Date & Time: 01st October 2021, 05:30 PM – 06:30 PM IST

Speaker: Vikas Khemani– Founder, Carnelian Asset Advisors

Moderator: Kamal Manocha– Founder & CEO, PMS AIF WORLD

India growth story - from here to where? With a different perspective on Investment Risks

While equity markets are not in a mood to take any breather, and the rally over 2021 has surprised everyone, with Mr. Vikas Khemani, founder and CEO of Carnelian Asset Advisors is very confident and sees a dramatic Shift in the economy brought by the reforms especially towards manufacturing and banking space over last 5-7 years and he attributes huge wealth creation opportunity to the same over the next 5-6 years.

To discuss the same in detail in the context of India’s growth story and have a better perspective of risks going forward, we conducted another well thoughtful webinar. Mr. Vikas Khemani has over two decades of experience in the equity markets. He founded Carnelian Asset Advisors 2 years ago. And, while many were worried about the economic challenges in 2020, this portfolio manager, a chartered accountant was seeing an opportunity for investors and launched the ‘The Shift’ strategy in OCT 2020 designed to invest in the manufacturing sector focused structural growth businesses, run by great management, at fair valuations with a belief that reforms related to all 4 factors of production i.e. land, labour, capital, and entrepreneurship will lead to superior returns for investors in this sector over long run. It is very easy to talk about what has happened in the past but India’s growth story has a lot of scepticism around it. To clear the air, it was crucial to have a conversation about what the future holds for Indian investors.

India continues to remain the most sought-after economy in the emerging market segment as there is massive room for growth and foreign institutions have taken note of the same.

A series of structural reforms from 2014 to 2019 had set the base for a bull run as it also helped wither the pandemic. The horrors of last year were soon converted to scepticism and the markets went in favour of investors as the current all-time highs. The greater conviction around next 5 year horizon will yield better results. It is crucial to have a clear perspective when the markets are at an all time high.

Mr. Vikas Khemani puts it, though Covid was a devastating disease which brought much sorrow, but it has been a boon for India’s economy.

Covid has helped in the emergence of economic growth drivers such as manufacturing and IT. While sectors such as Technology, Banking, Real Estate, and Infrastructure did play a crucial role in the recent market rally, it is worth noting that IT, which had been termed as a low growth sector, has become a defining one in the post pandemic era.

The global demand in the IT services is majorly met by the Indian market as Indian companies have bigger and better international deals on their table. The IT services exports industry is poised to touch USD 250bn by 2025. The digital spending will be based on cloud-based services as legacy capex takes a back seat. IT companies spend 50% of their revenue on salaries while the remaining on other operating expenses. The cumulative incremental growth in salaries will be USD 120bn which will fuel growth across sectors. Moreover, the incremental revenues from the sector will help to wipe out the current account deficit.

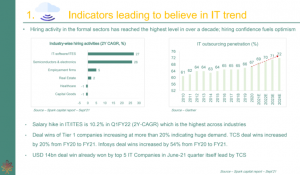

Hiring confidence has fuelled optimism and IT sector’s salary hike is the highest across industries.

India is surely on the cusp of a manufacturing boom where the focus has shifted to Atmanirbhar Bharat and the Production Linked Incentive Scheme. We are not sure about the former but the latter reform has repaid us in leaps and bounds as companies are scurrying to fall under this category. The Phased Manufacturing Plan (PMP) scheme by the government will boost local manufacturers and help them develop their art. India is already in line to replace China as far as labour supply is concerned and outsourcing of various aspects of business. China’s cost advantages have gone down as Indians are giving a stiff competition. To put it in context, India’s cost competitiveness has improved over the years. Indian tax rates are the lowest on the global scale as domestic manufacturers continue to remain in search of economies of scale.

We think that global manufacturers are setting up their base in India to meet the domestic as well as the global demand, says Mr. Vikas Khemani

Manufacturing only makes up 16% of our GDP but it has risen remarkably in the last few years. The stakes are going to rise as the government expects the share to be at least 25% making it a $1.25 trillion sector by 2025. All in all, the second order effect of the manufacturing change will lead to an incremental capex growth of USD 300-400bn over the next 3-4 years. The word is that one formal job in the manufacturing sector gives birth to 3 additional ancillary jobs in the vicinity of the plant. Moreover, it leads to a push in the investment cycle to support growth and expansion plans. Keeping a close watch on the capacity utilization numbers, we can gauge that we are in the midst of an expansionary cycle.

Expansion plans have made companies to tap the finance sector where banks have a major role to play. We are at the start of a lending cycle as well leading to swift payments being made by banks and lenders. Mr. Vikas Khemani also believes that the formation of a bad bank will help all industries. The digital payments have grown at 43% CAGR in the last 10 years. UPI payments and Digital Payment Index have been a game changer for the financial sector. Credit growth of 13% is possible with India turning a USD 5 trillion economy. Corporate houses have entered the deleveraging stage where debt is being wiped off the balance sheets of many. Furthermore, India’s credit to GDP ratio is the lowest, leaving ample of space for a deeper penetration with a fast paced credit cycle.

Reforms in the real estate sector like RERA will lead to consolidation in the industry. A favourable regulatory environment has formed the base for the sector to perform splendidly in the coming few years. Government is supporting the citizens with affordable housing schemes and the creation of jobs across sectors has set the tailwind for swift growth of the residential housing category. Lower interest rates will be a multiplier effect as the demand for houses will continue to rise. The affordability ratio can be calculated as the home loan EMI payment divided by income and this ratio has touched the lowest levels that were last seen in 2001.

The government’s infrastructure push has led to designing the 100% FDI plan in road construction segment. The public authority also plans to build 50km roads per day in the near future. India will be home to an additional 11,000 kms of National Highway by the end of next year. The Pradhan Mantri Gatishakti National Plan has set aside 100 lakh crore to build holistic infrastructure and aims to break the silos between roads, rail, air and waterways to reduce travel time. World class complex projects like the Ladakh tunnel (Asia’s second largest tunnel) are being planned to be completed in record time.

The need of the hour is to deliver more at a faster and better pace along with a mindset that augurs growth, says Mr. Vikas Khemani

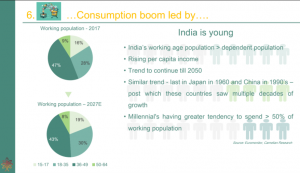

The expansion of sectors cumulatively will make those wallets even fatter or as we like to put it that the digital zero’s in your salary are bound to increase. Consumer discretionary spends will rise as the household income profile is expected to touch 386 million by 2030.

Mr. Vikas Khemani loves to quote Charlie Munger who says ‘When several forces combine in one direction, we get the desired amplification “Lollapalooza effect,” which one can’t get through simple addition.’

The snowball effect will be in play as multiple economic growth drivers emerge apart from agriculture that we have been seeing for a long time. Increase in IT spends and manufacturing growth will lead to job creation leading to higher or better disposable income. Corporate earnings to GDP were 2% in 2002 when the markets were in a turmoil but touched 7.8% by 2008. Similarly, in 2020, the ratio stood at 1.8% but it is expected to jump to 6% by 2025. Putting the same numerically, it would mean corporate earnings of $250bn, 5x of the number in 2020. We are coming out of a very long and stagnant earnings cycle and the current market valuation is a factor of a structural growth cycle. Metrics such as excess liquidity, moderate inflation, bottoming out of NPA, corporate de-leveraging and current account surplus are at the same level that were seen during 2002-2006.

India has always been a current account deficit country due to the vulnerability of the external account. With additional export or import substitution, India is poised to turn towards a current account surplus. Interest rates and liquidity can be managed smoothly, along with lower reliance on global cues. Countries like S. Korea, Japan, Thailand and China have traversed the path of current account surplus and have witnessed economy expansion cycle.

All of the above combined, will lead to massive wealth creation and the target of $5 trillion economy will be in sight or may be achieved within 4-5 years. The market cap may be around $5-7 trillion with the market cap to GDP ratio touching 140% by 2025. There are chances of intermittent volatility as timing the market is difficult. It is only possible to gauge trends from global cues and have a good understanding of the fundamentals. There are risks such as Rupee appreciation, inflation, geo-political conflicts, de-globalization and cyber attacks that may act as barriers to growth.

Reforms have been large scale but India is far from being innovative in certain sectors. Mr. Vikas Khemani defends the statement saying that the reforms have formed a conducive environment to breed innovative ideas. It is an Indian company that was second to start the manufacturing of a vaccine.

Speciality chemicals is also a sector where Indians have seen massive growth opportunities and have done significantly well. The engineering skills are renowned the world over along with manufacturing and electronic plants being set up in the country. The leaders in the government are bringing reforms that are ideal for innovative thinking. The mindset change has led to the spurt of unicorns and India being termed as ‘Start-up hub’. The leapfrog in growth is not poised to sustain for 1-2 years but until the Indian youth has run out of opportunities and ideas and the momentum will slow down.

A poll that ran during the webinar took the perspective of the audience about the purported market levels that could be seen in the next one year. The majority of the respondents were of the fact that the Sensex would be between 65k and 70k. The options also included 45k and 55k, but the majority remained bullish on the market indices. The second poll that was conducted asked the audience about the similarities of the current bull run with the 2003-08 period. Here, 39% of the audience felt that we are in a much better period than the one stated in the question and 34% feel that the current bull run is similar to the previous one. Mr. Kamal Manocha, our Founder and CEO, highlighted those structural changes are the major reasons for growth in the current run. A member of the audience pointed out that the market had peaked in 2008 when the PE multiple touched 28 and then it travelled to lows of 8-9. Today if we say that the bull run has just started, the PE multiple is already at 27-28. Interest rates have changed drastically, and its impact is quite visible. A 2% drop in interest rates improves equity valuations, keeping everything else constant, by 35%-40%.

India’s growth wheel has just started to move, and the impact of the drivers mentioned above will only be seen once the wheel moves at a brisk pace. Manufacturing, IT, Banking and Real Estate are some of the sectors that are going to reward investors in the long run. Diversifying the supply chain from China and taking up majority share of the same will be crucial for India’s growth story over the next 10 years. Well capitalised banking system has also formed a solid base for a growth environment. There are particularly no risks if the government spends on manufacturing, IT, banking, and reforms in the real estate segment. Hence, we have been conducting webinars under the title of Crystal Gazing Next Decade of Wealth Creation for Investors where market experts continue to share their experience and market trends are pondered upon. India’s GDP is growing at a steady speed, but the double digit is yet to be realised.

The webinar had built the momentum to discuss risk from different market experts as the risk reward ratio is a crucial gauge in wealth creation. Benjamin Graham says, ‘The essence of investment management is the management of risks, not the management of returns.’ A lot depends on how much time we spend of risk that can be controlled and managed. It is shocking to know that we spend around 20%-30% on the same but theoretically we could spend 70%-80%. On the contrary, we spend more time on the risks that cannot be controlled or managed by us.

Carnelian Asset Advisors has categorised risk as Permanent loss, Volatility and Opportunity loss. The first category involves studying the quality of management and earnings and this category is the most controllable. Similarly we can manage risk that might lead to a lost opportunity. Volatility risk involves macro factors, geo-political issues, liquidity, and temporary market dislocations. These are uncontrollable and the least amount of time should be spent on them. 32 lakh crores of wealth has been destroyed by 570 companies in the last 20 years due to controllable permanent loss risk.

Kotak Mahindra Bank is a company that has seen price correction 17 times >10% correction in a day, 8 times >25% drawdown in 3 months and 2 times >40% drawdown in 6 months. However, the stock is up 1145 times with a CAGR of 45% since 2002. Similarly, there are many examples of companies failing in short term over a span of 10-12 years they have performed excellently. Eicher Motors, TCS Bajaj Finance Ltd. and Infosys Ltd are some of those examples. The opportunity loss risk involves loss aversion bias, anchoring bias, style bias and recency bias. The anchoring bias leads to holding of the stock when reliance on a single piece of information is too high. We also believe that something that has happened in the near past might repeat itself leading to recency bias in investment.

Investing is never about NOW but it is always what will happen or what the future holds for us, says Mr. Vikas Khemani

It is imperative to evaluate businesses from time to time combined with reading texts, journals and books. Expanding your knowledge base will help reap better rewards in the future. Biases have eroded a lot of wealth for seasoned investors as well. It was only after 20 years that Warren Buffet entered the technology space with Apple.

The biases will lead you to an interesting question that ‘Who stole my returns: Me or Markets?’

Be truthful to yourself and answer the question so that you are never on the losing side.

The webinar was well rounded up by a question from the audience about the impact of the pandemic on the company balance sheets wherein corporate have started to deleverage. If they stop taking debt, India’s credit cycle will not start. Mr. Vikas Khemani points out that in the 2003-2008 bull run, the credit cycle was at its peak around 2007 when it grew 25-30%. High quality corporates are able to borrow at 6%-6.5%. It is within a year’s time that the credit cycle will pick up and put India on a better pedestal. India’s dependence on foreign capital is low and hence Fed’s hawkish stance will have a lower impact on the broader indices. The capital account surplus does not call for foreign funds to flow into the country. India’s attractiveness cannot be compared to any other country in the emerging market side. Institutional presence in the boards of various companies will also rise which is quite remarkable in the US market.

Carnelian remains bullish on India and sectors such as IT, Manufacturing, Banking, Real Estate, and the discretionary segment will perform marvellously. Keeping a steady perspective and incorporating market trends in one’s ideologies and beliefs will be important for wealth creation in the next decade.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

At PMS AIF WORLD, all PMS AIF Products are listed with all possible information and data for investors to understand & compare these products from the lens of risks as well as returns.

A unique proprietary framework has been founded by PMS AIF WORLD whereby 3 important attributes i.e. Quality (Q), Risk(R), and Consistency(C) are presented for more than 150 portfolio management services by covering 9 factors like Standard deviation, Beta, Sharpe, Alpha, Consistency Ratio, and so on. Many investors as well as the industry are using this proprietary framework to learn, compare, and select the best PMS products in India.

Here is the link to Register and access our QRC Database.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION