Investors have termed phases in equity markets as “bull and bear”, depending on whether equities are collectively appreciating or depreciating in value. A bull market is associated with persistently rising share prices, whereas a bear market denotes periods of decline in stock prices, typically 20% or more.

The fluctuations in the state of an economy from expansion to contraction are considered an economic cycle. Typically, it is measured with a country’s Gross Domestic Product (GDP). Still, other factors, such as employment rates, consumer spending, and interest rates, are also used in determining the stage of the economic cycle. The interest rate cycle directly impacts capital markets since businesses are more sensitive to changes in rates than other factors. Bull markets generally coincide with periods of robust economic growth, and the bear market with an economic downturn, but timing the cycles consistently is a fallacy.

Interest rates impact the value of future cash flows of businesses which is the driver of valuations of any business, so during rate hikes, it is better for the portfolio to be skewed towards value-oriented stocks rather than growth since most of the value for high-growth companies is concentrated in terminal value and a higher interest rate increases the discount rate reducing the company’s terminal value.

A company’s competitive dynamics and barriers to entry influence its’s valuation and sensitivity to changes in interest rates over time. Cyclical sectors have historically had a higher correlation with the economic cycle in contrast to defensive sectors. So, during periods of expansion, portfolios should consist of cyclicals and, during a slowdown in the global economy, inclined towards defensives.

Diversification across market capitalisation is notably in favour of protecting from volatility as the trend points in favour of Large-caps during rate hikes or economic downturns, or uncertainties globally.

As mentioned above, portfolios can be managed as per themes with Growth Vs Value, Cyclicals Vs Defensives, and across market capitalisation depending on the phase in the interest rate cycle. Still, diversification through asset allocations is crucial instead of just focusing on a purely mechanical relationship between shifting interest rates and stock valuations. It is ideal for holding a higher allocation to equities during the bull phase and optimal allocation during the bear phase.

Portfolio management begins with a series of observations about the behaviour of different asset types throughout previous cycles. Analysing the historical range of returns for Gold, bonds, and stocks over holding periods ranging from 1 to 15 years, we have noticed that asset classes with the potential for higher returns experience a wider distribution of outcomes and require long periods to mitigate the risk of loss. Uncertainties, crises, and pullbacks are inevitable and unpredictable in their timing, but through portfolio management over time, outcomes will be desirable.

Gold is globally considered a safe haven, so investors start investing in it when there is uncertainty in the economy and when the outlook turns bearish for equity markets.

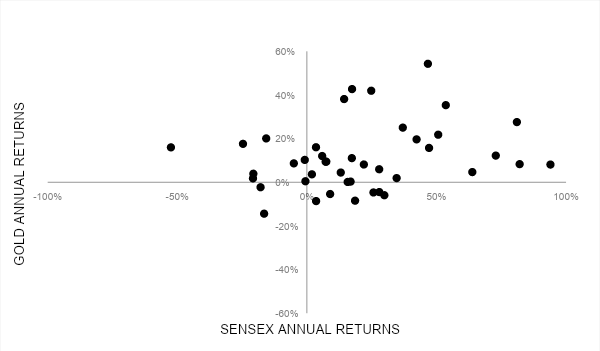

In Exhibit 1, we, at Right Horizons, have conducted a study on returns between gold and Sensex and have dissected the results into four quadrants, the first quadrant, Equity UP & Gold UP, implying returns were both positive during the year; the second one, Equity Down & Gold Up representing the returns were negative for equities whereas positive for gold, the third quadrant, Equity Down & Gold Down and the fourth Equity Up & Gold Down.

Drawing conclusions from the second and fourth quadrants, the plots highlighted in red imply that we can utilise the lower correlation between asset classes to improve the performance of portfolios during volatility in equity markets.

Exhibit 1: Sensex & Gold Returns

NOTE: Gold prices considered were averages for the years

NOTE: Gold prices considered were averages for the years

Source: Ace-Equity & Bankbazaar

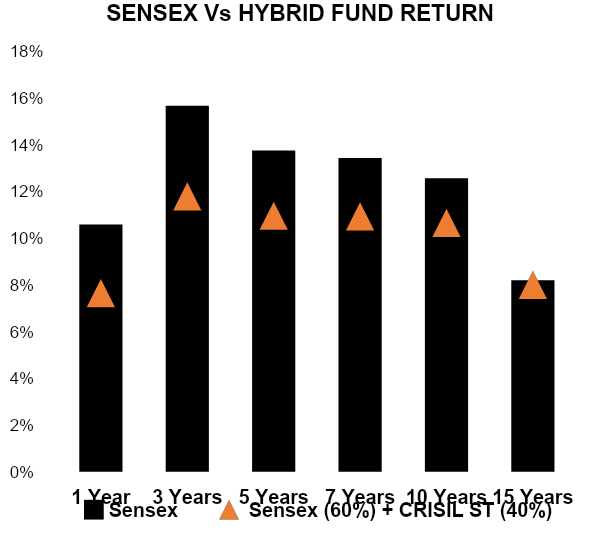

Exhibit 2(A) & 2(B): Index & Hybrid Fund Return & Volatility

From Exhibit 2(A&B), investors can see that even a vanilla Hybrid fund can mitigate volatility and maximise return. The reason is that asset classes barring a few exceptions are influenced abnormally by macroeconomic events.

From Exhibit 2(A&B), investors can see that even a vanilla Hybrid fund can mitigate volatility and maximise return. The reason is that asset classes barring a few exceptions are influenced abnormally by macroeconomic events.

Investors are exposed to unwarranted risk if investors misallocate the proportion of capital towards assets. For illustration, if an investor were to invest 100 per cent of the capital in equity would be exposed to undue volatility. However, optimal asset allocation will integrate capital market expectations with the investor’s desired level of risk and constraints, focusing on the long-term to compound wealth. Allocation is based on the quantifiable systemic risk of each asset class to generate maximum returns for the risk an investor can take on. In other words, investors must factor in the risks that can be tolerated and allocate capital in proportion to the desired level of risk.

In March 2020, prior to the announcement of the lockdown due to the Covid-19 pandemic, our valuation models signalled prices higher than historical averages, so to de-risk our flagship scheme Right Horizons Flexicap, we added gold and defensives like pharma due to lower valuation. Later the markets declined up to thirty-eight per cent, and as the markets turned bullish, the scheme significantly outperformed relative to the benchmark.

Post covid and the ongoing Russia-Ukraine war led to inflation spiking across economies. To control the raging inflation, most Central banks of major economies around the globe raised interest rates in unison, impacting the equity markets unfavourably. Unlike previous events, asset classes were affected differently this time. In response, we diversified across sub-asset categories focusing on sensitive sectors and positively impacted by raising interest rate scenarios. Investors can manage portfolios across market cycles through allocation across asset classes as per the desired level of risk and skew in favour of assets when outperformance is certain during a bull rally and vice versa.

Rather than being encapsulated with returns focusing on risk-adjusted returns, mitigating risks by managing portfolios through diversifying during weak productivity and market congestion at the bottom of the economy and maintaining a concentrated portfolio with themes benefiting during the upscale will lead to outperformance. Portfolios constructed by a Top-down approach for the sector with tailwinds and a bottoms-up approach for picking stocks are necessary to manage across cycles.