Recipe for Outperformance & Wealth Creation in stock markets by Samir Arora – PMS AIF WORLD

PMS AIF WORLD, which is India’s most trusted, alternates focused investment services firm lead by its Chief Strategist & CEO, Kamal Manocha, conducted an intuitive webinar with Mr. Samir Arora, Founder of Helios Capital.

Samir Arora, who brings a global investing experience of ~29 years, shared his learnings over the years with insightful examples and meaningful data points across Indian and US markets.

Many money managers make claims like ‘concentration builds wealth’ or ‘hold on for long term to build wealth’, or ‘allocate more money where there is high conviction backed by good management or ‘invest where there is expected growth in earnings.’ Samir Arora, one by one, covered all these so called wealth creation claims and concluded that stringent formulas don’t work in stock markets. He asserted that, investing is such a game where even popular fund managers fail in a short span of 5 to 10 years, as nothing works for ever. He clarified that, of course, factors like research, discipline, and the likes work, and must be done, but there is no particular formula to crack the markets in every situation, so one must be flexible with one’s philosophy and investment approach to last over longer periods of time.

Claim 1: Concentration Builds Wealth: There is a famous quote written by Mr. Warren Buffett, “Diversification may preserve wealth, but concentration builds wealth.

But, as per Samir Arora, it’s just a myth. He highlighted with data, ‘Truth is that only a few investments done by Warren Buffett have worked, and most of them have actually hurt him. Did he know what will work and what will not when these investments were done? The reality is that none of us know that we are ignorant, until something happens for us to gain that knowledge. Concentration works theoretically and retrospectively.

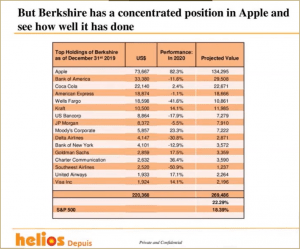

“Most of Warren Buffet’s holdings (assuming that he held all of these for FY19-20; we know that many were sold) underperformed the Index. Except for maybe Apple, Moody’s and Visa, every other stock in his concentrated portfolio underperformed the market. Data given below: –

The notion that only 10-15 companies can generate wealth in the long term is ‘mathematically wrong.’ The belief that Warren Buffett is sitting on cash of USD 100 bn, waiting to invest that entirely into one company rather than investing USD 10 bn each in 10 companies, is flawed.

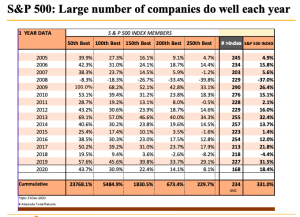

There are 500 companies in the S&P 500; how can it be that ONLY 20 of these will beat the index? The index is ultimately the weighted average of these companies.

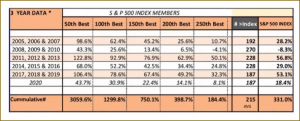

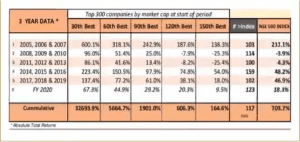

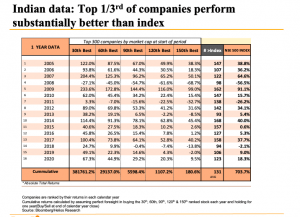

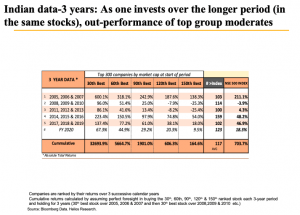

For the S&P 500, on a 3-year basis, an average of 215 companies out of 500 have beaten the Index. This is pure arithmetic. For India, on a 3-year basis, an average of 117/300 have beaten the Index.

Portfolio growth should be robust to handle new emerging opportunities and old reviving companies. This statement can be justified by the screenshots below.

Claim No 2: Long-term holding period builds wealth.

Mr. Samir Arora highlighted that the truth is that academic paper titled ‘Overconfidence’, ‘Under-Reaction’, and ‘Warren Buffett’s Investments’ by John S. Hughes, Jing Liu, and Mingshan Zhang has analysed Buffett’s investments over his prime years (1980 to 2006). These papers state that Warren Buffett’s median holding period is only one year, ~20% of his stocks held for more than 2 years, ~30% stocks are sold within six months.

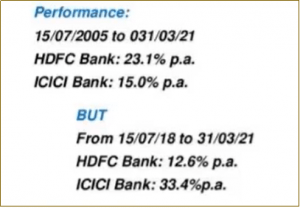

Holding for long term is fine, but Long Term does not mean “Buy & Forget”

- Stock trimming needs to happen

- Exit when you think that money can be put to better use somewhere else

- Do not follow “Keep this also and buy something else”

If 25 years ago, one had bought HUL instead of Nestle and just held that same HUL for long term, one would have made money but, less than half of what you could’ve made on Nestle (Nestle is up 131x v/s HUL which is up 59x till 31st Mar’21).

If 25 years ago, one invested in ACC and not on Reliance, and held that for long term, the returns would been less than 1/10th of Reliance. (RIL is up 207x v/s ACC which is up 59x over 25 years till 31st Mar’ 21)

And, what if one had invested in Tata Motors for long period of 25 years (Tata motors is up only 4x in 25 years, till 31st mar’ 21)?

Claim No 3: Allocate more, with high conviction to good management and growth in earnings.

The truth of life is that conviction is always higher on things that one knows, one won’t do in life, rather than things that one would actually do. For instance, Warren Buffett is convinced that he will not buy tech stocks.

On good management backed high conviction, Samir Arora pointed out that there is a basis to find out if bad management exists or not, but there is no basis of good management. If an MNC is listed in India, what are the screeners for good management? Is it that the parent company has to be clean? Or is it that the local company should be honest? What is the time frame to judge the company’s management? If TCS has good and efficient management, can one necessarily say so about Tata Motors because eventually the parent group is same? Samir Arora added if a company is not stealing money, then that is okay because it is basic, that one is not supposed to steal. But if a company does steal, it is definitely bad management in there.

Apart from this, while judging management, how will one separate the Halo Effect?

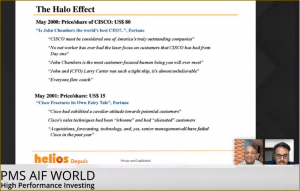

Halo effect basically means that if a company’s stock price is going up, everybody believes that it has good management & vice-versa. He added, show me a company that delivers high performance and I can always find something positive to say about the person in charge. But this is necessarily not true (in the longer term). For example: Fortune Magazine in May 2000 claimed CISCO (share price then: USD 80) to be an outstanding company; the same magazine, a year later wrote that sales techniques of CISCO (share price in May 2001: USD 15) had been irksome.

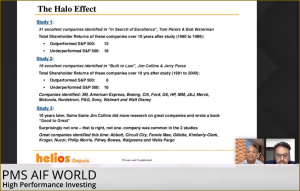

Some more examples of the Halo Effect are given in the below slide:

Study 1 shows that more than 50% of the ‘excellent companies’ identified in the book ‘In search for Excellence’ underperformed the benchmark S&P 500. Study 2 shows that even in a book titled ‘Built to Last’, more than 50% of the identified ‘excellent companies’ did not last long. Study 3 shows that the book ‘Good to Great’ (written by the same author who wrote ‘Built to Last’ identified an entirely different set of companies in this book as compared to the previous ones, but (not so) strangely, most of these companies did not turn out to be great!

So, in essence, Samir Arora, highlight the fact that the parameter ‘excellent companies’ with ‘good management’ is really subjective and keeps changing from time to time.

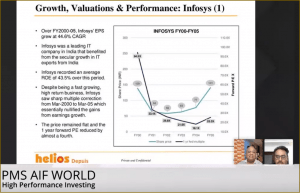

On allocation of more proportion with high conviction to businesses with high expectations of growth, Samir Arora questioned that even if one is sure of growth, will the price of stock necessarily go up?

Data shows, the answer is NO.

Infosys reported an earnings growth of about 44.6% p.a. for 5 years (FY2000-2005) but its share price did not even grow by 1%. From INR 139, it went up to INR 141.

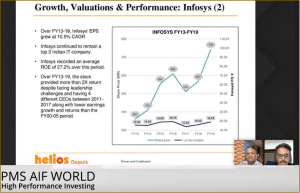

The same company (Infosys) in another phase (FY2013-2019), had an earnings growth of about 10.5% p.a. for 6 years, but the stock price more than doubled in this period.

There are two sides to everything; if you read The Little Book of Value Investing, you will be convinced that Value Investing is the way forward; but then if you pick up The Little Book that makes you rich, you will probably feel that Growth Investing is the way forward.

Helios’ Investment Process, which, Samir Arora says, should be everyone’s investment process as this is the recipe for outperformance & wealth creation. He added Helios offers differentiated philosophy with an actual track record of India investing for 25 years (and not back tested models or paper portfolios). Same team manages/advises FII Fund (Front seat experience of FII flows /behavior etc.). Same team manages/advises both long only and long/short strategy (Shorts provide yet another perspective). Some members of team also manage/advise global fund (so we have actual experience of developments in other major markets). Senior members of team have worked together for 15-20 years and know how to handle various phases of the market (that invariably come up)

Summary of Investment Process at Helios India Rising PMS

Reject stocks on basis on theme/potential for disruption/company management, strengths, strategy/corporate governance/financial analysis/medium term triggers & valuation.

Research team needs experience to balance these factors for most of the world is not black or white. From the list of stocks that cannot be “rejected on any factor”, do further research to arrive at “to BUY list”.

Goal is to have consistent performance relative to benchmark. Preferred themes are just that –preferred. On average 15% of the portfolio may not be in our preferred themes but should offer great value or trigger.

Buy stocks with an initial 1 to 3 years horizon. It is easier to analyze companies, strategies, environment, government policies, disruption possibilities, market preferences etc. over this period. Stocks that are held for longer term are not (always) identified in advance but if merited there is no reason to not continue owning many of the same stocks for another 1 to 3 years and so on.

Knowing that a large number of companies do well (contrary to widely held belief- see appendix) over any horizon but not knowing exactly whose turn it is next, own 30 to 40 companies (from our “to BUY list”) where we have “High confidence in reasonable returns” and where we have ”Reasonable confidence in high returns”.

Sharing his learnings, Samir Arora also covered thumb rules of investing in equities as an asset class, worth reading..

Risk-reward trade-off is crucial & is favorable for equities, as an investor is rewarded with 5-6% p.a. above the return on government bonds for investing in equities. So, one must accept equity as an asset class.

An economic downturn should not pause your investing activity, rather it is the perfect time to buy equities as you will be able to ride the growth in the near future.

Three themes prevalent in India, 1) Private sector financial, 2) Consumption, 3) Global sectors within the country – IT, Pharma, Specialty chemicals.

One should invest outside India also. Investing 10-20% is nothing wrong as rupee is depreciating 4-5% on an average.

Samir Arora does not view Bitcoin as a favorable asset class option as the bitcoin argument that is used is inconsistent and he is a ‘theoretical guy.’ He mentioned, the price of Bitcoin runs up as and when some XYZ company (Tesla, Visa, PayPal, etc) announces that it will accept payments in Bitcoin. So, if the value of Bitcoin goes up because it can be used as transaction payments, why will anyone use it for transactions? According to him, it is a ‘High Beta NASDAQ Stock.’

Samir Arora concludes that no one formula works for ever. The solution lies in diversification, being flexible, and looking at companies for 3 years because it is easier to project with this objectivity. Long term is a series of short term so if your stock works 3 years at a time it may be there in the portfolio for the long term but not committed upfront. A large number of companies do well, so if you can just eliminate the bad ones your portfolio will outperform the market.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION