Date & Time: 27th May 2021, 04:30 PM – 05:30 PM IST

Speakers:

Aishvarya Dadheech- Fund Manager, Ambit Asset Management

Manish Jain– Fund Manager, Ambit Asset Management

Moderator:

Sankalpo Pal – Biz. Development, PMS AIF WORLD

The Ambit approach to building a pandemic proof portfolio

The last financial year has been an interesting roller-coaster ride for investors. The pandemic gave a giant blow to the economy as the country’s GDP fell by almost 24% in the first quarter last year. As and when recovery was looked at, Indians started falling back to pre-pandemic behaviours and that accelerated the second wave of Covid-19 in India in March-April 2021.

It is not a wave but a tsunami as the magnitude of it has hit us so hard, from the perspective of human life.

The fact of the matter is, since the pandemic is taking a huge toll on us, we like to believe that nothing of this sort has happened before; which is wrong. If we look at the last 100 years, this corona virus pandemic that the world is going through presently, is the 6th or the 7th Global Crisis. To add to this, it is worth mentioning that everytime such a crisis has happened, people have felt that to be the end of the world.

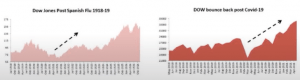

To put that into perspective, Spanish Flu (1918-20), as a crisis, was much bigger in magnitude than the current pandemic. Globally, about 40 million people died (we’ve lost about 1/10th of that number due to the covid-19 pandemic, till date). From the perspective of GDP, the corona virus pandemic (from 2019 till date) has resulted in a fall of about 4.50% of Global GDP; whereas the Spanish Flu resulted in a decline of 6% of the global GDP. Despite the havoc and fear caused by the Spanish Flu, the post-recovery was phenomenal. Economic recovery, in terms of US Real GDP Growth rate was 6%, 13%, and 4% in years 1922, 1923 and 1924 respectively. Even the US Real GDP Growth rate for Q1CY21 was 6.4%. This was a sharp V-shaped recovery that was witnessed (as seen in graphs below).

Markets are forward looking and thus, they react much before than we do. This is what is happening in India cuurently— with the number of cases gradually coming down, states are looking forward to open up and curb lockdown restrictions. But that should not revive too many hopes yet. The research team at Ambit still looks at GDP growth rate being at around 11-12% for this year.

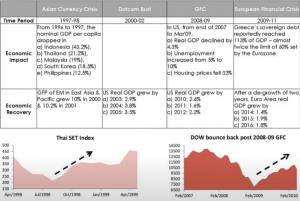

Moving away from the Global human crises to Global financial crises, we are all aware about the crises like the Asian Currency crisis, the Dotcom bubble, 2008 Financial crisis, and so on. A pattern has been observed that everytime the crisis settled down, a strong economy recovery happened. This is evident from the below infographic.

The Covid crisis hit the financials in March 2020. But if one looks at data post September 2020, one will notice a spurt in activity across sectors (Cement, Industrial, Entertainment, Real Estate, Automobiles, and so on). This spurt is evident in itself that once the second phase of Covid sobers down in the country, we will not be surprised to look at the recovery numbers that come out. To add to this, the low interest rates have been quite conducive for the growth in the economy, and this makes a quite compelling a case to remain invested in equities.

This brings us to ask the investors if their portfolio is pandemic proof or not. Staying invested in equities will only be fruitful if the portfolio can withstand the storm of the pandemic. Covid has helped formalization in a lot of ways (unorganized sector transitioning into organized sector). A lot of market leaders with a reasonable amount of market share in their respective sectors, have gained a lot during the pandemic, by capturing the unorganized space. This formalization was anticipated post Demonetization & post-GST implementation, but it did not happen; but this was forced to happen during & after the first & second phase of Covid-19 in the country. Thus, it is imperative to look if one has such business leaders in their portfolio or not. For example, the Tiles Industry has a lot of space for unorganized companies to it. Taking advantage of the situation, leaders like Kajaria Ceramics (who not only have a good leadership but also a strong balance sheet) absorbed some of the unorganized market space into their domain and increased their market share because of the same. Similarly, in the Footwear space, Relaxo (part of Ambit’s Coffee Can Portfolio) has done a marvellous job at consuming these unorganized players and gradually increasing its market leadership— very evident by the phenomenal results of last few quarters. In contrast, in the Cement Sector, formalization is not playing out because there are hardly any players under this umbrella. So, an investor must make sure that his/her portfolio consists of such players that are able to strategically amplify their markets share and position themselves as leaders in the said industry.

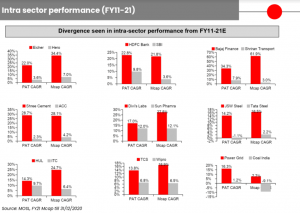

Moving on, it is required that the said company has sustainable and consistent earnings and put checks on whether these earnings are being converted into cash flows or not. For instance, a company called PI Industries (part of Ambit’s Good & Clean Portfolio) has been so consistent in earnings since the last 3 years, that it has generated impressive wealth for investors. On the other hand, weaker companies like Jyothy Laboratories, who have not given consistent earnings, have not generated return for investors. Similarly Insurance sector has seen massive earning growth but Power Sector has seen a weak, inconsistent earnings growth.

Apart from strong earnings, what is also required is a strong balance sheet. A strong balance sheet can be defined as one with low leverage, efficient capital allocation, generating high ROE, high ROCE, and the likes. For instance, Avenue Supermart which holds a strong balance sheet and financials has created good wealth for investors as opposed to Future Retail, which has a weak balance sheet, has destroyed investor’s wealth.

Lastly, an Effective and Complacent management also matters. Honesty & Integrity of the people managing the business is a must. For instance, a company like Raymond has strong presence even in Tier 2 & Tier 3 cities and has positioned itself across the country; but has failed to generate impressive returns. On the other hand, a company like Page Industries, not that big a brand like Raymond, but the kind of wealth they have generated for investors is huge. This is nothing but the manager’s play.

Wealth is not created by finding the right biz. but by finding the right people who are running the biz.

Above 4 are the most important parameters that one should look at in businesses while investing into them to build a pandemic proof portfolio.

Moving on, there are two major problems with investors today. One, their time horizon is not set— panic and fear in times of crisis will accelerate selling pressure and booking losses, rather than staying invested for the longer time. Second, as investors, we are always backward looking, but markets are forward looking and hence the disconnect happens.

Swing against the tide. During times of panic, be greedy; during times of optimism, be fearful.

No matter how big a catastrophe happens, the markets always recover.

Despite so many past crises, our economy is still afoot and we’re still the fastest growing economies in the world. The only caveat here, for investors, is selecting the right stock. So how does one select the right kind of stock?

The basic mantra over here is the consistency.

Let’s look at the journey of Relaxo Footwear— from INR 268 cores to almost INR 15,000 crores over a period of 15 years. This portrays a revenue CAGR of 17.5% and a PAT CAGR of 29%.

Even Pidilite, a business which has grown from being an adhesives company to being a full fledged consumer player, the journey has been 100x. Over the last 19 years, it has gone from INR 700 crores to INR 70,000 Crores with 16% Sales CAGR and 19% PAT CAGR. The team at Ambit were asked many questions in August 2020 as to why Reliance (which went from INR 800 in March 2020 to INR 2000 in Sept 2020) is not a part of their portfolio. Answering with some numbers, Ambit said, a company like Pidilite (as of Aug 2020) had a 10Y CAGR return of 24% and Reliance had a 10Y CAGR of 16%; Pidilite outperforming Reliance by a massive 8%. This is because one does not need to time his/her entry/exit in Pidilite as needed in Reliance— consistency is the key.

The following infographic depicts how PAT affects stock price movements: Consistent PAT biz. v/s inconsistent ones.

Coming back to identification of companies, it is to be noted that sector identification has to be top-down, but the company research has to ideally be bottom-up. It is imperative to focus on the quality of the company, quality of financials and the quality of management— the returns automatically follow.

Quality always pays. There is no substitute for quality.

Ambit’s disciplined approach to building a consistent portfolio consists of the following steps:

- Stringent Quantitative filters

- Deep research and team expertise / focus

- High focus on earnings growth + earnings quality

- Risk Management

Conviction cannot be bought, it is developed. Do not buy stocks, buy businesses.

Risk-Reward is a parameter that one has to look at but for the same, Ambit does not look at Price Multiples; they rather focus on Growth. A Prada bag will always be expensive than a Baggit Bag, but does that you mean necessarily buy Baggit because it’s cheap? Or do you also look at the quality and conviction that Prada offers? Similarly, some stocks will always remain expensive, but growth will follow along the same lines.

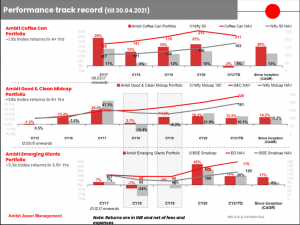

To conclude, one can look at the performance of the PMS Funds managed by Ambit. Just like the consistent companies they invest in, their funds have also shown a consistent performance over the years. It is the discipline and research that has helped generate such impressive results.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION