Date & Time: 30th June 2021, 05:30 PM – 06:30 PM IST

Speaker:

Amit Saxena, Director and Head — Alternative Investment Funds, Dolat Capital Market Private Ltd.

Moderator: Kamal Manocha – CEO & Chief Strategist, PMS AIF WORLD

Absolute Returns using Long Short Funds: Changing Landscape of Hedge Funds in India

It was in mid-2012 that SEBI had allowed Alternative Investment Funds (AIFs) to operate in India. Although a relatively young market, Hedge Funds fall under AIF Cat III of the various categories prescribed by the market regulator. Hunt Hedge Funds, Absolute Return Funds, Enhanced Return Funds, Debt Plus Category or Equity minus Category are some of the names given by investors. PMS AIF WORLD, an analysis driven, and data backed investment firm which is also an abode of quality, risk and consistency, conducted a webinar to dive deep in the hedge fund space along with Mr. Amit Saxena, Director & Head— Alternative Investment Funds at Dolat Capital Market Private Limited.

With over 16 years of experience in the market, Mr. Amit Saxena has previously worked with Nippon India Mutual Fund and global financial institution ING Group among numerous asset management companies (AMCs). Dolat Capital has 60+ years of experience in the Indian Capital markets bringing in state of the art technology and being attributed as the market makers for ETFs in India. It is also one of the leading brokerages and research house in the cash segment of the markets. Moreover, they have aced the B2B segment and are the market leaders in the derivative-based strategies. The spectrum of financial services at Dolat Capital range from proprietary book to institutional equities combined with investment banking to NBFCs. There have been 759 AIFs since 2012 with an AUM of ₹4.5 lakh crores. Category I of AIFs includes Angel funds, Venture Capital Funds, Infrastructure Funds and Social Venture Funds. They do not have leverage and enjoy tax passthrough status. The AUM for this category stands at ₹44,560 crores. The Category II AIFs are also closed ended and include PE Funds, Debt Funds and Real Estate funds. Similarly, they enjoy the tax pass through status along with no leverage. The AUM for the same stands at ₹3,56,627 crore which is quite a significant number. The Category III involves complex trading strategies used by Hedge Funds, Long-only funds and Long-short funds. They can take up to 2x leverage and do not have a tax pass through status. The CAT III AUM stands at ₹50,030 with significant growth noted in 2019-20.

The CAT III AIFs have two broad products namely Relative Return and Absolute Return. The former has long only funds whereas the latter includes long-short and hedge funds. The funds have the option to list as Open ended or Close ended as the category initially had only long-short funds under its belt. A long only close ended scheme will have to return investor’s money within 3 years along with enjoying a tax advantage status. Short-term gains are taxed at 15% while long term-gains at 10% which are paid at the fund level. The long only fund provides a concentrated portfolio along with personalized service entailing your personal needs. The flipside being that the returns are relative to the broad market-based indices. Long only funds are growing in significant numbers due to the numerous advantages offered by it.

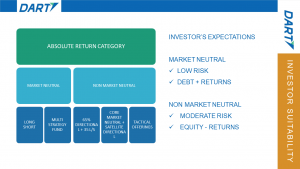

From the risk return prospective, absolute return funds are further classified into market neutral and non-market neutral. As the name suggests, market neutral funds do not take any direction for the market and include long-short and multi strategy funds.

Mr. Amit Saxena moved towards describing the non-market neutral strategy as they involve funds that are 65% directional in nature and are 35% market neutral. Another form of non-market neutral strategy includes a manger being core market neutral combined with a satellite direction. Lastly, a tactical offering will generate equity kind-of returns by combining various strategies. An investor having a low-risk profile along with in search of consistent returns should invest in market neutral products. The returns of a short-term debt fund are generated here, and investor stands to benefit over a 6 month to 1 year time horizon. A moderate risk investor will look to invest in non-market neutral products that generate returns like that of equities. Tactical offerings target double digit returns that are also known as equity minus returns. The investment choice depends on the liquidity needs, the risk profile, and the funds available to the investor.

Although long only funds generate attractive returns, their growth has been declining prior to the start of the new decade. Leverage and exposure to derivatives under the CAT III AIFs have been presumed to play a vital role in its downfall. The tax elevation under this category rose from 35% to 42.7% in 2019 with derivatives generating business income. This income is usually taxed under the highest slab with net returns reducing significantly. The risk reward ratio decreases drastically if the strategy used is not changed instantly.

If the net returns are not consistently beating the opportunity cost of the funds by a specific margin, then there is no point taking a risk.

Funds have changed their strategies as well as structure of the product to become more tax efficient. HNIs do not invest in products whose yields are dropping constantly as they are more tax-savvy investors. They usually expect liquidity to be high combined with low capital risk and consistent returns. Moreover, they are on the look-out for tax efficient products that generate post tax debt + IRR (Internal Rate of Return) kind of returns in hand. A trust usually entails higher tax bracket while the complications of forming a company are numerous. Hence, it is ideal to create a Limited Liability Partnership where the structure is tweaked from the fund manager’s perspective and not the investor himself. Market experts believe that investors’ trust will gradually shift to an LLP structure for better in hand returns. Dolat Capital was the first LLP to enter the market and changed the investing style for its investors completely. It is a diversification call whether to invest in long only funds that have outperformed long short funds numerous times in the past. If any investor would like to see his portfolio bleed during tumultuous times, he/she can continue investing in the long-only fund and conservatism altogether. However, diversification offers several benefits that investors need to be aware of such as lower risk and better returns.

Long-short funds of the absolute return category offer stable and positive returns as opposed to Equity Savings funds. The latter performs poorly when the market falls by 10% or when the yields go up. The opportunity cost may be in terms of arbitrage fund, a fixed deposit and cash flow which are unique in absolute terms. For instance, an investor seeking safety of capital and liquidity of funds, should invest in Liquid Funds that offer 2%-3% returns on a post-tax basis. As stated earlier, the absolute return fund category questions the investor’s risk appetite, the capital to be invested and the returns the investor is looking for. There is a common misconception among investors that when equity markets perform poorly, the only solution is debt market. Mr. Amit Saxena pointed out the fallacy and stated that a balanced portfolio in difficult times should be favored. Diversification benefits are witnessed when investing is done in a well-balanced fund. A relevant question was put forward with the help of an example by Mr. Kamal Manocha, who spoke about a hypothetical investor having a portfolio of ₹10 crores; half of the portfolio is invested into long only funds, PMS and AIFs. Specifically speaking, the equity returns have been phenomenal under this category for the investor and returns stand at 1.8x. There is a handsome chance of making another ₹2 crores from the same funds. The other half of the portfolio is invested in debt funds that are generating 5%-6% returns. There are two real questions that need to be answered from the point of view of the investor—

- Where should the excess equity returns be parked? Whether the profits should be booked, or allocations be increased?

- How is the scenario of gap down opening addressed while investing in absolute return funds?

The first question is answered from two perspectives— he mentions that if looked from a broader perspective, it is observed that the equity returns are booked initially just when the stock picks up momentum, but, on the contrary, an intelligent investor would wait and take further risk and push for superior returns. The profits booked can be taken to debt funds or long short funds that provide safety of capital for the investor. Hedged positions taken by arbitrage funds protect investors from gap down openings which answers the second question. The neutral positions secured via cash and futures position is ideal to prevent investors from such adverse scenarios. Another recourse could be a mix of put, call and futures where risk can be sufficiently hedged. Here, stable returns are generated between 5%-10% as safety of capital is of prime importance.

As everything has a cost, playing a very safe game will shorten the returns. Hence, Dolat Capital is happy underperforming if the returns are not negative for its investors.

It is a level playing field when we say investors want to save taxes, be it small investors or high net-worth clients. There are investors who are able to invest in absolute return funds as Dolat Capital’s LLP structure allows them to pay 35% tax. Investors earning above ₹5 crores can save tax by investing in funds that have an LLP structure as they will end up paying 35% tax. It is an arbitrage opportunity that investors can make use of. There will be new funds created that will look to exploit the lower tax bracket by registering themselves as an LLP structure with a suitable strategy. Given a March 2020 scenario, an arbitrage fund is bound to make unimaginable returns. Moreover, in extreme cases when the market opens below 20%, the strategy will definitely reap rewards. The best annual return on a post-tax basis that can be generated from Dolat Capital would be 8% in a volatile market and 5%-6% in normal market circumstances. Towards the end of the webinar, Mr. Amit Saxena was asked how losses in the cash segment are offset by gains in the derivatives market. It was a prudent answer which stated that since it is business income, it will be taxed at 35% for the LLP structure and hence would not require management.

The post-Covid era has seen miniscule attraction towards long-short funds to take benefits of diversification whereas the overall sentiment towards AIFs as a category has not changed. Dolat Capital has a monthly liquidity structure wherein an investor can invest once and redeem on the last Thursday of every month. The fund is devoid of entry/exit load as well as performance fees as of now, however, a management fee of 1.25% is charged over an investment of ₹1 crore. The Head of AIFs further mentioned that Gift City AIFs are an interesting opportunity for investors as the leverage problem has been removed. However, it will take a couple of years to build a suitable and liquid market for the same. There are compliances that an investment manager needs to follow as compared to zero compliance for an investor looking to invest in an LLP based AIF structure.

The webinar was wrapped up by highlighting the risks of investing in CAT III AIFs. An investor who is not aware of how the market functions will lead to various downfalls. Sophisticated investors, well averse with the investment horizon of the product should invest here. Furthermore, risks related to liquidity, credit and higher volatility need to be addressed before investing in this category. Optimal returns are generated keeping the risks in check as done by Dolat Capital’s long short fund.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

At PMS AIF WORLD, all PMS AIF Products are listed with all possible information and data for investors to understand & compare these products from the lens of risks as well as returns.

A unique proprietary framework has been founded by PMS AIF WORLD whereby 3 important attributes i.e. Quality (Q), Risk(R), and Consistency(C) are presented for more than 150 portfolio management services by covering 9 factors like Standard deviation, Beta, Sharpe, Alpha, Consistency Ratio, and so on. Many investors as well as the industry are using this proprietary framework to learn, compare, and select the best PMS products in India.

Here is the link to Register and access our QRC Database.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION