Date & Time: 26th March 2021, 05:30 PM – 06:30 PM IST

Speakers: Aniruddha Sarkar, CIO & Portfolio Manager, Quest Investment Advisors

Moderator: Kamal Manocha – Chief Strategist, PMS AIF WORLD

Transformation of Market Trend

The market is showing a transformation of trend from growth at any price to growth at a reasonable price. This implies that markets are no more polarized, and opportunities belong to broader markets. Since a few years, investing in Growth at Any Price has become popular and investors learned an easy way to make money investing in ‘Consistent Compounders.’ But this style of investing is showing relative Under – Performance recently, and traditional methods like Growth at Reasonable Price or Value Investing have been showing Out – Performance. It doesn’t matter what is right or wrong, but it’s important to understand, which style of investing is relevant in which market trend and how to strike a right balance between these styles to generate best performance at a portfolio level.

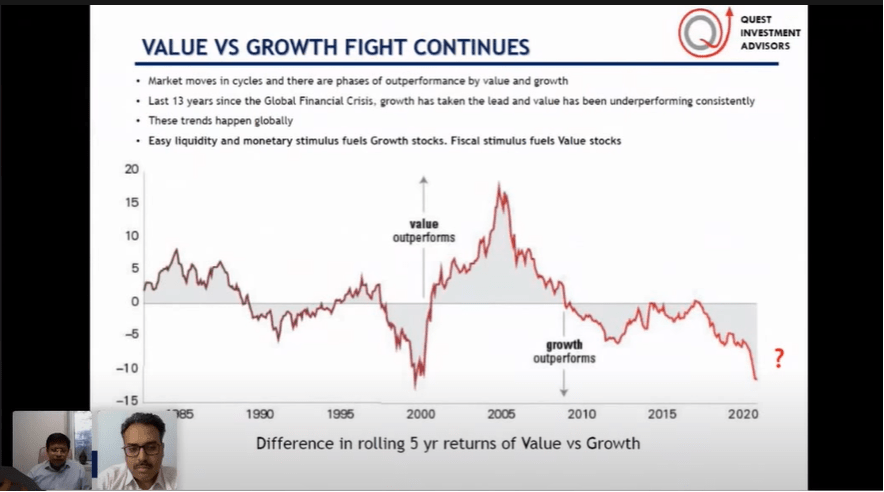

Mr. Aniruddha Sarkar, CIO & Portfolio Manager, Quest Investment Advisors has been in the industry since more than 15 years. As per him, if one studies the history of the markets for last 35-40 years, there have been market cycles, where growth style has done well and cycles where the value style has overpowered. The last decade favoured only Growth Style of investing. The way the global & domestic economy stand today, it will be naïve to stay fixated on one strategy; hence flexibility is required and thus comes the question of maintaining the right balance.

One of the reasons why growth has worked in the past years is because GDP numbers were on downwards, and investors were only comfortable investing in companies that were showing rise in earnings and figured out that the patterns of earnings for these companies are likely to remain so for many years, given their competitive edge. Thus, investing in such companies came at the cost of buying them at 4-5 times premium on the earnings growth, which implied ‘Buying at any price.’

Now, as the economy is showing signs of recovery and revival, and valuation of front end markets look expensive, investors want to look at broader markets and so ‘Buying at a reasonable price’ resonates better as it pertains to the idea of picking up growing companies at a good price that enable an investor to build his/her ‘margin of safety’ as well.

The above chart basically represents 5-year rolling return of the value phase of the market v/s the growth phase of the market. We can observe that in the post 2008 period, growth has outperformed value and all cyclicals such as metals, commodities, infrastructure, etc underperformed relative to companies that fall in consumption, IT, e-commerce etc.

The recency bias today has made most investors invest in growth at any price than waiting for markets to give them a reasonable price to invest in. However, what needs to be understood by most investors is that, whenever there is a liquidity/monetary stimulus in the economy (local or global), consumption is given a push and hence the growth stocks soar. On the other hand, whenever there is a fiscal push, which shifts the government’s focus on building infra, increasing capex, etc, leads to rise in value stocks. 2020-21 has been a very good example, reflecting that the infusion of trillions of USD in the global economy has led to growth stocks outperforming the value stocks by a large percentage.

But what lies ahead?

Mr. Aniruddha Sarkar believes that post pandemic, most governments will focus on building infrastructure. Locally, the Indian Budget is a good example which shows the govt.’s intentions of massive increase in private + public capex.

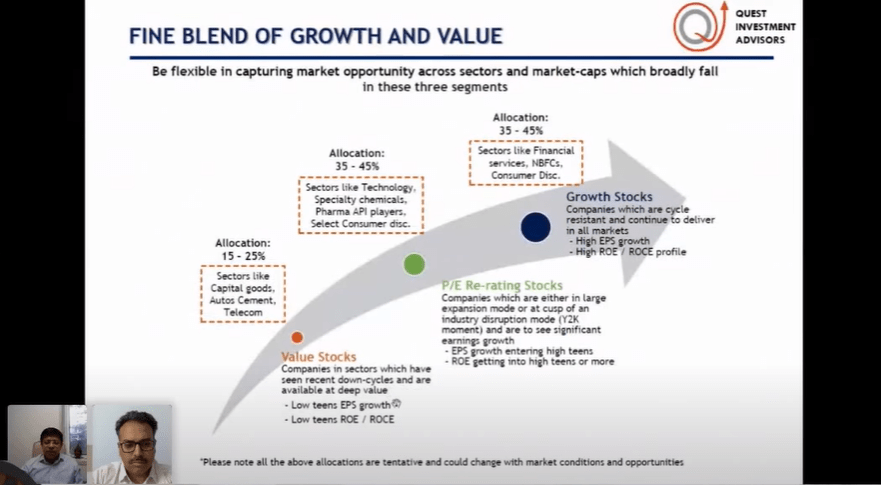

But do remember, it does not take long for a value stock to become a value trap. Hence, it is important to look for growth opportunities within the value part of the market. Talking about wealth creation that every investor is ultimately looking for, the biggest alpha can be generated from PE expansion, and the biggest PE expansion is only possible when one is able to buy something cheap that shows growth in the longer run, with in-built value in it. This transition of value to growth via PE expansion is explained by the below infographic.

So, The right switch at the right time can help generate alpha for wealth creation.

To make money in the markets, foremost is to know when to enter, then is to know the percentage of allocation towards each sector/company, and third is to know when to exit. Most of us are experts at entering the markets at the click of a ‘buy’ button; what we can’t fathom is the capital allocation/exposure and the exit time. This is where lies the differentiation that Mr. Aniruddha Sarkar brings to the table. He says that the percentage allocation in a particular stock shows the fund manager’s conviction on that particular bet. As for a promotor, capital allocation decides the future of his business, similarly, for a portfolio manager, or an investor, investment allocation decision determines the portfolio’s future.

And, if one is fixated to one approach, one ends up as a loser, as markets are dynamic, and for such portfolio managers, it becomes difficult to run on a road that most don’t even walk on. For instance, he mentions, in mid-2020 he picked SBI & Tata Motors. The question that most investors asked him then was why SBI and why not HDFC Bank, and why Tata Motors and why not Maruti. Come forward 8-9 months today, the performance that SBI & Tata Motors have shown compared to its peers is evidence of identifying potential outliers by striking a right balance in the portfolio and not staying fixated to a particular style of investing in all phases of markets.

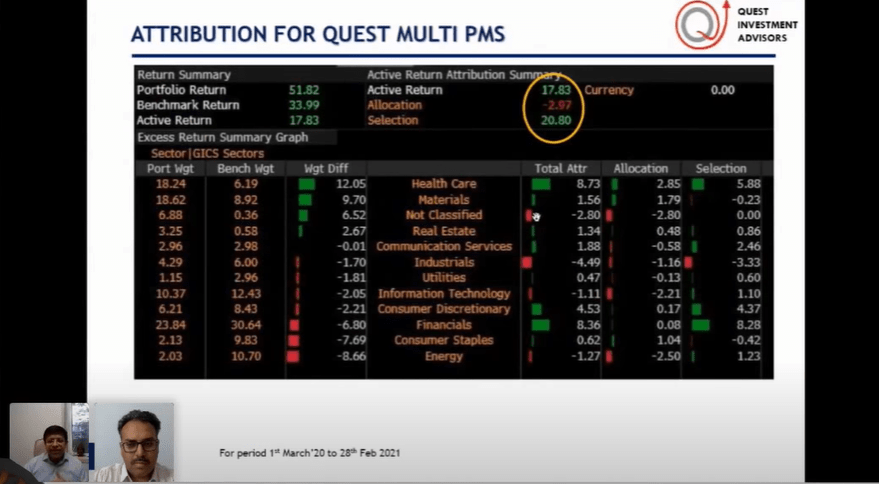

On the exit front, Mr. Aniruddha Sarkar mentioned that his portfolio had exited Bajaj Finance at the peak, when its valuation was really expensive – was trading at almost 8 times BV and then again entered the same stock months later, when it was at a reasonable valuation, being cushioned by the margin of safety. Just by exiting and entering this stock at the correct time, alpha of the portfolio increased by a good mark. Hence, agility and flexibility over a fixated approach has its own importance in markets as we are living in world which are dynamic and markets where front end growth stocks are expensive. The below data on Performance Attribution of Quest Multicap PMS is an evidence in itself.

There were some sectors on which the Quest Multi PMS was overweight than the benchmark index and some on which it was underweight. It can be observed that most of such allocation has helped generate alpha in the longer run. For instance, look at Financials’ exposure in the benchmark. It is around 31% whereas the Quest Multicap PMS portfolios exposure was about 24% and by being underweight, has given one of the largest alphas to this Portfolio. It is important to note here that 8.36% return from financials has come by not allocating more than index, but allocating less than index, but, within that picking those stocks which qualified, ‘growth a reasonable price ’ and being overweight on them. So to say, underweight on financials as a sector, but within the sector, overweight on SBI and underweight on HDFC Bank for example.

Talking about where the markets are headed, as mentioned earlier, he said that he is overweight on those sectors that will get a push because of the incoming fiscal stimulus. In fact, even within the Banking & Financial Sector, 80% of his exposure is in the cyclical side of the banks and not on the growth side. This shift was done a couple of months back, knowing that growth has done its job and it’s time to switch, in their perception.

The constant capex push, the $5 trillion economy vision, incentives for export-oriented businesses – all these factors will favour cyclicals in the coming 4-5 years. This does not mean growth will not perform; growth will also make money but cyclicals will outperform them in the coming years.

At the current juncture, Mr. Aniruddha Sarkar’s portfolio constitutes of about 60-70% of cyclicals as compared to 30% cyclicals 8 months back. This is what is meant by agility and flexibility of portfolio manager versus fixated approach.

To conclude, for continued alpha in the current state of stock markets, it is important to identify the growth outliers in the value part of the market i.e. growth at reasonable price. And, follow a flexible approach, so that one can transition once portfolio in line with change in market trend and state of economy.

RISK DISCLAIMER: Investments are subject to market-related risks. This write-up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION