Date & Time: 04th March 2022, 04:00 PM – 05:00 PM IST

Speaker: Aryaman Vir, Founder & CEO, MYRE Capital

Moderator: Kamal Manocha, Founder & CEO, PMS AIF WORLD

MYRE Capital is a tech-based fractional ownership platform that provides real estate owners and developers a source of stable finance whilst providing potential investors and stakeholders with end-to-end management and execution.

To throw some light on the same, Mr. Aryaman Vir, Founder & CEO, MYRE Capital has helped create awareness about fractional investing in the real estate market. Aryaman Vir has a degree in Networked and Social Systems Engineering and a Master’s in Systems Engineering from the University of Pennsylvania. It gave him the necessary knowledge base and skill set in engineering and nursed his interest in Algorithms and Big Data Analytics. This has helped him envision a robust model that caters to a wide range of audiences interested in safe and profit-yielding investments in the real estate sector.

The motto behind launching MYRE Capital is to provide retail investors’ access to institutional-grade assets. The idea thrives on the fact that an adequate chunk of the country’s commercial real estate has been taken up by institutional investors, with the stake being raised by the participation of foreign investors. Secondly, a retail investor with sufficient funds ends up investing in a highly risky commercial property that may not provide sufficient returns.

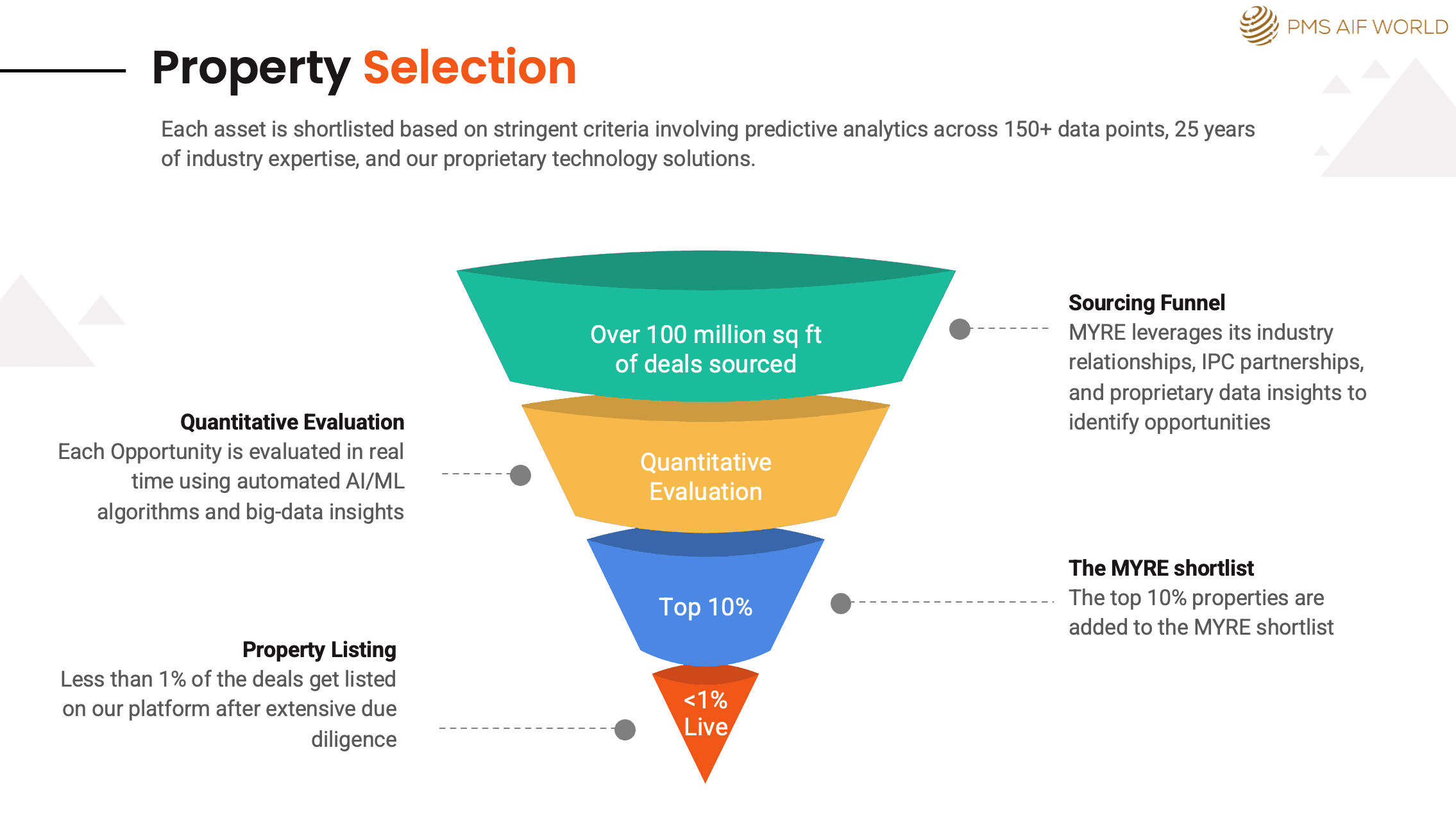

The diversification of a real estate portfolio is equally important from an investment point of view. MYRE Capital is a part of the largest architectural design firm in the country, Morphogenesis, headquartered in Bangalore with offices in Mumbai, Delhi and Bangalore. MYRE Capital’s each asset is shortlisted based on stringent criteria involving predictive analytics across 150+ data points, 25 years of industry expertise, and our proprietary technology solutions.

Rental income combined with capital appreciation are one of the key objectives to invest in the real estate market. The dual earning proposition has grabbed eyeballs of many institutional investors. There is sufficient downside protection in the form of a physical asset and the pandemic is proof that the market for quality commercial assets remains stable even during a turmoil.

Furthermore, MYRE Capital aims to remove traditional barriers to investing in the real estate asset class with sufficient planning and knowledge for all, with their parent company Morphogenesis having a presence in over 8 countries, handling projects for the last 25 years.

Commercial real estate has a higher rental yield, capital preservation, appreciation and is stable and non-correlated.

The Commercial Real Estate market in India is making a comeback with vacancies in the single digits and rent collection increasing at a steady pace, and with fractional investing picking up pace, investment in this class is believed to accelerate with time. The pandemic has led to increased size allocated to employees in all offices which now stands at 70-80 sq. ft. A single quarter inflow of $1.3bn in 2021 from institutional investors is proof that the market sentiment is changing. A lot of A+ grade properties were available to investors as the underlying fundamentals of the market did not change.

The Commercial Real Estate market in India is making a comeback with vacancies in the single digits and rent collection increasing at a steady pace, and with fractional investing picking up pace, investment in this class is believed to accelerate with time. The pandemic has led to increased size allocated to employees in all offices which now stands at 70-80 sq. ft. A single quarter inflow of $1.3bn in 2021 from institutional investors is proof that the market sentiment is changing. A lot of A+ grade properties were available to investors as the underlying fundamentals of the market did not change.

The investment is carried out through a special purpose vehicle that owns the underlying asset. MYRE Capital works as an asset manager ensuring a smooth experience for all stakeholders, during the investing cycle as well as post-acquisition of property.

It has led to a reduced ticket size for investors leading to a comprehensive yet diversified portfolio. Lastly, the tenant relations are also maintained by the in-house expert team leading to efficient dialogue between all parties involved.

To facilitate these fractional investments, a proprietary process is followed for property sourcing that identifies opportunities in leading markets and invests in the same. It is important to ascertain the intrinsic value and the actual market value of the property.

Data asymmetry has led to returns either being positive or negative with no room left in the middle whatsoever. Myre Capital has an in-house property selection team with the capability and knowledge to select the ideal ones. The team at MYRE capital has over 100m sq. ft. of deals to be sourced which is known as the sourcing funnel.

It is further followed by a quantitative evaluation of the shortlisted properties with AI and ML technology. A thorough analysis of the property ensuring that the due diligence parameters are met is carried out towards the end of the property selection process. It leads to a selection rate of under 1% out of the probable list that started the whole process.

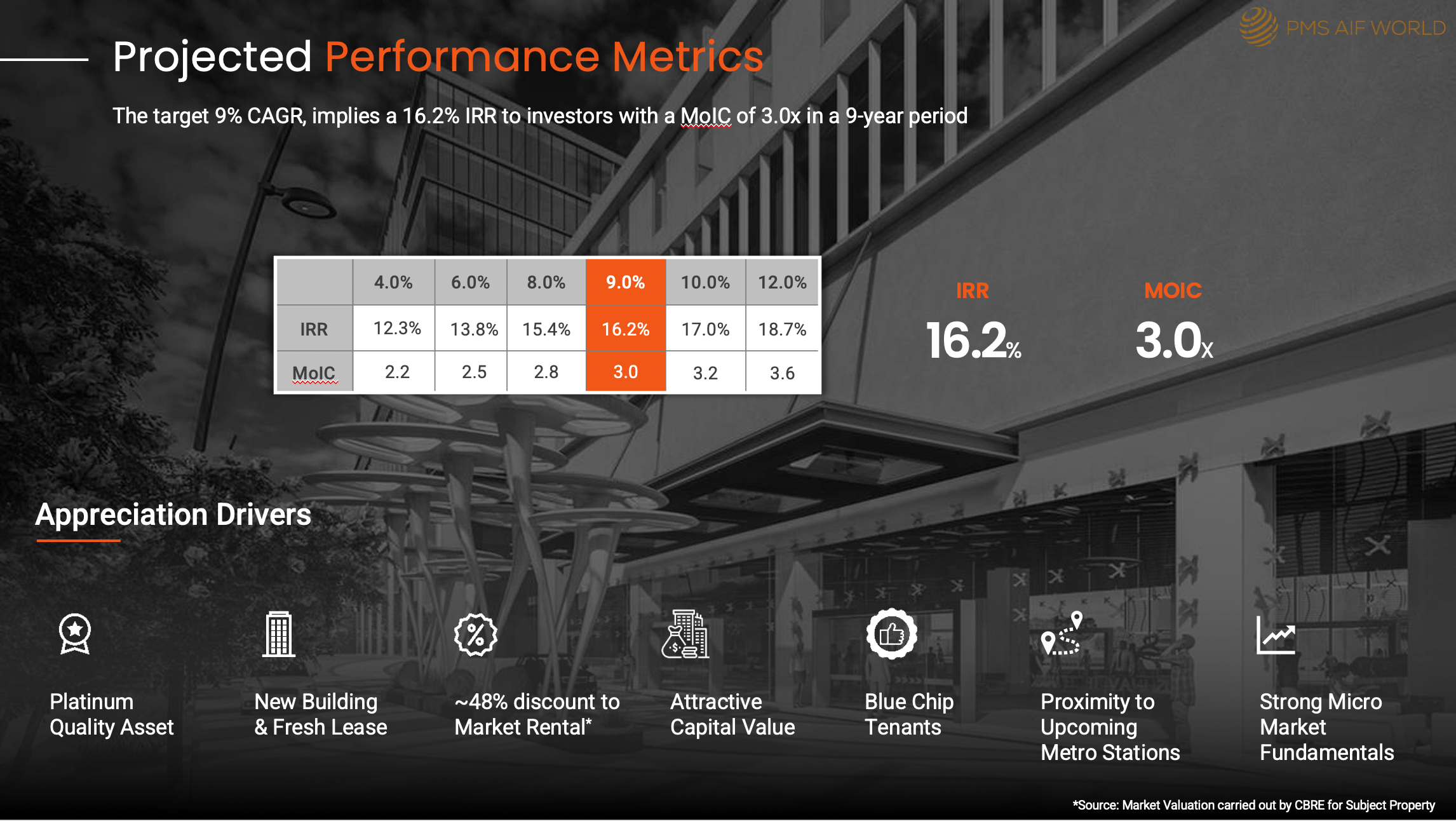

The curated listings from last year had a yield of 8-10% with a target IRR of 13-20%. The lease agreements have a time horizon of 9-15 years that ensures long term stability of the cash flow.

Myre Capital has Bentley, Smartworks, DHR Global, App direct as its tenants. Optimal post-tax returns and a diversified portfolio helps to increase returns for the investors.

In their signature fractional investments, enhanced liquidity options for all investors have led the firm to create a transparent platform. The platform has features like an online secondary market, private transactions, and a smooth exit at the time of sale for all fractional owners. They have a user base of 15,000 currently with unlimited access to the MYRE investor network. It has garnered an AUM of ₹100 cr over the past 12 months.

Myre Capital has ensured a 100% rental collection across all its assets despite three lockdowns.

They have an intriguing and exciting offering by the name of Vaishnavi Tech Park. It is located off the Outer Ring Road and very close to the Sarjapur Junction and has amenities like a cafeteria, food court and sufficient space for recreational activities. It has a total office space of 8 lakh sq. ft with an area of 5.6 acres.

It has an IGBC platinum certification that ensures certain mandatory requirements & credit points using a prescriptive approach and others on a performance-based approach. Smartworks is the anchor tenant in this asset. It is also country’s largest provider of agile workspaces with a pan Indian presence.

Our rental is at a 48% discount to the prevailing market rate, increasing the stickiness of the tenant to the premises and providing significant scope for the future mark to market appreciation.

The current entry yield stands at 8.7% with an average yield of 9.0%.

The appreciation drivers include platinum quality assets, new buildings and fresh leases and an attractive capital value. Proximity to upcoming metro projects and blue-chip tenants tend to increase rentals over a certain period of time.

The ownership structure at MYRE Capital involves a Special Purpose Vehicle (SPV) where the investors pool in their money. The SPV buys the property and MYRE Capital acts as the intermediary between the former and the building developer/promoter. The tenant pays rent to the SPV which is further disbursed to investors as a regular source of income.

The underlying framework for SPV & fractional investing is governed by the Companies Act whereby it is noted that investors can invest their funds in a privately held company. The private limited company complies with all the legal and regulatory documents which are required by the Companies Act 2013. Liquidity has been a question and a major hindrance when it comes to investing in real estate and it was Mr. Kamal Manocha who raised a pertinent question about liquidity in fractional investing.

The comparison can be drawn with a non-convertible bond where the continuous flow of rent acts as the interest income for the investors. It is a yielding product where the rent increases with time leading to mark-to-market gains at the time of exiting the fractional investment.

Also, a recent scenario has shown that existing investors take up the share of the investors leaving the ownership table. It is not always that it happens but unforeseen circumstances do create opportunities for many. They have fulfilled liquidity requests within a week which is not bad at all.

Mr. Aryaman Vir explained that A-grade assets are segregated with the help of categories like Platinum, Gold, Silver and Bronze. With age, the capex on building maintenance increases exponentially. The platinum category ensures that the maintenance cost remains low, while the bronze category witnesses a brisk increase.

PMS and AIF categories have increased the minimum threshold investment leaving fixed-income assets the only option available with investors.

MYRE Capital follows a 1 and 20 model for management fees. They charge 1% of the actual amount invested on a yearly basis which is deducted from the rent disbursal amount. If a particular investment involves zero rent, the company does not charge any fees from the investor. The chargeable performance fee of 20% above 12% IRR is only on realised capital appreciation.

Lastly, post-tax return is an area of concern for many investors, even in fractional investing. The benefit of LTCG is up for grabs if an investor exits after a 2-year time period. The indexation benefit reduces the effective tax rate for the investor The rental income has a pass-through structure which is received by the investor directly.

The real estate market is witnessing unprecedented growth and with the likes of new products entering the market investors have a lot to ponder over and invest their funds wisely into various streams leading to favorable returns over a long period of time.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION