Date & Time: 06th January 2022, 04:00 PM – 05:00 PM IST

Speakers:

Saurabh Mukherjea- Founder & CIO, Marcellus Investment Managers

Pramod Gubbi- Head of Sales, Marcellus Investment Managers

Ashvin Shetty- Portfolio Manager, Marcellus Investment Managers

Moderator: Sankalpo Pal, Biz. Development, PMS AIF WORLD

With mid & small caps being in the spotlight in the recent times, we, at PMS AIF WORLD recently hosted a webinar with the team at Marcellus Investment Managers (that handles a cumulative AUM of about Rs 12,000 Cr) to gain insights on their Marcellus Rising Giants Portfolio.

The reason why Marcellus has different portfolios for different market caps is liquidity. The liquidity availability along with aligning to the requirements of the clients, options are available for investors to pick & choose from, depending upon their investment objective & risk appetite.

Mr. Saurabh Mukherjea, Founder & CIO at Marcellus laid out the basic foundation of the portfolio and shed insights on why the Marcellus Rising Giants Portfolio has been compounding so well. Marcellus’ flagship product, Consistent Compounders Portfolio (CCP) focuses on large caps, its Little Champs Portfolio (LCP) focuses on small caps (a typical LCP stock would be of a market cap of $0.5bn). The Marcellus Rising Giants Portfolio came into existence on 16th Aug 2021, to offer investors a portfolio that focuses on both mid & small caps (a typical stock here would be of $3.5 bn).

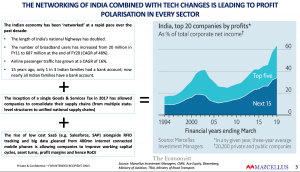

The above slide is the central insight on which all the products offered by Marcellus are based upon.

The first phase of change in our country’s economy is reflected by the fact that as national players up their game in their respective sectors, the regional players in the said category tend to die out as they can’t match up to the big sharks.

The second phase lies in the adoption of technology, particularly mobile, SaaS, and Cloud. Well-run small businesses can use these low-cost tech at their advantage to scale up their existing businesses at an unimaginable growth rate.

The third change is the acceleration in the attack on black money (GST, demonetization, etc). As more & more players face the inability of tax evasion & money laundering (into real estate or gold), more & more inflows have come into the financial markets, and the cost of capital here has come down.

The first few stocks in the above table reflect stocks that were market leaders 15-20 years ago as well and are so today also. But the latter part is where the Marcellus Rising Giants Portfolio focuses on… companies like Divis Labs, Relaxo, and so on, companies that have grown more than 20x in the last decade. This was possible due to the 3 changes discussed above, that disrupted India’s economy.

Companies like Relaxo & Dr. Lal Pathlabs barely existed 20 years ago. These companies are creatures of the new, integrated, tech-driven India.

Dr. Lal Pathlabs is a giant today, all thanks to 3 layers of technology.

- During the initial years of its expansion, the company used technology to locate districts & areas where population density was high but competition intensity was low. Having located such places, they placed their labs there.

- The second layer was the addition of the kinds of tests being provided. Dr. Lal Pathlabs did not restrict itself only to blood & urine tests, but forayed into genomics, allergies, oncology, etc, as well. Today, they offer about 5,000 tests whereas the nearest competitor offers about 3, 500 tests. These extra tests that are being offered are high-value high-margin tests, which does bring in the challenge of inventory management. The receivable days in the pathlab industry are 0, but the inventory days are very high. This is managed by borrowing the same no. of credit days from its suppliers, thus smoothly functioning on a zero working capital cycle.

- The third layer was added when the company decided to incorporate the home collection model.

These layers broadly outline the success of Dr. Lal Pathlabs, a company which had 50 centres a decade ago, today has about 5500 testing centres and has generated a ROI of about 125% in the last decade.

Companies like these form a part of the Marcellus Rising Giants Portfolio. Companies which are clean, efficient, and dominant.

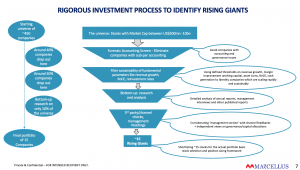

To filter down on such companies from a universe of 250 listed companies that form a part of the $0.5 bn to $10 bn market cap universe, a detailed primary & secondary research process is followed:

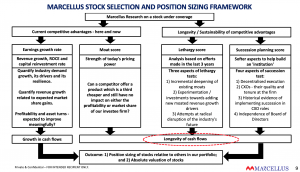

Once this data research is completed, from a universe of 250 companies, the team narrows down to 40 companies. Post-this, a position sizing framework is applied which then determine the 15 companies to be picked from the list of 40. The position sizing framework is mainly put to use to make sure the selected companies have the potential to play out for the next 15-20 years and not just 3-5 years. To put this into perspective, the team looks for businesses that have the potential to sustain earnings growth of 20% for 15/25 years, the generated multiple for that company can be almost 100x/250x. Not only this, they look for businesses whose promoters are a good mix of clean, competence, and integrity.

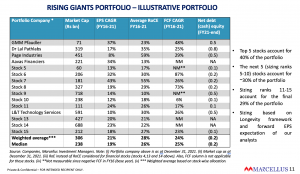

Once companies are ranked basis the above positioning, the top 15 companies make it to the portfolio. The current composition of the Marcellus Rising Giants Portfolio looks something like this:

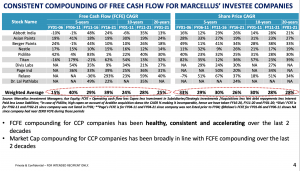

As is clearly visible, the overall weighted average portfolio EPS is about 21% despite the unprecedented macro slowdowns in the last few years. This was majorly possible because either these companies have gained market share within their respective sector or they made efficient use of capital allocation to generate earnings growth. Also, with most of these businesses acing the game of capital reinvestment (through expansion & technological enhancement), the Free Cash Flow CAGR is even better at 24%.

Mr. Saurabh Mukherjea answered a question on the possibility of superlative returns by the portfolio. He mentioned that for a poor country like India, even if its real GDP grows by 8-10% p.a., the formal sector can easily grow by 15% p.a. Industries like footwear, pathlabs, FMCG, etc have a huge chunk of informal sector weightage within them. It is for these giant formal players to play their cards and capture the weaker players in the said industry and grow their earnings. For instance, for the pathlabs industry, only about 10-15% of the total sector earnings are with the formal organised players currently. This is where the white space can be captured by these organised players who will take advantage of technology to grow.

Do not question the growth of the country, question if or not the investee company will participate in the growth or not. Growth is necessary, but not sufficient. What’s more important is to focus on differentiators and competitive advantages.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION