Date & Time: 03rd September 2021, 05:30 PM – 06:30 PM IST

Speaker: Dhaval Kapadia, CFA, CFP, Director, Portfolio Specialist,

Morningstar Investment Advisers India Pvt. Ltd.

Moderator: Kamal Manocha- CEO & Chief Strategist, PMS AIF WORLD

Optimizing risk-reward: The Morningstar approach

Morningstar’s multi-asset investing approach

Equity is the most favorable asset class for wealth generation and can be reasonably expected to outperform most other asset classes over long horizons. The ascent of the equity markets since the lows seen in March last year has been quite remarkable resulting in a large number of investors taking to direct stock investing as seen from a sharp rise in the number of demat accounts.

With the rise in valuations, investors have been in a dilemma of sorts wherein the question remains that whether to stay invested or sell-off right now and buy more later. PMS AIF WORLD hosted a webinar in collaboration with Mr. Dhaval Kapadia, Director, Portfolio Specialist at Morningstar Investment Advisers India Pvt. Ltd. Mr. Dhaval, CFA, CFP has over 25 years of experience in markets and is a part of the Investment Management team at Morningstar.

Mr. Dhaval Kapadia explains the concept of risk-reward trade-off with single asset investing. He goes on to state that with rising valuations, it is important to maintain a portfolio diversified across asset classes rather than being concentrated in a single asset class. He further explains that market valuations are crucial while investing into any asset class, as high valuations subject investors to the risk of sharp corrections.

Morningstar is a U.S.-based investment research firm that has over 8000+ employees across 29 countries. Morningstar brings together local investment management experience and global resources to deliver long-term investment results to clients and end-investors around the world. The AUM for the firm stands at $251.6 billion (June 2021). Morningstar’s Investment Management group’s investment philosophy is driven by the investment principles that are promoted throughout Morningstar, Inc. The principles are intended to guide their thinking, behavior, and decision-making. Following are Morningtar’s investment principles:

- We put investors first – firms that put investors first win in the long term because their investors win. Putting investors’ interests above all else is the foundation of our company.

- We’re independent-minded – to deliver results, we think it is necessary to invest with conviction, even when it means standing apart from the crowd. We are not afraid to take a contrarian view when our research supports it.

- We invest for the long term – taking a patient, long-term view helps people ride out the market’s ups and downs and take advantage of opportunities when they arise.

- We’re valuation-driven investors – anchoring decisions to an investment’s fair value – or what it’s really worth – can lead to greater potential for returns.

- We take a fundamental approach – powerful research is behind each decision we hold, and we understand what drives each investment we analyze. We focus on research into cash flows and other potential benefits of ownership to drive investment decisions.

- We strive to minimize costs – controlling costs helps investors build wealth by keeping more of what they earn. Fees, transaction costs, and taxes reduce the compounding benefits of investing, therefore, we believe it’s important to minimize costs whenever possible.

- We build portfolios holistically – to help manage risk and deliver better returns, truly diversified portfolios combine investments with different underlying drivers.

Morningstar follows a valuation-driven asset allocation approach to investing. The core capabilities of the firm remain in ‘Asset Allocation’, ‘Manager Selection,’ and ‘Portfolio Construction.’

The strong run-up in the markets over the last year has rewarded investors with ample returns. It took time to recover the losses and it was around November 2020 that things took a better shape. However, Professor Aswath Damodaran has explained that ‘Inflation is the biggest unknown and will influence how markets behave going ahead.’ It still remains a cause of concern as inflation levels in the USA are near all-time highs. The risk-reward ratio helps to understand the returns generated per unit of risk taken. A poll was conducted during the webinar asking the question ‘What are the real returns generated by equities over the last 20-25 years?’ The range of answers went from 4% to 7% where the majority of them took the latter one. However, Indian equities have returned slightly more than 7% as per data pulled up in the presentation. During the same period, Gold has returned 4% and fixed-income a meagre 2%.

On the flip side, the drawdown for Indian equities over the last 20 years has been remarkable as well. There have been multiple scenarios where the maximum drawdowns have breached 20% or more. The IT Tech bubble (early 2000’s), the global financial crisis (2008), the tumble between 2015 and 2017, and lastly the pandemic that hit last year (2020) are major incidents that have been unfavorable for investors. Mr. Kapadia showed that after a steep fall, the recovery period can be lengthy.

The upside in the equities can be great but we should be mindful of the downside losses, says Mr. Dhaval Kapadia.

Mr. Dhaval Kapadia pointed out that the sharper the drawdown in percentage terms, the higher is the recovery needed to recover your capital which may occur over a considerable time period. Other asset classes like Gold, Fixed Income, and international equities fared better than domestic equities over the same time frames. It proves the point that different asset classes react differently to various economic drivers thus underlying the need for multi-asset investing.

Thus, Morningstar has taken the multi-asset investing approach which focuses on optimizing risk-adjusted returns. Morningstar also offers exposure to international equities as part of its multi-asset portfolios. Global equities, particularly U.S. equities have outperformed Indian equities by a fair margin (in INR terms) over the past decade. They provide exposure to diverse opportunity set and provides investors an opportunity to participate in the growth of some of the leading global companies. India comprises less than 2% of the global market cap in international equities. This indicates the vast opportunity set for investors to create wealth and optimize their portfolio performance.

Global equities have a low correlation with Indian equities and thus provides valuable diversification to the portfolio. They also help provide a hedge against the depreciation of the rupee. Mr. Kapadia showed the calendar year performance of various asset classes over the past decade to highlight the diversification aspect. Diversification benefit was evident from the chart which showed Indian equities falling 26% in 2011 whereas US equities returned positive 20.6% in the same year. The chart showed that no asset class has consistently outperformed others year on year. Hence, it’s difficult to pick winners or losers further underscoring the need for multi-asset diversification.

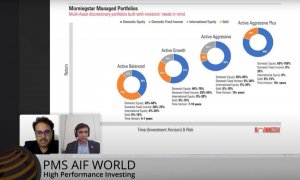

Morningstar Investment Advisers India Pvt. Ltd. offers multi-asset portfolios catering to investors with different risk appetites under its SEBI registered PMS license. The portfolios invest into direct plans of mutual funds across asset classes such as domestic equities, domestic fixed-income, money-market and international equities.

The domestic equity exposure is split across market-cap segments viz. large, mid, and small-caps; whereas the global exposure is to regions such as the US, Europe, and Emerging markets. Similarly, fixed income exposure is split across long-term, medium-term, short-term, and cash. The allocations are actively managed in the portfolio as valuations are an important part of the investment process.

There are suitable options for varying investment needs along with end-to-end solutions for all. The portfolio management process involves asset allocation, manager selection, and portfolio construction which is following by active ongoing monitoring to capitalize on market opportunities. The advantage of global and local expertise helps deliver superior risk-adjusted performances. The investment process accords due importance to overall portfolio costs, as lower costs result in higher returns for investors.

Mr. Kamal Manocha put forward an intriguing point wherein he compared the current market situation to 2003-2008 where valuations were steep, and investors did receive handsome returns. Moreover, he stated that the world GDP and India’s GDP grew in the period which is also the case at this point of time. Consistent rise in corporate earnings helps keep valuations in check. Investing in good businesses is the key to long-term performance.

Mr. Dhaval Kapadia states that the current rally has been phenomenal but when viewed over a five year period, the returns do not seem too over the top. He believes that markets are slightly over valued, and Morningstar has slight underweight in their respective portfolios as far as Indian equities are concerned. The run-up has been stronger in the US equities over the past decade when compared to the domestic equities. He also specified that certain segments in the US market are slightly overpriced when compared with global indices. Reasonable opportunities lie in Asia ex-Japan, the UK, and China as markets are fairly valued in these regions. The regulatory impact on Chinese equity markets has led to steep corrections and poses a decent opportunity for investors.

On the fixed-income side, Morningstar view that though interest levels have bottomed out, they are not likely to rise sharply over the immediate term given the RBI’s accommodative stance with a focus on growth. Mr. Kapadia stated that the medium-to-long term yield curve remains attractive from a risk-reward perspective. The credit risk segment looks relatively attractive relative to the banking & PSU debt segment.

Mr. Dhaval Kapadia stated the importance of evaluating the risk appetite of investors, which involves gauging their capacity and willingness to take risk, before zeroing on asset allocation. Capacity is determined by the investment horizon which is positively related. Willingness is an inherent nature of investors which may be low even after having a longer-term horizon.

Investors with higher risk appetite, could take higher allocations to equities that deliver substantial returns over long horizons. Mr, Kapadia also emphasized that future return expectations of asset classes should be evaluated in detail. The return expectations for each asset class are important for optimized returns for a portfolio. The expected growth and the price paid for the same needs to be understood and fairly looked upon. A qualitative and quantitative assessment regarding the choice of a portfolio manager is also beneficial.

The webinar was capped off by Mr. Kamal Manocha, who underlined the importance of a multi-asset portfolio to improve the investor’s investment experience. The data presented by Mr. Kapadia was fairly convincing to stress upon investors the benefits of maintaining well-diversified multi-asset portfolios to improve the overall risk-reward proposition.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

At PMS AIF WORLD, all PMS AIF Products are listed with all possible information and data for investors to understand & compare these products from the lens of risks as well as returns.

A unique proprietary framework has been founded by PMS AIF WORLD whereby 3 important attributes i.e. Quality (Q), Risk(R), and Consistency(C) are presented for more than 150 portfolio management services by covering 9 factors like Standard deviation, Beta, Sharpe, Alpha, Consistency Ratio, and so on. Many investors as well as the industry are using this proprietary framework to learn, compare, and select the best PMS products in India.

Here is the link to Register and access our QRC Database.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION