Date & Time: April 28, 2022 @ 04:00 PM IST

Speakers: Mr. Varun Daga, Co-Founder & Fund Manager, Girik Capital

Mr. Harshad Patwardhan, Chief Investment Officer, Girik Capital

Moderator: Kamal Manocha, Founder & CEO, PMS AIF WORLD

Mr. Kamal Manocha, Founder and CEO of PMS AIF WORLD held an engaging webinar in conversation with Mr. Varun Daga, Co-Founder & Fund Manager, Girik Capital and Mr. Harshad Patwardhan, Chief Investment Officer, Girik Capital to help investors understand and acquaint themselves with the CANSLIM way of investing in equities.

About PMS AIF WORLD

PMS AIF WORLD is a knowledge-driven, New Age Investment Services Company, providing analytics-backed quality investing service with an endeavor and promise of wealth creation and prosperity. We offer the finest PMS & AIF selection process after analyzing the products across 5 Ps – People, Philosophy, Performance, Portfolio, and Price, with an endeavor to ascertain the Quality, Risk, and Consistency (QRC) attributes that covers 9 ratios. We do such a detailed portfolio analysis before offering the same to investors.

We are a responsible and long-term investment service provider in the space of Alternates.

Invest through us in the best quality products and make informed investment decisions.

Speaker Profiles

Mr. Varun Daga and Mr. Harshad Patwardhan are part of the core investment committee at Girik Capital.

Mr. Varun Daga, who is the co-founder of Girik and jointly leads the investment decision-making process, he previously ran the equity investment division at his family office from 2006 to 2009. He holds a Bachelor of Management Studies, majoring in finance from Narsee Monjee College of Economics.

Mr. Harshad Patwardhan has over 27 years of experience in the market. He has previously worked with JP Morgan India and Edelweiss AMC. He is the Chief Investment Officer and jointly manages the investment decisions with the fund managers at Girik Capital. Apart from being a CFA charterholder, he has pursued B.Tech from IIT Bombay and PGDM from IIM, Lucknow.

Webinar Overview

The idea of investing the CANSLIM way came from William O’Neil, an American entrepreneur, who believed that a concrete methodology will lead to greater ideas into focus. Girik Capital is a boutique fund management house that has an AUM of over ₹1,000 cr spanning over 13 years of its existence.

They have a single multi-cap strategy where stocks are selected from large cap, mid cap & small cap. Furthermore, 15% of promoter’s share in the business proves that they have their skin in the game. Their prime focus is to deliver returns by investing in 25-30 businesses at any point of time.

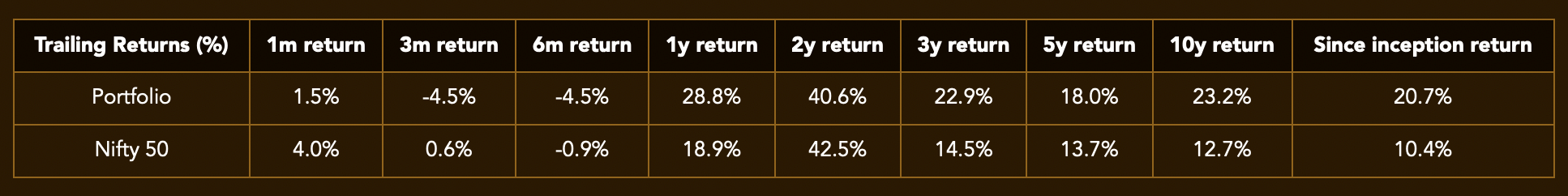

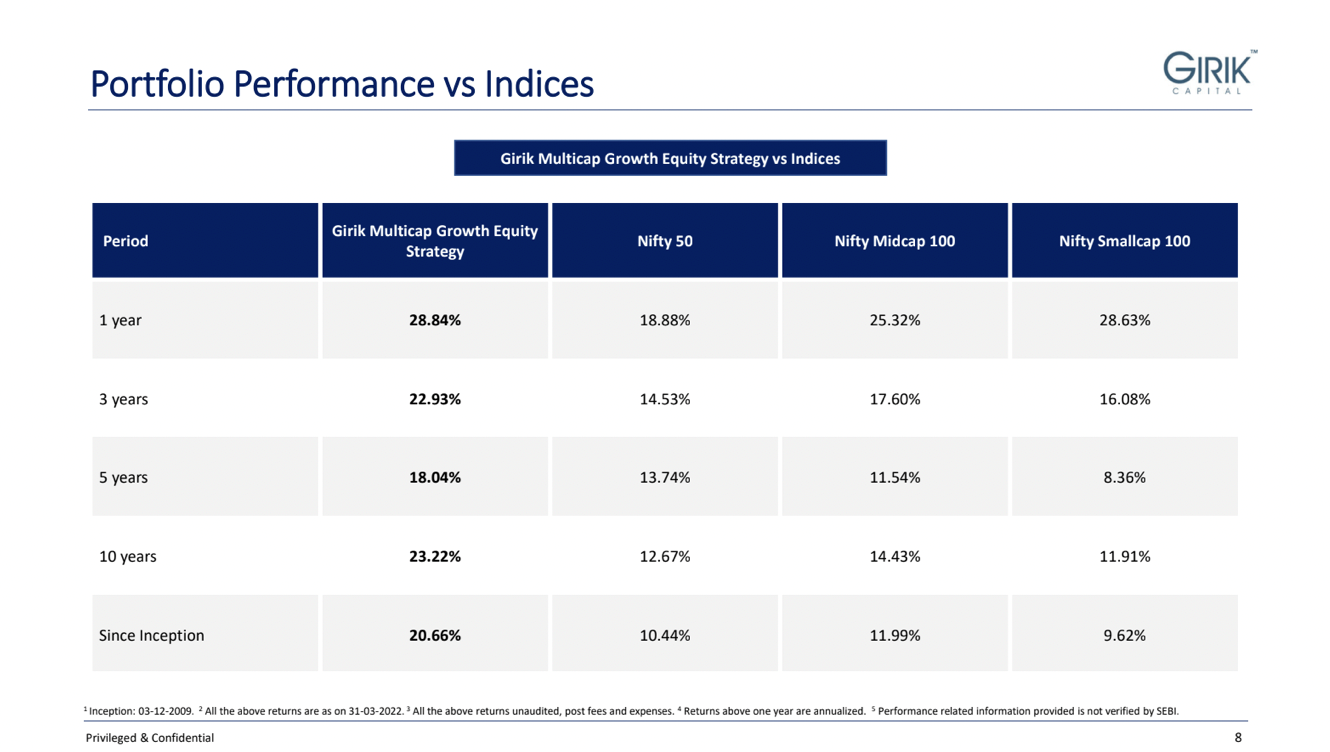

Girik Capital’s Multicap Growth Equity Strategy PMS has been delivering good returns over a long period of time:

The idea is to grow into a size rather than buy size, says Mr. Varun Daga

It is prudent to buy low and sell high, but at Girik Capital, the belief is twerked where buying higher and selling even higher makes its way. The unbiased approach of investing by the house has reaped returns for them over the years. One can make money in different sectors over a suitable period of time given a pre-requisite of an open mind.

The firm remains ahead of the market indices as far as returns and wealth creation is concerned over the last 10 years. The journey and partnership between the fund manager and the investor acts like a catalyst in the wealth creation process. The tough decisions taken during moments of turbulence show that the fund management house has built sufficient trust to draw fresh capital.

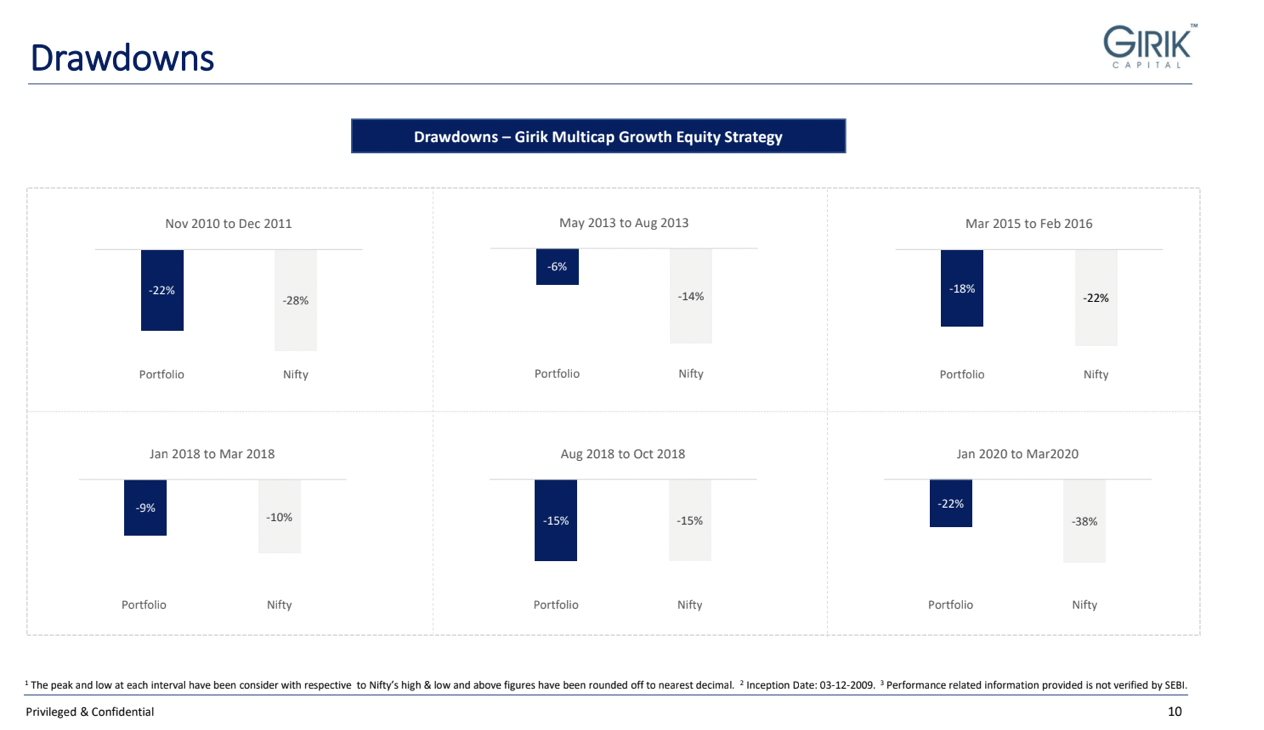

Times of crisis yet again prove a firm’s belief and the trust it has developed with its clients. There have been 6 major downturns post Girik Capital’s inception and it has always fallen less than the market index.

Managing risk is important as the risk reward relationship is indeed a precarious one.

At Girik Capital, they follow a model portfolio approach where the investor’s money is not allocated at one go. Investments are not made at any price as the creation of processes and systems takes time. The CANSLIM strategy has proved beneficial for the firm as it’s multi-cap portfolio ranks among the top 5 in the country. A lot of backtesting has been done in different markets across the world before choosing the strategy.

Screeners are placed based on price, earnings acceleration, and industry with the portfolio under question. Industry being the most important screener as 50% of the stocks movement is in direct relation to the industry it is in. The saying goes as ‘Let’s buy it, the stock is trading at its 52-week low’ making price the second most important screener.

However, a comparison between a portfolio comprising of 52-week lows and 52-week highs proved that the latter won by a bigger margin. There are stories like CDSL, Angel, Dixon, Bajaj Finance and very recently Shoppers Stop that have added value to the portfolio curated by Girik Capital. Fundamental changes within a company are the guiding path to unlock hidden value.

There are winners in every portfolio but CANSLIM has taught the firm how to ride the winners, says Mr. Varun Daga

Girik Capital’s investment in Tata Elxsi shows that earnings acceleration plays a pivotal role in generating returns. Reverse engineering and sufficient back testing has helped the fund house understand where money can be made rather than relying on some predominant values and norms. Lastly, governance and leadership also take up a small portion of the check list criteria before making an investment.

Another important market learning that came across the webinar was that one must not compromise quality for price. It is earnings acceleration that is a motivating factor to enter and be a part of an organisation. Furthermore, Mr. Varun Daga dug deep into the CANSLIM strategy and helped the viewers understand the acronym in a better way.

C- Current earnings acceleration

A- Annual earnings growth

N- New Product, service and management

S- Supply and demand

L- Leader or Laggard

I- Institutional sponsorship

M- Market direction

Delivering returns at a brisk pace and understanding various elements of investing is achieved through the CANSLIM way of investing. New IPOs have also made it to the criteria list for Girik Capital as they have held several in their portfolio. The supply and demand of a stock helps to ascertain how liquid it is and aids a suitable entry/exit strategy.

Girik Capital may not be on the 1st position in the industry but it should have leader metrics to take that position. An increasing institutional ownership is another suitable criterion to look before investing in a stock. Moreover, the aspect of risk management is covered very well when the firm looks at the market direction for guidance into the future.

Losses are made by everyone, but it is crucial to accept and reduce them at the earliest, says Mr. Varun Daga

At Girik Capital, care has been taken to enter liquid stocks and create a balanced portfolio. The reopening of several hotels and consumers taking the shopping spree has led to quite a few opportunities for the fund house.

The IT and metals have led the bull run but are in consolidation at the moment. They are on the prowl for a company with good management and an excellent product line. For Girik Capital, it is true that what has worked for them 10 years ago may not work out soon.

Markets have been turbulent over the last few months, and it is important for all to find pockets of strengths. Index funds have underperformed over the last two years, but investors want to ignore the fact and are keen to invest in them, as put up by Mr. Kamal Manocha, Founder & CEO, PMS AIF WORLD.

To better understand the physic of investors. Mr. Harshad Patwardhan exclaims that the dispersion of stock returns should be understood deeply. With index funds, sufficient capital is lost in losers as the exposure is for all stocks in the index.

Girik Capital’s philosophy states that to invest in a disciplined manner, investors should have a process that is followed regularly and try not to get their emotions better of them. The structural bull run is poised to ring in favorable economic conditions and the markets performing better. It is only through informed decisions and managed portfolio that one is going to outperform the index in the next few years.

The aim is to use our intelligence in an efficient manner, weed out the losers as quickly as possible, not be wedded to a particular story for a long time and manage risk closely and diligently to generate returns consistently.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION