WHITE OAK India Pioneers Equity

A portfolio of selected companies, agnostic to benchmark with a focus in stock selection on ensuring alpha generation.

White Oak Capital Management is one of the biggest India-focused long-only boutique Investment managers, founded in 2017 by Mr. Prashant Khemkha who has a long track record with Goldman Sachs Asset Management for managing money in Indian and Emerging markets.

White Oak manages close to USD 2.7 billion in Indian Equities. Its Clientele includes sovereign wealth funds, institutional mandates, family offices, and HNI Clients. White Oak India Pioneers Equity Portfolio is its premier offering under the PMS structure. It’s a portfolio of select companies, agnostic to benchmark with a focus in stock selection on ensuring alpha generation. It aims to consciously avoid market timing or sector rotation or other such top-down bets. Additionally, it understands, monitors, and aims to contain residual factor risks that are by-products of stock selection.

Login to Our Analytics Portal

Database of detailed QRC (Quality, Risk and Consistency) Analysis of 100+ PMS Strategies

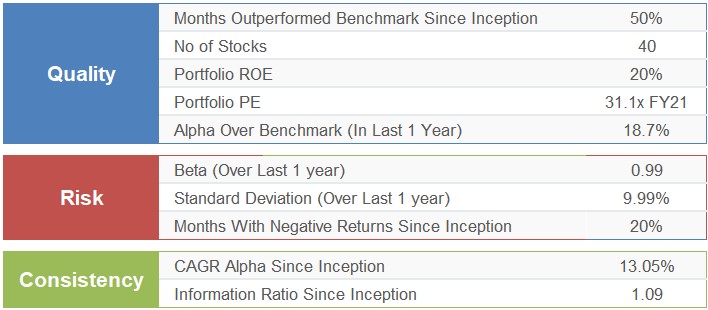

QRC : Quality, Risk, Consistency

NOTE: QRC calculations are done using Nifty 50 index, and data as of 27th Nov 2020.

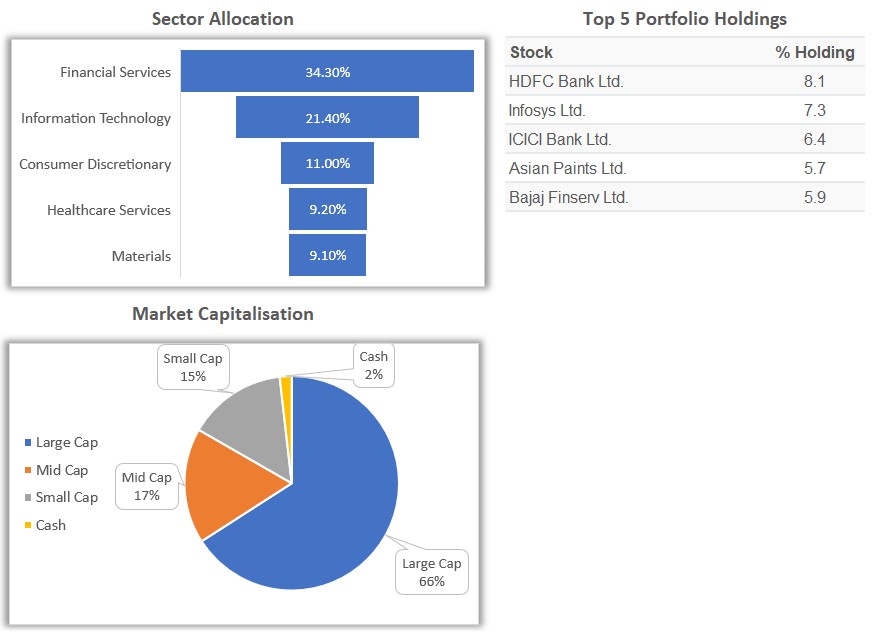

PORTFOLIO : Stocks / Sectors / Market Cap Allocation

NOTE: Data as of 27th Nov 2020

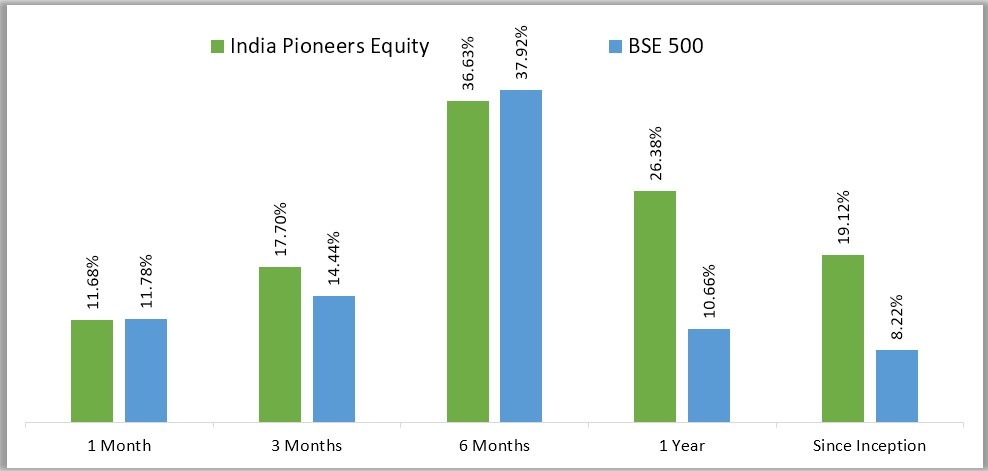

PERFORMANCE : Returns Over Benchmark

Since Inception White Oak India Pioneers Equity PMS has delivered a CAGR of 19.12% vs. BSE 500 returns of 8.22%, an outperformance of 10.90% (CAGR).

NOTE : Performance data as of 27th Nov 2020

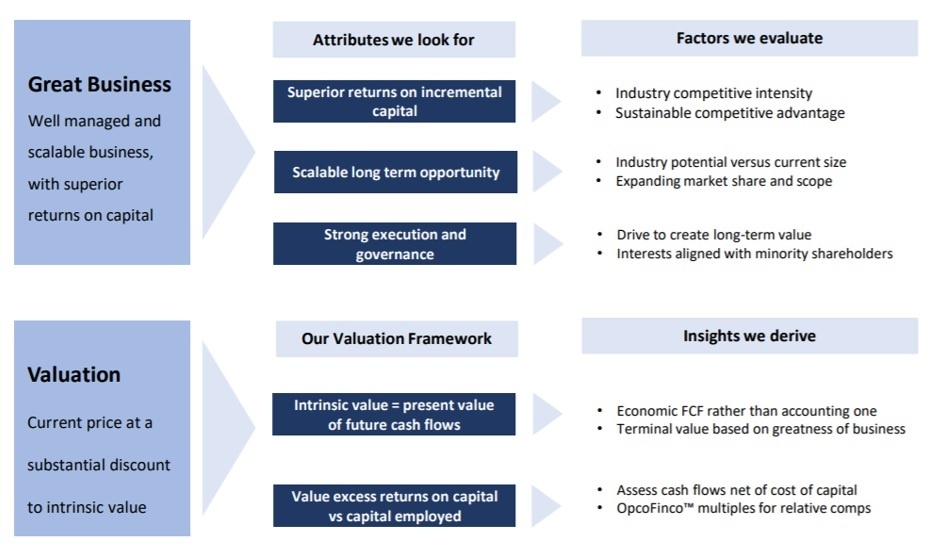

PHILOSOPHY

Outsized returns are earned over time by investing in great businesses at attractive valuations.

PEOPLE : Portfolio Manager, Management, Team

- Prior to White Oak, Prashant was the CIO and lead portfolio manager of GS India Equity at Goldman Sachs Asset Management (GSAM) from March 2007 to March 2017, and also for the Global Emerging Markets (GEM) Equity from June 2013 to March 2017.

- Prashant returned to Mumbai in 2006 to start the GSAM India business and served as the CIO and CEO/Co-CEO of their domestic Asset Management Company.

- Prashant graduated with honors from Mumbai University with a BE in Mechanical Engineering and earned an MBA in Finance from Vanderbilt University, where he received the Matt Wigginton Leadership Award for outstanding performance in Finance. He was awarded the CFA designation in 2001 and is a fellow of the Ananta Aspen Centre, India.

Aashish P Sommaiya

CEO

- At White Oak, Aashish P Sommaiya is responsible for managing and growing its operations. Aashish is an experienced professional and has experience of scaling up and managing relations across well-known AMCs like Motilal Oswal AMC and ICICI Pru AMC.

- Aashish has 20 years’ experience in business strategy and management, grooming talent, process-driven sales and distribution, product development and marketing of investment offerings.

- Aashish was responsible in the past for sales and distribution of one of India’s largest AMCs; ICICI Prudential AMC for their MF, PMS and Real Estate offerings through multiple distribution channels across India and the Middle East. Led new product development, product management, communication, and distribution channel delivery over a number of years.

- Previously built and managed operations of Motilal Oswal AMC – a niche, focused, expert equity boutique based on its time tested BUY RIGHT : SIT TIGHT investing style. India’s one and only 100% equity AMC with a sharply articulated philosophy of buying and holding companies that demonstrate high Quality, high Growth and Longevity of growth. Starting with about ₹1,300 crs ($150 mn) in 2013, Motilal Oswal AMC is today amongst the fastest growing AMCs in India managing ~ ₹40,000 crs ($5.6 bn) of equity assets across managed accounts (DPMS), alternative investment funds (AIF), offshore funds (FPI) and domestic Mutual Funds.

PRICE

- Management Fee: 2.5% p. a.

- Exit Load: 2% within 12 months of investment

- Other Operating Expenses: Custody Fee, Brokerage, Audit Fee Etc. ( Capped at 0.5% p. a )

We at PMS AIF WORLD work with investors not just to make them invest, but associate to make informed investment decisions towards long term wealth creation and prosperity of our clients.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION

Do Not Simply Invest, Make Informed Decisions

RISK DISCLAIMER: - Investments are subject to market related risks. The report is meant for general information purpose and not to be construed as any recommendation. Past Performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. Portfolio Management Services are market linked and do not offer any guaranteed/assured returns. SPECIAL DISCLAIMER : Different Portfolio Management Services present number differently. Some follow aggregate portfolio returns method, some follow model portfolio returns method, and some follow first client portfolio returns method. It is imperative to understand this difference before comparing the performance for any investment decision. Thus, it is necessary to deep dive not only performance, but also, people, philosophy, portfolio, and price before investing. We do such detailed 5 P analysis. Do not just invest, Make an informed investment decision.