TWRR vs IRR in PMS is a crucial comparison for investors looking to evaluate the true performance of Portfolio Management Services. Understanding the difference between Time-Weighted Rate of Return (TWRR) and Internal Rate of Return (IRR) can help you make smarter, data-backed investment decisions.

Introduction: Measuring PMS Returns Accurately

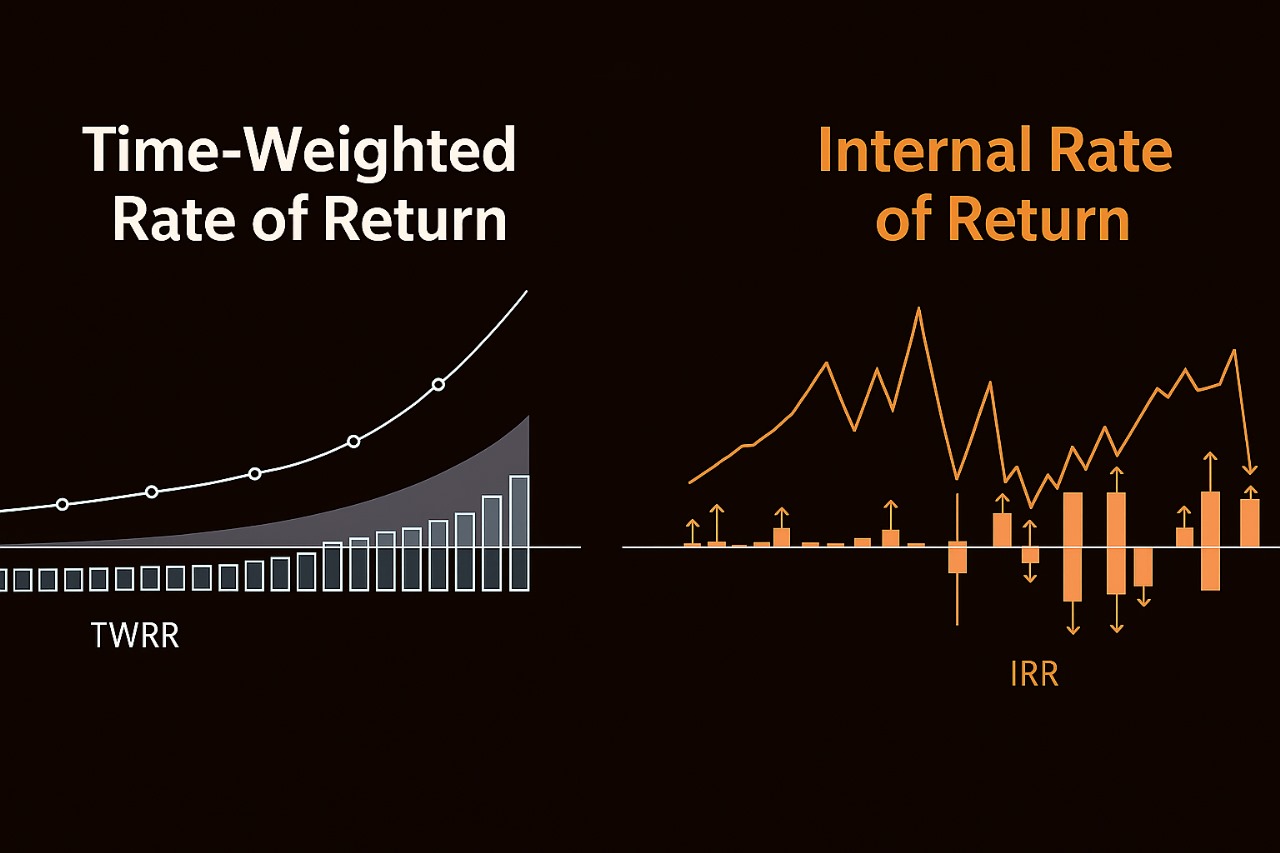

When investing in Portfolio Management Services (PMS), understanding performance goes beyond just looking at absolute returns. Two metrics commonly used are Time-Weighted Rate of Return (TWRR) and Internal Rate of Return (IRR). Each serves a different purpose — one reflects how the PMS manager performs, while the other captures the investor’s personal experience.

At PMS AIF WORLD, we believe in clarity. So let’s break down these metrics, how they apply to PMS, and which one matters for you.

TWRR vs IRR in PMS: What is Time-Weighted Rate of Return (TWRR)?

TWRR is the standard performance metric used by PMS providers. It measures returns by removing the effect of cash flows (i.e., when investors add or withdraw capital). This makes it ideal for comparing PMS strategies — as it reflects the manager’s stock-picking skill and asset allocation decisions.

How it Works in PMS:

PMS accounts are customized, and investors may invest at different times or add capital later. TWRR breaks the performance into sub-periods around each cash flow and calculates the return across those periods as if the manager had full control.

Use in PMS:

- Reported by SEBI-registered PMSes for performance disclosure

- Used on platforms (like PMS AIF WORLD) to compare different PMS strategies

- Helps evaluate manager’s alpha generation, independent of investor actions

TWRR vs IRR in PMS: Understanding Internal Rate of Return (IRR)

IRR, or Money-Weighted Rate of Return, tells the true return an investor earns — based on when and how much they invested or withdrew. It factors in the exact timing and size of cash flows, making it investor-specific.

How it Works in PMS:

If an investor puts ₹50 lakh on Day 1 and adds ₹10 lakh later, the IRR will consider those timings. If the market performed well after the ₹10 lakh was added, the IRR might be higher than TWRR. Conversely, if it dropped, IRR might be lower.

Use in PMS:

- Used in client-specific performance reports

- Shows how the portfolio performed from the investor’s lens

- Helps assess actual return on invested capital

TWRR vs IRR in PMS: Key Differences

| Feature | TWRR (Manager Performance) | IRR (Investor Experience) |

| Cash Flow Impact | Ignores investor cash flows | Includes timing and size of cash flows |

| Focus | PMS Manager’s skill | Investor’s personal return |

| Used In | PMS performance reports, SEBI filings | Investor statements and audits |

| Ideal For | Comparing PMS strategies | Measuring your personal outcome |

TWRR vs IRR: Key Differences

| Feature | TWRR | IRR (MWRR) |

| Cash Flow Impact | Ignores external cash flows | Includes timing & size of flows |

| Focus | Fund manager performance | Investor experience |

| Use in PMS/AIF | Used for standard performance reports | Used in client-level performance |

| Complexity | Requires period-wise NAV data | Needs all cash flow data + timings |

TWRR vs IRR in PMS: Simple Real-World Example to Understand the Difference

TWRR vs IRR — Simple Example with Different Results

Investor X’s Journey

| Date | Action | Amount |

| Jan 1 | Invested | ₹10,00,000 |

| Jul 1 | Added more | ₹10,00,000 |

| Dec 31 | Portfolio Value | ₹22,00,000 |

TWRR (Time-Weighted Return)

Let’s assume:

- From Jan to Jul, the PMS grows 30% (₹10L → ₹13L)

- From Jul to Dec, the PMS falls 10% (₹23L → ₹20.7L)

Step-by-step:

- Period 1 return (Jan–Jul):

R1=30%=1.30R_1 = 30\% = 1.30R1=30%=1.30 - Period 2 return (Jul–Dec):

R2=−10%=0.90R_2 = -10\% = 0.90R2=−10%=0.90

TWRR=(1.30×0.90)−1=1.17−1=17%\text{TWRR} = (1.30 × 0.90) – 1 = 1.17 – 1 = \boxed{17\%}TWRR=(1.30×0.90)−1=1.17−1=17%

TWRR = 17%

(Shows how the fund manager performed)

IRR (Internal Rate of Return)

Use cash flows:

| Date | Cash Flow |

| Jan 1 | -₹10,00,000 |

| Jul 1 | -₹10,00,000 |

| Dec 31 | +₹22,00,000 |

IRR ≈ 12.3%

(Shows what the investor actually earned)

Conclusion:

TWRR removes the effect of cash flows to isolate the manager’s skill. IRR includes the timing of your investments — and gives you the real return you earned.

When to Use Which?

| Situation | Recommended Metric |

| Comparing fund managers | TWRR |

| Evaluating investor-specific returns | IRR |

| Measuring portfolio manager skill | TWRR |

| Assessing real return to investor | IRR |

Both TWRR and IRR are important — but they serve different purposes. At PMS AIF WORLD, we help investors interpret these numbers correctly and choose investments with clarity and confidence.

If you’re unsure how your investment is performing or how to interpret your reports, our team is here to guide you — with transparency and insight.

Disclaimer: Securities investments are subject to market risks and there is no assurance or guarantee that the objective of the investments will be achieved. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements

Do Not Simply Invest, Make Informed Decisions

WISH TO MAKE INFORMED INVESTMENTS FOR LONG TERM WEALTH CREATION