Date & Time: 07th May 2021, 05:30 PM – 06:30 PM IST

Speakers:

Naveen Chandramohan- Founder & Fund Manager, ITUS Capital

Moderator: Kamal Manocha- CEO & Chief Strategist, PMS AIF WORLD

Constructing a portfolio in India, amidst uncertainty

With the global pandemic firmly rooted in our ‘normal’ life, the seeds have definitely been sown in the economy as well. Along with fear, comes uncertainty and it is precisely this uncertainty that has left investors on a cliff. The real question that they ask themselves now is nothing but the question of constructing and building their portfolio- moulding it in a shape that fits this uncertainty well.

In this webinar hosted by PMS AIF WORLD, Mr. Naveen Chandramohan of ITUS Capital, having an experience of 15 years, shares his insights on portfolio construction during such times.

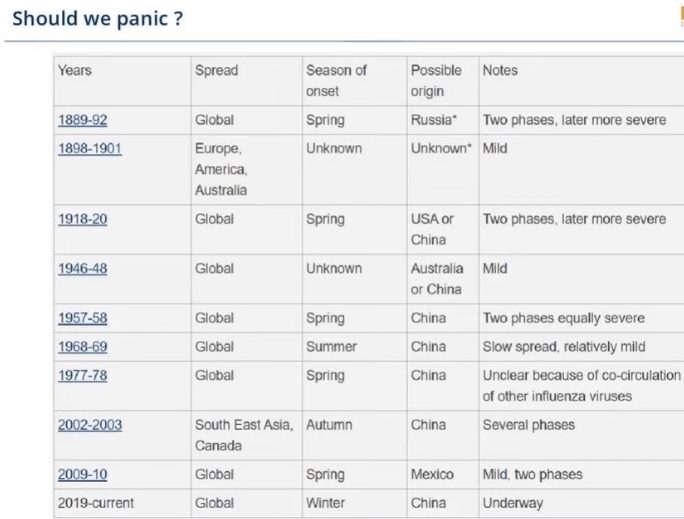

Being in the middle of the storm, it is indeed difficult for investors to stay calm. It is easier to sit back, but what is right is difficult- which is to learn from history. If we look back at some of the past crises (as observed in the slide below), one thing is common across the board— most of them have had two or three phases in which the severity amplifies or the severity tapers off from the second phase onwards.

The fact of the matter is that India did not prepare itself much for the second wave before its onset; so there is no point looking back now and asking, “What could we have done?” What is important is, what can now be done. From the above table, we can deduce that most outbreaks have lasted for a span of two years and most of them have tapered off in the second phase. As of the current pandemic, vaccination seems to be our likely solution and that too a very hopeful one. To give a breather to the current chaos, the cumulative growth numbers should be looked at— the cumulative growth rate (of COVID-19 cases), from a 7-day Moving Average, continues to fall in the second phase and is currently at 2.1%. Similarly, from a 7-day Moving Average perspective, the growth rate has also been increasing, courtesy selective states going into semi/full lockdowns and the vaccination pace picking up. Lastly, the daily death count (again from a 7-day MA perspective) is also stabilizing.

(All data has been taken from India Covid-19 tracker.)

Taking a step back, let us understand how the numbers have panned out for the Real Economy.

- The trend in GST Collection on a M-o-M basis (from Oct ’20 to April ‘21) is positive and April ’21 recorded the highest collection during this time frame. (Data: Ministry of Finance)

- There has been a robust increase in power consumption over a 30-day period or a 90-day period (both ending on 5th May) in this year as compared to last year. This is evidence that the economy is growing. (Data: Power Data, Economic Affairs)

- The growth in issuance of FASTags also shows improvement in mobility and a fairly healthy economic growth. (Data: Power Data, Economic Affairs)

What does all this mean to an investor?

India is now at an inflexion point of positioning itself as a manufacturing hub economy. India today, from a statistics perspective, matches that of China of 2005, with respect to % contribution of manufacturing sector in the GDP. Interest rates being low is a big factor conducive of economic growth. Apart from this, the fact that the share of the unorganized sector to GDP is coming down and this would certainly provide a philip to per capita GDP Growth.

Keeping these factors in mind and looking at the current situation with a foresight, an investor’s portfolio today, keeping a long term (3-year) horizon, should have exposure to:

- IT/Technology

- Pharma

- Domestic Manufacturing (Contract mfg., pharma mfg., or specialty chemicals)

- Platform / Infrastructure plays (like IndiaMart)

While there is pessimism regarding FDI and FII inflows into the country, what can give solace to this is the fact that MNCs are in dire need of diversifying their manufacturing units across geographical locations. Apple, for instance, is setting up one of the largest mfg. units in the outskirts of Tamil Nadu. The shift is happening but whether or not this can pick up pace at good speed, only time will say. The current pandemic is not the right market for companies to immediately move to India. Things will have to stabilize and we will have to live through this second phase to witness the change.

There are 2 kinds of opportunities— one is in our control and one is beyond our control. The opportunity in front of India today is in our control, as long as we execute this phase in the correct manner.

It is not wise for any investor to follow the “Buy & Forget” approach. A long-term horizon, in his view is of 3 years. Investors should re-visit and re-assess their portfolio from time to time. Keeping this in mind, along with the optimism he has, two sectors to look out for in the coming 3 years would be Pharma and Domestic Manufacturing (specific to R&D driven specialty chemicals).

Talking about secular stocks or consistent compounders, that maybe a huge chunk of an investors portfolio, Mr. Naveen Chandramohan emphasised on looking at shareholder returns. Many a times, once valuations are thrown out, the business growth usually does not discount in for the price an investor is looking for. There is nothing wrong in holding such good quality stocks but every fund manager should bear in mind that cycles change every now and then, and living through each cycle is what questions their sustainability.

One needs to make a distinction between great quality businesses and great shareholder return businesses.

A good % of allocation of a particular stock in the portfolio does not necessarily mean that it has the potential to generate the maximum returns, but on the contrary, it is because the fund manager expects the minimum drawdown on this investment as compared to other investments.

When we construct portfolios, the focus on drawdown is more important than upside maximization.

Taking note of the above statement, Mr. Naveen Chandramohan talked about Syngene International Ltd., one of their top holdings. Syngene International, in its initial years, was to Pharma, as was TCS & Infosys to IT, in their initial years. Many Fortune 500 Pharma companies started to outsource their R&D to countries like China and India because they get access to good quality PhDs and Scientists at about 40% less costs than that of the US. It is important to understand here that the stickiness of working with a Fortune 500 company, a B2B Contract, increases over time. Now Syngene International, post research also started developing manufacturing capacities. The interesting thing to notice here is that the P/L Statement of Syngene looks extremely stressed. The P/L growth over the last 2-3 years has merely been 12-14% annualized growth. However, the free cash flow growth has been consistent at 85-90% over the last 3 years. This signifies that this FCF has been re-invested as capex. The question that arises now is whether this capex will be used to improve the fixed asset turnover of the business or not; because if that happens, a very good inflexion point will come into picture.

A lot of people today invest in a lot of companies. What is the right number- how many companies should one have in the portfolio? To answer this question, an investor should ask himself two questions:

- Do I know the CEOs of all these companies?

- Do I know the market cap of all these companies?

If the answer is no, it means that there are way too many companies in the portfolio.

This knowledge was paramount to his understanding to lay foot on investing in Tata Consumers. Tata Consumers forms a small % of allocation in his fund. When Mr. Natarajan Chandrasekaran firmly set out the 5 businesses Tata Group was to focus on, Tata Consumers was one of them. Around this time, Mr. Sunil D’Souza was appointed the CEO of Tata Consumers. ITUS’ investment in Tata Consumers primarily revolves around the alignment plans set out by Mr. Sunil D’Souza. But, they have not made any new investments in the last half year as the current valuations do not give them that comfort.

On the other leg, they also have ITC which is one stock on which they are in the red from the time they’ve invested. They are in the middle of evaluating whether there thesis on ITC is right or wrong. Investing in a biz. by looking at its P/E is a flawed way of investment. Every (ITC) investor knows that the FCF generated from the robust cigarette biz. has been invested into the EBITDA loss making (over last 6 yrs) Hotel Biz. of ITC. The hold is because of two reasons. One, the management at ITC are acknowledging that they are not expanding the Hotels Biz. as needed and second, the FMCG margins have started to improve. If both of these stay put as is, ITC would generate a healthy return from a shareholder perspective. Even if one of this goes wrong, their thesis around ITC will be questioned and they would exit ITC.

To conclude, keeping the future in mind, once this phase tapers off, it is not necessary that the rise in interest rates will be supported by an underperformance in equities. If we go back in history and look at periods 1996-2000 or 2003-2007, these are the two biggest bull market periods of the US. The same period witnessed an increase in interest rates from about 3.25% to 6.5% in the US. This is history enough to suggest that it is not necessary for equities to go down when interest rates are increasing. To put it into perspective, interest rates will only see an increase when the economy revives, when inflation stabilises, and when growth takes shape— all of which is conducive to equities. So with a move in interest rates, it is not necessary that people will pull money out of equities and put into debt; but what could happen is that the rose-tinted valuations of certain companies will start coming under questions.

So, construct a healthy portfolio and build a thesis around each biz. Revalue and reassess the thesis from time to time and exit if needed. Irrespective of who the fund manager is (including yourself), there will be mistakes; the important thing is to be open about it, acknowledge it and stick to the rules that need to come into effect on happening of such mistakes. Uncertainty will always be there, have a good time horizon in frame, identify the right businesses, and returns will take shape.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION