NBFC universe comprises naughty accounting, playing with the credit rating agencies and playing a part in the money market with the major mutual fund houses. With strict regulations from SEBI and government policies, the source of funds dried up for the NBFCs.

- Lastly, 95% of India’s household wealth is locked up in physical assets like gold and real estate, something which the RBI feels is not present in any country in the world. Out of the total $10 trillion household wealth, roughly $500 billion is present in financial assets. Even the wealth of Jeff Bezos and Elon Musk in financial assets is way above the combined total in Indian financial markets. However, research has shown that the 5% wealth in financial assets is slowly increasing by 1% each year. Events like Demonetization, GST and the pandemic has made people realise that they have to beat inflation. Hence, Indians have started to buy life and health insurance, financial stability via investing in mutual funds and lastly in equity. This leads to placing safe bets in insurers and fund houses in India.

The webinar also witnessed contribution from the CFA and CA Mr. Tej Shah, the Portfolio Manager of Kings of Capital, who previously worked at a Silicon Valley VC fund named Mayfield, and his experience there has played a pivotal role in the performance of Kings of Capital. He stated that the last 6-7 years had been pretty dreadful for the financial sector of India where the Non Performing Assets aka NPAs continued to rise. It was an ideal situation a year ago to place a bet on the top-quality financial houses from banks to NBFCs to insurers.

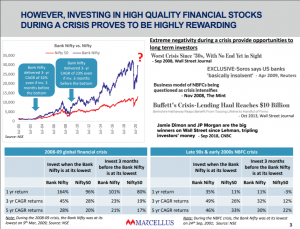

Research has shown that investing in high quality financial stocks during a crisis proves to be highly rewarding.

Investing in high quality financial lenders during crisis proves beneficial as there is a significant change in market share. The poor lenders are wiped off from the list and the top-notch remain in the game. The uncertainty around investing during/post a crisis is offset by placing a safe bet on the best financial banks or companies present on the list. Net Interest margins increase sufficiently for all power houses leading to a massive improve in the quality of assets. For example, HDFC banks’ NPAs rose, and the P/E ratio took a tumble. However, after the crisis, the NPAs reduced, and the P/E ratio rose to its highest level. Loan book growth and asset quality improves once a reputable bank comes out of a crisis. Conservative policies have played a role in the survival of the fittest in the financial sector during a crisis. Poor investing policies and corporate structure has led to the eradication of smaller players in the sector. The investment funnel at Marcellus has remained to have a gauge at the market share of the major contributors in the sector. High quality accounting combined with remarkable historical capital allocation, played a crucial role in stock selection for the Kings of Capital fund. Additionally, Marcellus’ forensic filters have helped to screen the 95-100 listed stocks present in the market. Approximately 30 companies do not pass the filters as the necessary criteria are not fulfilled. The capital allocation and accounting filters eliminate another 30 companies, leaving the firm with 25-30 stocks. Barriers to entry and competitive advantage have taken over the remaining stocks and helped in the screening process. Financial reports of the last 10-15 years help to gauge the consistency of the financial company. Collection managers have a key role to play as they have sufficient knowledge of the industry protocols. It boils down to 10-12 stocks in the Kings of Capital fund where 8 of them are from the lending universe and 4 from the non-lending universe. They have a median market capitalization of $9-$10 billion. 11 ratios in the screening process have been designed specifically for the financial sector. The relative scoring helps to weed out companies with naughty accounting policies.

Contingent liability as a % of net worth, NPA volatility and growth in auditors’ remuneration to growth in net interest income are some the financial filters for the stocks. Profitability is pumped up for a particular period with hefty upfront fee income and higher amount of loan disbursal that happened with Yes Bank. Companies are placed from Decile 1 to Decile 10, where the 1st Decile includes companies that are strong, and the 10th includes the weaker ones. Moreover, it was noted that companies in the first 3 deciles had strong correlation between accounting practices and share price returns. A case study of DHFL brought out that it had a poor fee income to net interest income ratio and that it was the second worst in the market. It had the third highest treasury income as a % of NII. Moreover, it routed interest expense through the Balance Sheet rather than the P&L acting as a major red flag for the asset management company.

The lenders in the Kings of Capital portfolio are growing at 20%, while the non-lenders like life and general insurers, are growing at 18%-19%. The latter provide stability to the portfolio as they are non-leveraged in their business model. Additionally, they have not taken a balance sheet risk, something which lenders have tried to do in the past. The gross NPA has risen from 1.8% to 2.5% for the lenders in the portfolio and so has the provision coverage ratios which rose from 51% to 80%. It shows that lenders have improved their balance sheet substantially over the last year. The net NPA, too, has not increased much for the top performers. Kings of Capital has a return of 32% since inception on 20th July 2020, whereas the Bank Nifty had a return of 56%. There are 5 banks that cover 90% of the Bank Nifty index of which two are not present in the fund (SBI and ICICI Bank). The fund also comprises 30% of non-lenders along with NBFCs.

As Mr. Saurabh Mukherjea puts it that our GDP is comprised of 40% of the financial sector, which has been consolidating with loan book growth at a steady rate of 20% and hence, it is ideal to keep investing in the same. The financial consolidation is similar to the one seen in Korea and the USA, and which will last for quite some time. It has been stressed several times that a market share rejig will ring in growth for the financial sector. The capital has dried up in PSU banks whose share will be taken up by the private sector lenders that have been delivering for the last couple of years. Banks with low quality governance, a history of corrupt activities and poor capital allocation have not been included in the fund.

Clean accounting is important in financial services, says Mr. Saurabh Mukherjea.

Lending is a highly leveraged activity and hence investing in clean lenders with a sound capital allocation plan is the ideal way to generate returns. Research has showed that as a country gets richer, retail lending becomes equally important which is a true story in India is as well. Retail credit involving home loans, car loans and SME loans will take precedence over the coming 10-15 years. In a stark comparison of real GDP growth and credit growth of private sector banks over the last decade revealed that the former could not outpace the credit growth of private sector banks. PSU banks continued to give up market share to private sector banks over the last few years. The webinar was capped off with the theme of retail lending playing a pivotal role in wealth creation and how investors can take substantial returns from the growth of the financial sector.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

At PMS AIF WORLD, all PMS AIF Products are listed with all possible information and data for investors to understand & compare these products from the lens of risks as well as returns.

A unique proprietary framework has been founded by PMS AIF WORLD whereby 3 important attributes i.e. Quality (Q), Risk(R), and Consistency(C) are presented for more than 150 portfolio management services by covering 9 factors like Standard deviation, Beta, Sharpe, Alpha, Consistency Ratio, and so on. Many investors as well as the industry are using this proprietary framework to learn, compare, and select the best PMS products in India.

Here is the link to Register and access our QRC Database.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION