(Article by team IIFL AMC)

Equities have seen volatility in the recently on the back of concerns like tapering & high valuations. The key to long term performance is strong macro, corporate earnings growth, and reasonable valuations.

Looking beyond

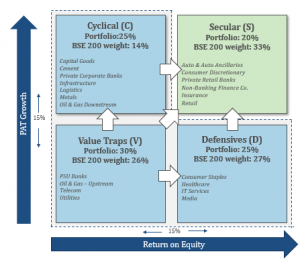

With the beginning of capex cycle, strong high frequency indicators and continued optimism on the GDP growth, belief is that cyclical recovery is underway. In terms of sectors that present interesting opportunities to participate in the domestic economic recovery are Private Sector Financials, Consumer Discretionary, Industrials and Materials. Indian IT services would continue to perform irrespective of the domestic economy returning to normalcy. While, the secular theme remains intact, there is an expectation of cyclical story playing out. Hence, it is advisable to have a balanced mix – defensive & secular sectors, where new growth drivers have emerged due to the pandemic and cyclical sectors to benefit from the recovery theme.

IIFL Phoenix Portfolio intends to create a portfolio of such businesses with an established track record, which have the potential to see a sharp improvement in fundamentals in the future.

Three stages of business turnaround cycle

Identification of successful turnaround events and improvement in fundamentals of the business are key to turnaround investing.

IIFL Phoenix Portfolio – Movement towards the secular segment

The sectors mentioned above are for illustration purpose only do not construe to be an offer or solicitation of an offer to buy/sell any securities in that sector or research analysis. The strategy may or may not be hold the same in its portfolio Source: Bloomberg, Internal. Data as on Nov 30, 2021. Allocation excluding cash has been rounded off to 100%. Allocation is subject to change.

The idea is to invest in companies which will eventually move in the secular quadrant – having higher ROE and higher growth trajectory. It is not selecting value over-growth or vice versa, rather it is about benefitting from both. Along with the cyclical recovery and the turnaround story, the portfolio will also benefit from the companies having secular growth story. IIFL Phoenix Portfolio – Well placed to benefit from both themes.

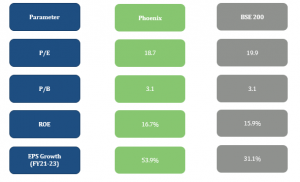

Phoenix – Portfolio Snapshot vs Benchmark

Past performance may or may not be sustained in future.

Source: Internal, Bloomberg. The P/E,P/B and ROE are based on FY23 estimates. This is for the portfolio as on Nov 30, 2021 and is subject to change based on portfolio composition and market movement. The current quants should not be construed as any indication/assurance for future returns.

Despite having P/B in line with the index, the portfolio has a higher earnings growth potential as compared to index, clearly showing that the construct is such that should benefit from turnaround in the portfolio companies.

To sum up, time never escapes unscathed and hence at all points of time our focus is on maintaining a balanced portfolio with a mix of companies which are likely to – experience structural growth or benefit from the economic turnaround.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF WORLD do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION