Date & Time: 25th March 2022, 05:30 PM IST

Speaker: Mr. Utsav Mehta, Fund Manager- Edelweiss Focused Mid and Small Cap Portfolio, Edelweiss AMC

Moderator: Kamal Manocha, Founder & CEO, PMS AIF WORLD

Mr. Kamal Manocha, Founder and CEO of PMS AIF WORLD held an engaging webinar in conversation with Mr. Utsav Mehta, Fund Manager- Edelweiss Focused Mid & Small Cap Portfolio, Edelweiss AMC.

About PMS AIF WORLD

Kamal Manocha is the Founder & CEO of PMS AIF WORLD.

PMS AIF WORLD is a knowledge driven, New Age Investment Services Company, providing analytics-backed quality investing service with an endeavor and promise for wealth creation and prosperity. Over 5+ years, we have been managing 500+ UHNI & NRI families, across 1000 CR+ assets. We, at PMS AIF WORLD, are very selective in our approach, and analyze products across 5 Ps – People, Philosophy, Performance, Portfolio, and Price with an endeavor to ascertain the Quality, Risk, and Consistency (QRC) attributes before suggesting the same to investors.

We offer responsible, long term investment service. Invest with us in the best quality products and make informed investment decisions.

Speaker Profile

Mr. Utsav Mehta has over 12 years of experience, holds the CFA charter and is a commerce graduate from Mumbai University. He covered the infrastructure and construction sector as an analyst in Edelweiss itself before turning into a fund manager. He is passionate about equities and investment, while continuously learning the way the market works. He is fund manager of Edelweiss Focused Mid & Small Cap Portfolio

Webinar & Speaker Perspective

It is human tendency to search for wealth creating opportunities leading to a certain disregard to the downfall. The burning question that investors continue to ask is whether investing is closer to poker or chess? Mr. Utsav Mehta, of Edelweiss AMC believes that it is quite like a game of chess where the opponent’s move is visible.

Mr. Utsav Mehta exclaims that outperformance can be achieved if investors avoid companies that fell by more than 40% in any given cycle. There is a common misconception that companies having a high ROE or earnings growth will not fall by 40% in any given cycle. The key is to find established business models in the mid & small cap space. If one knows the conversion rates, investors can be rewarded heavily. It is 40% of the companies in your portfolio that tend to have a CAGR of 15% over a 5-year period on an average.

We know that the mid & small cap funds have delivered returns, however, they are also a cause for concern as it was noted that 40% of companies in this bracket have delivered <0% returns on an average period of 5 years. They have burnt the investor’s portfolio.

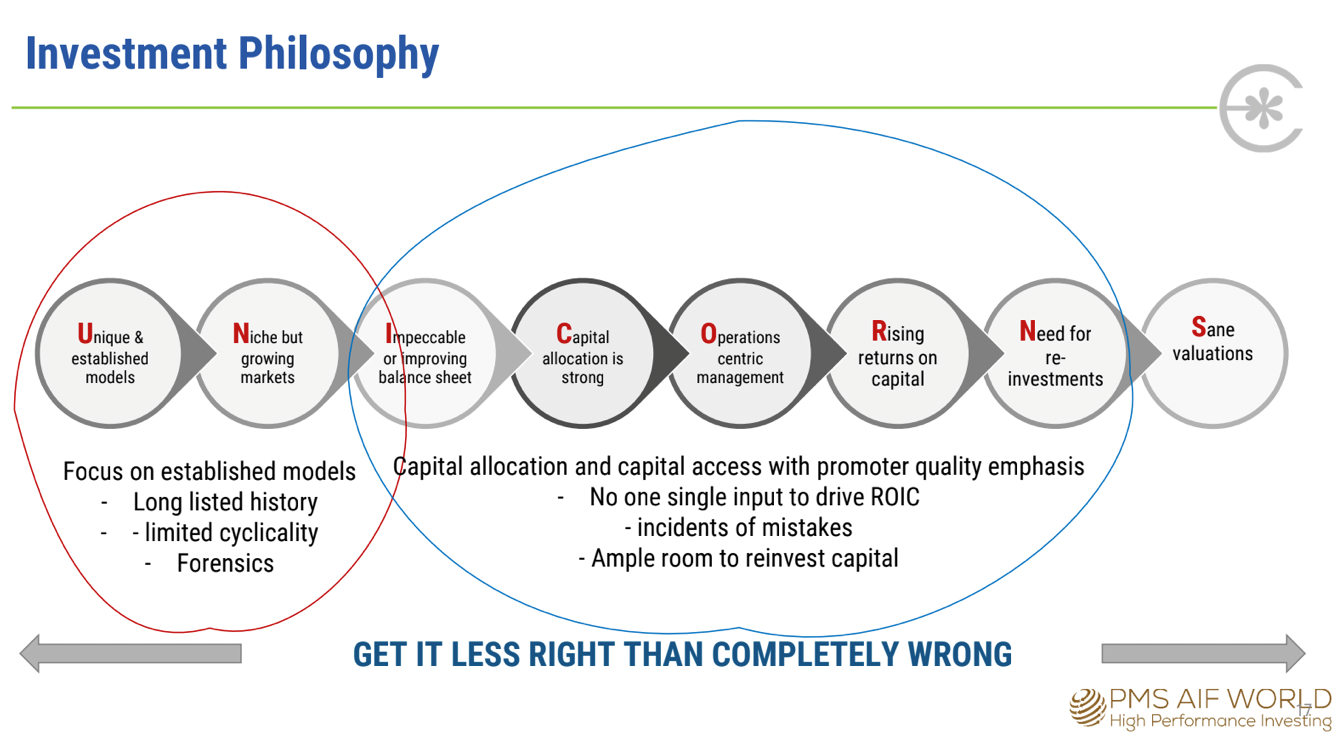

The aim of Edelweiss Focused Mid & Small Cap Portfolio, managed by is to invest in companies that have easy access to capital that can be reinvested for the growth of the company rather than buying competitors or entering a new business. Investors should not find companies with a flawless history because then there would be mistakes that are yet to happen. They should look for companies that have made mistakes and learnt from them.

The aim of Edelweiss Focused Mid & Small Cap Portfolio is to invest in companies that have easy access to capital that can be reinvested for the growth of the company rather than buying competitors or entering a new business. Investors should not find companies with a flawless history because then there would be mistakes that are yet to happen. They should look for companies that have made mistakes and learnt from them.

Robust processes and systems are placed to make sure behavioral biases or mistakes are not made. There should be a deep analysis of failures in the portfolio and also acknowledging correct attribution of drivers.

There is a two-fold way to outperformance— Take a call on the quality of the management and take a closer look at the financials. It is the captain that steers the ship to safety during a crisis and it is important to understand the capability of the CEO. Moreover, minimizing mistakes acts as a catalyst to a superior portfolio performance.

It is always safe to not have a view on the market because it is difficult to judge its trajectory. Mr. Utsav Mehta does not believe in holding stocks at any valuation or buying expensive stocks, but the pandemic has helped him learn a thing or two about the same. The key is to remain process oriented and be patient with equity investments, now, more than ever.

At Edelweiss AMC, the conviction to hold large-cap stocks in the portfolio is much higher than the small & mid-caps. However, the mid-caps have made tremendous returns for many investors over the last few years. There is fear that there is a bubble in high PE stocks as everyone is trying to take shelter under the same tree.

Furthermore, the definition of quality keeps evolving with each passing day. Jubilant Works is a stark example where the fast-food industry is growing faster than the GDP of the country. The recent turbulent times has resulted in the stock plunging by over 40% since the start of 2022. It’s the quality of management that has kept the ship sailing.

Edelweiss AMC believes that the hike in interest rates will lead to investors selling high PE stocks and 6 months later be in search of growth, completing a cycle. It’s the search for growth that tests the patience of several investors and fund managers. In a realistic world it is difficult to have and build that patience as these are just patterns and social constructs that we live by.

It should also be noted that a high ROCE company is less affected by a rise in interest rate rather than a lower ROCE company. Hence, it is not always good to look at high PE stocks from a bad angle when interest rates are rising. One should not look at the portfolio as large cap or mid cap oriented, but focus should remain on selecting the right fund manager and having faith in him/her.

Research continues to remain an integral part of investing at Edelweiss AMC— be it sector analysis or company background. Mr. Utsav Mehta’s team continues to do the groundwork in understanding the future of Jubilant Food works. They have set milestones for the company to achieve in the next three, six and nine months after which they can take a call.

A focused portfolio will show the light at the end of the tunnel as in the last 3 years India has witnessed an economic slowdown. Valuations are expensive, and the Edelweiss small and mid cap fund is open to accept fresh funds and certain sectors have already shown improvement to categorically rise in the ranks.

The market was speculative in nature around December 2021 and early January this year, but investors are advised to remain patient and continue having a time horizon of 3-4 years.

There is a lot of hope built into many companies but it is time to be smart about your money, says Mr. Utsav Mehta

The parting tip given by our guest speaker from Edelweiss AMC was to always account for what if you are wrong and keep some money aside for the same.

Understanding valuations is an on-going process and we continue to learn from the Western markets. Professional fund management answers a lot of questions and solves many a problem for investors. We, at PMS AIF WORLD, constantly strive to help investors build wealth by understanding their goals/needs & then connecting them with the best portfolio managers of the industry.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION