Date & Time: 27th August 2021, 05:30 PM – 06:30 PM IST

Speakers:

Nishit Shah, Fund Manager- PMS, PhillipCapital (India) Private Limited

Mihir Shirgaonkar, AVP- Alternative Investments, PhillipCapital (India) Private Limited

Moderator: Sankalpo Pal-Biz. Development, PMS AIF WORLD

Emerging Opportunities in the Indian Equity Markets

Global Diversification & Customized Portfolios

A customised portfolio along with a global diversification in it helps investors to manage country specific risk and also meet their specific requirements. With global capital markets experiencing a bull run, it was an opportune time for PMS AIF WORLD to keep a webinar to address opportunities and strengths in the global space. The webinar started off with Sankalpo Pal (who takes care of Biz. Development at PMS AIF WORLD) highlighting the importance of a sound PMS that helps managers and investors take informed decisions. The genesis of PMS AIF WORLD is found in QRC – Quality, Risk, and Consistency along with its dominance in the investment horizon space of Alternates. One of the esteemed guests for the webinar was Mr. Nishit Shah, AVP- Investments & Fund Manager- PMS, PhillipCapital (India) Private Limited, who has over 15 years of experience in the stock market, including Motilal Oswal and Sushil Finance. The second guest was CFA, CA, Mr. Mihir Shirgaonkar, AVP- Alternative Investments, PhillipCapital (India) Private Limited, who has over 6 years of experience in the assets management industry and is also a graduate from IIM-Ahmedabad.

Mr. Nishit Shah stated that Phillip Capital has over 40 years of experience with a presence in 15 countries. It is headquartered in Singapore and has shareholder funds in excess of USD 1.5 billion. Although being one of the late entrants to the PMS scene in India in 2016, their USP was playing the role of a boutique PMS provider. The access to global research has carved out a niche for PhillipCapital and its investors. The four pillars of PMS for the global asset management firm are ‘No model portfolio concept’, ‘Staggered Investments’, ‘Strict Discipline’ and ‘Hand Holding’. Customised client portfolio has helped them stay differentiated from their competitors. The investing thought process has been to make informed and correct decisions rather than timing the market. It is not necessary to invest the corpus on Day 1 itself. Moreover, it is prudent to wait for the right opportunity to come by and then take the ride.

The biggest learning in the last 15 years of my stay in the markets is that you may go wrong even after doing a lot of research, says Mr. NIshit Shah. But the idea is to accept that, and exit such businesses and move to better ones.

The firm had invested in Inox Leisure Private Limited and VIP bags in late 2019 and early 2020. However, keeping the global trend of the pandemic in mind they realised that the two ventures would fair badly in an adverse scenario. Hence, the management decided to sell the stocks at 15-20% loss post which they did fall 30% more with the nationwide lockdown being called. The relationship management team has been vital in understanding the requirements of investors and aligning the same with their investments. The investment philosophy has been to keep the winners as long as possible and sell the losers immediately. The ‘Clear No Go Areas’ are cyclical areas, companies with huge debt and dubious management teams. The firm is predominantly high growth-oriented combined with entering a stock at the right price.

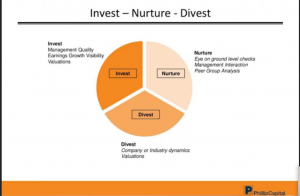

The filters present are into three broad categories namely – Invest, Nurture, and Divest. The first filter takes care that companies with a dubious management team is discarded. Poor earnings growth visibility and poor valuations are also a part of the first filter. A continuous eye on the investment helps the management team nurture it along with a sound peer group analysis. The company and industry stakeholders have a lot to say about the internal affairs concerning distributors and suppliers. Intricate detail to information provided by them helps to take informed decisions. HDFC Bank has fallen more than 20%, four times in its history and not to forget a 57% fall during the financial crisis. However, an investor could have gained 600% had the stock been held through all the downturns. Constant monitoring of the portfolio helps in avoidance of risk. A longer term approach helps you to see a wider picture that has the ups and downs. There are several strategies that are followed along with unique products but the one that has stood out is PACES: A Completely Customised Portfolio for investors. Customers have the option to create a portfolio that is ESG compliant, Thematic, Concentrated, or Diversified across asset classes. HNI clients have received phenomenal returns as portfolios are customised according to their requirements.

Mr. Mihir Shirgaonkar expressed the importance of IFSC and The Gift City advantage. The IFSC Authority was established as a ‘unified regulator’ in 2019. Seamless investments are possible through an efficient mechanism that was possible with the birth of The Gift City. It allows investors to take up positions in international markets and also LRS remittances for the same purpose. There are a couple of exchanges that have been built in 2016. When comparing Nifty 50 yearly returns with global indices over the last decade, it has not been the outperformer. It brings in the aspect of global diversification that leads to significant returns for investors. The US Indices namely Dow Jones, NASDAQ composite, and S&P 500 have outperformed on a CAGR basis compared with other indices. Technology and disruptive innovations have been heavily rewarded as seen in the NASDAQ composite in the last 10 years that has outperformed its peers. Single country risk exposure is mitigated with global diversification objectives. The GIFT City mechanism allows Indian investors to participate in global disruptive innovations with ease.

Adoption of ESG principles and climate change considerations has set a trend in global investment markets. Disruptive innovations in Technology, Healthcare, Financial Services and Manufacturing have the potential for generating superior returns. Moreover, these trends are visible in developed markets. Business dynamics have changed and so has Industry 4.0 considerations.

Today, technology is not considered as a standalone sector but embedded across traditional investments, says Mr. Mihir Shirgaonkar.

ETF industry has more than 9000+ products in 60+ countries with varied asset classes and financial instruments. Phillip Ventures IFSC Pvt. Ltd is domiciled in GIFT City and as part of their initial offering they have come up with an ETF portfolio. The portfolio management philosophy is driven by a value proposition that focuses on Long Term Wealth Generation. A research driven approach helps in leveraging global expertise. Global investments turn out to be seamless along with enabling participation in Trends of Today and Ideas of Tomorrow. The approach in managing investments is to monitor structural developments and aligning portfolio management processes. Adopting stringent risk management process leads to quantitative filters and qualitative assessments. The Phillip International Pioneer Portfolio lays emphasis on innovations and regional developments that has a potential upside. It is an equity-based ETF with the flexibility to invest in other asset classes as well. Capital appreciation via taking exposures in Sectors, Themes, and Geographies is ideal for the organization. The Phillip International Universal Portfolio is a multi-asset portfolio focused on achieving diversified exposure across instruments.

The first question lined up for the evening was the functionality of a SEZ and how the GIFT City improves the country’s financial system. Mr. Sankalpo Pal rightly pointed out that GIFT City is a Special Economic Zone built for seamless investments for all. Mr. Mihir Shirgaonkar elucidated that for the purpose of complying with the Foreign Exchange Management Act (FEMA), investments made in this SEZ are considered to be overseas investment. USD investment is promoted as it is a standard currency across the globe. The GIFT City has a unified regulator of its own and regulations are based on the investments guidelines laid out by SEBI. It is considered to be a doorway for inward and outward remittances especially making global diversification much easier for Indians. There are several dollar based contracts that are listed here. Investors not aware of various international products and stocks to buy have the option to invest in a customised portfolio through PhillipCapital. Mr. Sankalpo Pal looked ecstatic when he mentioned that discretionary PMS looks like a relic of the past. He took a question from the audience who was intrigued to know the value add at PhillipCapital and the various challenges that come its way.

The mandate that an investor signs before disbursing funds highlights the investment management process and the kind of products that will be included in the scheme. For e.g., large family offices are turning ESG compliant and hence investors are following their footsteps. Mr. Nishit Shah exclaimed that all investors have varying needs and requirements. Therefore, a curated portfolio works best for the investment team and the investor as well. The return to be generated for the clients does not take precedence over the business scalability. A curated portfolio just in the auto sector would not be advised by PhillipCapital as it has research-based conclusion that the sector will not outperform in the next 2 years. The primary objective has been to address the clients concern from the start itself.

A member of the audience asked about the geographies’ that PhillipCapital invests in where Mr. Sankalpo Pal was also intrigued to know about the process of fund disbursal while investing in GIFT City. Mr. Mihir Shirgaonkar stated that the firm has various country specific ETFs as there are 9000+ investible products in this industry spread across 60 countries. ETFs are broken down from geographies to sectors and lastly a particular business idea. The top-down approach helps to keep investment objectives in mind. The post-pandemic recovery is dominated by developed markets that are bound to outperform others. The unit currency of investment in GIFT City is USD and the firm currently invests in US ETFs and dollar as well. The LRS route is also available for customers to remit funds to them directly. Foreign currency account or Indian Banking Unit helps investors to maintain funds in international currencies. The regular taxation rates apply to investors as tax benefits are currently for business enterprises located within GIFT City.

The standard fee structure is followed by PhillipCapital wherein management fee and performance fee apply to all investments. A fixed fee structure is followed for investments in GIFT City products. The signature product offered by PhillipCapital is the Phillip Signature India Portfolio as it is a well balanced portfolio of large cap, mid cap and small cap. The overall fund philosophy does not change as the research driven mindset of the analysts upholds the motto at all times. The disciplined approach followed across the organization has helped reap better returns for clients.

The webinar was well capped off with Mr. Nishit Shah stating that the broader outlook for the Indian economy remains positive in the next 2-3 years. However the next 7-8 months are poised to be volatile as corrections above 10% were not visible in the last 1.5 years. A lot of opportunities are present in the mid and small cap space for investors. Mr. Mihir Shirgaonkar expects stress in the global equities space due to the various lockdowns imposed in specific countries. The low interest rate environment and the recent fall in the US Treasury Yield might leave suitable opportunities for various clients. Lastly, continuous monitoring of portfolio helps in consistency of returns and global diversification leads to better and superior returns.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

At PMS AIF WORLD, all PMS AIF Products are listed with all possible information and data for investors to understand & compare these products from the lens of risks as well as returns.

A unique proprietary framework has been founded by PMS AIF WORLD whereby 3 important attributes i.e. Quality (Q), Risk(R), and Consistency(C) are presented for more than 150 portfolio management services by covering 9 factors like Standard deviation, Beta, Sharpe, Alpha, Consistency Ratio, and so on. Many investors as well as the industry are using this proprietary framework to learn, compare, and select the best PMS products in India.

Here is the link to Register and access our QRC Database.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION