Date & Time: 06th May 2022 | 04:00 PM IST

Speaker: Mr. Aniruddha Sarkar, CIO & Fund Manager, Quest Investment Advisors

Moderator: Kamal Manocha, Founder & CEO, PMS AIF WORLD

Mr. Kamal Manocha, Founder and CEO of PMS AIF WORLD held an engaging webinar in conversation with Mr. Aniruddha Sarkar, CIO & Fund Manager, Quest Investment Advisors where they discussed the importance of sector rotation & how it helps generate Alpha.

About PMS AIF WORLD

PMS AIF WORLD is a knowledge-driven, New Age Investment Services Company, providing analytics-backed quality investing service with an endeavor and promise of wealth creation and prosperity. We offer the finest PMS & AIF selection process after analyzing the products across 5 Ps – People, Philosophy, Performance, Portfolio, and Price, with an endeavor to ascertain the Quality, Risk, and Consistency (QRC) attributes that covers 9 ratios. We do such a detailed portfolio analysis before offering the same to investors.

We are a responsible and long-term investment service provider in the space of Alternates.

Invest through us in the best quality products and make informed investment decisions.

Speaker Profile

Mr. Aniruddha Sarkar is the CIO and Portfolio Manager at Quest Investment Advisors since Feb ‘20. He has over 15 years of experience in the capital markets with diverse role managing money for investors across PMS, AIF and Advisory business. He holds a Bachelor’s degree in Commerce and an MBA in Finance.

He is passionate about identifying sectors and generating alpha for investors. He dives deeper into the sector rotation strategy with this webinar and sheds light on how investors can take control of their portfolio in trying times like these.

Webinar Overview

The outlook for the current market scenario thrives on ‘events’ and ‘earnings’, where the former has played a dominant role over the last 6 months. The macro environment remains precarious as the exorbitant returns made post the pandemic have started to decline and average out. The RBI’s rate hike and the surging inflation will definitely lead to flattish returns in the near future.

The team at Quest Investment Advisors believes that it is at the hands of the Portfolio Manager to find companies that builds a portfolio for investors that have incremental cash flows. The webinar was focused on discussing the philosophy behind Quest’s new AIF- Quest Smart Alpha- Sector Rotation Fund- Category III AIF.

Quest Investment Advisors offers 2 PMSs- Quest Flagship PMS & Quest Multi PMS; the performances for which is as below:

Furthermore, it is time to remain invested and ride the journey to the next bull cycle to generate alpha. The base effect will lead to the inflation cooling off in around January’23 and expectations around the Russian war might be positive around the same time.

The improvements in earnings and margins will lead to a question about where to invest

The near future depends on what you buy and not ‘IF’ you buy, where sector selection and companies to select within a sector comes into play. It is important to enter a particular sector, make returns and leave it at the right time.

The last 18 months are proof that sector rotation plays a key role in the wealth accumulation process.

Economic cycles are inevitable so are the earnings and the valuations cycle. The idea is to select companies at the bottom of the valuations cycle and exit when they have gone all along to the top. Moreover, the duration of the valuation cycle has decreased significantly over the past few months. Excess liquidity and first-time investors entering the market are the reasons behind the decrease.

Economic cycles are inevitable so are the earnings and the valuations cycle. The idea is to select companies at the bottom of the valuations cycle and exit when they have gone all along to the top. Moreover, the duration of the valuation cycle has decreased significantly over the past few months. Excess liquidity and first-time investors entering the market are the reasons behind the decrease.

The team at Quest Investment Advisors believe that every bull run has a different market leader from the point of view of sectors, as cyclicals and technology dominated sectors, post pandemic, led, which were laggards prior to it. The CAGR returns for all sectors except real estate over the last 16 years stands anywhere between 6-18%. However, individual performance in a particular year has showed a huge dispersion from the mean. The same is evident when returns are calculated based on market cap of all companies in the index. Hence, it is important to have a multi-cap portfolio strategy most of the times.

Sectoral returns are highly volatile making it important to rotate your sectoral investments. Quest Investment Advisors were overweight on the real estate sector over the last 2 years, and it has been to their advantage as it beat the real estate index and the Sensex as well. Improvement in affordability in housing, low interest rates and consolidation in the industry have proved beneficial.

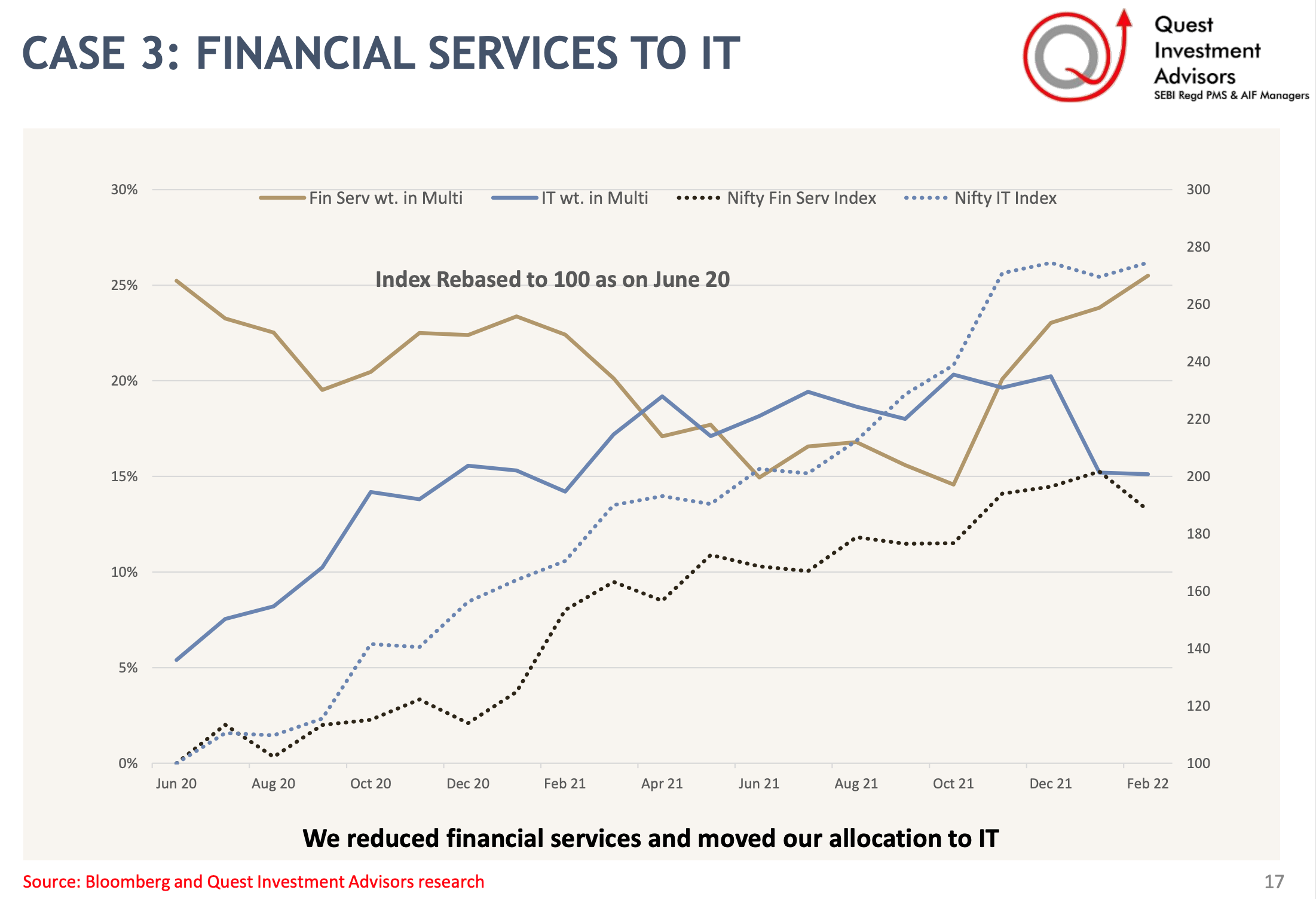

The ancillaries to the real estate sector, known as home and home improvements, also received a massive boost because of the above. Furthermore, they switched from financial services to IT in early 2020 and the strategy has yet again proved beneficial for Quest. The deals won, earnings picking up along with margins left a lot of room in the IT sector to generate alpha.

However, in the last few months, the above strategy has been reversed and at Quest Investment Advisors, they have added more of the financials in the portfolio. The important parameters kept in mind before carrying out sector rotation were different for each sector. For example, increasing penetration, commodity inflation, interest rates and credit availability were important towards consumer discretionary sector. The parameters are a mix of numbers and subjective outlook of each sector before taking a particular stand.

It should also be noted that companies within a sector do not move at the same time, making company rotation even more important. Mr. Aniruddha Sarkar suggests staying away from the crowd and it is good to have a contrarian strategy at times. For e.g., Quest exited Maruti and entered Tata Motors DVR in August’20.

The huge outperformance in a 12-month period shows that company rotation is of equal importance. The valuations of certain stocks tend to peak as everyone continues to buy it and the investment turns out to be risky.

The conversation then moved ahead with the whole agriculture sector in mind which is a major theme that will play out in the next 1-2 years. The price hike in rice, pulses and wheat will turn to give higher earnings growth for the whole sector. The sub-sectors will not be far behind with agri chemicals, agri equipment makers and FMCG companies that benefit from the sector will not be far behind.

Mr. Aniruddha Sarkar believes that domestic manufacturing will also start giving dividends within the next 18-24 months as many PLI schemes have been announced for the same. He further claims that some sort of returns have been made till now and it does not take much time for stock to go from cheap to expensive. Auto ancillaries, defense and chemicals will reap sufficient alpha for investors in the near term.

Lastly, he remains bullish on the real estate sector as buyers will look to purchase homes before the interest rates reach a peak. The income growth trending upwards and ease of affordability declining will add fuel to the demand leading to wealth creation for investors.

India’s growth story will take a massive hit with the Russian war lasting longer than expected, as inflation can only be tamed to a certain extent by RBI. Infra and the real estate sector will bite the dust as a ripple effect in the economy. The IT sector will continue to see strong earnings growth over the next 4-6 quarters but the relationship between the stocks and earnings performance is crucial.

You need to be out of sectors when the valuations are expensive, says Mr. Aniruddha Sarkar

It is just a valuation correction that is underway for stocks like HDFC and Infosys because they have met the expectations fairly, so to say. The large amount of FII exits happening in the former, the price has plunged drastically despite a bright outlook. The valuation correction and risk-reward ratio has made it bearable to add HDFC to the portfolio of Quest Investment Advisors.

The competition from electric vehicles has left little room in the auto sector and the domestic players to perform well. Quest Investment Advisors, as a fund house, remains bullish on Tata Motors and Mahindra & Mahindra, along with a slight bent towards Hero MotoCorp as well. Tata Power has reduced debt to quite an extent, it has 30% solar energy in use and its electric vehicle charging ecosystem has been a gamechanger and hence, an addition to the portfolio.

The sector rotation strategy in Quest Investment Advisors’ new AIF- Quest Smart Alpha- Sector Rotation Fund- Category III AIF. will deploy finds to exploit a couple of themes in agri, real estate and domestic manufacturing. Financials will also be a small part of the big scheme of things as it is ideal to have 4 sectors in the rotation strategy,

The portfolio will comprise of 5 stocks per sector leading to 15-20 stocks at any given point of time. Extreme weakness in the near-term future might see the fund keeping 50% cash while the active vs passive managing of funds will be keenly looked into. The contrarian views might lead to conflicts, but it is only possible that a 5th theme takes the place of one of themes already in play in the portfolio.

The right sector rotation policy has helped Quest Investment Advisors beat the index in the last 2 years as it is not ideal to have a 6-month horizon when entering the equity markets. It is an ideal time to invest money in a PMS, mutual fund or direct equity and allocate fresh funds if possible.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION