Dear Equity Investor,

Creating wealth from equity investments isn’t easy. It generally takes all you’ve got, and some time even more, as every time is the time of new learning. Only those who love the journey, win, as perseverance and conviction matter, at last. This is only possible if one doesn’t get carried away by losses or fall in price after investment.

If what you own is good, it will pay-off; keep the conviction.

While your mind could be crowded with negative emotions owing to many negatives like the rise in inflation & interest rates, FII selling, ongoing war, Liquidity reducing, and so on, let us give you a breather by talking about 10 positives that are encircling the economy right now:

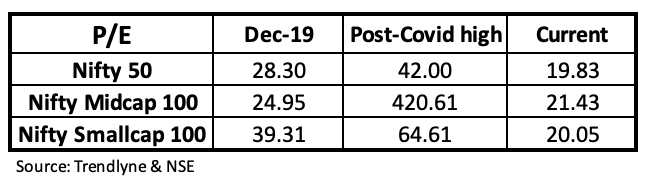

1) The P/E levels of broad market indices are currently citing reasonable valuations as they’re reasonably down from their post-Covid highs.

2) India’ GDP forecast for India stands at 7.5% for Year 2022 and 8% for Year 2023.

3)The gross GST collection in April 2022 all time high, at Rs 1,67,540 crore.

4) According to CMIE Data, the overall unemployment rate in India fell to 7.6% in March 2022, which was 8.10% in February 2022.

5) The Consumer Confidence in India continued to rise to reach 71.7 in March of 2022 from 64.4 in January. It is the highest reading in two years, amid improved sentiments on general economic situation, employment and household income.

6) The services sector in India recorded strong growth in the month of April. The seasonally adjusted S&P Global India Services PMI Business Activity Index jumped to a 5-month high of 57.9 in April, from 53.6 in March.

7) The pace of bank credit growth hit 9.6% in FY22, up from 5.6% in FY21.

8) The domestic air passenger traffic increased a sharp 83% year-on-year (y-o-y) to an estimated 10.5 million, bringing it closer to pre-Covid levels of April 2019.

9) According to the data released by the FADA, vehicle retail sales increased by 37% in April 2022, compared to the same month last year.

10) India’s merchandise exports rose by 24.22% year-on-year to USD 38.19 billion in April 2022 on the back of healthy growth in the sectors like petroleum products, electronic goods and chemicals, the government data showed.

We understand that the current corrective state of markets would be unsettling to your mind; but this to re-assure you that Equities are meant for long-term. We are in the golden phase of growth in corporate earnings, stable government, broad-based equity participation like never before and fair valuations. With your portfolio in the hands of the right portfolio managers, it’s bound to give returns over a period of time. And we are reviewing and watching this very closely and objectively.

They say all things come to an end—the good and the bad. So, this bearish phase shall pass through, as well.

And, as far as equity investing is concerned, instead of being fearful, approach should be entrepreneurial, and hence the current phase of fall in prices is more of an opportunity!

OUR INTENTION IS TO SHARE KNOWLEDGE DURING THE PHASE OF DARKNESS AS KNOWLEDGE IS A TORCH LIGHT TO PASS IT THROUGH!

Do not Simply Invest | Make Informed Decisions

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION