Written by Kamal Manocha, CEO – AdviceSense Wealth

Warren Buffett puts much of his wealth creation success down to having good habits. It is the good habits, he says, with saving and investing also that bring success, and the earlier you develop them, the better it is.

COVID, which otherwise is responsible for many negatives has actually brought lots and lots of good habits. We do not order outside food, anymore. We do not depend on others for household work, anymore. We don’t do un-necessary expenditures, anymore. If we put mathematics to all this, the numbers are eye-opening.

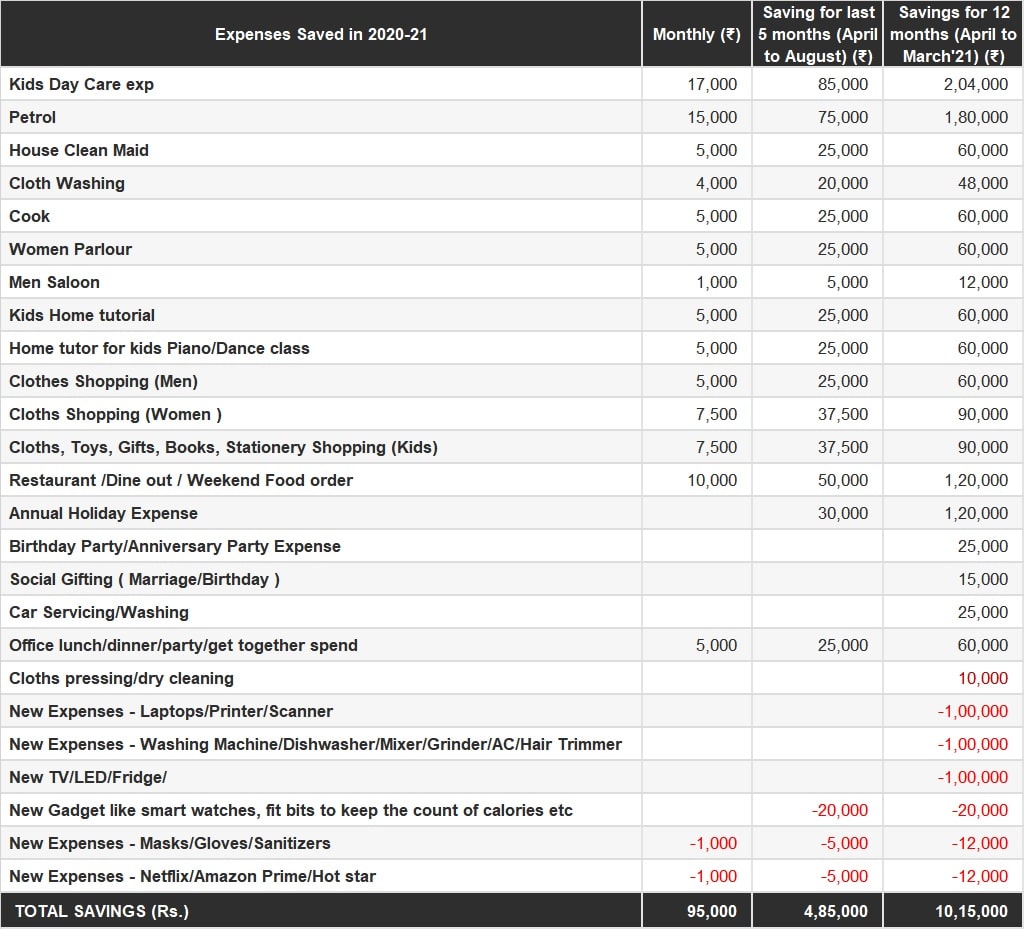

AVERAGE COVID SAVING DONE BY EACH FAMILY Earning 1.5L to 2.0L Per Month

Many monthly expenses that looked inevitable in the pre-COVID lifestyle, have been saved. Some of these are like – kids daycare, weekend shopping, parlor, saloon, home tutor visits for kids piano/dance classes, restaurants, food-orders, social gifting, holidaying, etc.

Some new expenses that have been added to the list are – like dishwasher, automatic washing machine, laptop, printer/scanner, work table/chair, NetFlix, etc .

On a net basis, any family that was earning 1.5L to 2L per month has already saved around 4.75 lacs in 5 months. Over FY 20-21, there will be a saving of a whopping 10 lacs. This was impossible for any family earning 18L to 24L per annum.

And, if you see the list of expenses saved and new expenses added. Most un-productive expenses have been saved and most productive expenses have been added. All is all positive.

Let us talk about companies, especially the MNCs, IT, and consulting firms.

There is a big learning for many of these businesses. It is well understood that with proper processes in place, work from home is a more effective & efficient option.

Many companies have realized that there was huge avoidable travel & hotel expenditure being spent in the name of on-shore/on-client site working mandates.

Many companies have realized that there was huge avoidable spending in the name of employee motivation on recreational activities like expensive offsites, monthly parties, annual meets, office cultural activities, etc.

All in all, it has been realized both by the employer as well as the employees that work-from-home provides the best flexibility and boosts morale for many who used to find tough to maintain work-life balance given that a lot of time used to be wasted on unnecessary travel, traffic, parties, meets, offsites, etc.

Today, working hours for most have actually increased and work happens with a more positive mindset and flexibility.

All this – money saved is money earned.

If Rs 12000 to Rs 15000 worth of tax rebate announced in the annual budget was taken as a positive event for equity markets, how can equity markets miss multiple times benefit that all this saving is bringing to many families?

For argument sake, one can say, that the money which is not being spent, is actually been taken out from the economy and hence low spending is slowing down the economy and will eventually adversely impact equity markets. One needs to understand that, all this saving that we are talking about pertains to only 2-3% of the population as only a few lac people earn 1.5L to 2.0L per month. And, reduced spending by this 2-3% population would have less than 8-10% impact on overall GDP.

The positive side of the argument is stronger as this saving will eventually be spent or invested.

Many will spend this on bigger discretionary purchases – like – Car, Bike, LEDs, Watches, Jewellery, etc.

And, for many, who are wiser, this will be invested. Also, this forced saving will bring a realization on how to save in the future. And, this the most important aspect from the perspective of equity markets.

The crux of the matter is that if there is a negative side to COVID, there is this huge positive side as well and this in FY 20-21 is directly positively impacting many individuals and companies by forcing them to save, and also provoking them to learn on how to spend less and still achieve desired results.

In our view, most of this is bringing a change in habits and so this a permanent change.

What Mr. Warren Buffett’s quoted about savings many years ago is actually turning into reality. Remember, the quote –

Do not save what is left after spending; instead spend what is left after saving.

This, in our view, is a BIG DRIVING FORCE, that will bring in more depth and width to the equity markets over the next decade, which for the last 3 years have been just polarised.

PMS AIF WORLD provides analysis driven high performance investing service in name of AdviceSense Wealth.

Check outIIFL Multicap PMS, ASK IEP PMS, Marcellus Consistent Compounders, Ambit Coffee CAN, White OAK India Pioneer Portfolio

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION