Date & Time: 16th April 2021, 05:30 PM – 06:30 PM IST

Speakers:

Parijat Garg- Senior VP- Fund Management, IIFL Asset Management

Shashi Singh– Senior Partner, IIFL Asset Management

Moderator: Sankalpo Pal- Biz. Development, PMS AIF WORLD

Relevance of Quant Investing in Mutual Funds for WEALTH CREATION

While the first part of this series (held on 16.04.2021) was all about Quant 101, this webinar focused on selecting, assessing, and evaluating Quant Funds.

Quant Investing van generate great returns if strategized in an efficient manner. It is not always necessary that ‘great returns’ mean 30-40% every year. Even if one beats the market by just 2% every year, over a period of 10 years, his/her portfolio would have generated almost 50% higher returns than that of the market.

Small differences in performances can add up to a lot and that’s what Quant Investing really counts on- rack up incremental performances over long periods of time to get outsized returns.

As an asset class, globally, Quant Strategies manage almost a trillion dollars in assets. Most of the giants are based out of US. There is no definite statistics available but India, roughly, manages about less than $250 million. But of course, gears are changing, and India is picking up on these strategies.

To beat the market, the primary requirement is to have some kind of additional advantage (an edge) over the market. This can be categorized into— information edge, behavioural edge, and analytical edge. When the markets are not extremely mature (like is the case of India), information itself becomes a very big source of advantage. As the markets mature, and information disseminates, the focus of generating returns shifts to the analytical edge; making sense of data and insights actually available with the help of algorithms can add an advantage. So as the market becomes more ‘informationally efficient,’ algos and systematic strategies start getting an edge over humans. Finally, behavioural edge, of course, is always a stronghold for quant strategies; humans are never free of biases and emotions— this behavioral aspect is completely eliminated in quant strategies.

One of the primary reasons for investing in any strategy is to generate alpha. If we look at Quant Strategies as sources of alpha, there are lots of different kinds of things than one can look into. A very arbitrary classification of strategies is—

- Long Short Strategies (Going long on some and short on some): These are also known as absolute strategies and here the attempt is to make money irrespective of the market direction. This, in India, is widely available in the form of AIFs (thanks to no shorting in Mutual Funds).

- Trading Strategies: These are strategies which look at specific stocks (probably with a technical know-how) not with a long-term portfolio aim but just to capture the swing/momentum. These are bets placed for a short term and not as long-term investments.

- Factor Strategies: The idea here is to pick stocks based on certain characteristics. For instance, buy companies with low P/B Value and high ROE and rebalance annually.

Apart from being sources of alpha, Quant Strategies can also serve as Investment Solutions. The most important thing that determines outcomes is your allocation strategy, i.e., how and where is your money being allocated— not only with respect to inter-assets (debt, equity, real estate, and so on) but also intra assets (within equity, how much in mid caps, how much in large caps, investment into high or low volatility stocks, investment into healthcare and technology, and so on). This allocation depends on an individual’s preference and requirements. A Quant Strategy can make sure that the portfolio that is built is optimized exactly for what the individual wants in the portfolio (free from the Fund Manager’s bias and emotions). So once your allocation is decided, objectively defined and rule-based algos will proceed with stock selection with respect to the allocation mandate. Lastly, some strategies will fit in the timing parameter as well. It is difficult but doable.

But why do Quant Funds matter? Let’s take a practical example to understand this.

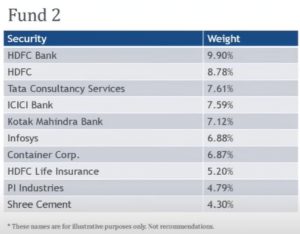

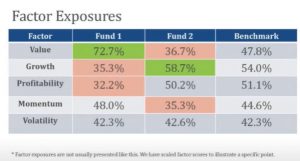

These are the top holdings of two very famous funds in India. If we look at it its surface, a layman can say that these are just investments into large, well-known companies and it’s hard to tell the difference between the two portfolios except for some seasoned investments. But, if we study closely, and look at it from a completely different lens, something very interesting comes up.

The first fund largely constitutes of ‘cheap stocks’ and this is measured very quantitatively/mathematically. So if the benchmark has 47.8% exposure to these cheap stocks, Fund 1 has 72.7% exposure. On the other hand, Fund 1 has a very low exposure to high growth or highly profitable companies, as compared to the benchmark’s exposure in such companies. This implies that if all your money is sitting in Fund 1 (because you know the fund manager or the fund manager’s track record is good), then you have missed out on gaining returns from highly profitable companies, which have generated good returns over the last couple of years.

Fund 2, on the other hand, has a very low exposure to cheap stocks. But cheap stocks have definitely done well in the last years and sometimes have outperformed everything. So if you had parked all your money in Fund 2 (because you know the fund manager or the fund manager’s track record is good), you would have missed out on the recent rally.

This is where Quant Funds come in— you don’t need to look for friendly faces or understand the track record of a fund manager. This gap that is there between opting for either fund 1 or 2 is sorted out by a perfectly optimized quant strategy. Of course, it does not guarantee peak returns for all but it assures your exposure in the segment you want.

Moving on, the assessment of quant strategies is quite different from that of traditional fund-manager based discretionary strategies. Quant strategies need to be assessed differently and unfortunately not many of us are equipped to do it smoothly. Since these have come in very recently, and most of them do not have a 10Y record, is it that one should wait 10 years before investing? Of course not.

We learnt in the previous webinar that these strategies can be back-tested. Having said that, a strategy that fits the past does not guarantee it will do well in the future. So an individual has to focus on two things here— where the strategy fits in your portfolio and whether the claims made are sensible and rational enough to work. To put it into perspective, the following questions can be asked out loud:

- What is the portfolio construction approach?

- How is the portfolio being built?

- Is it sector-driven or sector-neutral?

- Is it focused on specific parameters?

- What is the frequency of transactions— frequency of rebalancing?

- Intraday

- Semi-annually

- Yearly

- Is it an event-driven strategy or a factor-driven strategy?

- Risk of Overfitting:

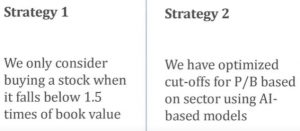

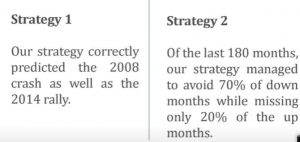

Even though strategy 2 looks more sophisticated, the risk of overfitting will be there in strategy 2. Think about it this way— while back-testing the 2nd guy probably realized that because of the cut-off 1.5, Pharma sector did not prove to be good enough, so for the Pharma Sector the cut-off became 1.4 or 1.7. So, because of such adjustments, overfitting happens. The more parameters there are in a strategy, the more the chances of it being overfitted.

Here, both the strategies are trying to time the market. But strategy 1 only took 2 decisions over a span of 8-10 years and strategy 2 took decisions every month in the same period of time and acted on it month by month. The chances that strategy 2 is more effective than strategy 1 is higher. The fewer the events predicted, the higher the chances of overfitting.

What is the core claim?

-

- Is it riding the momentum?

- Buying cheap stocks or growth stocks?

- Risk and volatility in balance?

- Does it aim to time the market?

- Time it month-on-month

- Time it during crisis

- What is the back-test period?

- Why that specific period?

- Could it have been a longer/shorter period?

- What is the investment universe?

- Large caps, mid caps, small caps, flexi caps

- What is the post-tax performance?

- Is AI good or bad?

- Are transaction costs a problem?

- Is overfitting being taken care of?

- Does it fit my portfolio needs?

With the right questions in mind and the knowledge of the kind of portfolio one wants, Quant Funds can really help one up the game and generate higher returns!

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION