Date & Time: 08th September 2021, 05:30 PM – 06:30 PM IST

Speakers:

Ramesh Mantri, Director- Investments & Principal Officer- PMS, White Oak Capital Management

Ayush Abhijeet, Associate Director- Investments, White Oak Capital Management

Moderator: Sankalpo Pal-Biz. Development, PMS AIF WORLD

How to balance the portfolio with Nifty at 17k?

Delivering Alpha by balancing Growth & Valuations:

White Oak India Pioneers Equity Portfolio

Markets at 17k are making investors fearful, making it difficult for investors to decide whether to stay invested or liquidate a part of their portfolio. So, PMS AIF WORLD organised a webinar with portfolio managers that are well known to generate Alpha by balancing growth and value.

Ramesh Mantri, Director- Investments & Principal Officer- PMS, White Oak Capital Management, has over 17 years of experience as an analyst across sectors. Having founded Ashoka Capital Advisors, he also has the privilege of being a part of a two-member team at Alden Global Value Advisors, a US based hedge fund. He was also an analyst at Crisil and is a CFA Charterholder.

Ayush Abhijeet, Associate Director- Investments, White Oak Capital Management brings with him loads of experience along with being a part of Avendus Capital as an analyst. Prior to that, he worked at Deutsche Bank as an investment manager and also Credit Suisse. He holds a B.Tech degree from IIT Delhi and a PGDM from IIM-Ahmedabad.

It is difficult to deliver value when valuations are sky high and a poll right at the start of the webinar proved the same. ‘Nifty at 17k – Am I fearful or greedy?’ was the question put forth and 92% respondents claimed that it is fearful while 8% said greedy.

White Oak Capital Management was founded in June 2017 by Prashant Khemka and it now manages ₹40,000 crore in Indian equity assets. Moreover, 80% of the investments are foreign funds which make them the largest FPI in India.

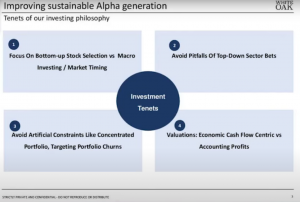

The four tenets of investing philosophy at White Oak Capital Management and creating the White Oak India Pioneer Equity Portfolio are as follows:

A Wall Street Journal report posted in 2019 showed that active managers in India continue to beat the benchmark indices and the persistence of managerial performance stood at 67%. It is one of the most compelling reasons to invest in emerging markets like India and generate Alpha. Experts and analysts have focused more on the macros and the global economy which is hard for anyone to predict. The last 10 years for the Indian equities have been no less than a roller coaster ride but wealth has been created for investors.

There is complete futility in predicting investment returns based on macroeconomic worries and events, says Mr. Ramesh Mantri

Macroeconomic tenets hardly influence returns from equity returns and no one has a crystal clear look into the future as to the course of action markets could take following a particular event.

Trying to understand the macro situation often leads to an investor timing the market which is yet again futile. An investor who remained fully invested from March 2020 till the end of that year, had 133 as his portfolio value on a base of 100 that was invested in March. However, a worried investor would have sold when the market fell by 40% and wants full exposure to the market when the rally is pretty evident. The latter investor has 100 as his portfolio value which proves that timing the market is difficult. It leads to the most important question of the webinar which is the relevance of Nifty at 17k.

‘Does it matter at all?’ is the question that Mr. Ramesh Mantri puts forth and explains that in the last 9 years markets have hit an all-time high 8 times.

In the last 21 years, the markets have hit an all-time high 70% of the time. Returns in the year post touching the high is 9% and 24.4% in 2 years post milestone. Corporate earnings have grown by more than 14% as the GDP declined at the start of this year. The earnings have beaten the estimates for 5 quarters on the trot. The earnings growth has been pegged at 34% this year and 50% for the next year. It will be the biggest growth since 2004.

India has done better than China over the last year as far as corporate earnings are concerned. Furthermore, the corporate deleveraging cycle is underway as gross debt growth has reduced significantly since 2013. Handling macro factors is an intricate process where the core belief is that the aggregate market is fairly valued at all times. A top-down approach is quite similar to a coin flip where there are equal possibilities of a right and a wrong. Staying fully invested at all times and entering businesses at attractive valuations is the key metric to build a sound portfolio. A balanced portfolio construction at all times and avoiding top-down philosophy is White Oak Capital Management’s approach to portfolio building.

Far more money has been lost by investors preparing for corrections or trying to anticipate corrections, than has been lost in corrections themselves – Peter Lynch

The above mentioned key metrics lead to a larger number of stocks for selection rather than closing them down with a macro approach. Alpha is consistently generated leading to top percentile performance of India dedicated fund managers. Lastly, it leads to prudent risk management where factor risks don’t overwhelm the portfolio. The zero sum game is duly followed when looking at the sector outlook. Data has shown that sector leadership has changed hands every year and it would be futile to take a call on any one of them. There was large hue and cry about the death of the IT industry from 2016-18 where major publishers rubbished the industry and the grim future of IT companies. Companies that had strong execution capabilities entered the portfolio at White Oak around the time of the crisis in late 2017. The relative valuations based on free cash flow metrics were in line with the market. Today, the sector is in the reckoning as it has a lot of potential. The portfolios constructed at White Oak are made in order to reduce risk to a single factor. A function of stock selection is alpha generations and consciously aim to avoid sector rotations calls or a top-down approach.

Performance is consistent by removing constraints like ‘concentrated portfolio’, ‘thresholds for portfolio churn’ and ‘buy and hold forever’. The constraints are nothing but a marketing gimmick which handcuffs performance. More the number of stocks, better is the alpha generated as India has a broad and heterogenous market. Higher inefficiencies in mid and small caps lead to a larger investible corpus for portfolio managers. A concentrated portfolio increases the role of luck in performance, just the way where lower number of coin tosses improves the chances of a favourable outcome. The role of skill is enhanced only in a diversified portfolio where the number of stocks chosen is larger than those in a concentrated portfolio.

All valuations are relative to the US 10 year yields that lead to alpha generation. It is crucial to have a logical framework to value businesses and merely looking at accounting multiples isn’t valuation.

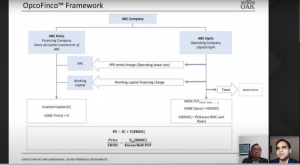

The OpcoFinco™ framework is followed at White Oak Capital Management

From September 2017 up until August 2021, White Oak has been successful in generating an average alpha of +217 bps including up and down markets. They have been able to outperform an up market 75% of the time and 80% of the time in a down market.

Sankalpo Pal, who takes care of Biz. Development at PMS AIF WORLD, highlighted the importance of category alpha where the portfolio performance is measured on a relative basis. The White Oak Indian Pioneer Equity portfolio has yielded an alpha of 3.5% on an average for the multi-cap segment and a relative alpha of 2.04% for the whole portfolio over the average alpha. A poll conducted by Sankalpo Pal during the webinar elucidated the fact that 40% of the respondents are in favour of a diversified portfolio whereas 16% have faith in a concentrated portfolio.

The IT companies are trading at all-time highs wherein a company employing large amounts of capital is reducing by the day as the demand for office space has reduced considerably. It makes the sector extremely efficient leading it to be categorised as Opco under the OpcoFinco™ framework. Here there are certain companies that are in line with the market or even trading at a discount. Great corporate governance structures along with extraordinary balance sheet numbers have led to the strong growth of the IT sector. On the other hand consumer packaged goods (CPG) industry employs zero capital due to negative working capital. For e.g., HUL and Nestle are companies whose fixed assets are also financed by a negative working capital which leads to their value being locked in the Opco side of the OpcoFinco™ framework.

Sankalpo Pal puts forth a tricky question about what are the benefits of a diversified portfolio as famous investors have long had a concentrated portfolio. Mr. Ramesh Mantri answers in a subtle line that concentrated portfolios are a marketing gimmick, just as mentioned earlier. Diversified portfolios are subject to more of skill and less of luck. A lot of value can be created if an investor takes up even a 1% share in listed companies in India that are diverse and heterogeneous in nature. Even small positions can generate significant amount of alpha.

A question was asked from the audience who was intrigued to know the difference between the bull run of 2000-07 and the current one that we are in. Yet again, Mr. Ramesh Mantri answers with a sense of pride that the Indian economy and the global economy have taken shape in a beautiful manner along these years. In a very miniscule manner, India was devoid of a mall in 2003 whereas there are innumerable malls today spread across the whole country. The sources of value creation and dynamics around the economy have changed a lot. The mix of companies and the kind of entrepreneurs in our country is marvellous.

A webinar could not be over without the view on current IPOs and the upcoming one’s that are coming in pricey and are small in terms of age. Mr. Ayush Abhijeet exclaims that the present value of future cash flows is at the heart of any valuation. Likewise, customer acquisition has been the main aim of upcoming companies that are trying to tap the public market. There are companies still trying to build a comparative advantage around their businesses and as investment managers they did need to be careful before taking an investment decision.

A lot has been stated about staying invested during market downturns and averaging out during the same time but investors are still in search of a particular behaviour pattern that they can follow when the markets are at an all-time high. Mr. Ramesh Mantri elucidates the importance of an individual’s strategic asset allocation and their risk appetite.

One must stay invested according to their financial plan, says Mr. Ramesh Mantri

Markets are very unpredictable in the short term and investors should remain very cautious. Furthermore, corporate profits in India are very concentrated where 80% of it comes from a few handful of companies. However, the broad based recovery in the last few quarters is testament that concentration is slightly shifting focus. Also current profits are poor indicators of future profits as the former’s consistency has a heavier weight. According to Mr. Ramesh Mantri, the IT services sector has been the best performing in the recent times where the top 5 companies contribute to 80% of the industries’ profits. However, White Oak India Pioneer Equity Portfolio has selected only 1 company to add to their portfolio as the smaller ones have shown potential. Focus has to shift to future winners as current winners may remain so for a long period of time.

Lastly, White Oak believes that achieving the target of $5 trillion is just a number as the importance should be more on the ingredients of good economic growth are achieved or not. The government reforms across sectors may help to achieve the target. The PLI scheme has touched early success with implementation in mobile phones and pharma industry. The global tailwind has also been in India’s favour where emerging as well as developed countries have shunned China. India is the anchor country to take the stride in her favour and also benefit from the PLI scheme.

Investors need to be true to their asset allocations and remain invested according to their financial plan. There will be potholes, once in a while, as we are very used to it but consistent alpha can be generated with a longer time horizon.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

At PMS AIF WORLD, all PMS AIF Products are listed with all possible information and data for investors to understand & compare these products from the lens of risks as well as returns.

A unique proprietary framework has been founded by PMS AIF WORLD whereby 3 important attributes i.e. Quality (Q), Risk(R), and Consistency(C) are presented for more than 150 portfolio management services by covering 9 factors like Standard deviation, Beta, Sharpe, Alpha, Consistency Ratio, and so on. Many investors as well as the industry are using this proprietary framework to learn, compare, and select the best PMS products in India.

Here is the link to Register and access our QRC Database.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION