Direct equity participation in the Indian equity market has surged to all-time highs. Such levels were last seen during the midpoint of the historical bull run of 2003-2007. There are 3 types of participants that constitute this segment –

1) Intra-day traders

2) Delivery based buyers

3) Long term investors

Markets over the last 5 months have been supportive, and all 3 types have made gains. However, wealth creation is not about a few trades, it is about compounding, and this will be experienced by those who will stick to informed quality investing and Hold for the longer term. This is achieved through disciplined long term investing. And, this is where self-investing is different from professionally managed structures like Portfolio Management Services. Self – investors may experience momentum & quick gains, but seldom experience wealth creation. Owing to greed & fear, self-investors tend to book profits early and miss compounding as in self-investing, individuals focus on the share price & its movement, but, in professional investing through PMSes, team’s focus is on companies’ business & earnings.

We perform deep analysis of investment products across 5 Ps – Portfolio, Performance, People, Philosophy, and Price before selecting the Best Equity Investment Portfolios.

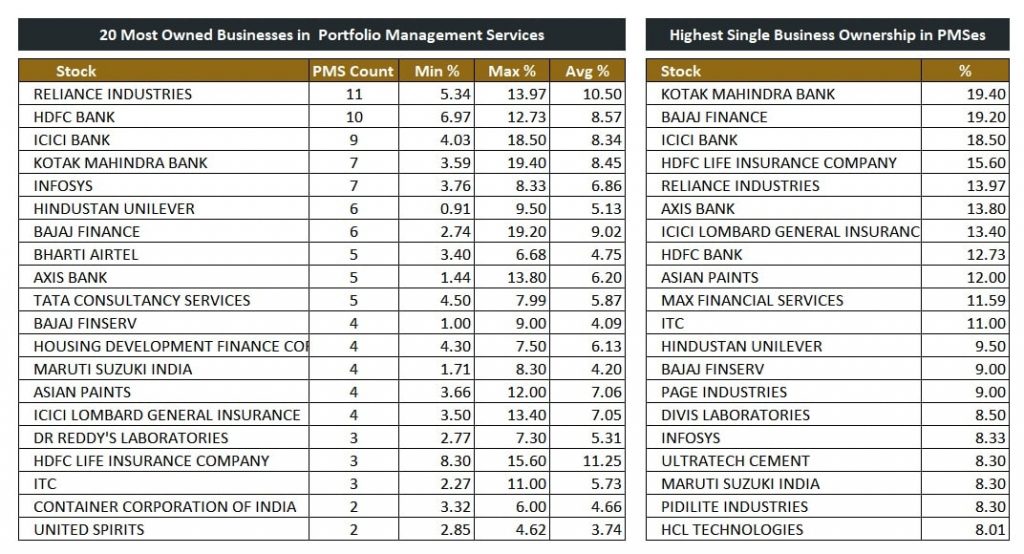

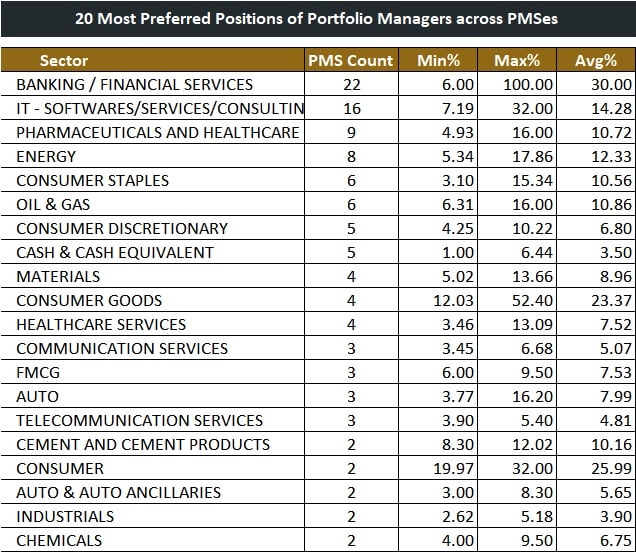

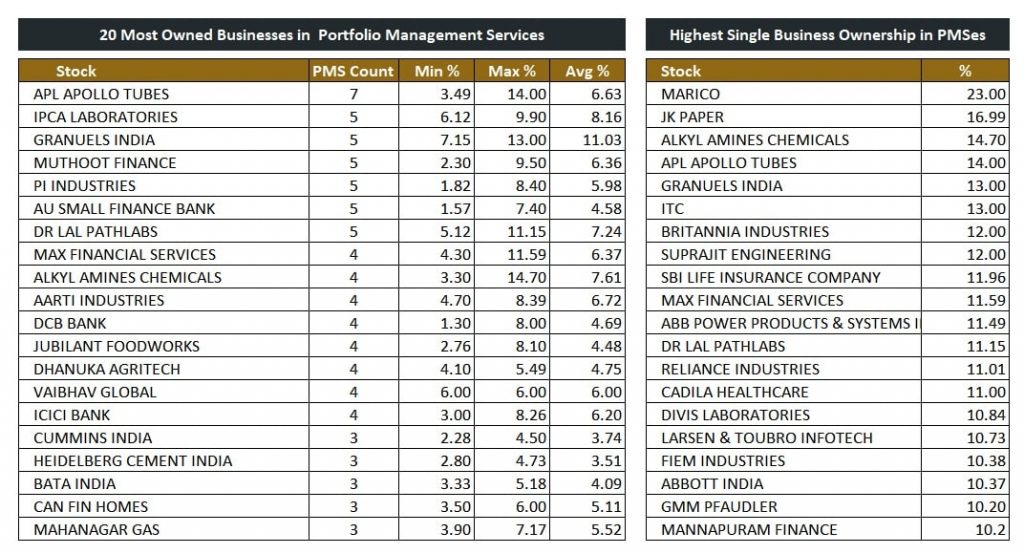

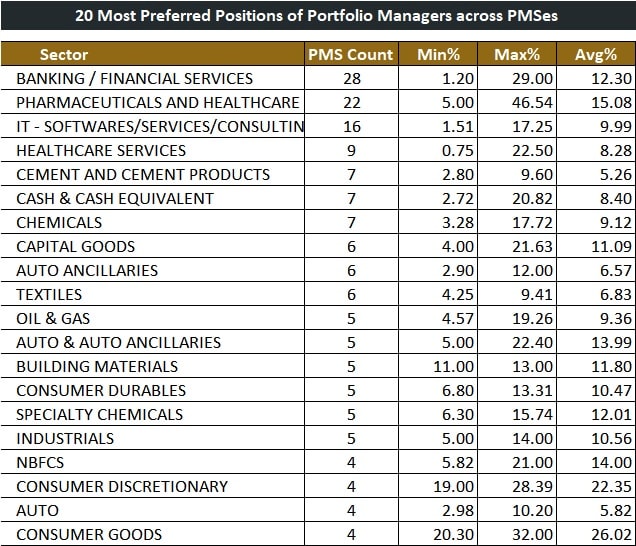

Here, we present the top 20 holdings across all Large Cap PMS Portfolios and all Mid – Small Cap PMS Portfolios, as a case in point to show that how portfolio managers despite a sharp rally in equity markets have continued to Hold – On as the focus is on prospects of business and growth in earnings, rather than just price. For many self-investors, many of these stocks, they may have missed, or bought, but exited early.

Top Holdings Across Large Cap PMS

Top Holdings Across Mid – Small Cap PMS

Holding on to the good equity investments requires high conviction in the portfolio at all points of time, else, one tends to exit early owing to the traps of emotions or impatience. With our super simple & articulate content via fund manager videos, newsletters, articles, webinars, we keep our clients updated, and this ensures our clients always make informed decisions, and not just while investing. This helps in maintaining HIGH CONVICTION.

Our Philosophy is simple, but not easy.

Quality + High Conviction = Compounding

We offer responsible, long term quality investing. Our clients say we are creating an eco-system of happily informed investors.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION

Do Not Simply Invest, Make Informed Decisions

Disclaimer: All Investments are subject to market risks. Past performance is not indicative of future returns. All data & analysis has been presented for general information purpose only and does not imply any kind of advice or recommendation. It is very important to do one’s own analysis before making any investment decision as every one has a different risk profile depending upon personal circumstances, attitude to risk. Note: Data is as of 31st July 2020 Source: Respective detailed facts sheets of Portfolio Management Services.