Financial services a threat to some, but opportunity to others

Kings of Capital By Marcellus

August 12, 2020 @ 5:30 PM – 6:30 PM

Financial services a threat to some, but opportunity to others - Kings of Capital By Marcellus

August 12, 2020 @ 5:30 PM – 6:30 PM

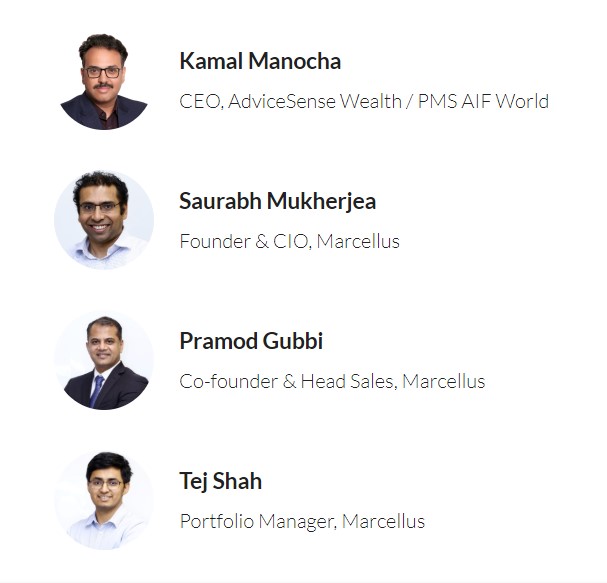

Saurabh Mukherjea, Founder & CIO

Pramod Gubbi, Co-founder & Head Sales

Tej Shah, Portfolio Manager

Next decade (Year 2020-Year 2030) throws lots of opportunities through the financialization of Indian household savings and thus financial services sector becomes all the more important & relevant from the perspective of Investments. Thus, we invited Marcellus PMS team to share their views as it has recently launched a new portfolio – Marcellus Kings of Capital which is focused on Financial Services.

Marcellus Kings of Capital portfolio comprises a full spectrum of financial service providers –lenders (banks, NBFCs and housing finance companies), and non- lenders (life insurers, general insurers, and asset managers/brokers.

Marcellus Kings of Capital is a highly concentrated portfolio 10 to 14 high-quality financial companies with clean books of accounts, and a long historical track record of profitable growth and promoters with prudent capital allocation skills.

There are two factors to take watch out for over the next 1 Year, and these present decent opportunities for making investments in the financial services sector, but by high-risk investment objective of 3 to 5 Years.

- Which lenders will be able to survive through the crisis without any bail-outs?

- Which lenders will have enough strength on the liabilities side of the balance sheet on the other side of the crisis to help accelerate loan book growth and lead the consolidation of market share once the crisis is behind us?

Team Marcellus with its strong filtration mechanism & investment philosophy is investing in Kings of Capital – a well-managed portfolio of lenders & non-lenders that stand to benefit in the post-COVID India, as froth would be removed and competition would reduce because of COVID related slow-down. The lending business is 60% of the portfolio, and non- lending is 40%.

- The loan book growth will accelerate because of their best quality liabilities franchise.

- Their NPA ratios will fall materially.

- NIMs will expand as these lenders will be able to pick and choose borrowers.

- Earnings will grow at an accelerated pace

The non-lending part of the portfolio adds resilience to the portfolio during times of stress because insurers have a lower beta than lending businesses while asset management and brokerage businesses do not take any balance sheet risk.

WISH TO MAKE INFORMED INVESTMENTS FOR LONG TERM WEALTH CREATION