“You get recessions. You have stock market declines. If you don’t understand that’s going to happen, then you’re not ready, you won’t do well in the markets” – Peter Lynch.

In March 2020, when the markets fell due to the Covid-19 Virus, from the top, it corrected almost 40% over 2-3 months

And currently, from its peak in Oct 2021, the markets have nearly corrected 18% as of June 2022. But the pain is more this time, only because this correction has taken more than 8 months, already.

During the March ’20 market crash, the markets remained in the correction/bearish phase for roughly about 2 to 3 months, after which recovery started taking place, albeit slowly, and then the next almost 1.5 years, we know that the markets were euphoric!

Whereas in the current correction – the 50-pack Nifty50 made a high of 18,604 in October ‘21 and since then, almost 8 months down the line, the markets have either been consolidating or sliding downwards.

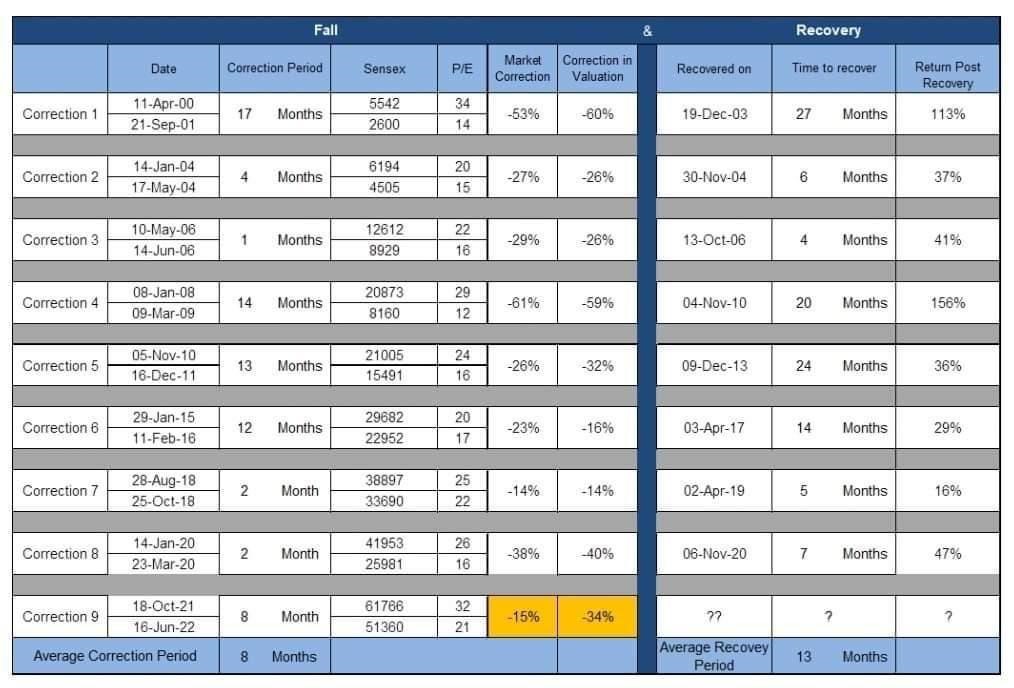

The below table explains how equity as an asset class has behaved in the last 22 years; and has witnessed corrections before as well. While we are writing this article, our endeavour is to explain that despite 8 corrections in the last 22 years, equity, as an asset class has delivered great returns in the past, and so will be its behaviour in the future, too!

A correction should only be painful for a naïve investor who invested in markets with the aim of generating quick returns. While we understand that a 8-month long correction can be difficult for any investor, it is important to note that Equity is a long term play and this correction, if viewed opportunistically, can help investors build Wealth.

Corrections can delay the time of potential returns but they cannot take away returns from your hands if you stay calm, positive, and invested in the right stocks.

3 factors drive stock markets: Valuations, Expected growth in corporate earnings/GDP and Liquidity. Currently, first 2 factors are positive as Valuations are attractive, if (trailing) Nifty 50 PE is referred to, as it stands at around 20. Second factor, expected growth in earnings and GDP is at all time highs, currently. Only the third factor, which is Liquidity, is unfavourable and given the first 2 factors being positive, the fall in the market is an opportunity for investors, as in long term, these 2 factors, and not liquidity, determine performance.

| Index | PE as of: | ||||

| 30-Jun-22 | 30-Jun-21 | 30-Jun-20 | 30-Jun-19 | 30-Jun-18 | |

| Nifty 50 | 19.5 | 28.33 | 26.32 | 28.98 | 25.9 |

| Nifty 500 | 20.05 | 30.2 | 29.35 | 30.96 | 30.47 |

| Nifty Midcap 100 | 20.57 | 34.44 | 88.29 | 30.96 | 48.36 |

| Nifty Smallcap 100 | 18.64 | 41.11 | 18.19 | 36.12 | 71.79 |

For those investors, who see 20 PE as expensive in comparison to the past, where PE has also gone down to lows of 12.5 in 2008, need to view PE in relation to FD/Fixed Income PE. In 2008, FD rates were at around 8%, and that accounted for a FD/Fixed Income PE of 100/8 = 12.5. Following the same calculations, and considering the current FD/Fixed Income rates at 5%, FD/Fixed Income PE, at present, is 100/5=20. So basically, at present, Equity as an asset class stands at similar value as Fixed Income, which is to say that it is at the lowest point of valuation, if compared to Fixed Income.

| Oct-21 | Nov-21 | Dec-21 | Jan-22 | Feb-22 | Mar-22 | Apr-22 | May-22 | Jun-22 | |

| FII Net Buy / Sell* | -25,572.19 | -39,901.92 | -35,493.59 | -41,346.35 | -45,720.07 | -43,281.31 | -40,652.75 | -54,292.47 | -58,112.37 |

| DII Net Buy / Sell* | 4,470.99 | 30,560.27 | 31,231.05 | 21,928.40 | 42,084.07 | 39,677.03 | 30,842.53 | 50,835.54 | 46,599.23 |

| Nifty 50 | 17,761.65 | 16,983.20 | 17,354.05 | 17,339.85 | 16,793.90 | 17,464.75 | 17,102.55 | 16,584.55 | 15,780.25 |

| S&P BSE Sensex | 59,306.93 | 57,064.87 | 58,253.82 | 58,014.17 | 56,247.28 | 58,568.51 | 57,060.87 | 55,566.41 | 53,018.94 |

* Data in Rs Crores

FII / DII data mentioned above is CM Provisional Data

Our thought-process of perceiving Equities attractive at this point of time is very well being validated by the DIIs. Investments by DIIs in the Indian stock market have crossed the Rs 2 trillion mark, so far in 2022. With still six-and-a-half months to go in the year of 2022, investments by DIIs in the equity market is the highest ever in a single calendar year.

Sure, Indian indices have fallen on the back of strong selling by FIIs in the past few months. This may have taken away some froth from valuations but, bear in mind that there haven’t been significant earnings downgrades yet. This data simply acknowledges the fact that Equities are in the Air & they will remain so!

Corrections are a part of the market cycle and investors not only have to go through it, but learn to grow through it.

A bear market will always be followed by prolonged recoveries, where the right stocks will rebound. So we simply urge you to not panic – do not indulge in panic selling, if what you hold is right. This is the best time to seek advice from professionals and balance out your asset allocation. Take advantage of lower prices, be opportunistic, have a broad risk management perspective & invest for the long term!

To help you pick the best investment styles, suited to your needs & profile, PMS AIF WORLD is here. Through our content and insights, our endeavour has always been to help investors make well informed decisions. The current market scenario is tough, sure, but it is an opportunity. An opportunity to buy the right stocks at right prices. Given the current market fall, a lot of good stocks are available at attractive valuations, making Equity investments attractive at this point of time.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION