Date & Time: 19th April 2022 | 04:00 PM IST

Speaker: Mr. Rajesh Kothari, Founder & MD, AlfAccurate Advisors

Moderator: Kamal Manocha, Founder & CEO, PMS AIF WORLD

Mr. Kamal Manocha, Founder and CEO of PMS AIF WORLD held an engaging webinar in conversation with Mr. Rajesh Kothari, Founder & MD, AlfAccurate Advisors on an accurate way to generate alpha over the next 5 years.

About PMS AIF WORLD

PMS AIF WORLD is a knowledge-driven, New Age Investment Services Company, providing analytics-backed quality investing service with an endeavor and promise of wealth creation and prosperity. We offer the finest PMS & AIF selection process after analyzing the products across 5 Ps – People, Philosophy, Performance, Portfolio, and Price, with an endeavor to ascertain the Quality, Risk, and Consistency (QRC) attributes that covers 9 ratios. We do such a detailed portfolio analysis before offering the same to investors.

We are a responsible and long-term investment service provider in the space of Alternates.

Invest through us in the best quality products and make informed investment decisions.

Speaker Profile

Mr. Rajesh Kothari is the visionary Founder & Managing Director of AlfAccurate Advisors (AAA) & the driving force behind making AAA one of India’s most respected, award-winning investment management firms. With 25+ years of rich experience in the Indian capital market with deep expertise in Long Only & Long Short investment strategy, he has conceptualized & executed AAA’s unique Radically Resilient investment ethos and 3M investment philosophy towards consistent superior risk-adjusted returns over the past 11 years.

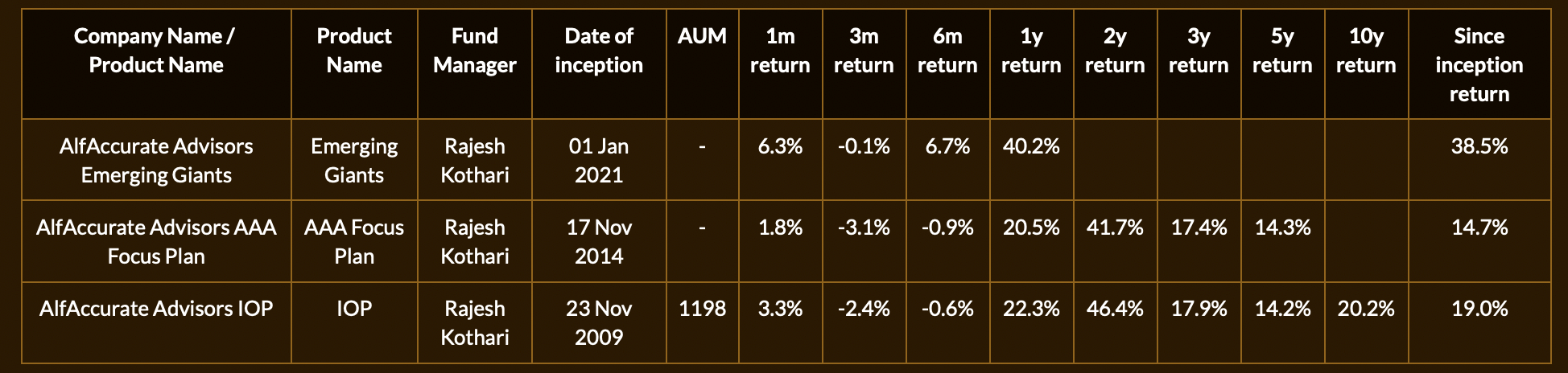

At AlfAccurate, he manages 3 PMSs, the performance for which is:

Data as of 31.03.2022

Webinar Overview

The webinar takes investors over the most accurate path towards alpha generation, but it was perfect to start by listing the downturns and acknowledging the presence of volatility in the markets. The war in Ukraine has left everyone aghast, including portfolios and people. Suffice to say that a quicker resolution will be way more beneficial than the other way round. Over the last 40 years, we have been witnessing over 8 invasions where the markets have corrected on an average by 10%. In the meantime, it took a little over a month to reclaim the pre-war scenario.

Investors need to keep in mind a lot of macro factors like the interest rates, volatility, and inflation numbers before beginning the investment journey. There is a direct relationship between inflation and the corporate profit to GDP until a certain level, post which, the markets and the profits are severely impacted.

Nifty50 Index delivered 95% returns despite US Fed Rate shooting up from 1.03% to 4.86% between April ‘04 – April ‘06. Moreover, Nifty went up by 36% during the second rate hike, from December ‘15 – December ‘18. The Fed announcing a rate hike means that the worst has been left behind and that the markets are going to remain on the greener side.

Treat volatility as your friend and take advantage of it in a shrewd manner, says Mr. Rajesh Kothari

Time in the market is more important than timing the market as missing out on the best 5 days over a 12-year period could erode wealth by more than 50-60%. Therefore, investors must invest consistently even during bad times.

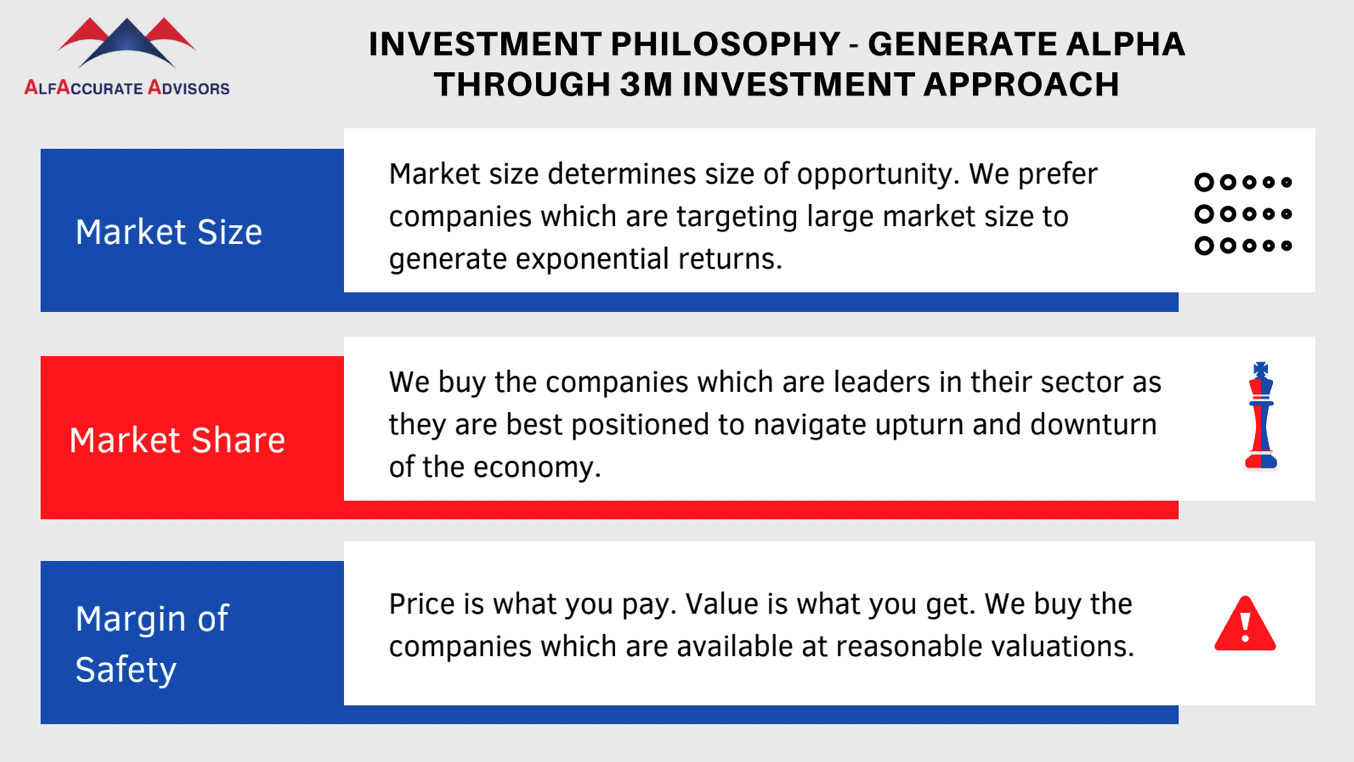

AlfAccurate Advisors’ way to investing is quite simple and investors can certainly take a note from it. The fund house believes that equity will continue to outperform, and a bottom-up approach helps them reap quality. Strong pricing power and a high-quality business will outperform a rising inflation environment. An active investment management approach helps them be aware of all price points.

The investment philosophy is to protect capital through prudent risk management. They follow the staggered portfolio approach that has a defined exit strategy. Expensive valuations, change in growth assumptions and rebalancing of the portfolio are few of the exit strategies.

Embrace the volatility, embrace the change, and embrace the dynamism, says Mr. Rajesh Kothari

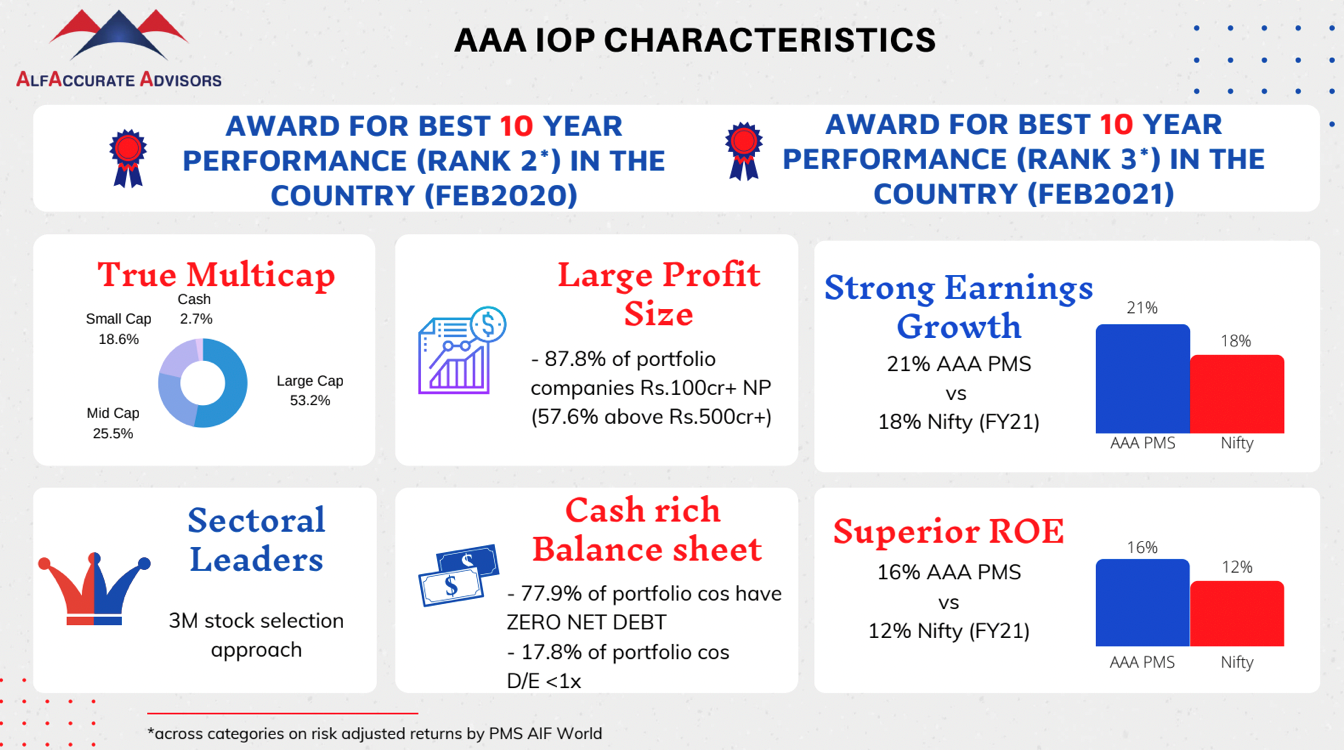

The portfolios here are diversified in terms of sectors, market cap and companies to reduce company specific risk. The prediction of earnings growth is vital to wealth creation in the long term. Macro factors are bound to affect the valuations but hold and sit tight is the name of the game. The period during 2003-2008 had an EPS CAGR of 26% whereas the Nifty CAGR stood at 38.1%.

It is equally important to play around a theme and the ‘AAA PMS Theme 1: Big getting bigger’ has been a game changer for the fund house. The consolidation process that is underway in each sector has led to identification of market leaders. Be it Axis bank taking over the credit card business of Citi bank or the PVR-Cinepolis merger. The higher incremental market share is allowing market leaders to get even bigger.

The ‘AAA PMS Theme 2: Capex Revival’ is another important theme where the total capex across sectors will touch +4,300 billion. There will be a massive jump of 134% over the previous 3yr period making it quintessential to identify and invest in such companies. ‘China + 1’ is another important theme that has played out significantly well over the last 2 years. The search of alternate sourcing options has left enough room for value creation in the country.

The Indian Inc. balance sheet has become much lighter leading to a swift earnings growth soon. Moreover, lenders’ balance sheet has also become lighter which is a positive sign. It is important to stay focused as inflation and fed rate hikes are part and parcel of investing.

Good quality should be combined by good earnings growth, says Mr. Rajesh Kothari

A client centric business model with suitable investment plans over the years have helped Mr. Rajesh Kothari take AlfAccurate Advisors to the place that it is today. There are very few PMS fund houses that have their fund manager as the founder as well. It reduces risks to a certain level as there are lesser chances of a change of guard.

At the team level, the house boasts of 79 years of experience which is the highest among the 200 names present in the PMS business. They have built trust and loyalty among customers to sustain this long in the market, delivering 20% CAGR over the last 12 years. Competency, reliability and availability of the fund manager and the house as a whole are important metrics to gauge before selecting a fund manager/PMS firm.

The kind of strategy an investor has invested in, determines whether he should invest further in it or buy new products. An investor may have a thematic product and may want a multi cap one. The investor should be able to buy a product as long as he/she has a suitable risk profile. There are many sectors that have various opportunities for investors, keeping aside IT.

IT is bound to increase at the same rate as the GDP of the country but 20% CAGR of revenue over the next 5 years is unlikely to happen. The PE multiple has moved to 25x-30x but if the expectations are not matched it is going to be re-rated. The 50-stock balanced portfolio at AAA has made amends as far as IT sector weighting is concerned.

We buy today what we like today has been the highlight of the webinar

There has been a significant rise in the order book and capex in the specialty chemicals industry and the capital goods sector as well. Banking & finance will have a moderate growth story as per Mr. Rajesh Kothari, as asset quality is something that matters over here. Lastly, IT sector will grow but at the same rate as the GDP.

Digitalization has taken over the world and India is not far behind. The financial services sector is bound to grow with firms making full use of technology and staying relevant in the future. The banking credit growth will rise eventually but the gross NPA and the cost of borrowing will decline.

To conclude the webinar, it was aptly to put that the AlfAccurate Advisors does not invest 100% of the investors’ funds on day 1 itself. The investment is spread across 90 days, depending on the scenario and the market outlook, as the fund house does not follow the model portfolio approach.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION