Can low risk lead to higher returns?

In a phase, where the market is firing away, one strategy in long-short space has been quietly making a steady journey. The strategy doesn’t get carried away by market euphoria and maintains the disciple of extracting alpha from the market. It would buy the stocks that are looking fundamentally better with a potential to outperform, and short stocks that are ripe for underperformance or fall in absolute terms.

So how does the strategy cut market risk?

By running a low net equity exposure, i.e., total longs less total short positions are kept minimal. This reduces market direction risk. Further, this long-short fund significantly diversifies the portfolio (both on the long and short side) across a large number of stock positions which minimizes the impact of a few stocks that may move adversely.

The said fund has beaten equivalent and higher-risk products across Mutual fund and AIF platforms with relative ease. While much of the talk these days has been centered around which funds or stocks have given the best returns, this fund has been making money on both buy (longs) and sell (short) positions. As market valuations rise in the backdrop of high cost/inflationary pressure, it is likely that the cream has already been skimmed, and the ride from here will come with more speedbumps. In such a scenario, it makes sense to look at this long-short fund which doesn’t hesitate in shorting the business that show signs of weakness.

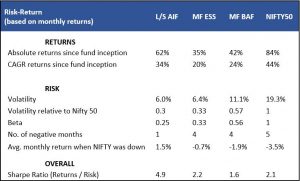

How well the fund has done both in terms of risk management (low volatility, downside prevention) and returns (primarily driven through alpha extraction) comes out very well from the table below:

- Fund performance is on a gross basis (i.e., post opex, but pre- fees). MF returns are the average of category returns under the “Direct” option

- Source: Capitaline, MFI, and internal calculations

As observed in the above table, the performance of this long-short fund has been compared with low-risk equity categories on the mutual fund platform, like Equity Savings (ESS), and Balanced Advantage Fund (BAF). For the comparison purpose, categories’ average returns under the “Direct” option have been considered.

Here, it is observed that this L/S fund has demonstrated the best risk management – lowest volatility and beta in returns, the fewest number of negative months, and even generation of positive returns during the market’s down months.

PMS AIF WORLD observed these numbers to understand in-depth, as these numbers show that this one AIF had taken relatively low net equity exposures, but delivered a good performance. Typically, in the bullish phase of the market, the higher risk (higher equity exposed) funds do best. Instead, what we see here is an asymmetrical behavior where the fund taking the lowest risk has generated the highest returns across the board that too in one of the fiercest bull market phases. This warrants special attention and analysis.” And, that is reason to publish this article

Breaking the mystery, allow us to introduce this Long-Short fund to you, it is TATA Equity Plus Absolute Returns Fund. This fund is managed by Mr. Harsh Agarwal, Head – Alternative Strategies, Tata Asset Management.

In his words – “As the name of the fund name suggests, the fund brings the benefit of structural uptrend in equities with an absolute return characteristic. The fund endeavors to capture a large part of the market upside without participating too much on the downside. He says, “we want to create a new equity product category through this fund – which is, ‘the lowest risk equity fund’. He adds, “we want the investors to benefit from opportunities that the equity market provides without having to take too much risk.”

CEO of PMS AIF WORLD, Mr. Kamal Manocha had done a detailed webinar with Mr. Harsh Agarwal on 24th Sept 2021. And, subsequently, he had been studying this space comparing all types of long-short funds in terms of performance, risk, and consistency.

The performance of TATA Equity Plus Absolute Returns Fund (the L/S category III AIF) really defies the notion that “Higher returns calls for higher risks”. This fund instead aims for the opposite – higher compounded returns by seeing less drawdowns.

To learn more about this product or to meet the fund manager, feel free to contact us.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION