Date & Time: September 24, 2021 @ 05:30 PM IST to 06:30 PM IST

Speaker: Harsh Agarwal – Head – Alternative Strategies, Tata Asset Management

Moderator: Kamal Manocha – Founder & CEO, PMS AIF WORLD

Strategies that don’t depend on markets to generate returns

Indian indices are aiming for the moon as investors continue to make merry in one of the best performing emerging market. The current bull run is one of the best in the sub-continent devoid of a 10% correction. At the same time, fixed income instruments do not have much in them to generate excess returns. It is during such time that an investor looks for a product that will protect his/her funds if the markets correct anytime soon. Here comes to play long-short funds that have a lower risk profile and generate consistent returns even when the valuations are sky high.

In this context, we, at PMS AIF WORLD thought it is important to have a discussion with Mr. Harsh Agarwal, Head – Alternative Strategies, Tata Asset Management, about the current state of the Indian economy and dive deep into such products. He has over 18 years of experience and has been a long short strategist for more than a decade. We unfold an interaction and gain information about the various features to look for while investing in AIFs from CAT III, their risk profiles and modus operandi.

We are aware that there are three points to keep in mind while investing in markets and they are namely, time spent in the market, timing the market and alpha extraction. To set the context, Mr. Harsh Agarwal spent couple of minutes describing forces that make the portfolio independent of the market movement. Timing the market and alpha extraction are critical aspects of making returns that are independent of market support. The use of technical and quantitative analysis some funds have shown that timing the market is possible but it’s a herculean task for any fundamentally inclined fund manager. As such fundamental driven strategies will focus more on alpha than timing the market. Apart from equity long-short strategies, certain options strategies also help generate returns that are uncorrelated to markets. Alpha is defined as the stocks (or fund’s) excess return over the benchmark. Long only schemes like MFs, PMS, long only AIFs follow the market movement but also generate (long) alpha. Long-short funds not only aim to capture this long alpha, but also make short alpha (make returns by shorting the stocks which underperform the market).

It’s difficult to be a seasoned long-short portfolio manager until and unless you are willing to lose some money and spend sufficient time in the market, says Mr. Harsh Agarwal

The example of the price movement of Maruti Suzuki over the last 3 months is an enriching one. Nifty rose around 12% over the couple of months but the price of the auto giant continued to fall by around 10%. So, it’s not necessary that all the stocks rise when the broad index is rising. The long-short funds actively look out for such opportunities to create short positions. The ratio of their overall long positions to short positions will determine how much these long-short funds want to participate in the market (or participate in this directional risk).

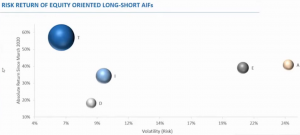

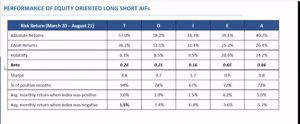

As long-short funds have more tools (especially short alpha and options strategies) with them to generate independent returns, Mr. Harsh Agarwal showed performance of existing equity oriented long-short funds tracked by us to demonstrate how the long-short funds have participated in market and how much alpha they have been able to extract from the market. He collected monthly returns data beginning March 2020 (to capture the fall phase of the market) till end of August 2021.Through statistical measures like volatility, beta he explains which funds more market are linked (will display higher volatility and beta), and which ones are taking lesser market risk (lower volatility and beta). Then taking their Sharpe performance (Returns/Risk) and performance in the bear months he explains how certain funds must have achieved very high alpha (high returns despite low market participation).

Returns and volatility of the funds from March 2020-Aug 2021

Further, he goes on to show performance of these long-short funds in different phases/time periods. It was an intriguing point that came out. One of the funds which has remarkably superior performance overall, wasn’t the top returns generator in any of the phases but was doing well in all the time frames. The key takeaway here was that the best fund or the strategy doesn’t have to best in any single market phase, but merely must be more consistent in all the phases.

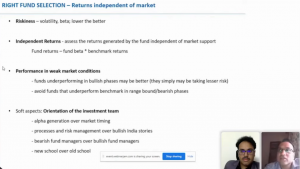

Having covered an insight into long-short funds and strategies, he moves on to extend the concept and importance of independent returns in fund selection. He also suggests few soft aspects, some of them were very new and unheard of, that investors should look at.

Amongst the quantitative parameters, the first and foremost are the risk parameters (volatility, beta profile of the funds). Funds that exhibit lower risk are likely to generate greater returns for the investors in long run. Then he suggests the importance of de-linked or independent returns that fund has been making. He argues these funds/fund managers will need less support of the market to make returns for the investors. He proposes an arithmetical formula to calculate this independence of returns; Fund returns – (fund beta * benchmark returns).

Market behaviour is not in our control as it heavily relies on global cues and the inter linkage of the global financial system and as such markets can fall/correct anytime.

He advises evaluation of performance of the fund in weak market conditions as a critical measure. It is more important to see how funds do in bear/range bound markets than to see how they do in bull phases. There may be funds who are simply not take part to full extent in the market frenzy due to risk averseness and hence underperform under such circumstances.

An important fact reiterated by Mr. Harsh Agarwal is that compounding places a massive role in wealth creation given a longer time horizon. Funds that fall less also compound better over longer time frame.

Mr. Harsh then shares his views on the soft aspects that investors should look at. In this aspect it is the orientation/investment though process of the investment team that should be seen. Here he reiterates the key aspect for investing is alpha extraction. Fund managers who are focussed on alpha will do better than those who trying to time the market.

Fund manager’s focus should be on alpha generation rather than market timing.

Further investment and risk management processes are critical aspects of investing. An unbiased process of stock selection keeping the investment objectives in mind is very important. Managers who talk about these processes more than giving a bullish market outlook are better off. Ones with process orientation will try relentlessly to improve them further making it unbiased and churning out alpha ideas. This brings to a very interesting point with respect to desired orientation of the fund manager. He argues betting on cautious-bearish fund managers over bullish ones. While highly counterintuitive and debateable, it is thought provoking. He opines that the bearish managers are more quality conscious and very selective in what they want to have in the portfolio. On the other hand, those who get too bullish may lower their guard and become somewhat complacent in what they buy in the portfolio. Having worked for the US markets closely, Mr. Harsh Agarwal observes that the legendary investor Warren Buffet probably too has a bearish mindset while picking stocks. Warren talks about margin of safety, selecting stocks assuming markets will remain shut indefinitely, making returns with low risk and rule of not losing money. He believes that Warren’s most important criterion for buying stocks is the visible longevity of the business. If business can survive for long and if is capital efficient it will grow. Warren Buffet picked up stocks like Coca-Cola, Gillette, large pharma, and banks which have strong business visibility. He cites example of how Warren Buffet bought large stakes in railroad stocks in 2007 even as street was predominantly ‘sell’ on these stocks because of lack of strong growth opportunities, Warren saw something different. In USA, the railroads are primarily used to transport goods from one place to another. Their growth prospects were not too exciting and linked to economic activity. Warren Buffet liked them as they were strong businesses with limited competition, and strong balance sheets/cash flows. It served him well in 2008 crash as these stocks were better off. Over a long period of time these stocks have made fabulous returns for the investors while business prima facie would appear very dull and simple.

Managers who talk about risk management and processes will be better off from those who only talk about the bull run, says Mr. Harsh Agarwal

Mr. Harsh further advises that fund managers from the new school of thinking are better off than old schools. The former is not so valuation conscious and have liking for high growth technology-oriented companies. While old school managers will avoid these stocks because of high valuations. He argues that in world of low /zero-ish interest rates, valuations are less important, and investors are more willing to pay any price for growth businesses.

Our motive was to educate the audience about investments in long-short funds that fall under CAT III of AIFs and not to sell an investment product. There are funds that had positive returns even when the broader Indian index (Nifty) was negative. It is sufficient to say that long –short funds have a low risk profile and generate positive returns even when the indices are down. They are less risky than long-only products. They use derivative instruments efficiently which not only enhances returns but also reduces risks. Through an example Mr. Harsh Agarwal explained that buying stocks of RIL worth ₹1,00,000 loses 10,000 if market comes under pressure and the stock falls by 10%. If investor uses the investment as margin money and takes 3.5x exposure in Reliance stock, he will lose 35,000 when stock goes down by 10%. A long-short manager will say buy ₹1,00,000 worth of Reliance in stock futures and short NIFTY worth ₹1,00,000. In this case, the loss in Reliance stock will partially or fully get offset by gains made short NIFTY position. One could end up making money if NIFTY were to fall more than Reliance. Unlike stock markets where wealth is either getting created (due to rise in markets) mor getting destroyed (due to fall), derivatives are essentially a zero-sum game where one will be on the winning side while the other must have lost. Returns in hedged strategies are range bounded and funds will focus on alpha while limiting the market directional risk. The long-short funds can extract alpha from both the long and short side of the market, something that conventional products can’t do. As such return opportunities are higher for long-short funds.

An interesting question was asked by Mr. Kamal Manocha, our founder & CEO, that can long bias and long-short funds add value or complement an investor’s long-term goal of wealth creation from equity markets. He says that there are various kind of equity long-short funds. Few of them are heavily long (exposed to equities) and take high market directional risk, while others are more risk conscious and take less market direction risk. The latter will add value and complement investors’ long only fund exposures. Additionally, there are a few long-short funds which are beating index returns over longer time frames and their inclusion will be good for the investors, but investors must understand their own risk appetite before deciding on funds they want to invest in.

On the ending note, Mr. Harsh Agarwal refrains from giving his view on the market outlook as it would demean the very purpose of this webinar (i.e. strategies that don’t depend on market to generate returns), but highlights that the economy is in strong recovery phase. For taking a view on the future one can investigate the past. Since 2010 NIFTY has given ~12% CAGR returns, and significant portion of this has been due to valuation re-rating which in turn has been driven by liquidity and interest rates. As the starting point now is high (in terms of valuations) the long-term future returns are likely to be lower than what they have been in the past. And in that context, it will be more important than ever before to evaluate products/strategies that generate returns without needing much support from the market. Some of these funds can do well even when the market falls. As such the coming decade will favour long-short or hedge funds.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

At PMS AIF WORLD, all PMS AIF Products are listed with all possible information and data for investors to understand & compare these products from the lens of risks as well as returns.

A unique proprietary framework has been founded by PMS AIF WORLD whereby 3 important attributes i.e. Quality (Q), Risk(R), and Consistency(C) are presented for more than 150 portfolio management services by covering 9 factors like Standard deviation, Beta, Sharpe, Alpha, Consistency Ratio, and so on. Many investors as well as the industry are using this proprietary framework to learn, compare, and select the best PMS products in India.

Here is the link to Register and access our QRC Database.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION