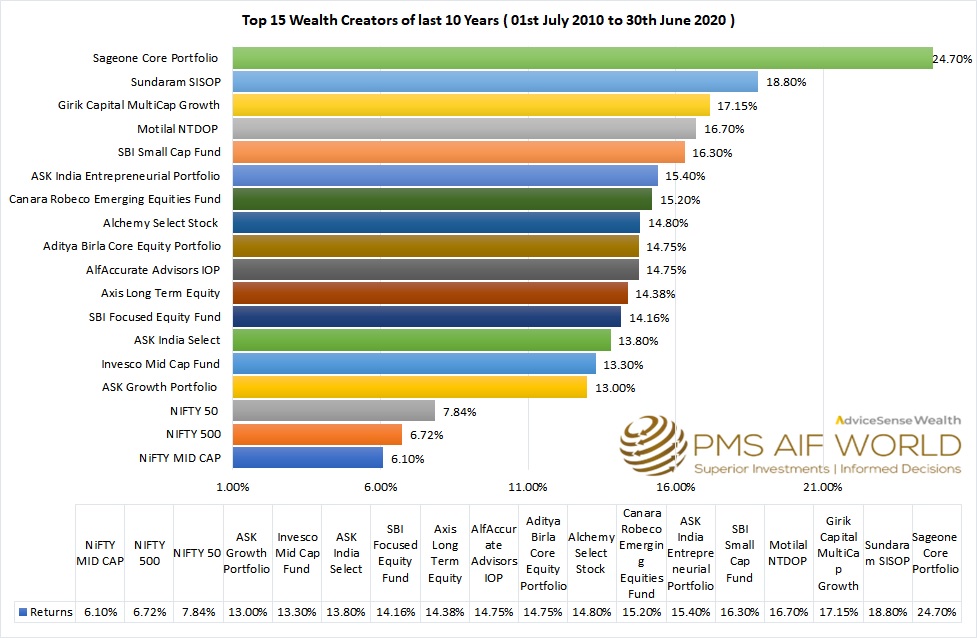

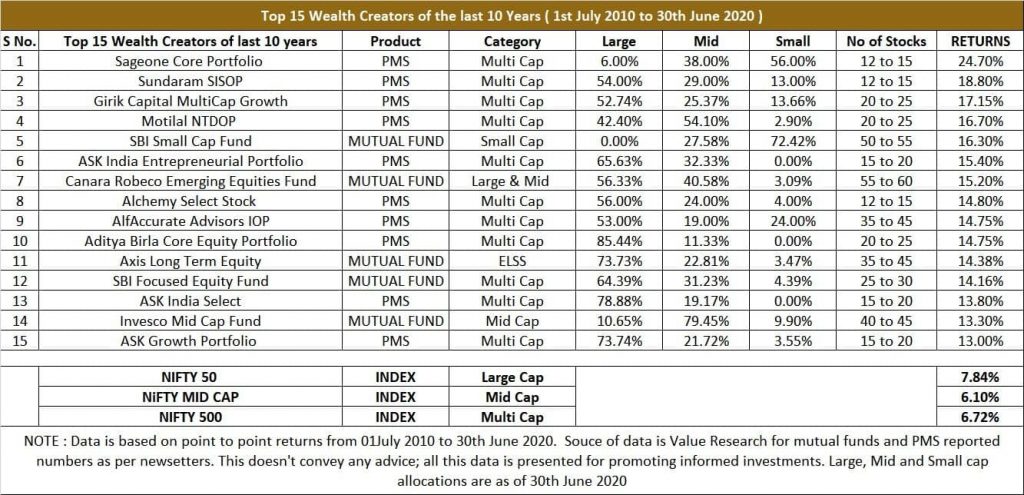

Top 15 Wealth Creators of last 10 Years

Across All Multicap, Large-cap, Mid-cap, Small-cap Categories of Mutual Funds, and Across all categories of SEBI registered Portfolio Management Services (PMS)

First of all, let us understand a few facts.

Going by number, more than 300 open-ended mutual fund schemes were in existence in 2010, but, there have been less than 30 portfolio management services that were prevalent then.

Additionally, going by the size, the equity mutual fund industry stands at a whopping 8 lac crores, but the size of portfolio management services stands at 1.2 lac crores.

Despite, all, this, when we studied last 10-year performance of all India focused equity products across Mutual Funds and Portfolio Management Services, across categories, and tried to prepare a broader list of top 15 Wealth Creators of last 10 years (01/07/2010 to 30/06/2020), results were surprisingly in favour of Portfolio Management Services (PMS).

Out of 15 Wealth Creators of the last 10 years, 10 wealth creators have been Focused & Concentrated Portfolio Management Services.

MOST EQUITY INVESTORS DO NOT MAKE SUCH RETURNS AS THEY CHASE EQUITY WITHOUT HIGH CONVICTION AND FOCUS, AND END UP OWNING OVER DIVERSIFIED EQUITY PORTFOLIOS COMPRISING OF BALANCED FUNDS, INDEX FUNDS, THEMATIC FUNDS, HYBRID FUNDS, OVERALL MARKET. THUS, MOST INVESTOR PORTFOLIOS DESPITE 10 YEAR HORIZON DELIVER RETURNS SIMILAR TO NIFTY 50 OR NIFTY 500.

Also, read Where should you invest – Portfolio Management Services (PMS) or Mutual Funds (MF)?

This was simple. The difficult task starts from here on. And, that is –

- How to select Top Wealth Creating Portfolios for the Next 10 years?

- How to keep the conviction to hold these investments for the longer-term, given the vagaries of the dynamic world and rising risks?

And, this is best endeavored by our Analytics-driven, Performance focused Quality approach to Investing. We are a new-age Wealth Management Company. With us, investors make informed investment decisions.

We are very selective, and we analyze investment products across 5 Ps Factors – People, Philosophy, Performance, Portfolio, and Price with an aim to ascertain the Quality, Risk, and Consistency(QRC) attributes before suggesting the same to investors. This covers Sensitivity measures like Beta, risk measures like Standard deviation, Consistency measures like Annualised Alpha, Outperformance measures like Information Ratio, and risk-adjusted measures like Sharpe Ratio in an improved version. All this helps us identify QUALITY.

Holding on to the good equity investments requires high conviction in the portfolio at all points of time, else, one tends to exit early owing to the traps of emotions or impatience. With our super simple & articulate content via fund manager videos, newsletters, articles, webinars, we keep our clients updated, and this ensures our clients always make informed decisions, and not just while investing. This helps in maintaining HIGH CONVICTION.

Our Philosophy is simple, but not easy.

Quality + High Conviction = Compounding

We offer responsible, long term quality investing. Our clients say we are creating an eco-system of happily informed investors.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION

Do Not Simply Invest, Make Informed Decisions

Disclaimer: All Investments are subject to market risks. Please read all Scheme Information Documents (SID) /Key Information Memorandum (KIM), addendum issued from time to time, and other related documents carefully before investing. Past performance is not indicative of future returns. All this analysis has been performed and presented for general information purpose only and does not imply any kind of financial advice or recommendations. Financial advice is provided after understanding investors’ risk profile and investment objectives by certified professionals who bring appropriate experience. You may contact our experts and we shall provide professional consulting through our best in class Wealth Management Service in the brand name of Advice Sense Wealth Management ( www.advicesense.com ). Also, it is very important to do one’s own analysis before making any investment decision based on one’s own personal circumstances. Disclosures: All numbers presented are net of expenses. Thematic and Sectoral Portfolios/Funds have not been including in this analysis. More than 1 Year returns are CAGR. These are point to point returns from 01st July 2010 to 30th June 2020. Source: Value Research has been referred for Mutual Fund data and respective PMS Companies' Audited Factsheets for PMS Data.