What’s common between

Inflation and James Bond?

They are both licensed to kill…

The latest James Bond movie combines the best of old-world espionage and modern-day filmmaking. Daniel Craig transitions James Bond to the modern world and leaves the fans desiring for more.

Just like James Bond kills the enemies of her majesty, Inflation kills or destroys your wealth… in true 007 style. You then have to destroy or mitigate its effects to create wealth and built a corpus to be used in the future when your income stream might reduce, or you might not be as inclined to continue your mundane professional life.

We all know that one needs Equities to beat inflation and create wealth. The focus of our study in this article is to show real-life situations and examples of how daily lifestyle is affected if you don’t mitigate the inflation risk.

CASE 1: Bollywood

In our first case study, we will use Bollywood to effectively show how inflation can affect your lifestyle and can be the proverbial silent wealth destructor as unlike stock market indices, we don’t see inflation making huge noises every morning.

We did a very simple exercise to understand lifestyle inflation.

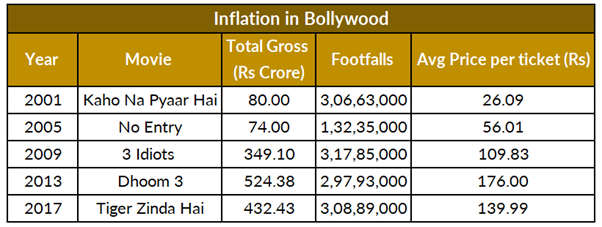

We took the highest grossing and the most popular movies from 2001 onwards and calculated the price per ticket from their India sales. Then we checked the average price per ticket at an interval of 4 years.

P.S.: We took the highest-grossing movie for the Year.

It’s interesting to observe that the average ticket price almost doubled every 4 years except the period from 2013 to 2017. We don’t have the numbers from 2017 to 2021 as Covid has kept movie theatres shut for most of the country.

Prices doubling every 4 years mean a CAGR return of close to 19%. There could have been technological advances, or the number of theatres increased in India, but the fact is that the average price increase is much higher than any inflation metric. So, if you want to watch the blockbuster Bollywood movie in 2031 you have to have an antidote to inflation.

CASE 2: Vada Pav

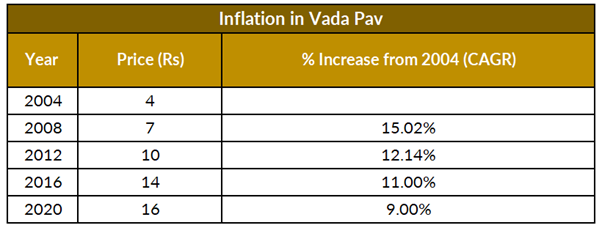

If you have visited the Western State of Maharashtra – you would have noticed that a common man’s breakfast/ snack/ lunch/ dinner could all, be combined into one food item, VADA PAV. Let’s understand how the Vada Pav prices have moved over the last 16 years.

The prices are indicative and have been taken from a local Vada Pav vendor who has been in business for the last 30 years.

Vada Pav which is considered the food of the common man in Maharashtra has seen a price rise CAGR of 9%, a tad bit higher than the actual inflation represented by the notified basket of goods as per the government of India. If this is the inflation in the most common and cheap foods, think of your fancy restaurant meal and try to comprehend the price, you would start thinking of Inflation and possibly think of ways to prevent inflation from eroding your wealth.

CASE 3: Keeping up with Coffee!

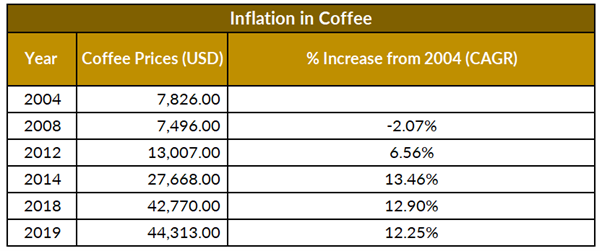

Around the world, a couple of billion people wake up to the smell of coffee every morning, so we could not help but include coffee in our study of how lifestyle inflation eats up your wealth. Seemingly innocent, nobody ever thinks they can run out of coffee money, and we can’t blame people for that. However, we can’t underestimate the inflation commodities like coffee are subjected to. Let’s take a look at the chart below to understand how coffee prices have behaved in the past.

In the above table we have taken coffee prices represented by the producers’ prices per tonne, thus representing a CAGR price rice of close to 12.25% since 2004, which means to enjoy your coffee over the next couple of decades you have to grow your wealth at a rate higher than that or reduce coffee consumption (what a nightmare!), otherwise, there is a very small but real risk that you would have run out of money to purchase adequate coffee.

Since coffee is traded as a commodity, the prices can fluctuate from time to time, and this is quite visible in the above table. However, despite all the fluctuation, there’s a low double-digit price CAGR for producing coffee— again inflation, the SILENT WEALTH DESTRUCTOR strikes.

It’s important that we beat inflation to create enough wealth to sustain our lifestyle over the next 20, 30 or even 40 years.

How do we do it? Like it has been said in multiple notes and webinars— the only answer to inflation is Equities. We go one step ahead by saying that do not just involve yourself in equities but practice informed investing to beat inflation and sustain wealth.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

At PMS AIF WORLD, all PMS AIF Products are listed with all possible information and data for investors to understand & compare these products from the lens of risks as well as returns.

A unique proprietary framework has been founded by PMS AIF WORLD whereby 3 important attributes i.e. Quality (Q), Risk(R), and Consistency(C) are presented for more than 150 portfolio management services by covering 9 factors like Standard deviation, Beta, Sharpe, Alpha, Consistency Ratio, and so on. Many investors as well as the industry are using this proprietary framework to learn, compare, and select the best PMS products in India.

Here is the link to Register and access our QRC Database.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION