Date & Time: 18th February 2022, 04:00 PM – 05:00 PM IST

Speaker: Madanagopal Ramu, Head – Equity & Fund Manager, Sundaram Alternates

Moderator: Kamal Manocha, Founder & CEO, PMS AIF WORLD

The current market situation in India looks uncertain as the pandemic has taken away a lot of jobs and the low base effect in the previous fiscal is yet to be overcome from a valuation’s perspective. Add to it the escalation of war in Ukraine, unusually high inflation, and the lingering impact of the pandemic – all pose risks to future global economic growth. It is therefore unsurprising that equities have seen an increase in volatility. We’re in an all-too-common situation where investors (and speculators) attempt to discern the correct price of these risks, creating heightened loss aversion for as long as the uncertainty exists. Is this time different?

These difficult times led us at PMS AIF WORLD, to host an Alternates summit where investors were left richer, happier, and wiser on knowledge terms and hopefully monetarily as our list of experts had a lot to share.

Our quest to gain & share knowledge does not limit us to confluences only, as we host insightful webinars every week. Our CEO, Mr. Kamal Manocha recently engaged himself in a conversation with Mr. Madanagopal Ramu, Head – Equity & Fund Manager, Sundaram Alternates. Mr. Ramu shed light on the future of small and mid cap stocks, the digital outlook, the manufacturing sector and the Indian economies’ growth potential down the line.

This blog entails insights into the new Sundaram ATLAS CAT III AIF Fund that will be launched and will have 4 themes at play with wealth creation potential in the coming 4 years.

Mr. Madanagopal Ramu has over 15 years of experience in the market, and the esteemed CA credential to his name combined with an MBA in Finance. The experience of our guest speaker has thrown light on some of the nuances that investors need to keep in mind with corrections around the corner in the Indian equity market.

The Indian economy is on a stronger footing as compared to the last 4-5 years; India also remains the only country to grow faster than the pre-pandemic times. Sectors like IT and Manufacturing are growing at a steady pace along with the Services sector chipping in with some crucial numbers. Sundaram Alternates believes that the economy is growing at 6% when adjusted for base and expects the same to be higher by a % in the next fiscal and the Sundaram AIF in question discounts the same.

Moreover, FDI inflows and tax collection numbers have risen substantially leading to a rise in infrastructure projects in the country. Private capex will also increase as urban consumption is expected to remain strong in the second half of the year. Increased urban consumption will double the capacity utilization numbers in various sectors and verticals. Furthermore, the IT sector jobs have increased with work from home opportunities galore within the same. With China taking a back seat, exports from India will bolster growth soon.

The current estimates for banking and manufacturing sectors are at their lowest trajectory level and they will dominate within the next 2 years and more. EFY23 and EFY24 earnings estimates are ₹ 850 and ₹ 950 respectively. The estimates are reachable as the low base effect has a huge role to play and this Sundaram AIF is structured on the belief that the market to bottom out from thereon.

Earnings will act as a light post or a guide to investors in the next 4-5 years, says Mr. Madanagopal Ramu

Strong earnings trajectory topped with excellent macro numbers are decisive indicators that will steer market numbers to better positions. A 13%-15% CAGR return over the next 2-3 years is achievable without taking too much risk.

The portfolio currently being handled at Sundaram Alternates is a concentrated one including just 15 stocks while the latest Sundaram ATLAS CAT III AIF will include 20 mid & small cap stocks in total. Small cap stocks under certain sectors are at high valuations that investors need to steer away from.

The nature of small deals in the IT sector has provided a major boost to small cap stocks than their market dominant players. For example, MindTree is growing sequentially Y-o-Y at 16% which leaves the premium to be paid for such a valuation, a key point to be noted. It should also be noted that the growth numbers in the sector are not different from the market leaders, however, some small stocks are trading at 60 times as well.

A few handful investors could turn the tide of small stocks in their favor by selling their ownership within a short span of time. Earnings trajectory, valuations and growth potential of small cap stocks need to be kept in mind to receive decent returns. Banking, consumer discretionary, IT and manufacturing will bring in a different flavor and enthusiasm in the market. Global inflation is driven majorly by the prices of metals and oil and with easing of inflation the prices are bound to come down within the next 6 months. Telecom industry, on the other hand, has reached a stage where prices have increased considerably in the last 2 years, but a repeat telecast of the same is out of the question.

The major theme played by Sundaram AIF is ‘4×4 Wealth Multiplier Effect’ wherein a certain category of companies are targeted rather than the whole sector. It aims to identify structural growth stories in the Indian context.

Investing in a company will only create value if there is sufficient alpha that is to be unearthed due to heavy performance underestimation of certain companies. Secondly, a lot of value is placed on the table where the moat of the business is ideal and sustainable, but management is not capable enough to drive the numbers. It is imperative to note that reasonable allocation in the Sundaram AIF portfolio to such undervalued companies will lead to alpha generation in a couple of years time.

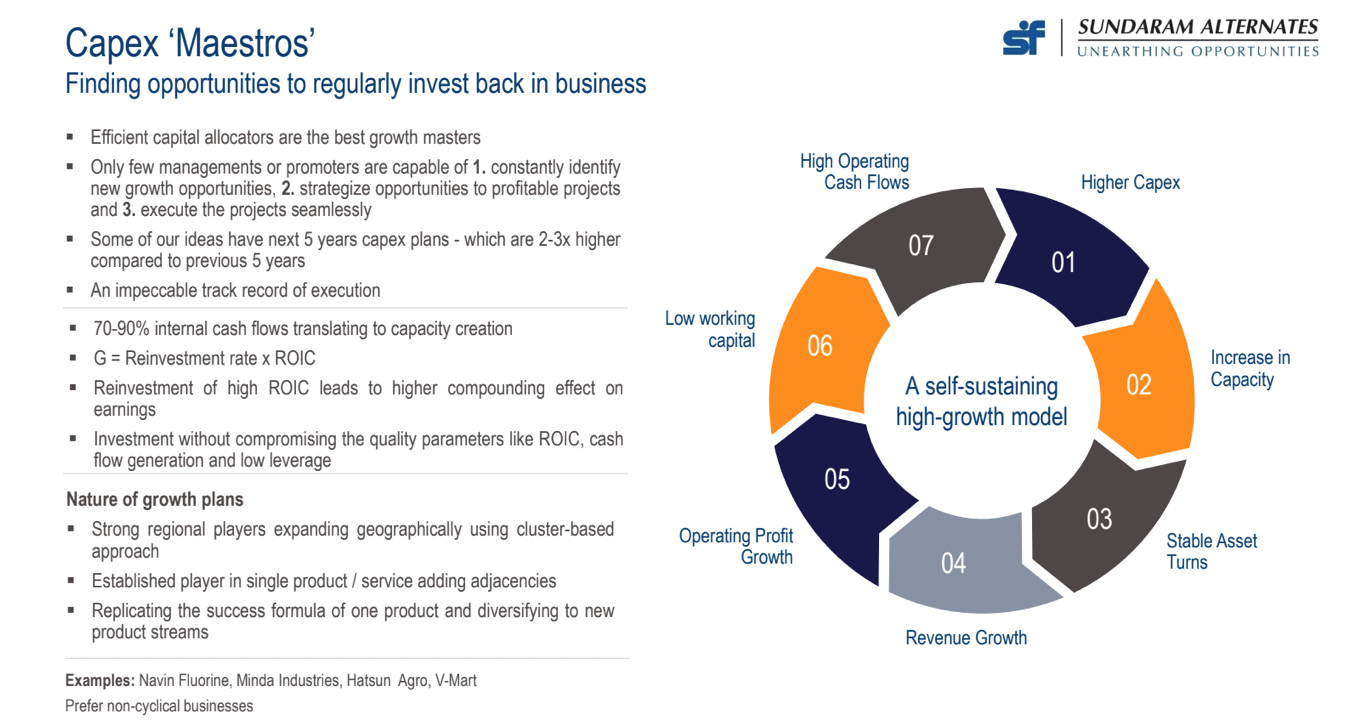

Under the theme as mentioned earlier, a few handfuls of companies are categorized as Capex ‘Maestros’ as they efficiently allocate capital within the business. They have an impeccable track record of performance with companies like Titan and DMart- expecting their store numbers to double in the next 5 years.

The promoters of such companies can constantly identify new growth opportunities and execute projects seamlessly. An important metric to evaluate such a company is to calculate its growth rate (g) as g = Reinvestment rate x ROIC.

Promoters have continuously reinvested their profits leading to a better reinvestment rate.

Navin Flourine, for instance, has identified opportunities in the specialty chemicals segment and diversified their business in the same direction. The ₹200cr internal accrual for Navin Flourine is poised to double within the next 2 years.

The metrics speak for themselves and hence it is crucial to identify such undervalued companies. The 5-year growth trajectory of a company could be gauged by the ROIC, capex plans and how they plan to reinvest the same in the next 5 years.

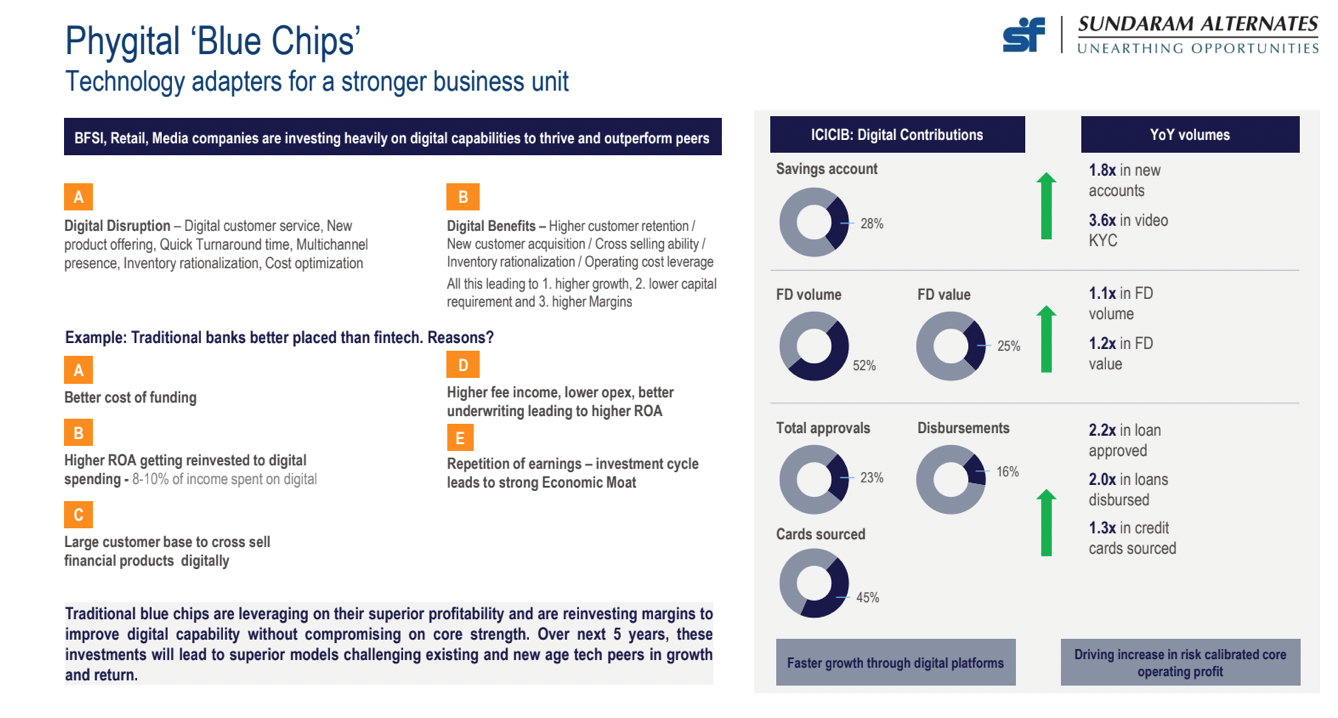

The current momentum on the digital side has led to the creation of a new theme in this Sundaram AIF. This theme is named ‘Phygital Blue Chips’. The banking sector has reduced costs by the offering of crucial services with the touch of a button. The throughput of a retail store also increases with increase in online sales. The digital story of India is unique and will be written down for the history books. ICICI Bank spends approximately 8% of its cost on the expansion of its digital services.

‘Blue Chip’ companies of each sector, especially private companies, have a lot of potential to expand soon. However, there are a few banks/companies that are outsourcing their digital space to the FinTech’s, but Sundaram Alternates have a special eye for those carrying out the expansion themselves. AU Small Finance Bank is a good example that invests 20 basis points in their digital expansion.

The higher listing price for PayTm was not justified as Mr. Madanagopal Ramu and his team believes that Bajaj Finance has a better moat. The latter can now expand into digital services as profits are steadily coming in and the credit book is already seasoned. A strong business model combined with room for digital expansion will reap a lot of benefits to investors in the long-term.

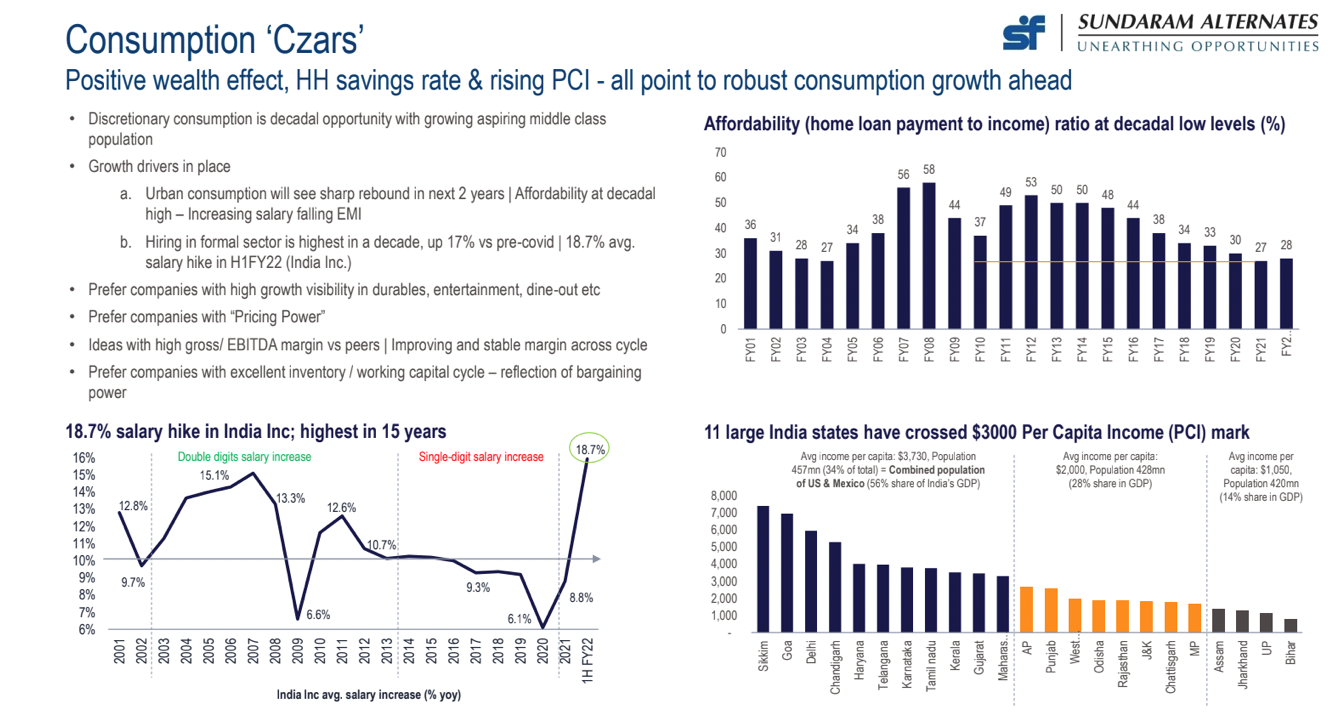

A third theme in Sundaram’s AIF portfolio plays around the consumption discretionary companies with Consumption ‘Czars’ being the category name. Marico, Dabur, Nestle and Britannia are companies with growth numbers in single digits but are trading at 60 times PE.

The growth estimate should be higher than 3% of the cost of capital to have a positive wealth effect. With inflation easing in the second half of the year, companies with the capability to have pricing power and retain the same will be able to grow significantly.

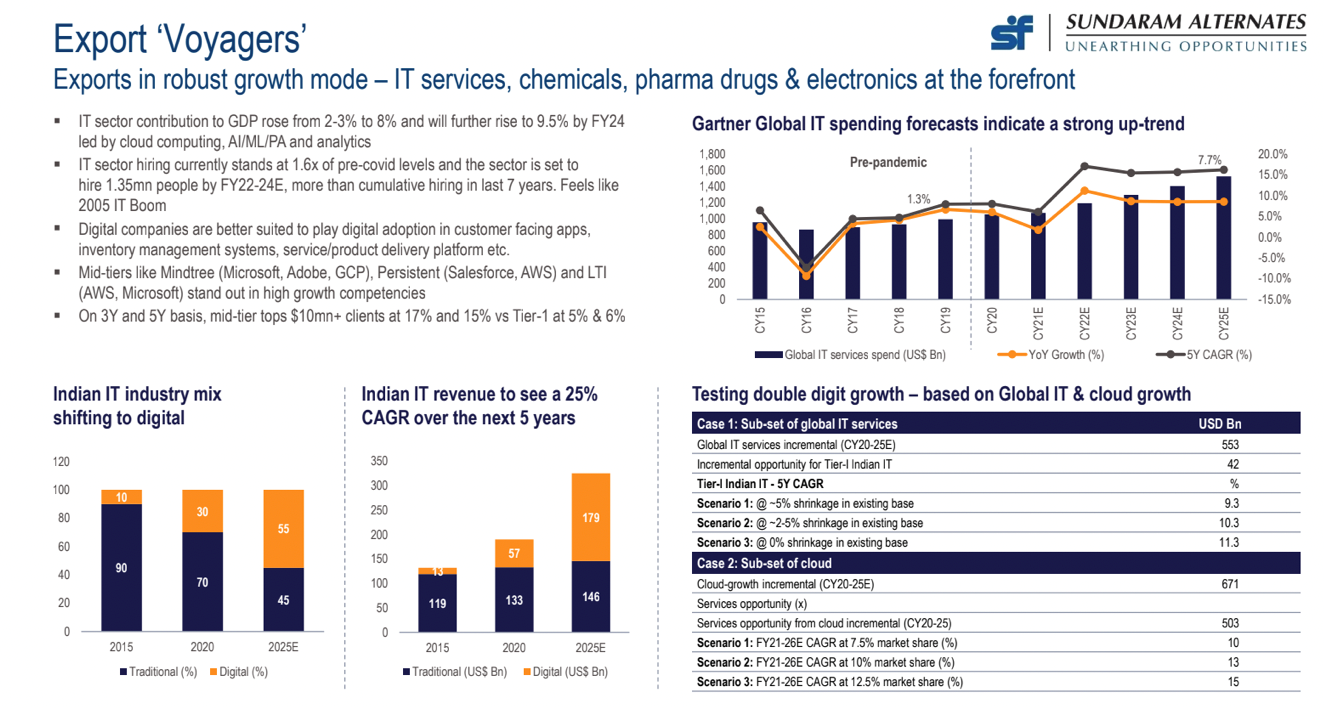

An 18.7% salary growth in India is the highest in the last 15 years urban consumption in top 100 cities across the country leaves a lot of growth opportunity for such consumer facing companies. Lastly, Export Voyagers is an export theme where the Indian IT industry mix is shifting to digital. As China has reached a stage where it is not adding onto its capacity utilization space, it leaves room for other players in the industry to expand.

Moving on to the 4th theme laid out in Sundaram’s AIF, which is Export ‘Voyagers’, a KPMG report established that India ranks decently on the primary cost of doing business with parameters like hourly compensation costs, real estate costs and utility cost rates favorable. Exports in the country are benefiting from the macro context that is being played in India’s favor. Global climate change agreements are also helpful as leaders like China and the US are reaching their maximum capacity.

The insightful and detailed presentation on Sundaram AIF was followed by a very pertinent question from Mr. Kamal Manocha, Founder & CEO, PMS AIF WORLD, that some growth stories like Titan and Avenue Supermarts have a PE multiple that is way higher than the industry average and hence investment in the same is questionable to quite a certain extent. Mr. Madanagopal Ramu stated that not only growth but growth at a price is the way to move forward.

The growth story of Nykaa and Zomato is in contrast as their valuations were stretched as too much money was chasing far less unlocked ‘value’. The margin of safety was too low and the profitability per customer will have to be realigned with the passage of time. With a fulfillment cost of 6%, Avenue Supermart is the only retail player that has such strong numbers and hence the valuations follow.

FMCG companies are known to deliver growth to consumers as well as investors, but they remain in single digits and are out of question at Sundaram Alternates. A lot of study has gone into metrics that allow wealth to grow at a steady pace such as rentals and lease agreements are removed from EBITDA and then arrived at EV/EBITDA multiple. Investors are advised to wait for some correction to take place before entering stocks like Avenue Supermarts.

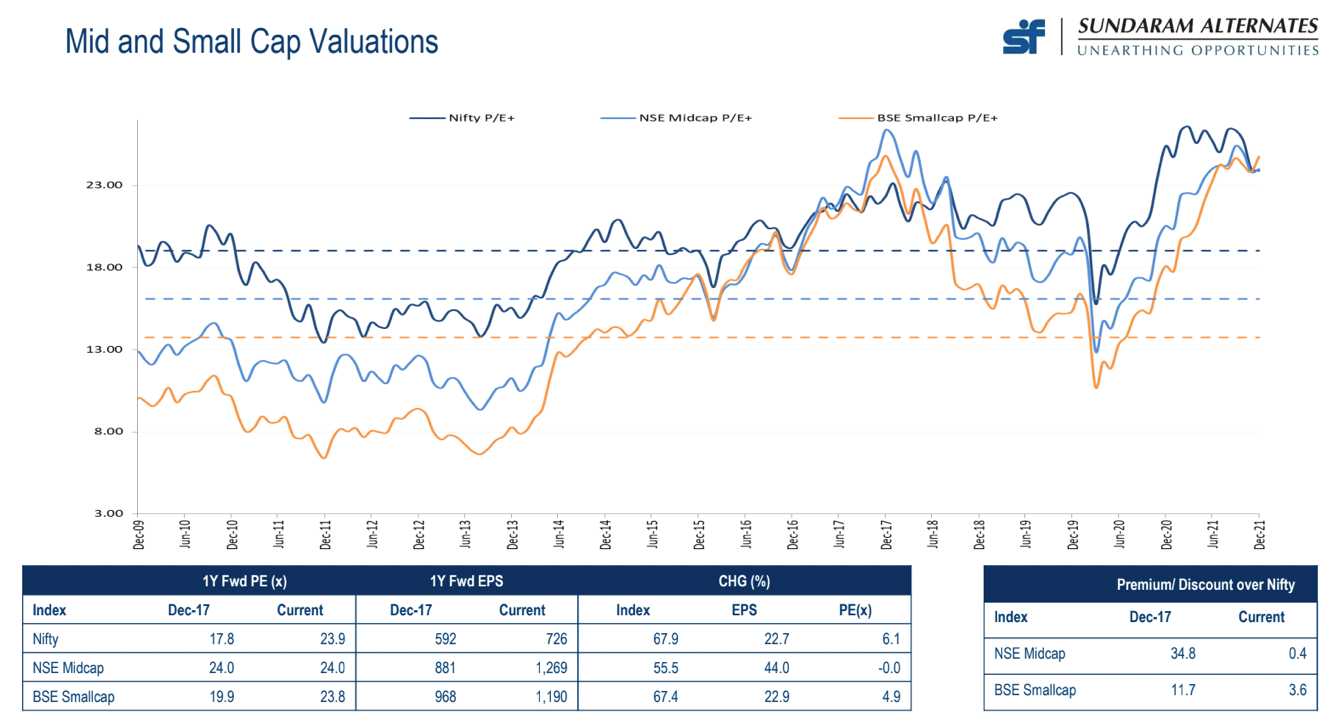

IT is not an option today, but one must adopt it sooner or later. With that context in mind, Sundaram Alternates believes that the prices of small cap stocks will be affected by a small volume of investment which has caused various investors to steer clear from several companies. A mid vs small cap valuation chart shows the liquidity chasing in the market.

The chart above shows that the small-cap stocks were better placed than mid-cap stocks from 2010-2017. The global story of China ban has helped the domestic players significantly with small cap stocks coming into the picture recently. However, they are still very pricey with just decent growth numbers.

The current valuations for the small cap stocks do not make for an ideal investment recipe but waiting for a significant correction is the best solution at this point of time.

Find a midway between earnings-growth potential and PE multiple to make an ideal investment

Real Estate is one such sector where the companies associated with building materials did not deliver results prior to the pandemic. Additionally, India’s real estate story was in a pothole during the same time. Too much debt in the books has led to Sundaram Alternates not including the same in their AIF portfolio.

Dearth of data to show significant growth in the real estate sector combined with the lack of credit in the market has dealt a serious blow to the same. Hence, only a few players in the cement business and pipe manufacturers are present in the portfolio while the rest have been avoided.

With the rise in commercial real estate properties, the returns for investors will rise steadily. There is ample room for improvement, but all expectations and decent numbers do not sound good for an investment.

The framework currently kept in mind is of a lower inflation level in the coming few years as the expansion of the global supply chain management system and the advent of the digital sector will lay the foundation stone of an efficient portfolio.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION