Date & Time: 06th August 2021, 05:30 PM – 06:30 PM IST

Speaker:

Satwik Jain, Fund Manager- RH Perennial Fund & Executive Chairman- Generational Capital

Moderator:

Sankalpo Pal-Biz. Development, PMS AIF WORLD

Generating consistent returns: Right Horizons Philosophy & Process

Generating returns during all cycles of the market has for long been the motto of numerous portfolio managers and considering the current situation, it is paramount. PMS AIF WORLD is a performance-focused, analysis-driven, data-backed new-age investment services firm. We offer informed investing experience to our clients and provide the best quality investment products that are managed by experienced money managers. Aligning ourselves with what investors seek the most, we conducted a webinar with Mr. Satwik Jain, Fund Manager- RH Perennial Fund & Executive Chairman- Generational Capital, and discussed how investors can generate consistent returns. Mr. Satwik, apart from being at helm of such designations, has represented India as a golfer in many international tournaments & has also co-founded a health tech start-up aggregating over 150 fitness centres across the country. His career at Deloitte allowed him to work closely for a lot of IPOs & M&A deals- this turnaround made him look at the field on investments closely and approach at it.

With almost 80% of the webinar audience feeling that the current bull run is the best one they have participated in, this webinar opened the floor to Mr. Satwik Jain, a portfolio manager who looks at providing the best risk-adjusted returns for his investors. The name Perennial suggests that the fund is looking for long-term compounding and not the highest returns essentially.

Being a bottom-up stock picker, he advises clients not to get too caught up with macro data as the prime focus— if one looks at data since 2007, Nifty is up by 2.8 times whereas many companies have delivered performance that have compounded the capital by more than 100x. As a fund manager, he aims at identifying those ‘perennials’ which have the potential to grow their earnings at 20%, irrespective of the macros. The difference between the current and the previous bull runs is that of the deleveraging factor— there has been a massive deleveraging exercise across all sectors of the economy leading to consolidation in those sectors. With that said, he mentioned that the Perennial Fund is divided into 2 parts— Growth (IT & Financials) and Defensives (Pharma & FMCG).

True capitalists with market dominance and superb execution are taking away the market share. These are the best times for organized players to create immense wealth.

Moving beyond the bull run, his vision for the coming decade is that some massive trends are underway and the highest contribution towards India’s GDP in the coming years would come from new-age tech businesses— the fact that a food delivery company like Zomato has more employees than India Post is a testament to that fact. India, today, has the lowest cost of internet usage per GB, thanks to Mukesh Ambani’s Jio, whose launch has helped internet users grow by 4x in India. Apart from consumer tech, another emerging trend is Phygital— traditional businesses adopting digital means to run the principle business. For instance, Maruti Suzuki’s 36-step buying process consists of 24 steps that are digitized. So, it is given that the future is going to be a tech era, but which companies succeed in adopting it, only time will tell.

Moving on from tech, he mentioned that the fund has about 25-30% allocation in the healthcare sector. Answering to the question of why such heavy positions in this counter, he mentioned that the end goal of the firm is to compound capital at 18-20% p.a. irrespective of the state of the economy and to concur this statement, healthcare is the most anti-fragile sector.

Even if the economy is in a recession, the healthcare companies would keep on compounding because they form a part of compulsory consumption.

Post the Global Financial Crisis, between 2009 and 2019, the Fed expanded its balance sheet from $900 billion to $3.7 trillion and in the last few months, it has expanded to $7.1 trillion— the Fed has printed more money in this timeframe than it has in the last 108 years. This liquidity needs to be channelised somewhere— be it Gold, Equities, Cryptos, and so on. Trends are global and liquidity tends to chase growth. Looking at the past, it can be figured out that which companies shined during which cycles.

The above table very clearly lays out the historical and on current trends and the companies that gave 100x returns in that particular phase. Talking about the present situation, it is the era of Technology and whenever we talk about disruption in this field on a global level, it is the FAANG companies that come to our mind, to begin with. It is worth noting that most of these global companies boast a market cap that’s almost equal to the Indian GDP, so one can only imagine the level of hyper-scaling that is in the picture. We are witnessing similar trends in India as well where not only IT Service companies but also platform companies like IndiaMART, Info Edge, are doing pretty well.

Compounding, on a day-to-day affair is a very under-appreciated concept and the Perennial Fund is trying to bridge this. The Fund aims to compound the investor’s capital at around 18-24% p.a. The fund looks at the earnings growth of the portfolio companies to reassess the compounding conviction from time to time. To put things into perspective, the earnings growth of the (debt-free) portfolio companies of The Perennial Fund for the last 5 years has been at around 20% with a Return on Equity (ROE) of around 27%. Mr. Satwik Jain goes on to say that he has observed that globally, all profit pools across sectors are getting consolidated in the hands of a few franchises. For instance, despite the presence of networking social media like LinkedIn or a multi-billion-dollar enterprise like Monster, Info Edge’s Naukri.com has built a strong monopoly in the field of Job search. It now boasts of 80% of revenue share and about 110% of profitability in this space, as other spaces are loss-making, at an aggregate level.

The aim is to make a sustainable portfolio of 20-25 companies that comprises of both already established leaders (which will provide consistent returns), and emerging leaders (which will generate alpha over its peers).

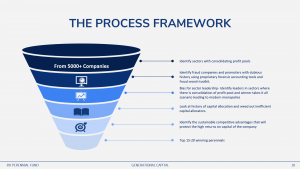

To build such a portfolio, the following framework is used:

Post this, identification of clean accounts take place and that happens through various checks and balances done by digging deep into the company financials accompanied by a 150-keyword Fraud Search to check the intent and vision of the company management. 80-90% of research time is spent on looking at the promoter quality and company forensics— promoter background checks, financial wealth of other related companies/subsidiaries (listed or unlisted), pledging of shares, checks for litigations and/or court cases. These checks sound monotonous but help gain a lot of insight into the company. For instance, while performing these checks, he once came across the fact that a leading QSR chain (favourite of the market) has been pledging their shares and putting their money into their sick businesses having questionable royalty demands.

Interesting findings like these help in avoiding time bombs in the bull market.

Once these checks are in place, one is left with a cohort of 90-100 companies and the next task is to narrow down to those businesses which have a large addressable market. For instance, Titan’s Tanishq earns around ₹18,000 crore revenue but the Gold Jewellery Market is of ₹3 lakh crore and stands to grow at 6-7% annually; so Tanishq has a huge scope of doubling its growth in this space.

Next is to look for companies that have a re-investment runway as these companies have the potential to compound the capital at high rates of return. For example, a company like Relaxo Footwears that makes a profit of only ₹10 per pair of slippers, sells around 18-20 crore pairs annually. The company spends the profits on brand ambassadors (Salman Khan, Katrina Kaif, etc) and on capex, it keeps setting up factories to scale up the business and today, in the lower-end of the footwear segment, Relaxo practically has no competitor.

On the management side, two things are looked at— capital allocation & capital distribution. For instance, a business like Nestle India that does not require to re-invest profits as capital, pays it out to shareholders as dividends.

Apart from these parameters, since wealth creation is a function of the future, it is important to look at the moats of the companies as well to understand its potential and capability to survive. Naukri.com, for example, which has some 9 crore CVs floated on its platform, has built a dominant monopoly. D-Mart, for instance, initially set up stores in the outskirts of the cities, that helped cut down on costs, and lower costs led to more customers and ultimately greater profits. Companies like Lonza and Syngene have the moat of switching costs and that places them in the multi-bagger category over its peers. Brands like Titan’s Tanishq, Nestle, and so on hold a very important moat of intangible assets like smile & value perceived. A gold jewellery that carries the brand name Tanishq (that charges 25-30% as making charges) will be considered a better gift than a gold jewellery from a local goldsmith (who charges about 5% making charge) and this is where the moat comes into picture and thanks to that, Tanishq is registering ₹18,000 crore as revenue.

To sum up the philosophy, 75% portfolio allocation into consumer and pharma sectors would protect his downside in the bear market as these are stocks which are low in beta and volatility; whereas the other part of allocation into IT and financial sector would generate alpha for the fund in a bull market as these are high-growth, hyper-scaling businesses. Looking at companies that can double their earnings in the next 4-5 years, few portfolio holdings of the fund are: Honeywell, Syngene, LTI, Astral Pipes, Info Edge, and so on. The 4-month fund has been beating the benchmark consistently (75% hit ratio) and has a list of companies that have superior fundamentals.

Safety of capital is of paramount importance and the focus is on Return of Capital rather than Return on Capital.

The webinars hosted by PMS AIF WORLD are attended by investors looking to create wealth over time. All of our webinars are aimed at discussing funds and topics that help investors find the correct path to achieve financial freedom. We help investors make informed decisions and for that, we try to take questions from the investors and help them seek answers to what they wonder most. Having said that, a host of questions were queued up for the guest speaker during this webinar.

Mr. Satwik Jain, answering the first question, mentioned that the only way to look at expensive companies is to gauge the level of growth that can be factored into the future. For instance, before the commencement of the fund, for Page Industries, the level of growth was factored in at 25% and for Nestle it was around 12%. So till that amount of growth is maintained, there is no harm in staying invested in those stocks. Sustainability of cash flows is of prime importance here and even if it comes with a higher price, that should be okay.

“I am a business analyst first and a valuation analyst later.”

To this, Mr. Sankalpo Pal, who heads the Biz. Development at PMS AIF WORLD also made a very important point, that as an investor, one buys the business and not the valuations per se. So for instance, if one likes the business story offered by Dr. Lal Path Labs but is not comfortable with valuations, one should probably go ahead with a 4% allocation instead of a 7% allocation and in future, whenever the valuations cool down, probably add more to the existing portfolio.

Hitting the bull’s eye (no pun intended!) directly, Mr. Pal asked our guest speaker that what is it about the Perennial Fund that differentiates it from other funds in the market and as a wealth manager, what advise would Mr. Jain spare for his clients. He addressed the question by defining the asset-allocation model that is followed by their team. He mentioned that the model aims to trim off the emotions from both the clients’ end as well as from the end of the RM managing the client. The client could either be very optimistic towards the bull run willing to allocate more capital into equities or could be pessimistic and fearful because of the sudden stellar rally, wanting to exit all positions. It is important that such emotions are kept under check and the team at RH Perennial Fund vouches to do so. He maintains the conviction that given the times, an investor should stick to focussed funds over funds that comprise of low-quality cyclical stocks. Consumer companies, on the other hand, unlike cyclicals, give you time to exit in case anything goes wrong. Addressing what kind of investors should invest into RH Perennial Fund, he said that the existing clients are families who are looking at building wealth over the next decade and not looking at an exit route in a year or two. These existing families include promoters of listed companies, Bollywood celebrities, etc, who are looking at the safety of their capital, which the fund offers along with an aim to earn a CAGR of 15-20% p.a.

A lot of value migration has taken place in both the telecom and the aviation sector and the fact that both have lost a command over pricing power, the best of the best companies are also going out of business in this space.

Summing up the webinar by discussing about the IPO frenzy and the new-age unicorns, Mr. Jain expressed his happiness that Indian exchanges are providing an opportunity to companies like Zomato to list themselves but at the same time it should be kept in mind that investing in platform companies can turn out to be sustainable if there is a revenue-based subscription model attached to the business, i.e. once acquired, the client keeps contributing to the revenues of the business on a recurring basis. It is not necessary that all these new-age tech-based companies are loss making; for instance, Car Trade Tech, another tech company that came out with its IPO, is a profitable business in the making and building. PMS AIF WORLD being a platform-based service provider and leveraging the most of technology to our advantage, concurs to Mr. Jain’s conviction that by the end of the decade, most of Nifty50’s constituents will be tech companies.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

At PMS AIF WORLD, all PMS AIF Products are listed with all possible information and data for investors to understand & compare these products from the lens of risks as well as returns.

A unique proprietary framework has been founded by PMS AIF WORLD whereby 3 important attributes i.e. Quality (Q), Risk(R), and Consistency(C) are presented for more than 150 portfolio management services by covering 9 factors like Standard deviation, Beta, Sharpe, Alpha, Consistency Ratio, and so on. Many investors as well as the industry are using this proprietary framework to learn, compare, and select the best PMS products in India.

Here is the link to Register and access our QRC Database.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION