Date & Time: 25th February 2022, 04:00 PM – 05:00 PM IST

Speakers:

Kanika Agarrwal, Co-founder, Upside AI

Nikhil Hooda, Co-founder, Upside AI

Moderator: Kamal Manocha, Founder & CEO, PMS AIF WORLD

Let’s begin addressing the elephant in the room – Mr. Putin, interest rates, oil prices, COIVD-19, and Mr. Powell’s remarks. If you look at history, there will always be such events, however, markets have always recovered from them, said Kanika Agarrwal from Upside AI.

Source: Upside AI

Even the top 25% of the US mutual funds could not beat the index over the long term, quotes Upside AI. It is noted that “at least two out of three mutual funds underperform the overall market in any given year” said, Daniel Kahneman. As Mr. Warren Buffett has time & again mentioned that investment over a lifetime does not require a stratospheric IQ, unusual business insights, or inside information but a sound intellectual framework for making decisions and the ability to keep emotions from corroding that framework.

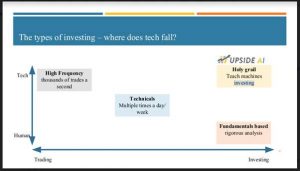

Upside AI PMS’s viewpoint – Today, technology has transformed the way people invest their money globally. Trading activities in the US are performed using technology, with 60% of trading work being completed on technology-based systems. The top five hedge funds in the world are quant funds. They should consider reinvesting in themselves to adopt a systematic AI, Machine learning, and tech-driven approach. Human beings are average investors when analysed for a longer time period. The best performers do not necessarily perform better than peers or consistently beat the market for consecutive years and it is not possible to predict if a manager will do well in the future based solely on its past performance.

Source: Upside AI

Upside AI believes that tech is an important aspect in investing because of many factors like high frequency of trades i.e. thousands of trades a second, fundamentals and technical based rigorous analysis multiple times a day, analyzing millions of portfolios every quarter, rebalancing of portfolios from time to time as per the market conditions and so on.

Source: Upside AI

Source: Upside AI

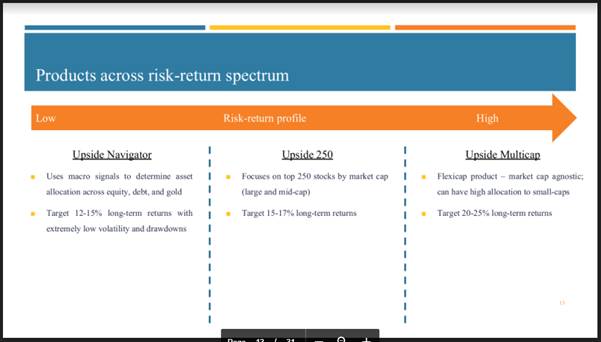

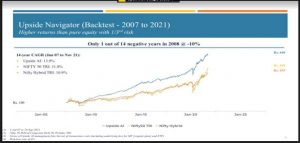

Upside AI positions their products considering the risk-return spectrum by using macro signals, a focussed approach, and a long-term investment horizon. It dynamically allocates money into equity, debt, and gold such that it is more systemized and manual work is minimal. Past performance – from June 07 to Nov ’21, the fund has generated 13.9% return which is a relative alpha of 2.1% as compared to Nifty 50 TRI of 11.8% and 3% as compared to Nifty Hybrid TRI of 10.9% CAGR. Upside AI’s PMS gives you equity-like returns with debt-like stability, by focussing on the top 250 stocks and it generally has a high allocation to small and mid-caps for long-term returns.

“Diversification is an established tenet of conservative investment”, said Benjamin Graham.

To try & maintain the stability of returns in the portfolio, Upside AI uses the Upside Navigator. It is a framework of quantifying market using macros, an optimum asset mix, achieve mid-teen returns with low draw downs and volatility, and long only purchases excluding futures and options. It promises stable returns even during extreme market movements, smoother return profile, and superior risk adjusted returns. As expected the live numbers from the period of Dec 2021 to February 2022, the net downside for Upside AI was -1.18% as compared to -7.03% and -3.51% for Nifty 50 TRI and Nifty Hybrid TRI respectively. Even during the crisis of 2008, Upside AI PMS’s returns fell less as compared to Nifty 50 TRI i.e. -10% vs. -51% for Nifty TRI and similarly in Q1 2020, -7% versus -29% returns for Nifty 50 TRI.

Upside AI’s 250 strategy includes buy and hold high quality large and mid-caps to make a stable portfolio with consistent returns. The returns are at par with Nifty 250 TRI falling short by 148% and significantly exceed Nifty 50 TRI by 645%, as depicted in the snapshot below. For the period (June 07 to June 19) Upside AI PMS’s net return was 15.6% higher than top 5 MFs 12.2% and Nifty 250 10.9% and outperformed across four market cycles.

Source: Upside AI

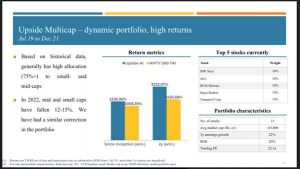

Upside AI’s Multi-cap portfolio is dynamic and aims to generate higher returns with 75% allocation towards small and mid-caps. Both since inception i.e. Jul 19 to Dec 21 and 2 year annual returns for Upside AI multi-cap portfolio are higher than Nifty 500 TRI. For the period (June 07 to June 19) Upside AI PMS’s net return was 24.9% higher than top 5 MFs 14.3% and Nifty 250 9.7% and outperformed across four market cycles.

Source: Upside AI

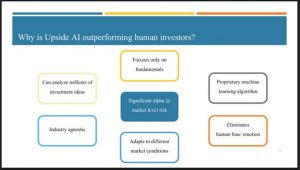

Food for thought is that computer power has grown a trillion times in the last 50 years, and Upside AI wants to capture this and tilt the balances in favour of the investors. Few of the important factors why Upside AI believes that AI is, and will outperform human investing techniques and styles are shown in the image below:

Source: Upside AI PMS

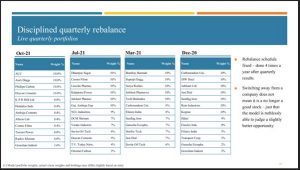

Upside AI belives in a disciplined rebalancing schedule that is done after quarterly results, 4 times a year. Regular switching ensures that stock selection is done with no bias and includes a stock with a relatively better opportunity.

Source: Upside AI

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION