Date & Time: 11th June 2021, 05:30 PM – 06:30 PM IST

Speaker: Abhishek Agarwal– Managing Partner, Rockstud Capital LLP

Moderator: Kamal Manocha – CEO & Chief Strategist, PMS AIF WORLD

Start Ups and Small Caps: Unicorns of Tomorrow

PMS AIF WORLD was set up in 2019 with an aim of informed investing experience for savvy investors. Kamal Manocha, the founder of PMS AIF WORLD, had previously worked for a decade with Citibank, Delhi. He was unsatisfied with the way banks and private wealth management firms were operating as these firms were relying primarily on relationship traits as a mechanism to acquire clients and were focussed on selling a few branded products only, especially in the space of PMS and AIFs; with low knowledge in this area, as there was no way to compare and analyze these products. But PMS AIF WORLD is transforming this space with the power of data, analysis, audio-video content, articles, interviews, educative webinars with an aim of offering the best quality products which follow a simple approach to wealth creation along with simplistic content & analysis for an informed investing experience. We are very selective in our approach, and analyze PMS AIF products across 5 Ps – People, Philosophy, Performance, Portfolio, Price.

Here we present another such interesting Alternative Investment Fund set up by Mr. Abhishek Agarwal, Managing Partner, Rockstud Capital, who brings 14 years of investing experience with more than a decade in field of start-up and small business investing. His staunch belief is that investing in diversified portfolio of right small businesses is bound to create best wealth especially over next decade. What sets his small businesses focused alternative investment fund in category 2 apart from many other funds is its Unique Hybrid Equity Strategy investing in Early-Stage Startups at Pre-series A round & Listed Equities traded on NSE in a split of 51:49 to mitigate risk and liquidity issues with a potential for exceptional returns.

As Mr. Abhishek Agarwal puts it, Indian investors are mindful of risk and tenure of their investment and more importantly the trust factor in a new brand. To build in the required credibility and trust for its investors it has partnered with marquee fund service partners like Khaitan and Co (Fund Documentation), BDO (Auditor), Milestone (Trustee), Vistra ITCL (Fund Accounting), Axis Bank (Custodian), CRISIL (AIF Benchmarking).

Equities in 2011-2012 where not doing pretty well as the markets were directionless post the financial crisis of 2008. The Flipkart story gained resilience in 2013 which kick started India’s start-up story. It was in 2014 that Mr. Abhishek Agarwal started his investment journey in the start-up space. So far, he has over 30 companies in his portfolio giving him the unique proposition of going through an entire cycle of the start-up space within a span of 6-7 years. The personal portfolio of the managing partner of Rockstud Capital comprises of 24 start-ups with ~50% of startup failure rate and in spite of which he has recovered his entire invested capital in 24 startups from just 3 exits – Loginext Solutions (16x in 4 yrs.), Kwench Lab Solutions (5x in 4 yrs.), Wellness Forever (Partial Exit) (3x in 3 yrs.) while the remaining 10 are still live and doing well. The 50% success rate in his personal portfolio is staggering when compared to the world average of 15-20% that helps Mr. Abhishek Agarwal sell his story.

At Rockstud Capital, they believe in limiting the downside risk of an investor with the help of a hybrid equity structure to participate in India’s growth story. An investor investing ₹ 1 crore in the Fund would be having an exposure of ~ ₹ 50 lakhs in startups with a portfolio of 10-15 companies, thereby limiting his exposure to a single portfolio company to maximum of ₹ 5 lakhs only which is possible only because of its hybrid equity strategy and small fund target size of ₹ 100 crs.

After closely looking at how start-ups evolve, a company turns unicorn after an average life span of 7-9 years. The company is considered nascent from the seed stage until the Series B round of funding. The risk-reward ratio is very high as the companies’ product has to be appealing and scalable. Moreover, it should have the correct market mix and product mix to retain customers for the long term. Rockstud Capital has taken a step forward by investing in the pre-series A stage of a startups. It analyzes the product fit and post validation of the product the fund jumps in the bandwagon. It invests usually with other institutional VC investors for a span of 4-5 years. If the company is ready for a Series B funding by that time, it has the potential to provide returns of 5-20x. The portfolio approach is quite rewarding rather than investing in a few outliers with doubtful returns.

India’s growth story has been astounding with 50 unicorns taking the centre stage within 10 years. Furthermore, 14 of them have made the landmark achievement within 6 months of 2021. However, the marathon is not yet over as China has 200 start-ups and the USA at the peak with 300. It is time for entrepreneurs to jump in the tide and reap returns for themselves as well as retail clients.

‘If you make a product that has value you will always find a buyer’.

Lilac Insights, one of the portfolio companies of Rockstud Capital Investment Fund – Series I, is doing pretty well in the diagnostic sphere offering reproductive (prenatal) and cancer genetics testing for the past 10 years. Genetic testing is a type of medical test that identifies changes in chromosomes, genes, or proteins. It provide clarity on the results, guide therapy selection and monitoring, and allow disease risk profiling. With the advancement of technology, we need enhanced testing centres as people are looking for preventive medical solution and the COVID has just accelerated its demand. The company has beautifully understood the risk parameters from the genetics of the client. Veteran investors and founders like Rakesh Sharma and Subhamoy Dastidar have played a crucial role in paving the path for a pleasant future of Lilac Insights. The gaps exposed by COVID in India’s healthcare system are driving the growth story fuelled by foreign investors in Indian ecosystem. Global genetic testing market is worth ~$23 billion, India in spite of being 2nd most populated country in the world with nearly a 5th of the world’s population, accounts for only ₹400-500 Crs currently, but is expected to grow at 3YCAGR of 30% due to rising awareness. In India, 26 million babies are born every year, at least a million are born with genetic diseases and most go undetected. Compared to this, China does over 10-12 million tests and the USA does over 100-150 million tests a year. India’s genetic testing market is nothing when compared to its potential and growth in countries like the US or even the India’s routine diagnostics market which is worth ₹40,000 crore. It is pertinent to note that the listed diagnostic companies like Dr Lal Pathlabs, Metropolis, Thyrocare are trading at ~15x Sales multiple, while we have invested in Lilac Insight at just 5x Sales multiple. It has raised ₹ 46 crores in last round and aims to generate a revenue of ₹ 200 crores within 3-5 years, if achieved it could easily command a valuation of above ₹ 1000 crs at that point of time.

In the agriculture space, Rockstud has invested in BigHaat Agro Pvt. Ltd. which is transforming the entire pre-harvest journey of the farmer with the help of technology. The biggest impact that the Technology can have in India or globally is in agriculture industry because of the economic activity as well as from employability perspective. Agriculture employs 58% of India’s population, but contributes only 15% of GDP in spite of having 2nd largest arable land (160 million hectares) in the world after US. Further, the recent reforms in the agriculture sector by the government have made India turn into one of the largest exporters, but due to lack of education and infrastructure, farmers have not been able to reap the benefits. Farmers have no clear visibility of the quality and pricing of the agriculture inputs which leads to overall poor experience and farmers’ earning way below potential. BigHaat Agro Pvt. Ltd. provides farmers access to advisory and farm inputs such as seeds, fertilizers, chemicals, instruments, and accessories, thereby Digitizing the agriculture inputs ecosystem with the use of technology. Founders come from agriculture family background and have also worked in tech and engineering roles in USA at Honeywell Technology. The e-commerce portal is devoid of middlemen and with the technical know-how of the founders, they are ready to exploit the opportunities at hand. It has raised over ₹ 19 crores over three rounds of funding. With a post-money valuation of ₹ 61.8 crores, it is one of the success stories of Rockstud Capital.

‘A start-up offers you scale and accelerated growth and if it capitalizes the same an investor stands to make money.’

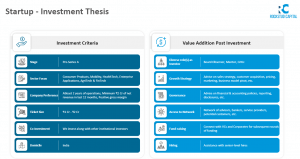

The start-up investment thesis is well defined by Rockstud Capital and it also provides nurturing and mentoring to its portfolio companies along with much needed equity capital. Key decision-making processes are monitored closely by the fund along with representation in the board of directors. The fund provides the much-needed scaling benefits and access to a network of bankers, advisors, and service providers. Lastly, it also helps start-ups to hire senior level employees to multiply the business with effervescence.

Gone are the days when only incumbent or large players were able to attract capital from the investors, the technological disruption especially in the post Covid-19 world has busted all the myths around it. Today, technological disruption has led to creation of many small niche business to flourish and even displace the incumbent or large players. BYJUs ($801 Mn), Swiggy ($800 Mn), Sharechat ($502 Mn) are few of the new age businesses which have been successful in raise capital in 2021. But as one invests in the new age business one need to be mindful and should follow a portfolio approach which helps to diversify risk and protect you from extreme results that are not in your favor.

At Rockstud Capital Investment Fund – Series I, it helps investors to minimize risk by following Unique Hybrid Equity Strategy investing in Early-Stage Startups at Pre-series A round & Listed Equities traded on NSE in a split of 51:49 to mitigate risk and liquidity issues with a potential for exceptional returns.

It is a fact that Indian indices have doubled over the past one and a half years with market cap at BSE already crossing $3 trillion. The market cap to GDP ratio is nearly one as the markets need to replicate the overall sentiment in the economy. The top 100 stocks are where most of the action has taken place while stocks in the tails have not fared well enough. Though there are 5000 listed companies in India, Top 100 company’s accounts for almost 70% of the total market capitalization of all the listed companies. The fund has seen gains of 101% this year with 5 multi baggers in its listed equity portfolio spread across its FACT(H) theme.

Rockstud had identified TATA ELXSI LTD over a year ago when it had a market cap of ₹ 4,000 crores which currently stands at ₹ 24,000 crore. The niche IT player works in the automation side of the car manufacturing business. As customers not only want fuel efficient cars but also interiors and digital gadgets present within the setup are required. Client list includes Jaguar, LandRover, Mahindra, and Renault as customer aspirations have grown multifold. The market is growing at an astounding rate of 25% as compared to 5% couple of years ago. The company has grown 24% p.a. and the fund highlights it by making it the most technology efficient company in the whole portfolio. It even did well during the pandemic with strong investors from abroad combined with efficient corporate governance, social norms and policies and key financials that grown over the years.

Hold quality and make money is the sole mantra for investing in start-ups.

Another further in its cap is AMBER ENTERPRISES INDIA LTD, the largest OEM manufacturer in the country with 9 out of 10 air-condition companies in India being on their client list. It has received the necessary push from the government that has helped it become a quality company by providing fabulous returns to its investors. A research revealed that only 4% of India’s population use AC; that leaves room for the company to grow. It is still an untapped industry with 98% of the population now receiving electricity. The discretionary spend among Indians is around the $2000 mark which is bound to multiple as the economy grows. Moreover, the humid weather conditions make it ideal for the AC industry to grow by a significant number. The markets easing via FIIs investing compelled Rockstud to invest in Amber. The second competitor does not have a chance to make a point against the number one manufacturer.

A quality company backed by simple facts is bound to give returns. As an investor, you are investing in India’s growth story. The webinar rounded up with a question that the ~50/50 portfolio strategy was due to the fact that losses need to be covered or investing in start-ups is more beneficial than investing in small cap funds. Mr. Abhishek Agarwal exclaims that the bet on equity places a higher risk while the bets placed on small companies leaves the investor with a potential to unlock the growth story. The corporate structure of a company backed by efficient technology will give returns come what may. There are bets that will fail miserably but it is the overall returns that need to be looked at.

At Rockstud Capital Investment Fund Series I, it invests at Pre-series A stage (providing bridge funding) and exits at Series B due to which it has a short tenure of just 4 years plus applicable extensions vs 7-10 years for typical venture capital funds in the industry.. Wealth creation is all about patience and the shorter-term horizon is for investors ready to take the necessary risks. However, it is minimized as investments are made in 10-15 start-ups out of which 1-2 stands to remain as multi-baggers while other provide average return and few busts. Lastly, the AIF CAT I and II funds in India are taxed at the investors end with only TDS deducted at the company level. Start-up investments attract a tax of 20% if held for more than 2 years that very well rounds up the conversation that start-ups and small caps are bound to grow within the next few years.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

At PMS AIF WORLD, all PMS AIF Products are listed with all possible information and data for investors to understand & compare these products from the lens of risks as well as returns.

A unique proprietary framework has been founded by PMS AIF WORLD whereby 3 important attributes i.e. Quality (Q), Risk(R), and Consistency(C) are presented for more than 150 portfolio management services by covering 9 factors like Standard deviation, Beta, Sharpe, Alpha, Consistency Ratio, and so on. Many investors as well as the industry are using this proprietary framework to learn, compare, and select the best PMS products in India.

Here is the link to Register and access our QRC Database.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION